Chapter 9: Financial Risk

Management

Outline:

Overview of Risk Management in Treasury

Derivative Instruments Used as Financial Risk

Management Tools

FX Risk Management in Treasury

FX Exposure

Currency Derivatives Used to Hedge FX Exposure

Interest Rate Exposure and Risk Management

Commodity Price Exposure

Other Issues Related to Financial Risk

Management

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 1

Basics of Financial Risk

Management

Financial risk is the risk of direct or indirect

losses resulting from uncertainties in the

future levels of interest and FX rates and

commodity prices.

Financial risk has increased significantly

recently for two reasons:

1

The speed of business through advances in

technology and communications

2

The scope of business through trends toward

globalization

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 2

Discussion Question

Match the following terms with the clues provided.

Value at risk

Sensitivity analysis

Scenario analysis

Monte Carlo

simulation

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

What-if exercises that

alter a single variable;

can identify most

influential variables.

Developed in trading

rooms to estimate

possible losses in a day.

Computer uses a series of

probability distributions

to set multiple variables.

Changes more than one

variable at a time;

experts supply range of

values.

Session 6: Module 4, Chapter 9 - 3

Discussion Question

What is the role of the treasury area?

Answer:

The treasury department is a clearinghouse for

daily functional information. Treasury

professionals are asked to:

Supply information to assist in analysis

to determine an organization’s risk

appetite and profile.

Implement an overall risk management

strategy.

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 4

Hedging, Speculation and Arbitrage

Hedging

Reducing or eliminating risks

associated with the uncertain future

cash flows

Assuming risk and betting on the

direction of the market and whether

Speculation

the price of an asset will go up (long)

or down (short)

Arbitrage

Assuming no risk but attempting to

profit from market inefficiencies by

buying an asset in one market and

simultaneously selling in another

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 5

Benefits of Financial Risk

Management

The company’s probability of

financial distress decreases

because the firm can assess

costs and revenues more

accurately.

Greater predictability in

future cash flows makes the

company more attractive to

shareholders.

The company gains an

enhanced borrowing

advantage in credit markets

because lenders view the firm

as being less risky.

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 6

Derivative Instruments Used as

Financial Risk Management Tools

Derivative instrument

is a financial product

that acquires its value

by inference through

a formulaic

connection to another

asset (such as

another financial

instrument, currency

or commodity).

Primary uses:

Use of derivatives may

have immediate

favorable/unfavorable

impact on cash flow.

Four basic types of

derivative instruments:

Forwards

Futures

Swaps

Options

Managing FX

Managing interest

rates

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 7

Forward Contracts

A customized agreement between two parties to buy

or sell a fixed amount of an asset at a future date

at a price agreed upon today

Asset involved is referred to as the underlying

asset.

Future date (maturity date of the contract).

Price is delivery price of contract.

Company buying asset is one party; the other is

called the counterparty (bank or FX dealer).

Buying party is long a forward contract;

counterparty is short a forward contract.

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 8

Futures Contracts

A standardized contract between two parties traded on

an organized exchange

Similar to forwards in intent (payoff profiles

from long and short positions are the same)

but differ in execution (e.g., counterparty is

the exchange itself).

Size of contract and its maturity date set by

exchange.

Trading requires a margin account.

Futures contracts are rarely settled by actual

delivery and are usually closed out prior to

maturity.

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 9

Swaps

An agreement between two parties to exchange (swap)

a set of cash flows at a future point in time

Types of swaps include:

Interest rate swap—an agreement to

exchange interest payments (e.g., a fixedrate loan for a floating-rate loan)

Currency swap—an agreement to convert an

obligation in one currency to an obligation in

another currency

Commodity swap—an agreement to

exchange a floating price for a commodity at

a fixed price

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 10

Options

A contract where one party has the right (but not the

obligation) to buy or sell a fixed amount of an underlying

asset at a fixed price on or before a specified date

Counterparty (writer of the option) selling the

option receives a premium from the buyer.

May be exchange-traded or negotiated with a

counterparty.

