Bank branch audit - THE CHARTERED ACCOUNTANTS STUDY

advertisement

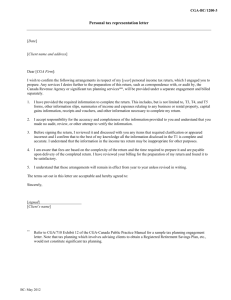

Bank Branch Audit – Managing Risk An Integrated Work Paper Model CA Sripriya Kumar Member – SIRC of ICAI Bank Branch Audit Working Paper Manual A FOREWORD Dear Professional Colleague This model working paper on Audit planning, Audit Program and a template of a Working Paper Document file has been designed to assist Small and Medium Practitioners in the performance and documentation of our Bank Branch audit engagements and to enable Peer review processes There are 2 key risks associated with Bank Audits. One, the Audit risk that a material misstatement could go undetected and two, a professional risk which may arise due to non-performance of appropriate and relevant audit procedures or maintenance of working papers to demonstrate the work done. This Standard template of work paper document will minimise, if not eliminate such risks This is intended to ensure process standardization that will assure a base line quality in the work we do as well as Common Minimum Standard that we will be able to display as a profession to mitigate the above risks. This is an indicative document that helps us to approach the work we do on a Top down basis as well as to ensure that we comprehensively cover and document the engagement correctly and consistently. User discretion is recommended to modify this document to suit the needs to the entity you are auditing There is a tremendous amount of published data on Bank Branch Audits and I have merely attempted to consolidate and compile some of this into an integrated template. This is my personal view and does not necessarily reflect all Best Practices in Audit Planning and Work Paper Management that are unique to every practicing professional. This document will also enable an acceptable level of documentation for Peer Reviews whose key expectation in a Bank Audit Peer review process would be the ability of the working papers to demonstrate adequate work done to ensure : Financial statements being true and fair and free from material misrepresentations Compliance with RBI norms including master and other circulars Compliance with relevant Accounting Standards as relevant to Bank Branches Compliance with Audit, Review and Other Standards of the ICAI as relevant One of the key changes in reporting as compared to the previous year is the introduction of a new reporting format in line with SA700, SA705 and SA706. In addition to this we are required to provide data on the number and value of Memorandum of Changes proposed by us on the face of the Main Audit Report, a measurable output of the branch audit exercise. This entire document may be printed at the end of the audit and working papers be organised and cross referenced in the respective sections for user and reviewer convenience I have for this compilation used certain audit plan tables / appendices from a publication tilted Hand book on Bank Branch Audit by CA P R Suresh and gratefully acknowledge the same Page 2 CA Sripriya K Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual BANK BRANCH AUDIT INTEGRATED WORK PAPER FILE Bank Name Branch Year 2014-15 Date of Commencement Date of Completion Partner In Charge File reference Number of Staff deployed Advances Value Address of the Branch Name of the Manager Phone Number Page 3 Circle Office Contact Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual Objective and Scope of audit _____________________________________________________________________ 6 2. Scope Limitations, if any _________________________________________________________________________ 8 3. Report, Returns and Certificates ________________________________________________________________ 9 4. Auditing Review and Other Standards ________________________________________________________11 5. Engagement documentation ____________________________________________________________________13 6. Branch Overview _________________________________________________________________________________14 7. General Ledger – Sub Ledger reconciliation _________________________________________________20 8. Review Notes of Concurrent, Risk Based Audit, Inspection Reports _____________________21 9. Audit Strategy _____________________________________________________________________________________22 10. Key Reports from CBS to be used for audit ________________________________________________24 11. Standard