LEONHARDT – Cal

advertisement

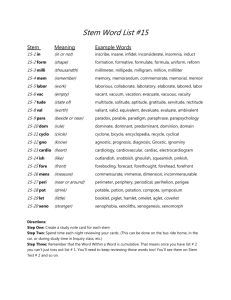

Cal-X Stars Innovation and Business Accelerator FOCUSED on Launching Great Cardiovascular and Social Good Impact Companies Super brief history Leonhardt Ventures founded in 1982. Has since raised $145 million that has been invested in the development of over 28 innovations and companies. 21 direct Leonhardt patents and over 70 acquired or licensed patents or technologies. 1982-1985 – Built dozens of cardiac cath labs & ICUs around the world. 1986-1994 – Developed world leadership in polyurethane balloon cardiovascular catheters. 1995-1998 – Developed world leadership in stent grafts and percutaneous heart valves. 1999 – 2008 – Developed world clinical leadership in stem cell repair of damaged heart muscle. 2009 – Launched Leonhardt’s Launchpads Life Science Incubator. 2008 to 2012 – Developed world leadership in the development of electrical stimulation for stem cell therapies. 2012 – Launched Cal-X Stars Innovation & Business Accelerator. Leonhardt Ventures’ Cal-X Stars Business Accelerator, Inc. Presenter: Howard J. Leonhardt, Founder, CEO 1531 6th Street, Unit 401, Santa Monica, CA 90401 Office Direct 310 310 2534 Elevator Pitch = All star team with over $14 billion in previous exits is launching an unprecedented portfolio of breakthrough technologies focused in two clear areas (1) cardiovascular and (2) social good impact. Cardio disruptive technologies include the first stem cell recruiting heart pacemaker, the first biological pacemaker, two revolutionary heart pumps, the first implantable stem cell pump, the first stem cell therapies for heart failure treatment, the first wireless energy device for directing stem therapies non-invasively and the first stem cell recruiting women’s bra. The social good impact portfolio is anchored by The California Stock Exchange – the first conscious capitalism stock exchange duly designed to aide life science and other growth cos to bridge the gap from friends and family financing to a NASDAQ or NYSE IPO. One of a kind stand out technologies driven by proven team. FOCUSED on the launch process where the greatest equity is available at the least cost = best FOCUS for investors. Unmatched on two fronts Cardio - Heart failure is the leading economic drain on the U.S. healthcare system today. Our technologies are destined to cut these costs by more than one half. 50 million people are set to die from heart failure this decade. We expect to save more than 30 million lives. NO other technology rebuilds scarred heart with living cells like ours does, the way hearts are built in the first place. The combined R&D pipelines of Medtronic, St. Jude, Boston Scientific and J&J do not come close to match our pioneering patented portfolio in this space. Social good impact – The California Stock Exchange, the first conscious capitalism stock exchange, is not just a stock exchange it is the leading engine of innovation and job creation and re-boots U.S. economic leadership for this century. 23 million new U.S. jobs on the way, not just any jobs but jobs people love! About to prove that doing good is not just good for good sake but is good business. For the people that believe in this they now have a home marketplace. Current Pains to the Customers Heart Failure = Leading economic drain on U.S. healthcare system. 50 million about to die in next 3-5 years worldwide without a better solution. No current therapy addresses underlying problem of recovering heart scar tissue post heart attack. Social good impact financing = NYSE, NASDAQ, VCs, Formal Angel Groups all fail to meet the financing needs of life science and other social good impact cos. years 3 to 9. It takes 9 years for a good co these days to get to a NASDAQ IPO up from 3 in the early 1980’s. Most life science and other social good startups run out of seed financing by about year 3. VCs and angel groups increasingly want to see revenues before investing. The FDA approval process has lengthened to more than 5 years to get approval for any major new breakthrough technology. Our Solutions Heart Failure = We are the only ones that