Short Term Financial Management in a Multinational

advertisement

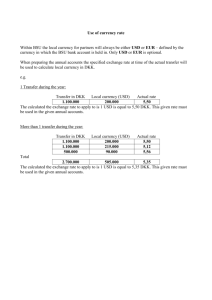

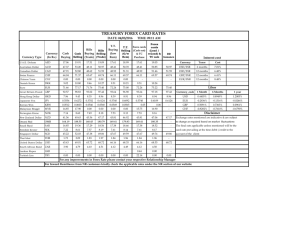

Short Term Financial Management in a Multinational Corporation Introduction • The essence of short term financial management can be stated as – Minimize the working capital needs consistent with other policies – Raise short term funds at the minimum possible cost and deploy short term cash surpluses at the maximum possible rate of return consistent with the firm's risk preferences and liquidity needs • In a multinational context, the added dimensions are the multiplicity of currencies and a much wider array of markets and instruments for raising and deploying funds • Focus on cash management since it is complex because of possibility of raising and deploying cash in many currencies, many locations, and profit opportunities presented by imperfections in international money and foreign exchange markets • Other aspects of short-term financial management such as inventories, receivables/payables management etc. not too different in a multinational context as opposed to a purely domestic firm. • Even a purely domestic firm or a firm with imports and exports but no cross-border manufacturing facilities can "internationalize" its cash management if the government of the country permits free capital inflows and outflows • In India as of now, the capital account has not been fully opened up; short-term borrowings are generally discouraged and there are restrictions on parking surplus funds abroad. Also, restrictions on leading-lagging, netting etc. • Indian firms have been permitted access to foreign money markets (through domestic banks) for pre-shipment credits for exports and settlement of import payments • The Exchange Earners Foreign Currency (EEFC) account facility is available to all exporters (50% of FC earnings) with special facilities for software firms 100% EOUs (100%). • Cannot access foreign markets for day-to-day cash management • Banks arbitrage between domestic and foreign money markets so that forward margins closely related to interest rate differentials. • The passive approach confines itself to minimizing cash needs and currency exposure as well as optimal deployment of cash balances arising out of the firm's operating requirements • The active approach deliberately creates cash positions to profit from perceived market imperfections or the firm's supposedly superior forecasting ability • Again a matter of risk-reward tradeoff. Short Term Borrowing and Investment • The principal dimensions of the borrowinginvestment decisions are the instrument, currency, location of the financial center and any tax related issues such as withholding taxes, capital gains taxes versus ordinary income taxes, double tax avoidance treaties etc. • On a covered basis, the choice of currency of borrowing does not matter. (Apart from any tax considerations) • Only when the borrower firm holds views regarding currency movements which are different from market expectations as embodied in the forward rate, does the currency of borrowing become an important choice variable Where should Surplus Cash be Held? • Minimizing transaction costs: Funds received in currency A, needed later in currency A then hold them in currency A • Liquidity: Funds should be held in a currency in which they are most likely to be needed (not necessarily same as the currency in which they are received) • Political risk • Availability of investment vehicles and their liquidity • Withholding taxes – One of the cheapest ways of covering shortterm deficits is internal funds – A centralized cash management system with cash pooling described below can efficiently allocate internal surpluses – External sources of short-term funding consist of overdraft facilities, fixed term bank loans and advances and instruments like commercial paper, trade and bankers' acceptances Centralized Management Versus Decentralized Cash Management • Centralized cash management has several advantages – Netting – Exposure Management – Cash Pooling (Reduces cash requirements) • Disadvantages of centralized management – Some funds have to be held locally in each subsidiary to meet unforeseen payments Centralized Management Versus Decentralized Cash Management – Local problems in dealing with customers, suppliers etc. – Performance evaluation conflicts – Conflicts of interest can arise if a subsidiary is not wholly owned but a joint venture with minority local stake Netting with Central Depository Some firms use a central depository as a cash pool to facilitate funds mobilization and reduce the chance of misallocated funds. $15 $55 Central depository $40 Consider the case of an American multinational with subsidiaries in France, Switzerland and the UK. The parent operates a cash management center. By a specific date each month - say the 15th - all units, the subsidiaries as well as the parent report their receivables and payables among themselves to the CMC. The CMC uses the current spot rates to convert all cash flows into a common denominator viz.US dollars. Figure below shows the positions reported by the various units. The spot rates are assumed to be USD/CHF = 1.5000, GBP/USD = 1.6000 and EUR/USD = 1.2000 SWITZERLAND CHF 1.5m (USD 1m) EUR 5m (USD 6m) GBP 1m CHF 9m (USD 1.6m) (USD 6m) GBP 2m (USD 3.2m) FRANCE UK EUR 2.5m (USD 3m) USD 2m USD 1m USA (PARENT) GBP 3m (USD 4.8 m) The CMC nets out the receivables against payables of each unit and informs the net payers to pay designated amounts to the net receivers. The actual settlements take place at a specified date - say the 25th of the month - for which the net payers acquire the necessary currencies at the spot rate ruling at that time. Any exchange gains or losses are attributed to the individual units. The net positions of the various units, in millions of dollars, are as follows (+ sign indicates inflow and a - sign an outflow): US: + 2 + 1 - 4.8 = -1.8 UK : +4.8 + 3.2 + 1.6 - 2.25 - 6.0 = +1.35 France : + 4.5 + 2.25 - 1.0 - 3.2 - 2.0 = 0.55 Switzerland : + 1.0 + 6.0 - 4.5 - 1.6 - 1.0 = -0.1