Call option: Contract giving the owner the right

to buy an asset.

Put option: Contract giving the owner the right

to sell an asset.

Strike/exercise price: The fixed or contracted

price of the underlying asset.

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 11

Discussion Question

Which of the following is true of options?

a) American option: exercise only on delivery

date

b) European option: exercise any time through

delivery date

c) Bermuda option: exercise only on

specific dates that are evenly spaced

over option’s life

Answer: c

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 12

Relationship Between an Option

Premium and Strike (Exercise) Price

If the underlying asset price is

equal to the strike price of the

option

Call or put

option

At-the-money

Call option

Out-of-the-money

If the asset price is less than the

strike price of the option

Put option

Out-of-the-money

If the asset price exceeds the

strike price of the option

Call option

In-the-money

If the asset price is greater than

the strike price of the option

Put option

In-the-money

If the asset price is less than the

strike price of the option

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 13

Discussion Question

A call option with a $50 strike price is

purchased when the underlying asset is

selling for $46 per unit. The premium paid is

$1. Identify if the following put options are

in-, at-, or out-of-the-money.

Answers:

Price of

Underlying

Asset ($)

$50 Call Option

Value ($)

Profit (+) or

Loss () ($)

OUT

46

0

−1

AT

50

0

−1

IN

54

4

+3

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 14

Discussion Question

A put option with a $50 strike price is

purchased when the underlying asset is

selling for $54 per unit. The premium paid is

$1. Identify if the following put options are

in-, at-, or out-of-the-money.

Answers:

Price of

Underlying

Asset ($)

$50 Call Option

Value ($)

Profit (+) or

Loss () ($)

OUT

54

0

−1

AT

50

0

−1

IN

46

4

+3

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 15

Managing FX Rate Fluctuations

Foreign

exchange

(FX) risk

International companies with cash flows

in various foreign currencies must assess

the volatility of the types and levels of FX

rate fluctuations for each currency.

Cash flow

complexity

Global companies must manage cash

flows from subsidiaries, suppliers and

customers in each country in which they

operate.

Tax issues

Global treasury operations must

interpret the rules and regulations of

different tax authorities.

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 16

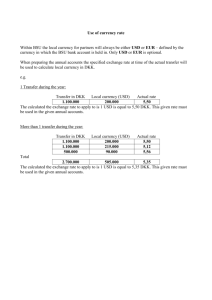

Sample Foreign Currency Quotation

Formats

Currency

USD Equivalent

Currency per USD

GBP-British Pound

GBP/USD 1.4870

USD/GBP 0.6725

CAD-Canadian Dollar

CAD/USD 0.9742

USD/CAD 1.0265

EUR-Euro

EUR/USD 1.3383

USD/EUR 0.7472

JPY-Japanese Yen

JPY/USD 0.010804

USD/JPY 92.56

Given USD

USD/rate = FC

USD x rate = FC

Given foreign

currency (FC)

FC x rate = USD

FC/rate = USD

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 17

Foreign Exchange (FX) Rates

Example: The quoted rate for the USD

equivalent is EUR 1.3383. How many euros

would $2 million buy?

$2,000,000

= EUR1,494,433

1.3383

Example: The quoted rate for the USD

equivalent is GBP 1.4870. How many pounds

would $2 million buy?

$2,000,000

= GBP1,344,990

1.4870

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 18

Foreign Exchange (FX) Rates

Example: The quoted rate for the Japanese

yen is USD/JPY 92.56. How many yen would

$2 million purchase?

$2,000,000 92.56 = JPY185,120,000

Example: The quoted rate for the Canadian

dollar is USD/CAN 1.0265. CAN250,000

would be equivalent to how many USD?

CAN250,000

= $243,546 (USD)

1.0265

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 19

Foreign Exchange (FX) Rates:

Bid-Offer Spreads and Dealer Profit

Bid rate: Dealer buys currency.

Offer rate: Dealer sells currency.

Bid/offer spread or bid/ask spread: Difference

between rates (dealer’s profit).

