Ownership and Management Company Change Policy

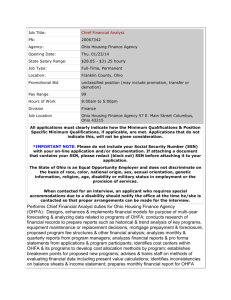

advertisement

Ownership/General Partner and Management Company Change Policy Purpose: To ensure that the Ohio Housing Finance Agency (OHFA) Office of Program Compliance (PC) and the Office of Planning, Preservation & Development (PP&D) have performed due diligence in the review and approval of ownership and management company change requests to prevent changes from negatively impacting the compliance of the project with OHFAadministered programs. The owner of a low-income Housing Tax Credit (HTC) project is identified on the Form 8609. HTC projects are owned by partnerships. The tax credit is used to generate private equity, often prior to or during the construction of the project. Developers typically "sell" the credits by entering into limited partnerships (or limited liability companies) with an investor, with 99.99% of the profits, losses, depreciation, and tax credits being allocated to the investor as a partner in the partnership. Limited partners do not participate in the management decision of the partnership or project. The General Partner has primary partnership control and is responsible for the management of the project. The General Partner is essential in assuring compliance with the tax credit regulations. Thus, it is crucial that OHFA conducts a thorough review of all ownership requests. Equally important is a thorough review of management company changes. In managing the life cycle of a multi-family project, property managers must be familiar with IRC Section 42; IRS Regulation 1.42; and the Qualified Allocation Plan (QAP) in effect during the year in which the tax credits were allocated. Owners and property managers are solely responsible for ensuring that the project(s) they own or manage are in compliance with local, state, and federal laws and regulations. Good property management practices help to ensure that the project remains viable and compliant. Ownership/General and Limited Partner Change Procedures (for projects financed with or without Housing Tax Credits) OHFA will review an owner’s request on a case-by-case basis. Requests must be compliant with the current year QAP and as such must be submitted to OHFA 60 days prior to the proposed change. New ownership requests do not require OHFA Board approval. If the project has not yet received Form 8609s, any requests to change ownership/general partner, or limited partnership interest should be directed to Kevin Clark, Manager of the Office of PP&D at kclark@ohiohome.org or by mail to 57 East Main Street, Columbus, Ohio 43215. It is the responsibility of PP&D to inform PC of any approved ownership changes that occur during this Ohio Housing Finance Agency time frame. Once a project is placed in service and issued Form 8609s from PP&D, the request to change ownership/general partnership, or limited partnership interest should be sent to Betsy Krieger, Assistant Director of Program Compliance, at bkrieger@ohiohome.org or by mail to 57 East Main Street, Columbus, Ohio 43215. If a project is not financed with Housing Tax Credits (i.e. gap financing only), the owner should notify the Compliance Analyst responsible for the project of the proposed ownership change. PC will then notify PP&D of the request and conduct a shared review of the request. Any approved change in ownership will be entered into OHFA’s database system, DevCo to ensure accurate updates and reporting of OHFA’s project portfolio. A request to change the General Partnership interest of a Housing Tax Credit (HTC) project must include the following. OHFA may require additional documents not contained in this list. If the request concerns a new owner that is known to OHFA through prior and/or existing relationships, only items #1, 4, 5, 7-10, and 12 should be submitted. 1. A cover letter fully explaining why the ownership change is necessary 2. Summary of the new owner’s experience in affordable or rental housing 3. Performance of the new owner in owning and/or renting housing. Information must include any housing or code violations and if the owner was penalized by any local court for not responding to code or housing violations 4. Brief description of the management company’s experience in managing affordable housing if the property management is changing as a result of the ownership change 5. Current vacancy rates for the property (if presently placed in service) 6. A completed Project Proforma 7. Estimated operating budget for the project though Y15 of the Housing Tax Credit compliance period 8. Copy of an executed sale agreement or letter of intent to purchase the project 9. History of the project’s reserve account for the last three tax years including the required monthly replacement amount (if presently placed in service) 10. OHFA’s Disposition of Property Form PC-E37 11. Prior years’ audited financial statements and current year-to-date audited financial statements (if presently placed in service). If an audited financial statement is not available, submit a financial statement that has