Environmental Evaluation Grid: Meat Industry

advertisement

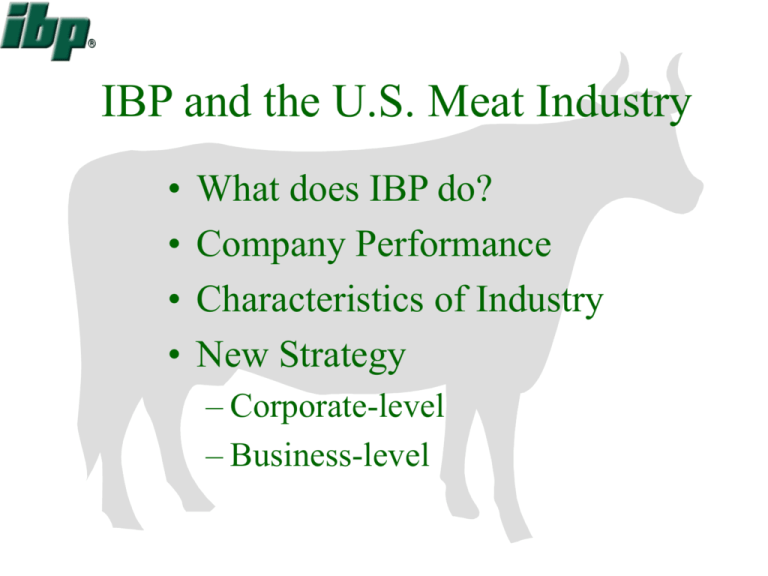

IBP and the U.S. Meat Industry • • • • What does IBP do? Company Performance Characteristics of Industry New Strategy – Corporate-level – Business-level Financials (Data from Case) 11000 Sales 9000 7000 5000 1985 1986 1987 1988 1989 1986 1987 1988 1989 120 95 Net 70 Earnings 45 20 1985 IBP vs. CAG vs. S&P 500 S&P 500 CAG IBP 1990 2000 U.S. Per Capita Meat Consumption (Pounds per Year) 100 90 80 70 60 50 40 30 20 10 0 Beef Pork Chicken Fish 1970 1975 1980 1985 1990 1995 2000 Comparative Meat Prices $3 $3 $2 $2 $1 Beef Pork $1 Chicken $0 1970 1975 1980 1985 1989 5-Forces Model of Beef Industry Potential Entrants Suppliers Rivalry Substitutes Buyers Industry Consolidation 90 Market Share 80 70 60 50 IBP ConAgra Cargill CR-3 40 30 20 10 0 1982 1987 1988 1989 Strengths • Largest, low-cost producer: – Market Share Leader: Beef and Pork – Sales:Asset Efficiency = 6.7 (IBP) vs. 2.6 (CA) Weaknesses • Buys from spot market – Vulnerable to price increases in down cycles • Highly leveraged (D/E = 84%) – Dependent on Occidental • Lacks brand name recognition • No consumer marketing skills Threats • Declining beef consumption: – 20% since 1976 – 30% decline predicted by 2000 • Poultry is preferred substitute • More intense rivalry from Cargill, ConAgra – Top three hold 70% market share • Poor image: calories, fat, cholesterol • Beef carcass prices continue to rise Environmental Evaluation Grid Very Bad General Environment Competitive Environment TOTAL IMPACT Economics Demographics Political-Legal Sociocultural Technological Global Potential Entry Suppliers Customers Substitutes Rivalry Bad Benign ? Good Very Good Business-level Opportunities • Under-marketed Industry – a la Philip-Morris’ entry into beer industry (Miller) • Few Branded/value-added Products – But, rivals and substitutes already have lead in brand name recognition (HealthyChoice, Purdue) • Export Markets: – EU restrictions on Growth hormones, antibiotics – EU mad-cow disease – Japanese taste preferences Corporate-Level Opportunities • Related horizontal diversification – Leverage meat processing skills/advantages in other “attractive” meat segments • Related vertical diversification – Backwards – Value-managed feedlots, meat characteristics – Forwards – Value-added consumer products Pork? Is Chicken the Answer? Bison? Exotic/Game Meats? Venison Ostrich Elk Strategic Recommendations • Business-level strategy (stay with current portfolio) – How should IBP compete? • Corporate-level strategy – Related – In which meat segments should IBP compete? – Unrelated – In which other “industries” can IBP compete? • Mission – To position IBP as the world’s premier valueadded meat producer through innovation, customer attentiveness, and efficiency • Goals – Increase ROS to 3.0% by 1991 – Increase exports/total sales to 15% by 1991 – Develop 2 new branded products each year – Reduce spot transactions by 50% by 1993 Branded Products • Pure Iowan brand beef – 30% leaner that USDA Grade A – Designate 2 value-managed feedlots • Low-fat feeds • Antibiotic-free • Growth hormone-free Branded Products • Tobasco Burgers – Semi-Prepped / Co-Branded Ground Beef – License Tabasco® Name ($5mil) – Purchase Meat chopping equip for 3 plants ($10mil) – Supply contract with Campbell’s for 150k gallons Tabasco® Bloody Mary Mix per year ($150k) Branded Products • American Patriot Beer-Fed Beef – U.S. version of Japanese Kobe Beef – License Sam Adams® Name ($5mil) – Designate 4 feedlots as ‘value managed’ – Supply contract with beer producers for finished beer waste and fermentation grain by-products ($600k) Branded Products Beef Sushi and Buffalo Wings Distribution Production • Restaurants • Beer-fed steer • Upscale grocers • Bison IBP’s response to the “Chicken Wing” Marketing • Ads • In-store promos • Co-branding – Sam Adams – Kirin Distribution – Branded Products • Direct Sales to “upscale” grocers/meat shops – Hire 12 district sales/technical specialists ($35k ea.) – Fleet of 100 ten-foot refrigerated specialty trucks and uniformed drivers (Drivers $25k, trucks $55K ea.) • National steakhouses – Morton’s – Ruth’s Chris • Web-based Sales – Direct:wwww.pure-iowan.comx – Indirect: Distribution agreements with: • Omaha Steaks • Peapod Marketing • Branded Products – Packaging and Labeling: Change brand from IBP to Pure Iowan, feature Tabasco® and Sam Adams ® – Fold-out scratch-n’-sniff ads in Gourmet, Food & Wine, Southern Living ($150k each magazine biweekly) – Set up feature with Graham Kerr’s cooking show ($200K) – TV ads during PGA Tournament and USTA Matches ($100K for each 30-second spot) Marketing (misc.) • Transnational International Strategy – Sam Adams® beer-fed beef promoted/shipped to wholly-owned Tokyo sales/distribution center – Pure Iowan® additive-free beef promoted/shipped to wholly-owned London & Rotterdam sales/distribution centers • Marketing Executive – Hire SVP Marketing manager from Kraft, Pepsico, or P&G ($500K) Strategy Recap HQ Marketing Exec. Reduce spot transactions Bloody Mary, beer by-products Procure Tech. Dev. Profit Margin Value-added products IBL Mfg. Valueadded Feedlots Meat chopping equip. OBL Truck Fleet; Intl. Mkt. Co-brand Ads Sales Svc.