Lecture 2: Probability and Insurance

advertisement

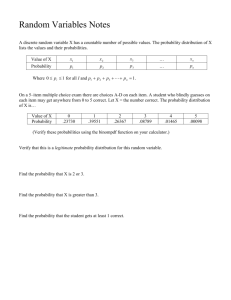

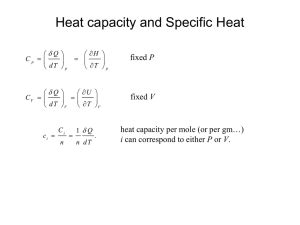

Lecture 2 The Universal Principle of Risk Management Pooling and Hedging of Risk Probability and Insurance • Concept of probability began in 1660s • Concept of probability grew from interest in gambling. • Mahabarata story (ca. 400 AD) of Nala and Rtuparna, suggests some probability theory was understood in India then. • Fire of London 1666 and Insurance Probability and Its Rules • Random variable: A quantity determined by the outcome of an experiment • Discrete and continuous random variables • Independent trials • Probability P, 0<P<1 • Multiplication rule for independent events: Prob(A and B) = Prob(A)Prob(B) Insurance and Multiplication Rule • Probability of n independent accidents = Pn • Probability of x accidents in n policies (Binomial Distributon): f ( x) P (1 P) x ( n x ) n!/( x!(n x)!) Expected Value, Mean, Average E ( x) x i 1 prob( x xi ) xi E ( x) x f ( x) xdx n x xi / n i 1 Geometric Mean • For positive numbers only • Better than arithmetic mean when used for (gross) returns • Geometric Arithmetic n G( x) ( xi )1/ n i 1 Variance and Standard Deviation • Variance (2)is a measure of dispersion • Standard deviation is square root of variance var( x) prob( x xi )( xi E( x)) 2 i 1 n s ( xi x) 2 / n 2 x i 1 Covariance • A Measure of how much two variables move together n cov( x, y ) ( x x)( y y ) / n i 1 Correlation • A scaled measure of how much two variables move together • -1 1 cov( x, y ) /( s x s y ) Regression, Beta=.5, corr=.93 Return XYZ Corporation against Market 1990-2001 25 Return on XYZ Corporation 20 15 Each point represents a year. Linear (Each point represents a year.) 10 5 0 -10 -5 0 5 10 Return on the Market 15 20 25 Distributions • Normal distribution (Gaussian) (bell-shaped curve) • Fat-tailed distribution common in finance Normal Distribution Norm al Distribution w ith Zero Mean 0.45 0.4 0.35 0.3 0.25 f(x) Standard Dev. = 3 Standard Dev. = 1 0.2 0.15 0.1 0.05 0 -15 -10 -5 0 Return (x) 5 10 15 Normal Versus Fat-Tailed Norm al Versus Fat Tailed Distributions 0.45 0.4 0.35 0.3 0.25 f(x) Normal Distribution Cauchy Distribution 0.2 0.15 0.1 0.05 0 -15 -10 -5 0 Return x 5 10 15 Expected Utility • Pascal’s Conjecture • St. Petersburg Paradox, Bernoulli: Toss coin until you get a head, k tosses, win 2(k-1) coins. • With log utility, a win after k periods is worth ln(2k-1) E(U ) prob( x xi )U ( xi ) i 1 Present Discounted Value (PDV) • PDV of a dollar in one year = 1/(1+r) • PDV of a dollar in n years = 1/(1+r)n • PDV of a stream of payments x1,..,xn T PDV xt /(1 r ) t t 1 Consol and Annuity Formulas • Consol pays constant quantity x forever • Growing consol pays x(1+g)^t in t years. • Annuity pays x from time 1 to T Consol PDV x / r Growing Consol PDV x /( r g ) Annuity PDV x 11/(1 r )T r Insurance Annuities Life annuities: Pay a stream of income until a person dies. Uncertainty faced by insurer is termination date T Problems Faced by Insurance Companies • Probabilities may change through time • Policy holders may alter probabilities (moral hazard) • Policy holders may not be representative of population from which probabilities were derived • Insurance Company’s portfolio faces risk