Schedules ___________________________________________________________________________25 12. Advances and General Audit plan ___________________________________________________________28 13. Advances Verification – Large advances ____________________________________________________30 14. Special Note on Audit of Restructured Advances _________________________________________34 15. Advances Verification – Cash Credit and overdraft accounts____________________________35 16. Advances Verification – Housing loans _____________________________________________________37 17. Advances Verification – Educational loans_________________________________________________38 18. Advances Verification – Vehicle loans ______________________________________________________39 19. Advances Verification – Jewel Loans ________________________________________________________40 20. Advances Verification – Loans against Own Deposits ____________________________________41 21. Advances Verification – Loans against financial assets __________________________________42 22. NPA Review _____________________________________________________________________________________43 23. Verification of Deposits _______________________________________________________________________44 24. Interest Verification ___________________________________________________________________________45 25. Check list for Long Form Audit Report _____________________________________________________46 26. Profit and Loss Account – Analytical review procedures ________________________________49 27. Certification Related Working papers ______________________________________________________49 28. Tax Audit Workings____________________________________________________________________________49 29. Other Working papers ________________________________________________________________________50 30. References ______________________________________________________________________________________50 31. Appendices _____________________________________________________________________________________50 Prepared By : Reviewed By : Page 1. 4 TABLE OF CONTENTS Page 5 Bank Branch Audit Working Paper Manual Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 1. Objective and Scope of audit 1.1. We have been appointed as the Statutory Auditors of the ……………………… Branch of ……………………………………….. ……………………………… Bank for the year 2014-15 1.2. The appointment letter dated ………………… has been accepted by us on ……………………………………………. after due communication to the previous year auditor vide letter dated ……………………………………. 1.3. The key terms of reference is to certify the financial statements of the branch as at March 31, 2014 with reference to a True and Fair perspective 1.4. The Branch audit instructions as received from the Head / Circle office have been duly cognised for in the preparation of this integrated work paper document 1.5. The following key reports / certificates are required to be issued by us Branch Auditors report Memorandum of Changes if any Certified / Attested financial statements Long Form Audit Report Schedules and Certificates as per index attached in the next segment Tax Audit report under Section 44AB of the Income tax Act 1.6. The audit was commenced on ……………. and completed on …………………. By the following team Name Designation Days From To Partner Qualified Paid Assistant Audit Assistant Prepared By : Reviewed By : Page 1.7. The key risks in Bank Branch Audits are as under Misstatement of income, expenses, Assets or Liabilities. Unrecorded liabilities and contingent liabilities Asset Classification and NPA provisions not adequate for impaired assets , Asset Classification and Income Recognition especially for restructured assets KYC / AML norm compliance related issues Internal control failures over banking operations including potential / undetected / detected frauds Wrong certification 6 Articleship trainee Bank Branch Audit Working Paper Manual 1.8. The details of Bank Staff from whom data / records / information and explanations were solicited / obtained for the purpose of this audit are as under Designation Name Grade Branch Manager Loans Officer Deposit Officer Page 7 Other Officers Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 2. Scope Limitations, if any 2.1. The following scope limitations have been appropriately dealt with in the Audit report of the branch / LFAR and suitably highlighted as matters of emphasis 2.2. The Branch management has not been able to furnish the following details / records / explanations in connection with the audit Information requested and not provided Amount Impact on audit, if any Management Comments Refer 7. 