18-1

McGraw-Hill/Irwin

© 2003 The McGraw-Hill Companies, Inc., All Rights Reserved.

28-2

PART

THREE

CONCEPT/PROJECT

EVALUATION

38-3

Concept/Project Evaluation

Figure III.1

48-4

CHAPTER

EIGHT

THE CONCEPT

EVALUATION SYSTEM

58-5

The Evaluation System

Figure 8.1

68-6

Cumulative Expenditures Curve

Figure 8.2

% of

expenditures

Many high-tech

products

Many consumer

products

Time

Launch

78-7

Risk/Payoff Matrix at Each

Evaluation

Decision

A

Stop the Project Now

B

Continue to Next Evaluation

A. Product would fail if

marketed

AA

BA

B. Product would succeed if

marketed

AB

BB

• Cells AA and BB are “correct” decisions.

• Cells BA and AB are errors, but they have

different cost and probability dimensions.

Figure 8.3

88-8

Planning the Evaluation

System: Four Concepts

• Rolling Evaluation (tentative nature of new

products process)

• Potholes

• People

• Surrogates

98-9

Rolling Evaluation (or,

"Everything is Tentative")

• Project is assessed continuously (rather than a single

Go/No Go decision)

• Financial analysis also needs to be built up continuously

• Not enough data early on for complex financial analyses

• Run risk of killing off too many good ideas early

• Marketing begins early in the process

• Key: new product participants avoid "good/bad"

mindsets, avoid premature closure

8-10

10

Potholes

Know what the really damaging problems

are for your firm and focus on them when

evaluating concepts.

Example: Campbell Soup focuses on:

• 1. Manufacturing Cost

• 2. Taste

8-11

11

People

• Proposal may be hard to stop once there

is buy-in on the concept.

• Need tough demanding hurdles, especially

late in new products process.

• Personal risk associated with new product

development.

• Need system that protects developers and

offers reassurance (if warranted).

8-12

12

Surrogates

• Surrogate questions give clues to the

real answer.

Real Question

Will they prefer it?

after

Will cost be competitive?

Will competition leap in?

Will it sell?

Surrogate Question

Did they keep the prototype

product we gave them

the concept test?

Does it match our

manufacturing skills?

What did they do last time?

Did it do well in field testing?

8-13

13

An A-T-A-R Model of Innovation

Diffusion

Figure 8.5

Profits = Units Sold x Profit Per Unit

Units Sold = Number of buying units

x % aware of product

x % who would try product if they can get it

x % to whom product is available

x % of triers who become repeat purchasers

x Number of units repeaters buy in a year

Profit Per Unit = Revenue per unit - cost per unit

8-14

14

The A-T-A-R Model: Definitions

Figure 8.6

• Buying Unit: Purchase point (person or

department/buying center).

• Aware: Has heard about the new product with

some characteristic that differentiates it.

• Available: If the buyer wants to try the product,

the effort to find it will be successful (expressed

as a percentage).

• Trial: Usually means a purchase or consumption

of the product.

• Repeat: The product is bought at least once

more, or (for durables) recommended to others.

8-15

15

A-T-A-R Model Application

10 million

players

x 40%

x 20%

Number of owners of Walkman-like CD

Percent awareness after one year

Percent of "aware" owners who will try

product

x 70%

Percent availability at electronics retailers

x 20%

Percent of triers who will buy a second unit

x $50

Price per unit minus trade margins and

discounts ($100) minus unit cost at the

intended volume ($50)

= $5,600,000 Profits

8-16

16

Model

1. Each factor is subject to estimation.

Estimates improve with each step in the development

phase.

2. Inadequate profit forecast can be improved by

changing factors.

If profit forecast is inadequate, look at each factor and

see which can be improved, and at what cost.

8-17

17

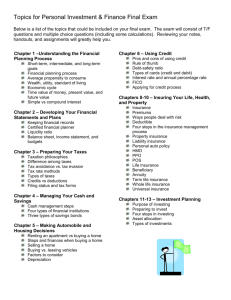

Getting the Estimates for

A-T-A-R Model

Item

Market Units

Awareness

Trial

Availability

Repeat

Consumption

Price/Unit

Cost/Unit

Market

Research

XX

Concept Test

X

X

XX

Product Use

Test

X

X

X

X

X

XX

X

X

Component

Testing

X

X

X

X

XX: Best source for that item.

X: Some knowledge gained.

X

X

Figure 8.7

Market Test

X

X

X

XX

X

XX

XX

XX