Anthony Leadbetter MBAM 613.17 3/30/09 During my time at Merrill

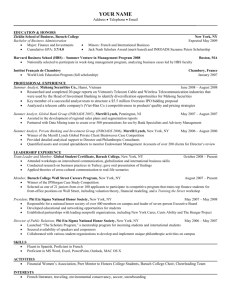

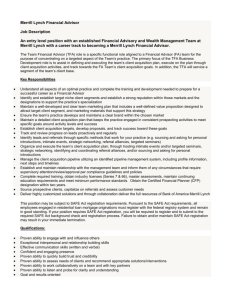

advertisement

Anthony Leadbetter MBAM 613.17 3/30/09 During my time at Merrill Lynch it was hard to see the supply chain of the entire company versus our team of six that provided private wealth management services. So for the interest of this paper I will discuss the six-person team. Our team was in the business of providing a service to clients to create or maintain wealth generation through investing in numerous varieties of products based on the best interests of the client. The main positions of the team were the financial analyst, a client associate who performed administrative duties, and two financial advisors, one more senior than the other. Our supply chain began with a client who had a need or desire for certain returns, then the analyst would construct a portfolio using a range of products that would optimize returns while mitigating risk. The first financial advisor would require approval, and upon further revisions the more senior advisor approved the final proposal. The technology that was used was primarily from three software packages. Microsoft Office Suite was used to create the presentation, Merrill Lynch’s legacy system provided some of the personal information of the client, and its main ERP (which I believe was from PeopleSoft) was perfect for all the necessary research. Three of the six shifts of Johnson and Kopczak were recognizable. The legacy and PeopleSoft system was crossenterprise rather than cross-functional yet there was slightly different accessibility to certain areas depending on someone’s title. Our business was based on a demand focus rather than a supply focus. We knew clients existed that preferred professional financial services expertise. We couldn’t create our service without the demand. Some other major capabilities of Merrill’s products were that they could be customized to each client. There were no specific mandated allocations that restricted how their accounts would be Anthony Leadbetter MBAM 613.17 3/30/09 managed. We manifested tailored offerings that had evolved from initial mass-market supply offerings. This was largely due to the ERP system that encompassed available information from every function and department of the company, such as: alternative assets, financial derivatives, bonds, equity, or loan generation across all consumer types. Over time Merrill Lynch was transferred some complex legacy system functions to the ERP by creating new modules that were more user friendly and reduced the amount of typical work time. With the legacy system, in most cases the employee would have to contact a specialist within the company for help to perform a task that may only take one minute, but due to of the lack of training it may take up to thirty minutes. This was due to waiting on the phone for a representative and then that person may not have always had the correct answer. I believe that Merrill Lynch constantly tried to incorporate the NEBIC framework so that it could provide information and ease of use to its employees faster and more effectively to help improve productivity so that the clients would benefit from faster access of information. It allowed our team to provide full proposals from initially in two weeks down to two hours due to the capabilities, increased training, and efficiency of the employees on the team. Bank of America acquired Merrill Lynch at the beginning of the year. I would expect that the integration of the two different information systems would take a couple years to fully integrate. Hopefully they both have the same vendor for their ERP to make it a smoother transition. Eventually, due to the enormous capacity that both companies have for financial instruments they should be able to offer greater custom detailed services in a more productive and efficient environment in the future. Anthony Leadbetter MBAM 613.17 3/30/09 References Keane, R. H., Herbohn, J., & Slaughter, G. (n.d.). THEORETICAL BACKGROUND OF SUPPLY CHAIN MANAGEMENT AND POTENTIAL SUPPLY CHAIN OF NORTH QUEENSLAND TIMBER INDUSTRY. Retrieved from http://espace.library.uq.edu.au/eserv/UQ:8169/n3_Keane_et_al_T.pdf Shahzada, B., Jan, V., Wim, V., & Herwig, M. (2009). Creating Customer Value through SOA and Outsourcing: A NEBIC Approach. International Journal of Social Sciences, 1-7.