have developed and patented a reliable way to convert heart scar tissue into new living pumping muscle which allows heart failure patients to recover. We are leaders in muscle stem cells, SDF-1, electrical stimulation, nutrient hydrogel, implantable stem cell pumps, wireless energy for growth factor release and stem cell recruitment and differentiation, perfusion improving heart pumps. We are the only ones with the complete solution. We pre-treat the scar, treat the scar with stem cell transplantation creating new contractile muscle and post treat the area to maintain and build on original muscle growth. No one else comes close to a complete solution. Where others are tapping out at 53 meters improvement in a patient’s exercise capacity we are expecting over 200 meters improvement, or better. Our Solutions Social Good Impact Financing – A new stock exchange with new rules… Holistic analysis of companies including innovation culture, R&D pipeline, morale, sense of vision and purpose, long term commitment. No day trading. No short trading. Emphasis on promoting local investing. Greater transparency. Less volatility. A place where doing well by doing good will become the norm rather than the exception. Market & Strategy Heart Failure Market 50 million patients and growing. Current cost > $150,000 ea annually to care for. We will cut this cost by more than one half. Cost to produce $5000. Reimbursement $58,000+ We will create, make and sell. Our primary strategy is to win the prime time podium at the major cardio meetings by winning support of the opinion leaders. We have done it before and can do this again. Market & Strategy The California Stock Exchange Over 1 million great U.S. social good impact and life science seeking better financing options. Over 1 billion potential investors worldwide that believe that the better future is… one where companies that treat people and their communities well win and take their investors along on this win. The current cost of an NASDAQ IPO is $2.3 to $4.8 million. We will cut this range down to $40,000 to $450,000. Investors are on a roller coaster ride on Wall Street with the over emphasis on short term quarterly net profits at all costs including cutting R&D and people. We will get them off this roller coaster. The current financing systems favor men owned enterprises over women owned 95:5. We will end this gender gap and gain the support of 50% of the world’s population in the process. We will prove with solid data that treating people and communities well with a product with a true sense of purpose is not just good for good sake, but is good business. Companies with this conscious capitalism model will attract the most talented members. This will foster innovation and superior customer service. This leads to happier repeat customers which leads to more reliable steady returns for investors. For the people that believe in these principles this will be their home marketplace. We will attract a whole new class of investors in the marketplace. Competition Heart Failure • In-direct = Medtronic, Boston Scientific, St. Jude with pacers = only 16 meters improvement. • In-direct = HeartWare, Thoratec, Cardiac Assist, Abiomed with mechanical artificial heart pumps – they do nothing to repair problem they only allow pts to live temporarily with problem. Low quality of life. • In-direct = All CHF drug manufacturers. $8 billion is spent ea yr on these drugs. Their performance is minus 4 meters decline in exercise capacity. • Direct = Mesoblast, Cytori, Aastrom, NeoStem, Cardio-3, Osiris, Capricor. None of these cell types can grow new contractile muscle in scar tissue. All of them are one dimensional incomplete solutions. Their best result is 53 meters improvement as a group. Osiris with allogeneic bone marrow comes in a 10 meters. • We have achieved 95.7 meters improvement already in Phase III trials and animal data indicates we should be to over 200 meters with SDF-1 and repeat delivery alone and we are adding many more enhancements with the new generation of developments. Competition Table Improve Scar Tissue Repair FDA Sales Medtronic 16 mtrs No Y $3 bil. St. Jude 16 mtrs No Y $2 bil. Boston Scientific 16 mtrs No Y $2 bil. CHF Drugs -4 mters No Y $8 bil. Mesoblast 53 mtrs No N Valuation $2 billion Capricor 53 mtrs No N ? Osiris 10 mtrs No N ? Cytori Therap. 