History-Timeline - Idaho Credit Union League

advertisement

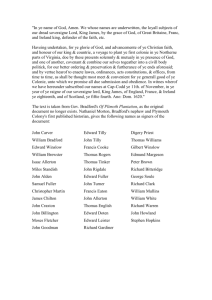

Edward A. Filene For 100 years…. Driving the Spirit of America One member at a time Visit cuna.org/100years for celebration information. Edward A. Filene 1844 Weavers in Rochdale, England established a consumer co-op store based on the first set of cooperative principles. Edward A. Filene 1846 Herman Schulze-Delitzsch organizes a cooperative mill, bakery, and other cooperative credit endeavors. Edward A. Filene 1849 Friedrich Wilhelm Raiffeisen establishes “peoples” banks in Germany. Edward A. Filene 1866 Luigi Luzzatti opens the first cooperative bank in Milan, Italy. Edward A. Filene 1900 Alphonse Desjardins forms La Caisse Populaire de Levis in Quebec, Canada. Edward A. Filene 1907 World traveler Edward A. Filene encounters cooperative credit societies in India, seeing them as a way to economic democracy. Edward A. Filene 1909 Massachusetts passes the first state credit union act. 1908 St. Mary’s Bank (La Caisse Populaire de Saint Marie) opens in Manchester, New Hampshire. Edward A. Filene 1921 Roy F. Bergengren is hired as credit union organizer for the Massachusetts Credit Union Association. Edward A. Filene 1921 Filene forms and funds the Credit Union National Extension Bureau with Bergengren as director. Edward A. Filene 1923 Many credit unions were organized in urban areas, like this one in Boston. Edward A. Filene 1924 The Bridge newsletter is launched for the credit union movement. 1923 Joseph Stern, cartoonist with the Boston Herald, creates the “Little Man Under the Umbrella” as the first trademark of the credit union movement. Edward A. Filene 1930s Credit unions weather the Great Depression with no major losses. Edward A. Filene 1930 Filene contributes more than $1 million to the credit union movement. Edward A. Filene June 26, 1934 Federal Credit Union Act signed into law. Edward A. Filene August 10, 1934 Constitution and Bylaws of Credit Union National Association signed at Estes Park, Colorado. Roy F. Bergengren is named managing director. After Estes Park meeting, Bergengren and Thomas Doig divide the country between them and set out on a marathon trip to organize state credit union leagues. Edward A. Filene 1935 CUNA Mutual Insurance Company created, offering life and disability insurance. Edward A. Filene 1935 CUNA establishes headquarters in Madison, Wisconsin Edward A. Filene August 1941 The Federal Reserve Board issues Regulation W, limiting the amount of money consumers can obtain through installment credit. Edward A. Filene 1943 CUNA produces its first Film, “The Credit Union – John Doe’s Bank.” May 1942 CUNA establishes an office in Washington, D.C. operated out of D.C. League. Edward A. Filene 1945 Thomas W. Doig becomes CUNA managing director. Edward A. Filene 1946 Dora Maxwell organizes 120 credit unions in NYC in a 5-month period. Other women prominent in the movement during this period include Louise McCarren, Evelyn Higgins, and Agnes Gartland. Edward A. Filene 1948 The first Credit Union Day is celebrated on the 3rd Thursday in October. The observance will grow into International Credit Union Day. Edward A. Filene 1950 President Harry S. Truman dedicates Filene House in Madison, Wisconsin. Edward A. Filene 1950s – Bankers undertake first serious campaign for taxation of credit unions. 1952 – Credit union membership experiences rapid growth during this period. By 1952, the number of credit unions jumps to 12,280 with 5,904,629 members. Edward A. Filene October 18, 1954 World Extension Department begins operation. 1953 The benefits of credit union membership are dramatized with a new movie, “Kings X.” Edward A. Filene Summer 1954 First CUNA School for credit union personnel launched with support of the University of Wisconsin School of Business. Edward A. Filene 1955 Credit unions sponsor their first national advertising campaign with radio news broadcasts in the U.S. and Canada, using spokespeople such as Lorne Greene. Edward A. Filene September 22, 1959 The pen used by President Dwight D. Eisenhower to sign the Credit Union Act of 1959 (H.R. 8305), is presented by U.S. Senator Leverett A. Saltonstall (R-Mass.) to Julius Stone, President of CUNA’s Board of Directors. Edward A. Filene 1960 CUNA Mutual moves to a new building on Mineral Point Road, Madison, Wisconsin. Edward A. Filene May 1957 CUNA Mutual receives its own managing director. (Beginning of separation from CUNA). May 11, 1958 CUNA amends its bylaws to enable worldwide membership. Credit unions from leagues around the globe can now join. Edward A. Filene 1963 President John F. Kennedy signs amendments to the Federal Credit Union Act. Edward A. Filene 1964 The credit union movement establishes Global Projects Office, working with the U.S. Agency for International Development to organize credit unions worldwide. Edward A. Filene 1966 Credit unions get tools to offer money orders, travelers checks, and a Government Securities Program through the auspices of ICU Services Corp. Edward A. Filene 1966 Credit union leaders meet in Washington, D.C. to describe the need for credit unions in low income areas and outline some of the accomplishments made so far in the anti-poverty war. Edward A. Filene 1969 Credit unions get their own core data processing organization with the formation of CUNADATA Corp. Edward A. Filene 1970 Independent Agency Bill creates National Credit Union Administration. First administrator, Herman Nickerson Jr., was sworn in on Sept. 21. Edward A. Filene 1970 National Credit Union Share Insurance Fund created. 