1 2.3. The following unit visits requested by us could not be undertaken due to the following reasons Information requested and not provided Amount Impact on audit, if any Management Comments Page 8 Refer 7.2 Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 3. Report, Returns and Certificates 3.1. Key Deliverables 9 BS 9 – DETAILS OF COUNTRYWISE, RISK CATEGORY WISE EXPOSURE B 10 11 12 13 14 15 16 Supplementary to BS Schedules SUPP. B – BREAK UP OF LCS, GUARANTEES, ETC. SUPP. C – CLASSIFICATION OF ADVANCES Supp D - Break iup of sundry receivables and sundry depsoits SUPP. E1 & E2 – EXPOSURE TO SENSITIVE SECTOR Supp F - information relating to DSB 1 and additional information SUPP. G – CASH & BANK BALANCE FOR SELECT NON-FRIDAYS Supp H - Residual maturity pattern of forex advances / deposits SUPP. K - PARTICULARS OF EXPENDITURE AND INCOME RELATING TO PREVIOUS YEARS SUPP. M – BREAK UP OF PAYMENTS TO AND PROVISIONS FOR EMPLOYEES LA General and LA Suit Filed as at 31-03-15 Loan Analysis Summary Recoveries made in Select Borrowal accounts from 01-04-14 to 31-03-15 Control Sheet for NPA, Income Recognition, Movement of NPA and Interest reversal of NPA BS - 3 Expenditure for the half year ended 30-09-15 BS - 4 Income for the half year ended 30-09-15 Supp M - 30-09-14 SFVM inventory statement 1 2 3 4 5 6 17 18 C 19 20 21 22 23 24 25 Prepared By : Reviewed By : 9 7 8 RETURNS BS - 1 Liabilities BS - 2 Assets BS - 3 Expenditure for the half year ended 31-03-15 BS - 4 Income for the half year ended 31-03-15 Final A & L as on 31-03-15 Final P & L for the year 31-03-15 BS 7 – STATEMENT OF CLAIMS MADE AGAINST THE BANK NOT ACKNOWLEDGED AS DEBT BS 8 – DETAILS OF RESTRUCTUTRED A/C (EXCLUDING CDR) Page Index Completion Status S No No of copies We are required to certify and complete the following individual reports / returns and certificates ( modify as necessary based on banks standard instructions ). The number of copies of each submission, applicability and / or completion status is also as under Index 26 27 28 29 30 31 CERTIFICATES Branch Audit Report Annexure A to E ( Memorandum of Changes ) Questionnaire in addition to Branch Audit report Special Deposit Scheme 1975 Compulsory Deposit scheme 1974 PMRY scheme 32 33 34 35 36 37 Form of Certificate on sharing of recoveries in claim settled accounts under SLGS 1971/SLGS(SSI) 1981 Interest Subvention claim Interest relief on Rupee Export credit Compliance of Accounting Standard 11 as per Annual Closing Circular Technology upgradation fund scheme Capital subsidy scheme for processing machinery 38 LFAR 39 Tax audit report 40 41 42 43 44 45 SLR / CRR Ghosh Committee Report Jhilani Committee Report Statement of Capital Adequacy Statement of Risk Weight Assets Certificate of passing previous year MOC Certificate of Compliance with Income recognition, Asset Classsification and provisioning norms Provision for sacrifice under NPV method for restructured advances Provision held on upgraded restructured advances for two years Sector wise, security wise and asset classification wise statement Certificate of Lending to Sensitive Sector Certificate of Cash Margin held 46 47 48 49 50 51 Completion Status S No No of copies Bank Branch Audit Working Paper Manual 3.2. Attach final attested report, statements and certificates to be attached to this segment Page 10 3.3. In case of any schedules not audited by us ( eg. Sep 30 A/L, P/L etc) these may be signed with a seal as “Initialled for Identification purposes only” Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 4. Auditing Review and Other Standards The work has been planned and performed in accordance with the following Auditing, Review and Other Standards as prescribed by the Institute of Chartered Accountants of India to the extent applicable for the engagement SA210 SA220 SA230 SA240 SA250 SA260 SA265 SA299 SA300 SA315 SA320 SA330 SA402 SA450 SA500 SA550 SA560 SA570 SA580 SA600 SA610 AUDIT EVIDENCE—SPECIFIC CONSIDERATIONS FOR SELECTED ITEMS. EXTERNAL CONFIRMATIONS. INITIAL AUDIT ENGAGEMENTS—OPENING BALANCES. ANALYTICAL PROCEDURES. AUDIT SAMPLING. AUDITING ACCOUNTING ESTIMATES, INCLUDING FAIR VALUE ACCOUNTING ESTIMATES, AND RELATED DISCLOSURES. RELATED PARTIES. SUBSEQUENT EVENTS. GOING CONCERN. WRITTEN