53 mtrs No N Valuation $500 mil. NeoStem ? No N ? Cardio-3 53 mtrs No N Valuation $300 mil. LEONHARDT – Cal-X Stars *200 mtrs YES! N *$6 bil. * = projected Competition Table Holistic Analysis Clear Branding Min. IPO Total IPO Cost NYSE No No $1 bil. $5 mil. NASDAQ No No $100 mil. $2.3 to $4.8 mil. OTC Markets No No ? ? BATS No No ? ? TSX Venture No No ? ? Cal-X Yes Yes $8 mil. $40K to $450K Management Team We have built an all star team of over 40 proven industry veterans with over $14 billion in exits in the cardiovascular space alone. Our scientific advisory board, research and clinical investigation teams includes over 70 world leaders in the space. Our cGMP manufacturing team has over 30 years experience. Howard J. Leonhardt, Chairman & CEO – 21 U.S. patents. Has brought more than five cardio products to market leadership positions. Over 200,000 patients have been treated with Leonhardt inventions to date. His TALENT thoracic stent graft captured 70% world market share before being sold to Medtronic. Alex Richardson – CEO Core Manufacturing – 30 years experience in electronics and medical device cos primarily with Alfed Mann companies. Jeremy Koff – VP Business Development – 20+ years in product launch experience primarily with Alfred Mann companies. Alan Remen – 30 years operational management experience in technology companies. Dr. William Abraham – Chairman Scientific Advisory Board – Chief of Heart Failure at OSU. PI of the MIRACLE trial that launched the $9 billion CRT/ICD era of heart failure treatment. Financial Projections 2015 2016 2017 2018 2019 Revenues $117.7 $204.6 $337.4 $154.2 $227,699 Expenses $14,500 $701.3 $722.9 $745.1 $767.7 Net ($14,382) $(496.7) ($385.5) ($590.9) $227,231 Above table is in 000’s. Note – These are breakthrough first ever products un-tested in markets. Markets are big – really big. This is very very difficult to predict. We are focused on addressing great market needs with far superior products. Brief History Review Leonhardt Ventures founded in 1982. 1982-85 – Built cardic cath labs around the world – AGMC + IMA. 1986 – Introduced private label line of cardio balloon catheters, oxygenators and heart valves – World Medical Corp. – PolyCath, DMG and Labcor. 1987 - $3.2 million in sales, $200K net profit – World Medical. Richard Spencer former President of Cordis Corp. joins. 1988 – Dr. Race Kao and Dr. George Magovern team members complete first case of muscle stem repair of damaged heart muscle in dogs and publish in The Physiologist. – Bioheart MyoCell. 1988 – Patented line of polyurethane balloon cardiovascular catheters and launched World Medical Manufacturing Corp. – PolyCath. 1989 – Developed first stem cell delivery catheter Pro-Cell, later patented and sold to Medtronic. 1990 – FDA 510K authorization to market received. Captured world leading market share for polyurethane cardiovascular balloon catheters. Supplied Cordis Corp., Nippon Zeon and later Novoste. 1990 – Team member Wendell King successfully completes and patents the first biological pacemaker – BioPace. 1990 – Team member Dr. Stu Williams patent endothelial cell procurement device and cell sodding of grafts – EndoCell. 1991 – Developed and patented PENSIL intravascular lung catheter working with Penn State University. Brief History in Review 1991 – Developed blood vessel patch that led to first prototype of TALENT (Taheri-Leonhardt) stent graft for aortic aneurysm repair – 5 patents. Later captured 70% of world market share and sold to Medtronic. 1992 – Developed vibrational energy device to prevent plaque formation in arteries – CoroStim. 1992 – Radiation delivery catheter developed and patented for restenosis prevention after stenting or balloon angioplasty. 1993 – Leonhardt and Greenan invent, patent and develop first percutaneous heart valve – ValveStent. Later sold to Medtronic. 1995 – Leonhardt led team complete first ever percutaneous repair of an aortic aneurysm in Melbourne, Australia with Dr. Ken Thomson and Dr. Peter Field. 