Job Order & Process Costing Problems

advertisement

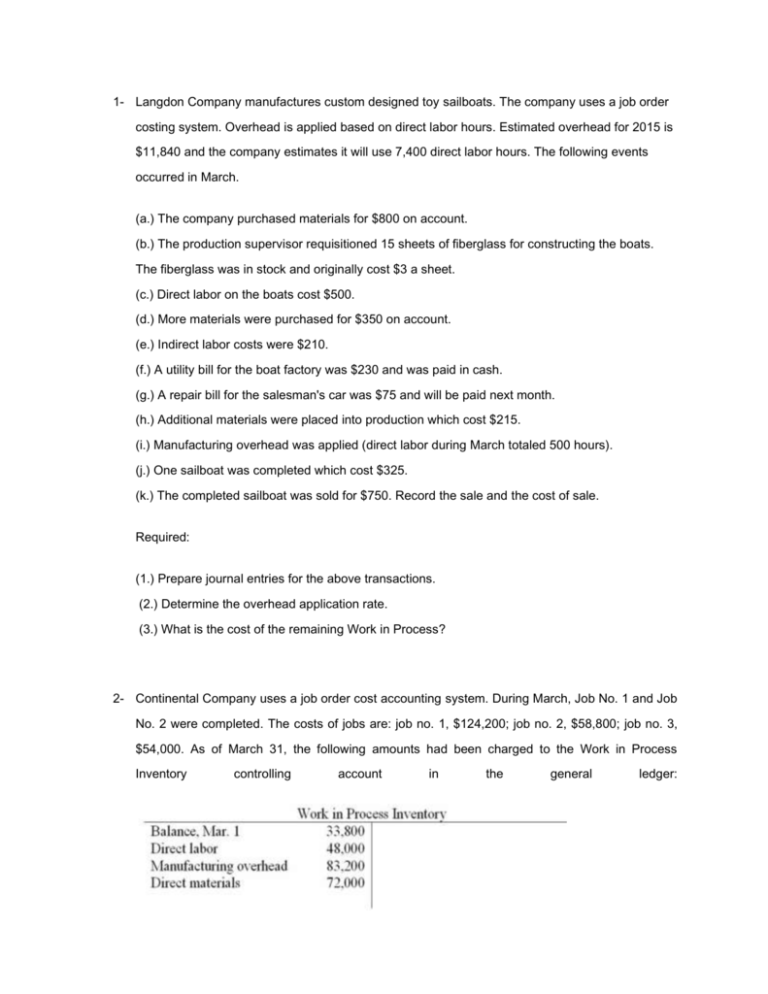

1- Langdon Company manufactures custom designed toy sailboats. The company uses a job order costing system. Overhead is applied based on direct labor hours. Estimated overhead for 2015 is $11,840 and the company estimates it will use 7,400 direct labor hours. The following events occurred in March. (a.) The company purchased materials for $800 on account. (b.) The production supervisor requisitioned 15 sheets of fiberglass for constructing the boats. The fiberglass was in stock and originally cost $3 a sheet. (c.) Direct labor on the boats cost $500. (d.) More materials were purchased for $350 on account. (e.) Indirect labor costs were $210. (f.) A utility bill for the boat factory was $230 and was paid in cash. (g.) A repair bill for the salesman's car was $75 and will be paid next month. (h.) Additional materials were placed into production which cost $215. (i.) Manufacturing overhead was applied (direct labor during March totaled 500 hours). (j.) One sailboat was completed which cost $325. (k.) The completed sailboat was sold for $750. Record the sale and the cost of sale. Required: (1.) Prepare journal entries for the above transactions. (2.) Determine the overhead application rate. (3.) What is the cost of the remaining Work in Process? 2- Continental Company uses a job order cost accounting system. During March, Job No. 1 and Job No. 2 were completed. The costs of jobs are: job no. 1, $124,200; job no. 2, $58,800; job no. 3, $54,000. As of March 31, the following amounts had been charged to the Work in Process Inventory controlling account in the general ledger: (a) Prepare the general journal entry to reflect the jobs completed during March. (b) Compute the cost of the unfinished jobs at March 31. 3- Burgandy Corporation makes plastic and wooden picture frames. The company has assigned $107,000 in monthly manufacturing overhead costs to two cost pools as follows: $67,000 to power costs, and $40,000 to production set-up costs. Additional monthly data are provided below: Power costs are allocated to products using machine hours as an activity base. Set-up costs are allocated to products based on the number of production runs each product line requires. (a) Allocate manufacturing overhead from the activity cost pools to each product line. (b) Compare the total per-unit cost of manufacturing plastic frames and wooden frames. (c) On a per-unit basis, which product line appears to be most profitable? 4- Joyce Industries uses a process costing system. All of the company's manufacturing activities take place in a single processing department. There was no beginning inventory in May. During the month, $60,000 of materials were added and $40,000 of labor and $75,000 of overhead costs were charged to work in process. The entire work in process inventory of 20,000 units was completed and transferred to finished goods. Of these 20,000 units, 15,000 were sold on account at $14 per unit. In the space provided, prepare a general journal entry to summarize each of the following categories of transactions for the month of May (you may omit explanations): (a.) The recording of manufacturing costs applied to production (use a single journal entry). (b.) The transfer of completed units from work in process to the finished goods warehouse. (c.) The sale of 15,000 units manufactured during the month and the related cost of goods sold. 5- The records of Westminster Manufacturing Company for the month of May show the following costs in Department A: The beginning inventory for May consisted of 10,000 units which were 80% complete as to direct materials and 60% complete as to labor and overhead. A total of 100,000 units were completed and transferred out during May, and 20,000 units remained in the work in process inventory. The ending inventory was 80% complete as to direct materials and 40% complete as to labor and overhead. By using FIFO method, compute the following: (a) Direct materials cost per equivalent unit. (b) Equivalent units of production for direct labor and overhead. (c) Total cost of 100,000 units completed. (d) Total cost of 20,000 units in process at the end of the month. 6- Monfort Company used Weighted Average Method and had the following information: If 148,500 Beginning Work-in-process is 100,000 Direct Material Cost and 48,500 Conversion Costs. (1.) What are equivalent units of production for materials? (2.) What was the cost per equivalent unit of production for materials? (3.) What were the equivalent units of production for conversion cost? (4.) What was the cost per equivalent unit of production for conversion costs?