been reviewed or compiled by a third-party accountant 12. Copy of the property’s current-year rent roll (if presently placed in service) 2 Ohio Housing Finance Agency If the request is received by PC, the Assistant Director will schedule a meeting with the Compliance Analyst responsible for the project, the Analyst’s Manager, the Director of PC, a PP&D Project Portfolio team member, and the proposed new owner. Generally, the review process of the request takes no more than 20 business days. If approved, the Compliance Analyst responsible for the project will send OHFA’s PC-L64 General Partnership Approval Letter to the current owner. The Analyst will also issue Form 8823 to the IRS for reporting the ownership change. A request to change the Limited Partnership interest of a HTC project must include the following. OHFA may require additional documents not contained in this list. 1. A cover letter fully explaining why the partnership change is necessary 2. Summary of the new partnership experience in affordable or rental housing 3. Performance of the partnership in owning and/or renting housing. Information must include any housing or code violations and if the owner was penalized by any local court for not responding to code or housing violations A request to change the ownership interest of a project not financed with Housing Tax Credits (HTC) (i.e. gap-financing) must include the following. OHFA may require additional documents not contained in this list. If the request concerns a new owner that is known to OHFA through prior and/or existing relationships, only items #1, 4, 5, 7-10, and 12 should be submitted. 1. A cover letter fully explaining why the ownership change is necessary 2. Summary of the new owner’s experience in affordable or rental housing 3. Performance of the new owner in owning and/or renting housing. Information must include any housing or code violations and if the owner was penalized by any local court for not responding to code or housing violations 4. Brief description of the management company’s experience in managing affordable housing if the property management is changing as a result of the ownership change 5. Current vacancy rates for the property (if presently placed in service) 6. A completed Project Proforma 7. Estimated operating budget for the project though Y15 of the Housing Tax Credit compliance period 8. Copy of an executed sale agreement or letter of intent to purchase the project 9. History of the project’s reserve account for the last three tax years including the required monthly replacement amount (if presently placed in service) 3 Ohio Housing Finance Agency 10. OHFA’s Disposition of Property Form PC-E37 11. Prior years’ audited financial statements and current year-to-date audited financial statements (if presently placed in service). If an audited financial statement is not available, submit a financial statement that has been reviewed or compiled by a third-party accountant 12. Copy of the property’s current year rent roll (if presently placed in service) Property Management Company Change Procedures OHFA will review an owner’s request to change a property management company on a case-bycase basis. Requests must be compliant with the current year QAP and as such must be submitted to OHFA 60 days prior to the proposed change. New management change requests do not require OHFA Board approval. Requests to change a management company prior to the issuance of Form 8609 should be directed to Kevin Clark, Manager of the Office of PP&D at kclark@ohiohome.org, or by mail to 57 East Main Street, Columbus, Ohio. It is the responsibility of PP&D to inform PC of any approved management company changes. Once a project is placed in service and received Form 8609s, the owner should notify the Compliance Analyst responsible for the project of the proposed management company change. It is the responsibility of PC to inform PP&D of any approved management company changes. If a project is not financed with Housing Tax Credits (i.e. gap-financing only), the owner should notify the Compliance Analyst responsible for the project of the proposed management company change. It is the responsibility of PC to inform PP&D of any approved management company changes. Any approved change in a management company will be entered into OHFA’s database system, DevCo to ensure accurate updates and reporting of OHFA’s project portfolio. An owner request to change the property management company must include the following. OHFA may require additional documents not contained in this list. If the request concerns a management company that is known to OHFA through prior and/or existing relationships, only item #1 should be submitted. 1. A cover letter fully explaining why the property management company change is necessary 2. Summary of the property management company’s experience in managing affordable housing 3. Capacity of the new management company (e.g. trade association memberships, compliance certifications, experience in affordable housing) 4. OHFA’s PC-E38 Management Company Capacity Questionnaire OCP-28 4