Michael Porter

advertisement

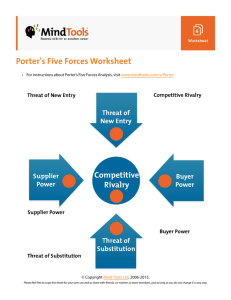

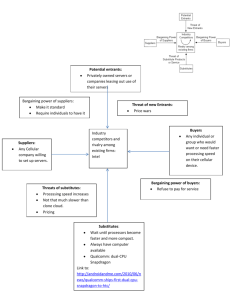

Porter’s model of 5 competitive forces is one of the most often used business Potential New Entrants strategy tools How easy or hard it is for new entrants to start and compete? Any barriers to their entry? How strong is the rivalry among existing players? Does only one player dominate? Bargaining Power of Suppliers IntraIndustry Rivalry Strategic Business Unit How strong is the position of the suppliers? Are there many? Few? Monopoly? Source: Michael E. Porter “Forces Governing Competition in Industry (Harvard Business Review, Mar.-Apr. 1979) Bargaining Power of the Buyers How strong is the position of the buyers? Can we sell in large volumes? Do we need to discount heavily? Substitute Products and Services How easy or hard it is for a new product or service to replace what already exists? Porter’s Five Competitive Forces That Shape Strategy www.youtube.com/watch?v=mYF2_FBCvXw Porter’s Competitive Forces http://www.bbc.co.uk/dna/h2g2/alabaster/A583120 Michael Porter on why America needs an economic strategy Generic Strategies and Industry Forces Generic Strategies Industry Force Cost Leadership Differentiation Focus Entry Barriers Ability to cut price in retaliation deters potential entrants. Customer loyalty can discourage potential entrants. Focusing develops core competencies that can act as an entry barrier. Buyer Power Ability to offer lower price to powerful buyers. Large buyers have less power to negotiate because of few close alternatives. Large buyers have less power to negotiate because of few alternatives. Supplier Power Better insulated from powerful suppliers. Better able to pass on supplier price increases to customers. Suppliers have power because of low volumes, but a differentiationfocused firm is better able to pass on supplier price increases. Threat of Substitutes Can use low price to defend against substitutes. Customer's become attached to differentiating attributes, reducing threat of substitutes. Specialized products & core competency protect against substitutes. Better able to compete on price. Brand loyalty to keep customers from rivals. Rivals cannot meet differentiation-focused customer needs. Rivalry Applying the Porter Competitive Model to Wal-Mart Potential New Entrants Foreign General Merchandisers or Discounters Established Retailer Shifting Strategy to Discounting or Megastores Intra-Industry Rivalry Bargaining Power of Suppliers U.S. Product Manufacturers Foreign Manufacturers Local Governments I/T Product and Service Suppliers SBU: Wal-Mart Rivals: Kmart, Target, Toys R Us, Specialty Stores Bargaining Power of Buyers Substitute Products and Services Mail Order Telemarketing Home Shopping Network Buying Clubs Electronic Shopping Door-to-door Sales Consumers in Small Town U.S.A. Consumers in the Metropolitans Areas in the U.S. Canadian and Mexican Consumers Other Foreign Consumers Porter Competitive Model Education Industry: U.S. Universities Potential New Entrants Bargaining Power of Suppliers Faculty and Staff Equipment, Service, Suppliers Alumni Foundations, Business Government Foreign Universities Distance Learning Motorola University Phoenix, DeVry, National Intra-Industry Rivalry Strategic Business Unit Substitute Products and Services Books and Videotapes Computer-Based Training Training Companies Consulting Firms Bargaining Power of Buyers Students Parents Business Employers Legislators Porter’s Model and the Role of the Government: The government plays an important role in Porter’s diamond model. Like everybody else, Porter argues that there are some things that governments do that they shouldn't, and other things that they do not do but should. He says, "Government’s proper role is as a catalyst and challenger; it is to encourage - or even push - companies to raise their aspirations and move to higher levels of competitive performance …" Governments can influence all four of Porter’s determinants through a variety of actions such as – – – – – Subsidies to firms, either directly (money) or indirectly (through infrastructure). Tax codes applicable to corporation, business or property ownership. Educational policies that affect the skill level of workers. They should focus on specialized factor creation. (How can they do this?) They should enforce tough standards. (This prescription may seem counterintuitive. What is his rationale? Maybe to establish high technical and product standards including environmental regulations.) The problem, of course, is through these actions, it becomes clear which industries they are choosing to help innovate. What methods do they use to choose? What happens if they pick the wrong industries? Criticisms Although Porter theory is renowned, it has a number of critics. Porter developed this paper based on case studies and these tend to only apply to developed economies. Porter argues that only outward-FDI is valuable in creating competitive advantage, and inbound-FDI does not increase domestic competition significantly because the domestic firms lack the capability to defend their own markets and face a process of market-share erosion and decline. However, there seems to be little empirical evidence to support that claim. The Porter model does not adequately address the role of MNCs. There seems to be ample evidence that the diamond is influenced by factors outside the home country.

![[5] James William Porter The third member of the Kentucky trio was](http://s3.studylib.net/store/data/007720435_2-b7ae8b469a9e5e8e28988eb9f13b60e3-300x300.png)