Dealer bid-offer quote; e.g., USD/JPY 90.57-63.

Company

Delivers

Dealer

Buys

Dealer

Sells

Company

Receives

Company wants to

buy Japanese yen

(JPY)

USD

USD at

bid rate

(JPY90.57)

JPY

JPY

Company wants to

sell JPY for USD

JPY

JPY

USD at

offer rate

(JPY90.63)

USD

Scenario

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 20

Foreign Exchange (FX) Markets

Spot market

(spot rate)

Forward market

(forward rate)

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Par

Discount

Premium

Interest rate

parity

Session 6: Module 4, Chapter 9 - 21

FX Rate Exposure

Implicit and explicit transaction exposures are two pieces of a single transaction. Implicit is the piece from exposure initiation to

balance sheet realization; explicit is the piece from balance sheet realization through cash flow.

SOURCE: PRICEWATERHOUSECOOPERS LLP, 2007

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 22

FX Rate Exposure

Types of FX

exposure

Economic

Transaction

Translation

Types of

derivatives

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Currency

forwards

Currency

Currency

Currency

or FX

futures

swaps

options

Session 6: Module 4, Chapter 9 - 23

Currency or FX Forward

Three factors:

Current spot rate

Term of forward

contract

Current interest

rates in two

countries during

term

EXAMPLE:

A U.S. company (importer) has

agreed to pay an invoice for

GBP125,000 in 90 days.

The importer purchases a

forward contract today at

$1.6365 in USD per GBP,

deliverable in 90 days.

At the end of the 90 days, the

importer pays:

USD1.6365 x GBP125,000 =

USD204,563

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 24

Currency Futures

Traded on

organized

Common Contracts

exchanges

Margin

Currency Pair Contract Size

Required

Standardized

in amounts

EUR/USD

EUR125,000

$2,205

and maturity

USD/JPY

JPY12,500,000

$2,700

dates

GBP/USD

GBP62,500

$1,485

70% of daily

USD/CHF

CHF125,000

$1,350

volume on

USD/CAD

CAD100,000

$1,755

the CME

Contracts

generally

offered for sixmonth maturities

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 25

Currency Futures Example

U.S. importer must pay invoice for GBP125,000 in 90 days.

Company purchases futures contract for GBP/USD 1.6369.

Margin requirement = $2,970.

Contract settle price: GBP/USD 1.6521

Change in contract value = (1.6521 – 1.6369) x 125,000 = $1,900

New margin account value = $2,970 + $1,900 = $4,870

Futures contract decreases to GBP/USD 1.6472

Change in contract value = (1.6472 – 1.6521) x 125,000 = –$612.50

New margin account value = $4,870 – $612.50 = $4,257.50

If exchange rate rises to GBP/USD 1.7245

Profit on contract = $1.7245 – $1.6369 = $0.0876 per GBP

If exchange rate drops to GBP/USD1.5681

Loss on contract = $0.0688 per GBP; however, next cost still GBP/USD

1.6369

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 26

Currency Swaps

The exchange of a floating-rate cash

flow denominated in one currency

with a fixed-rate cash flow

denominated in another currency, as

well as exchange of principal

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 27

Currency Swaps Example

U.S.-based firm wishes to borrow JPY100 million for 10

years at exchange rate of USD/JPY 90.9091.

Borrows

$1,100,000 (USD equivalent to JPY100 million) for 10

years at 6% fixed interest rate.

Currency swap to yen-denominated funding:

Semiannual payments in yen to counterparty at fixed rate of 5.2%

Counterparty makes semiannual payments in USD to firm at fixed rate of

5.4%

Every

six months for 10 years, firm pays counterparty

JPY2,600,000 from local yen currency.

0.052 x JPY100,000,000 x (180/360)

Every six months for 10 years, counterparty pays firm $29,700.

0.054 x $1,100,000 x (180/360) = $29,700

End

of 10 years, investment matures, returning JPY100 million

principal, which firm pays counterparty; counterparty pays firm

$1,100,000.

