Chapter 14. Net Noninterest Income, Operational Risk

advertisement

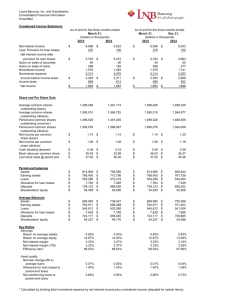

Chapter 14. Net Noninterest Income, Operational Risk, Securitization, and Derivatives Activities Learning Objectives: To understand a bank's net noninterest income ("burden") and operational risk To understand the process of securitization and its net benefits To understand banks' derivatives activities and domination by the five largest U.S. banks Chapter 14 1 Chapter Theme Although securitization and derivatives activities capture two important aspects of modern banking, banks have been doing traditional offbalance sheet activities (OBSAs) such as loan commitments and lines of credit for centuries. Chapter 14 2 Theme (continued) Banks face pressure, especially the largest ones, to generate fee or noninterest income, to reduce noninterest or operating expenses, and to improve capital adequacy. In the context of the return-on-equity model, the competitive and regulatory pressures on both ROA and EM reflect, in part, these forces of change. Chapter 14 3 Theme (continued) These pressures get bankers' attention because they affect two pillars of bank performance: profitability (ROA) and capital adequacy (EM). On balance, OBSAs (including the selling of risk-management services) present banks with opportunities to strengthen customer relationships and to reduce the probability of financial distress for client firms, thereby reducing the bank's risk exposure to these customers. Chapter 14 4 Theme (concluded) While net interest income and net interest margin (NIM) capture the intermediation aspect of a bank's business, net noninterest income ("burden") reflects the nonintermediation and operational aspects of a bank's business. Operational risk refers to the risk of loss that banks and other financial institutions face from catastrophic events, human error, and other unpredictable happenings, e.g., the collapse of Barings, a UK investment bank. Chapter 14 5 Motives for OBSAs Think of the ROE model ROE = ROA x EM All other things being equal (ceteris paribus), OBSAs can increase ROA without adding leverage to the balance sheet Effective risk-based capital requirements, however, price the risk of OBSAs and restrict opportunities for regulatory capital arbitrage Chapter 14 6 Net Noninterest Income (“Burden”) Net noninterest income is the difference between noninterest income and noninterest income For almost all banks, this measure is less than zero – hence, it is a bank’s “burden” Fee income and operating efficiency are the focal variables Chapter 14 7 Net Noninterest Income by Bank Size (1999) Size class % of assets Change* Top ten -0.90 38 11-100 -0.78 88 101-1,000 -1.39 62 All others -2.28 20 All banks -1.11 72 *Change since 1990 in basis points Chapter 14 8 The Components of Noninterest (Fee) Income Services charges on deposits Income from trust activities Trading income The 100 largest banks, especially the 10 largest, dominate this business activity Other (noninterest) income Chapter 14 9 Insights from the Second Stage of the ROE Model ROA = PM x AU Data for all banks: 1985: ROA = 0.0640 x 0.1084 = 0.0069 1999: ROA = 0.1556 x 0.0942 = 0.0131 ROA almost doubled over this period. Why? How? PM surged while AU dropped slightly Chapter 14 10 Further Insights The components of PM and AU are three: Profits or net income “Sales” (interest income + noninterest income) Assets Think of the growth rates for these three variables Chapter 14 11 Further Insights (continued) For PM to increase, the growth of NI > the growth rate of sales For AU to decline, the growth of sales < the growth of assets On balance, g(NI) > g(A) > g(sales) After improvement in loan quality, the rapid growth o NI traces to noninterest income (see Table 14-1, p. 471) Chapter 14 12 Operating Efficiency and Noninterest Expense The components of noninterest expense: Salaries, wages, and employee benefits Expense of premises and fixed assets Other noninterest expense Data for 1999 (% of assets), respectively, are: 1.59, 0.48, and 1.70 (3.77 total up from 3.49 for 1990) Chapter 14 13 Noninterest Expense by Bank Size (1999) Size class Top ten 11-100 101-1,000 All others All banks % of assets 3.45 4.15 3.70 3.71 3.77 Chapter 14 14 Operational Risk Management: The Next Frontier (Box 14-1) It is the uncertainty associated with direct or indirect losses from inadequate or failed internal systems, processes, or people or from external events (e.g., 11 Sept. 2001) It has become a discipline unto itself with its own management structure, processes, and tools The Basel Committee plans to include a capital charge of operational risk for large international banks Chapter 14 15 Why Focus on Operational Risk? Concern about losses due to ineffective operations Regulators concerns about operational risk Increased operational risk associated with globalization Growing attention on enterprise-wide risk management (holistic approach) Threat of terrorism Chapter 14 16 September 11, 2001 and Catastrophic Risk The banks and securities firms affected by this dastardly act had secondary and tertiary backup systems Although backing up personnel can’t be done on a large scale, geographic diversification would reduce concentration risk Chapter 14 17 Risk Removal Techniques: Securitization and Loan Participations Loan participations The traditional method