Investment Banking Merrill Lynch & Co.

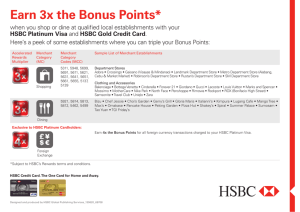

advertisement

Industry Research Players for Commercial & Investment Banks Commercial Bank HSBC Group Over 130 years history 9,500 offices in 80 countries/territories Domestic commercial banking and financial services Commercial Bank - HSBC Personal Service: - Multi-currency accounts - Term deposits - Personal credit service - Mortgage finance - Hire purchase and leasing Commercial Bank - HSBC Business Service - Cash management - Financing working capital - Importing/exporting accounts - Retirement planning - Premises leasing Strategy - HSBC Business Scope - Improvement 1. 2. 3. Premier/PowerVantage/Super Ease ATM, 24-hour Phone banking Center, over 20 Mortgage Advice Centers Internet banking, PC banking over private network, interactive TV, fixed telephone and WAP-enabled mobile Strategy - HSBC Business Scope - Innovation: Investment Service 1. 2. Provides trust, custody and fund administration services Launches “All Weather Plus Capital Guaranteed Fund” * Absolute returns (guaranteed return of 5%) * Increasing income (Profit lock-in) * Unlimited upside potential (absolute price movement ) Strategy - HSBC Geographical Scope - 2000.5, renamed to HSBC’s General Representative Office Mainland China - 2001.12, took a minority stake of 8% in the Bank of Shanghai - 2002.10, acquired a 10% stake in Ping An Insurance Company of China Limited - Gained permission to be custodians for fund under the QFII scheme Strategy - HSBC Geographical Scope - Comes together with DTZ Debenham Tie Leung (Shanghai) to allow foreign investors, both living inside and outside China, to buy properties and manage their mortgage financing in the foreign currency Investment Banking Merrill Lynch & Co. Background The Early Years 1907 Charles E. Merrill arrived in New York and met Edmund C. Lynch, and a great partnership began. 1914 On 6 January, Charles E Merrill & Co. opens its doors. Merrill persuades Lynch to join him and, on 19 May, they open their office at 7 Wall Street. Background 1915 Charles E. Merrill & Co. changes its name to Merrill, Lynch & Co. The Present 2000 Merrill Lynch and HSBC form a joint venture to create the first global, online investment and banking service aimed at the growing number of self-directed affluent investors outside the United States. 2002 HSBC and Merrill Lynch agree in principle that the joint venture is to be integrated into the HSBC Group. Merrill Lynch creates an equity wholesaling business in Europe, which provides broker-dealer clients fast and reliable trading in 15,000 European, U.S. and U.K. equities. The Present 2002 Merrill Lynch's browser-based MLX portal provides a single electronic window through which investors can access any product, any time in the trading cycle, anywhere in the world. Strategy Enlarge the market ( investors outside US) Provide variety of services Satisfy the needs of different kinds of investors Cooperate with other corporations ( Joint Venture with HSBC) Customers Types Individual Investors Small/Midsize Business Corporations and Institutional Investors Individual Investor (inside US) Services Offered Banking and Lending Business Needs Estate Planning Investment Strategies Nonprofit Organization Retirement Tax- Efficient Investment Small/Midsize Business Objective : SIMPLY YOUR BUSINESS THROUGH ONE ACCOUNT(WCMA) Cash Management Business Financing Retirement and Benefits Selling the Business Working Capital Management Account (WCMA) Sweeps incoming cash into your choice of money market account where it can earn interest or dividends until needed. Pays down loan balances to minimize interest costs. Corporations and Institutional Investors Offer equity, debt, and investment banking services to corporations, financial institutions, agencies and governments around the world. Offer clients total access to Merrill Lynch's resources in order to deliver totally integrated and, often, pioneering solutions to our clients. Raise capital for its clients through securities underwriting, private placements, loan syndication, and other financing techniques. Provide investors with access to world markets through global underwriting, trading, and distribution of stocks, bonds and other financial instruments, including government securities, convertibles, derivatives, and foreign currencies. Offer merger and acquisition solutions to corporations and governments around the world. We also leverage our industry-leading technology and expertise to supply clearance, settlement and securities financing services to its clients worldwide. Q&A ~The End~