Taxation

advertisement

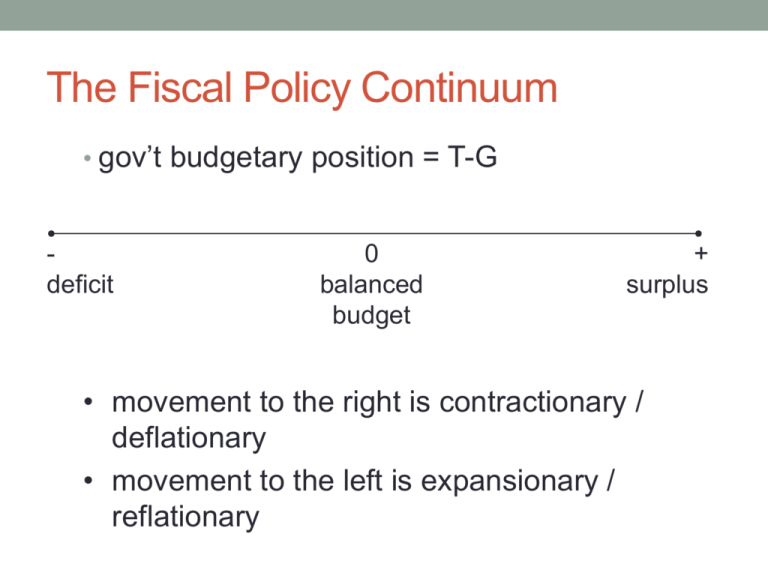

The Fiscal Policy Continuum • gov’t budgetary position = T-G deficit 0 balanced budget + surplus • movement to the right is contractionary / deflationary • movement to the left is expansionary / reflationary What are Taxes For? • Raise revenue • Reduce the demand for de-merit goods • Internalise external costs • Discourage imports • Redistribute income Types of Taxes • Direct Tax • Indirect Tax Regressive Tax • takes a higher proportion of income from lower income earners (eg. council tax – assume identical homes to identical tax payable) Income Tax Payable Tax Rate £10,000 £2000 20% £40,000 £2000 5% £100,000 £2000 2% Proportional Tax • takes an equal proportion of income from all earners (eg. UK corporation tax – in the UK, most corporations pay the ‘main rate’ – > £300K profit) Income (Profit) Tax Rate Tax Payable Average Tax Rate £300,000 21% £63,000 21% £500,000 21% £105,000 21% £1M 21% £210,000 21% Progressive Tax • takes a higher proportion of income from higher income earners (eg. UK income tax) Income Taxable Income Tax Rate Tax Payable Average Tax Rate £10,000 £0 0% £0 0% £42,000 £32,000 20% £6,400 15% £150,000 32K @ 20% 118K @ 40% £53,600 36% 32K @ 20% 118K @ 40% 150K @ 45% £121,100 40% £150,000 £300,000 (£10K allowance gone) £300,000 Question to consider? • National Insurance works like this: • Based on weekly gross earnings • First £0 - £153 / week – 0% • Next £153 - £805 / week – 12% • Anything above £805 / week – 2% • Is this regressive, proportional or progressive? Evaluation of a Tax: How do we decide if it’s a good tax? • Equity: the impact of the tax on people at different levels of income (regressive, progressive, proportional) • Efficiency: does the tax raise enough revenue without distorting the mkt? (eg. Income taxes may ↓ incentive to work, indirect taxes prices to creative allocative inefficiency) • Transparency & Certainty: does it cost a lot to implement & can it be reliably collected (black mkts) Financing of Gov’t Expenditure • Taxes - central gov’t • Taxes - local authorities (eg. council tax) • National insurance contributions paid by employees and employers • Borrowing (PSNBR) • Sale of assets Functions of Gov’t Expenditure • Provision of Public and Merit Goods & Services • Provision of Social Security • Regulation of Economic Activity • Improving Efficiency of Allocation of Resources • Influencing the Level of Economic Activity Categories of Gov’t Expenditure • Current Expenditure • Capital Expenditure • Transfer Payments • Debt Interest Factors Influencing Level of Gov’t Expenditure • Economic Cycle • Demographic Changes • Social / Cultural Changes • Demand for Goods & Services • Demand for Public / Merit Goods • Political Views • Interest Rates • Risk of Conflict Automatic v Discretionary Fiscal Policy • Automatic: changes in tax rev. & spending brought about by cyclical changes in GDP (during recession, more people on benefits, less tax rev. ∴ boosts AD) • Discretionary: active demand management (during recession, chancellor may decide to lower taxes to boost AD) When Expenditure >Tax Revenue • Structural Deficit – occurs when gov’t deliberately runs a budget deficit to increase AD (may seek to unemp. or econ.growth) • Cyclical Deficit – result of a cyclical fall in economic activity (recession or slowdown) that tax rev. & gov’t expenditure • PSNCR (public sector net cash requirement) or PSNBR (borrowing) – amount by which gov’t spends more than it raises in revenue –financed by borrowing money from the private sector, or overseas or by selling assets (will be a negative number when gov’t runs a surplus – some nat’l debt can be repaid)