achieved by using loan syndications Credit of $50 million or more are regarded as syndicated loans Large syndications have 100 or more banks participating (see Box 14-2 on page 477 for the major players) Almost $2 trillion in syndicated loans at year-end 2000 Chapter 14 18 The Modern Approach: Securitization John Reed said: “Securitization is the substitution of more efficient public capital markets for less efficient, higher cost financial intermediaries in the funding of debt instruments.” Good news: Several benefits (next slide) Bad news: Threatens existence of traditional intermediaries Chapter 14 19 The Benefits of Securitization Increased liquidity from the ability to sell assets Enhanced revenue/profits from asset sales Increased servicing income Conservation of capital Chapter 14 20 Understanding the Process of Securitization Five basic parties: 1. 2. 3. 4. 5. Loan originator (bank) Loan purchaser (affiliated trust) Loan packager (underwriter of the securities) Credit enhancer (guarantor) Investors (individuals and banks) Table 14-2 and Figure 14-1 (pp. 479-480) summarize the process in terms of the structure of deals and cash flows Chapter 14 21 Terminology Asset-backed securities The underlying loans represent the cash flows that stand behind and give value to asset-backed securities Mortgage-backed securities – securitization began with these instruments and spread such that the modern banker’s calling card reads: “Have Loans, Will Securitize” (see Table 14-3, p. 481) Chapter 14 22 Terminology (continued) Pass-through securities are not collateralized or secured by “hard assets” but are backed by unsecured credits such as credit-card receivables (Some confusion exists here because the cash flows “pass through” whether the underlying asset is “hard” or “soft”) Chapter 14 23 Terminology (continued) Collateralized debt obligations (CDOs) Two main sources of underlying assets or collateral are: loans (CLOs) and bonds (CBOs) A CDO has a legal structure called a special-purpose vehicle (SPV) set up as a subsidiary of a holding company – view it as a balance sheet Chapter 14 24 Terminology (continued) Collateralized-loan obligations (CLOs) In a traditional CLO, the originating bank physically transfers the loan portfolio to the SPV, which issues the securities backed by the underlying loans In a synthetic CLO, the assets are not physically transferred and a credit derivative (see Chapter 11) transfer the credit risk of the collateral to the SPV Chapter 14 25 Terminology (continued) Three kinds of synthetic CLOs exist: 1. Fully funded in which all the credit risk transfers to the SPV 2. Partially funded in which part of the credit risk is transferred to the SPV 3. Unfunded in which none of the credit risk transfers to the SPV – the transfer is achieved with a credit derivative Chapter 14 26 Securitization: A Two-Way Street It’s a risk-removal technique Use it to add assets and risk to an existing balance sheet Chapter 14 27 Value-Added Through Securitization (Table 14-3) Underlying asset Securitized Asset Illiquid Liquid Weak valuation Market values Lender monitoringThird party monitors Higher oper exp Lower oper exp Product limits Wider offerings Limited market Broader market Chapter 14 28 Derivatives: Hedging, Speculating, Selling Risk-Management Services Two basic kinds of derivatives: 1. Futures and forwards (linear contracts) 2. Options (nonlinear contracts) Value based on or “derived” from the underlying which can be an interest rate, exchange rate, equity return, or a commodity price Trading: Exchange versus OTC As a hedging tool, see Box 14-3 (p. 487) Chapter 14 29 Derivative Securities Three classes: 1. Structured securities and deposits (e.g., duel-currency bonds) 2. Stripped securities (e.g., IOs and POs) 3. Securities with option characteristics (e.g., callable bonds) See Table 14-5 (p. 485) for additional examples of derivative securities) Chapter 14 30 Discussions Topics Bankers Trust and Derivatives Liability Who dominates the world of derivatives and why? Are derivatives the basic business of banking? Have derivatives fundamentally changed financial management? A framework for risk management Chapter 14 31 The Risk of Derivatives Activities IS MORC ILL? (see Table 14-6, p. 491) These nine risks can be condensed into four broad risk categories 1. 2. 3. 4. Market risk Credit risk Liquidity risk Operational and legal risk Chapter 14 32 Measuring Risk Exposure Notional value is not a good measure Credit-equivalent exposure is the sum of 1. Bilaterally netted current credit exposure 2. Future exposure Glossary (Box 14-4, p, 493) Data (Table 14-7, 14-8, 14-9, pp. 494497) Chapter 14 33 Transparency and Disclosure Bank loans and OTC derivatives share three common characteristics: 1. Customized 2. Privately negotiated 3. Often lack liquidity and transparency Result: They are more difficult to value and manage Chapter 14 34 The Regulatory Dialectic (Struggle Model) Thesis: Derivatives and securitization Antithesis: Risk-based capital requirements for these activities Synthesis: Regulatory capital arbitrage seeks ways to circumvent requirements Chapter 14 35 Chapter Summary Asset securitization and derivatives activities capture two of the traits of modern banking Although the world of derivatives is dominated by large banks, securitization has a much broader appeal Chapter 14 36