1970 World Council of Credit Unions is chartered. This is the first Board of Directors. Edward A. Filene 1971 Herb Wegner named CUNA managing director. Title changes to president in 1971. Edward A. Filene 1973 The range of services offered to credit union members expands significantly through products developed by movement organizations such as CUNA Service Group. Edward A. Filene 1975 Credit Union entry in the Tournament of Roses parade wins Queen’s Trophy. 1974 A new symbol is introduced to unify credit union identification across the nation with a hands-and-globe format. Edward A. Filene 1976 The American Bankers Association sues NCUA in the U.S. District Court in the District of Columbia asking the court to declare share drafts illegal and declare a permanent injunction Edward A. Filene 1977 Selected credit unions begin offering VISA credit cards in pilot program. Edward A. Filene 1978 U.S. District Court in the District of Columbia declares share drafts legal and the American Bankers Association promptly appeals the decision. 1977 The Credit Union mini-bill passes. Allows credit unions to offer shares and share certificates at variable rates. Edward A. Filene 1979 Jim R. Williams becomes CUNA president. Edward A. Filene May 1980 Dedication of CUNA’s headquarters building on Mineral Point Road, Madison, Wisconsin. Edward A. Filene 1980 HR 4986 signed into law by President Jimmy Carter. This bill allows federal credit unions to issue share drafts, give interest-bearing negotiable orders of withdrawal (NOW) to federally chartered or insured financial institutions, and guarantees the phase-out of Reg Q which limits rates on deposits. Edward A. Filene 1983 CUNA launches first Credit Union Roundtable. 1983 Agreement with MasterCard International further expands members’ access to card services. Edward A. Filene February 10, 1984 U.S. Postal Service issues commemorative stamp in honor of the 50th anniversary of the Federal Credit Union Act in Salem, Mass. the birthplace of Edward A. Filene. Edward A. Filene 1987 Ralph S. Swoboda becomes President/CEO of CUNA. Edward A. Filene 1989 Bailout of Federal Savings and Loan Insurance Corp. Federal Institutions Reform, Recovery, and Enforcement Act of 1989 to study soundness of the insurance funds. Edward A. Filene 1991 Operation Grassroots culminates in 15,000 credit unionists rallying on the National Mall and delivering petitions bearing more than 6 million signatures in support of an independent CU system and federal regulator. Edward A. Filene 1995 Federal Employees Credit Union destroyed with the bombing of the Murrah Building in Oklahoma City. Credit unions hasten to assist in recovering from the disaster, which killed 18 of the credit union’s employees. 1995 Membership in U.S. credit unions reaches 69,302,489 members, with 12,209 credit unions managing assets of $316,177,980,519. Edward A. Filene 1996 Daniel A. Mica named CUNA President/CEO. Edward A. Filene February 1998 The U.S. Supreme Court rules 5-4 to limit CU Fields of Membership to single groups, raising the specter of millions of consumers forced out of their credit unions. 1997 Credit Union Campaign for Consumer Choice is launched after banking industry lawsuits restrict the ability of credit unions to serve multiple membership groups. Edward A. Filene August 1998 President Clinton signs into law H.R. 1151, The Credit Union Membership Access Act. Edward A. Filene 1999 Learning from the Consumer Choice Campaign that CUs must make political involvement a year-round endeavor, CUNA launches the Hike the Hill program. Edward A. Filene 2000 Renaissance Commission created by CUNA’s Board to explore credit unions’ role in the 21st century and determine the legislative and regulatory changes needed to enhance that role in the future. Edward A. Filene 2000 CUNA leagues and credit unions Partner with the National Endowment For Financial Education to bring Financial education training modules into the nation’s high schools. 2000 CUNA launches the National Credit Union Brand Campaign, introducing a national brand logo and the slogan “America’s Credit Unions: Where People are Worth More than Money.” Edward A. Filene 2001 Terrorist attacks in New York and Washington, D.C. prompt cancellation of the grand opening of the Credit Union House and the 2001 Credit Union Symposium. Credit Unions provide moral and financial support to those impacted by the attacks. Edward A. Filene 2003 Credit unions rededicate themselves to reaching out to serve low income and underserved communities. Edward A. Filene September 25, 2003 Credit Union House holds grand opening and ribbon-cutting ceremony. Members of the Pennsylvania Credit Union League are given the ribbon cutting honors. Edward A. Filene 2004 America’s Credit Union Museum is dedicated in Manchester, N.H. The museum is housed on the site of the nation’s first credit union. 2004 Alan Greenspan speaks at CUNA’s Governmental Affairs Conference Edward A. Filene 2005 In response to the devastation wrought by Hurricane Katrina, the CU system launches Operation RESCU to coordinate preparedness against future disasters. Edward A. Filene 2007 Credit union membership tops 90 million. Edward A. Filene 2008 After 31 years at the Washington Hilton Hotel, the CUNA Governmental Affairs Conference moves to the Washington Convention Center, drawing record attendance of more than 5,000. Edward A. Filene November 2008 St. Mary’s Bank Credit Union, the nation’s first, marks its centennial anniversary. Edward A. Filene 2008 Credit union federal deposit insurance coverage levels are raised to $250,000 from $100,000 after President Bush signs the Emergency Economic Stabilization Act. Edward A. Filene TODAY YOU play an important role in shaping the future of the credit union movement. visit cuna.org/100years for more information.