1997 – Leonhardt and Taheri patent improved biological pacemaker. 1998 – World Medical Mfg. Corp. reaches $9.2 million in sales with $1 million net profit and merges with Arterial Vascular Engineering, Inc. of Santa Rosa, California. November of 1998 Medtronic acquires combined companies for $4.3 billion. 1999 – TALENT stent graft captures 70% of world market share for thoracic aortic aneurysm repair and 35% of AAA market. Eventually peripheral division sales built around this product line grow to $800 million annually by 2009. 1999 – TALENT stent graft positive results for treating aortic dissections for the first time are published in THE NEW ENGLAND JOURNAL OF MEDICINE - Nienaber CA, Fattori R, Lund G, et al. Nonsurgical reconstruction of thoracic aortic dissection by stent-graft placement. N Engl J Med. 1999;340:15391545. 1999 – Leonhardt launches Bioheart, Inc. the first company dedicated to stem cell repair of damaged heart muscle. 2000 – Bioheart launches in U.S. market first ever cardiovascular genetic test – Pla2 – currently over $200 million in annual sales with various producers. 2001 - Leonhardt founded Bioheart led team completes historic first ever clinical case of stem cell repair of damaged heart tissue with Dr. Patrick Serruys, Dr. P. Smits, Dr. Warren Sherman, Dr. Doris Taylor and Dr. Kumar Ravi. Brief History in Review 2000 - Leonhardt launches Leonhardt Vineyards in California. 2002 – Leonhardt, Chachques and Kanno being filing series of landmark patents later issued for utilizing electrical stimulation to recruit and differentiated stem cells into useful tissues – regeneration. 3 pioneering patents with dozens of claims are eventually issued with more pending. 2007 – Leonhardt resigns as CEO of Bioheart. Bioheart stock price remained above $7 per share during entire 9 year tenure as CEO. $85 million in capital was raised. 33 patents issued or acquired. MyoCell completed Phase II/III clinical trial with success. 2008 – Bioheart completes IPO under CEO Bill Pinon. 2008 – Bioheart announces by press release formal plans to divest its noncore assets and Leonhardt takes on assignment as CTO to find homes for each technology to be developed. 2010 – Bioheart published Phase III clinical trial results demonstrating 95.7 meters improvement over placebo. 2011 – The California Stock Exchange plans are formally announced. Soon there-after INC. Magazine, Forbes, UpStart Business Journal, Northbay Biz, Crowdfund Insider, Startup California, The Press Democrat, Impact, Caypen, TCA, It’s Just Good Business, CBS Radio, The California Womens Conference and others cover the story of the development of the first conscious capitalism stock exchange. Brief History Review 2011 – MyoStim Pacers and BioPace are officially spun out of Bioheart to be incubated in California by Leonhardt Ventures and Airspeed Equity and are later enrolled into the Cal-X Stars Innovation and Business Accelerator in 2012. 2011 – Leonhardt renews research collaboration with Dr. Eric Duckers and Dr. Pieter Doevendans in The Netherlands for research collaboration on Bioheart, BioLeonhardt, MyoStim Pacers and BioPace. 2012 – The Cal-X Stars Innovation & Business Accelerator is launched. 2012 – Stem Cell Bra is the first Cal-X Stars new product development. A patent application is filed and the company is launched with Dr. Joel Aronowitz from Cedars Sinai UCLA. 2012 - Leonhardt travels to Germany to structure conditional agreement with Cardiogbridge for U.S. rights and investment opportunity in the Reitan heart pump on a catheter. 2013 – Cal-X Stars Business Accelerator has 28 portfolio companies or innovations enrolled for acceleration services and launches first funding round. 14 cardiovascular and 14 social good impact. 33 member Scientific Advisory Board of world opinion leaders is assembled. Business team of over 40 is signed up. 2013 – Working with the team at Core Manufacturing the Leonhardt team develops the first stem cell pump, implantable heart sensor and wireless energy devices for directing stem cell therapies non-invasively.