6% interest rate = semiannual payment to creditors of $33,000

(0.06) x (1,100,000) x (180/360) = $33,000

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 28

Currency Options

Give the buyer the

right to buy (call)

or sell (put) a

fixed amount of

foreign currency

at a fixed

exchange rate

(strike price) on

or before a

specific future

date

EXAMPLE:

Foreign-currency call option sets

ceiling price to buy foreign

currency in terms of the domestic

currency.

Ceiling price is strike price plus

premium paid for call.

Call option on EUR has strike price

of $1.30 with premium of $0.10.

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Maximum ceiling = ($1.30 +

$0.10) = $1.40 per euro

Session 6: Module 4, Chapter 9 - 29

Interest Rate Exposure

Examples

Falling rates with

variable interest

rate investments

may mean lower

earnings.

Rising rates with

debt tied to

variable interest

rates may mean

higher borrowing

costs.

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Interest rate

forwards

Forward rate

agreement (FRA)

Interest rate

futures

Interest rate swaps

Interest rate

options

Interest rate cap

Interest rate floor

Interest rate collar

Session 6: Module 4, Chapter 9 - 30

Interest Rate Futures Contract

Example

Futures contract pricing on one-year T-bill is

100 minus the promised interest rate.

Futures rate is 1.5%.

Contract price = Predetermined price of 98.5 (100 – 1.5).

If

actual rate is 2.1% at end of year, realized value is

only 97.9.

100 – 2.1 = 97.9

The

holder of the long position will be paid by the

seller of the contract the difference.

98.5 – 97.9 = 0.6 per unit of the contract

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 31

Example: Interest Rate Swap

Parties A and B enter into a five-year swap with a notional

value of $100M. A takes fixed side (exchanging floating rate

exposure for fixed rate), B takes floating side (vice versa). A

pays fixed rate (5.5%) to B, and B pays floating rate to A

(LIBOR+3.5%). At the end of each year:

Party A will owe Party B $100M x 5.5%.

Party B will owe Party A $100M x (LIBOR + 3.5%).

In practice, there is a netting procedure and only the

difference is settled. If LIBOR is < 2%, then A pays B, and if

LIBOR > 2%, then B pays A. For example:

If LIBOR is 1.25%, then Party A pays Party B as follows:

[0.0550 – (0.0125 + 0.0350)] x $100M = $750,000

If LIBOR is 2.50%, then Party B pays Party A as follows:

[(0.0250 + 0.0350) – 0.0550] x $100M = $500,000

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 32

Commodity Price Exposure

Price exposure

Results from

changes in the price

of a commodity

used or sold:

Rising prices for a

commodity used

creates exposure.

Declining prices for a

commodity sold

creates exposure.

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Delivery exposure

Occurs when

regular supply of a

commodity is

crucial

Can be mitigated by

entering into a

long-term

agreement with a

producer

Session 6: Module 4, Chapter 9 - 33

Discussion Question

What is one of the primary problems in the

valuation of, and subsequent accounting for,

derivatives?

Answer:

Determining their accurate value.

As a general guideline, Topic

820-10: Fair Value Measurements

offers some guidance on this issue.

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 34

Discussion Question

How does the Dodd-Frank Act bring more

transparency and accountability to the

derivatives market?

Answer:

Closes regulatory gaps

Requires central clearing and

exchange trading

Requires market transparency

Adds financial safeguards

Sets higher standards of conduct

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Session 6: Module 4, Chapter 9 - 35

Emerging Markets

Emerging market

currencies:

Exotic currency

characteristics

Free floating with

partial pricing

transparency and

liquidity

Capital controls

impacting

bilateral

availability at any

point in time

Non-readily

tradable in the

worldwide FX

marketplace

v3.0 © 2011 Association for Financial Professionals. All rights reserved.

Illiquidity

Volatility

Reduced transparency

Limited derivative

availability

Capital controls

Heightened carrying risk

Pricing distortions

Limited risk-sharing

options

Minimal internal heading

alternatives

Transfer risks

Session 6: Module 4, Chapter 9 - 36