REPRESENTATIONS. USING THE WORK OF ANOTHER AUDITOR. USING THE WORK OF INTERNAL AUDITORS. SA620 USING THE WORK OF AN AUDITOR’S EXPERT. Page SA501 SA505 SA510 SA520 SA530 SA540 Description OVERALL OBJECTIVES OF THE INDEPENDENT AUDITOR AND THE CONDUCT OF AN AUDIT IN ACCORDANCE WITH STANDARDS ON AUDITING. AGREEING THE TERMS OF AUDIT ENGAGEMENTS. QUALITY CONTROL FOR AN AUDIT OF FINANCIAL STATEMENTS. AUDIT DOCUMENTATION. THE AUDITOR’S RESPONSIBILITIES RELATING TO FRAUD IN AN AUDIT OF FINANCIAL STATEMENTS. CONSIDERATION OF LAWS AND REGULATIONS IN AN AUDIT OF FINANCIAL STATEMENTS. COMMUNICATION WITH THOSE CHARGED WITH GOVERNANCE. COMMUNICATING DEFICIENCIES IN INTERNAL CONTROL TO THOSE CHARGED WITH GOVERNANCE AND MANAGEMENT. RESPONSIBILITY OF JOINT AUDITORS. PLANNING AN AUDIT OF FINANCIAL STATEMENTS. IDENTIFYING AND ASSESSING THE RISK OF MATERIAL MISSTATEMENT THROUGH UNDERSTANDING THE ENTITY AND ITS ENVIRONMENT. MATERIALITY IN PLANNING AND PERFORMING AN AUDIT. THE AUDITOR’S RESPONSES TO ASSESSED RISKS. AUDIT CONSIDERATIONS RELATING TO AN ENTITY USING A SERVICE ORGANISATION. EVALUATION OF MISSTATEMENTS IDENTIFIED DURING THE AUDIT. AUDIT EVIDENCE. 11 SA reference SA 200 Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual Description FORMING AN OPINION AND REPORTING ON FINANCIAL STATEMENTS. SA705 MODIFICATIONS TO THE OPINION IN THE INDEPENDENT AUDITOR’S REPORT. SA706 EMPHASIS OF MATTER PARAGRAPHS AND OTHER MATTER PARAGRAPHS IN THE INDEPENDENT AUDITOR’S REPORT. SA710 COMPARATIVE INFORMATION— CORRESPONDING FIGURES AND COMPARATIVE FINANCIAL STATEMENTS. SA720 THE AUDITOR’S RESPONSIBILITY IN RELATION TO OTHER INFORMATION IN DOCUMENTS CONTAINING AUDITED FINANCIAL STATEMENTS. SA800 SPECIAL CONSIDERATIONS—AUDITS OF FINANCIAL STATEMENTS PREPARED IN ACCORDANCE WITH SPECIAL PURPOSE FRAMEWORKS. SA805 SPECIAL CONSIDERATIONS—AUDITS OF SINGLE FINANCIAL STATEMENTS AND SPECIFIC ELEMENTS, ACCOUNTS OR ITEMS OF A FINANCIAL STATEMENT. SA810 ENGAGEMENTS TO REPORT ON SUMMARY FINANCIAL STATEMENTS. SRE2400 ENGAGEMENTS TO REVIEW FINANCIAL STATEMENTS. SRE2410 REVIEW OF INTERIM FINANCIAL INFORMATION PERFORMED BY THE INDEPENDENT AUDITOR OF THE ENTITY. SAE3400 THE EXAMINATION OF PROSPECTIVE FINANCIAL INFORMATION. SAE3402 ASSURANCE REPORTS ON CONTROLS AT A SERVICE ORGANISATION. SRS4400 ENGAGEMENTS TO PERFORM AGREED-UPON PROCEDURES REGARDING FINANCIAL INFORMATION. SRS4410 ENGAGEMENTS TO COMPILE FINANCIAL INFORMATION. Page 12 SA reference SA700 Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 5. Engagement documentation 5.1. Audit Acceptance Letter The audit acceptance letter has been provided to the CO and a copy is kept in the next page. Related documentation including Declaration of fidelity and secrecy, Declaration of full time practice and Declaration of Indebtedness has also been attached to this section. Refer Appendix 1 for acceptance letter 5.2. Engagement Letter An engagement letter has been issued and kept in Appendix 2 5.3. Letter of communication with previous auditor Communication to the previous auditor M/s ………………………….. has been sent on ………………………. Vide courier ref ……………………… dated ……………………… and response has / has not been received. Further the previous auditor has / has not been contacted over phone / e mail. Refer Appendix 3 for Communication sent and response received. Refer Appendix 3 5.4. Representation letter Page 13 Management Representation letter has been obtained and kept in Appendix 4 Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 6. Branch Overview 6.1. Key data Description 2014-15 2013-14 Rs . lakhs Rs . lakhs 2014-15 2013-14 Target Rs . lakhs Actual Rs . Lakhs Total Assets Total liabilities Total Advances Total Deposits Income Expenditure Profit / Loss 6.2. Target Vs Accomplishment Description Total Advances Total Deposits Page 14 Rating of the Branch Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 6.3. Advances Overview - top 10 advance categories of the branch S No Category of advances 1 Cash Credit 2 Overdraft 3 Term loans 4 Crop loans 5 Housing loans 6 Jewel loans 2014-15 2014-15 2013-14 2013-14 Rs . lakhs No of accts Rs . lakhs No of accts 7 8.. 10 Other advances Page 15 Total Advances Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 6.4. Large Advance Profiling List of advances greater than Rs 2 Crores or individually accounting for 5% of the total advances whichever is lower to be covered for detailed checking are as under S No Account reference / name 2014-15 2014-15 2013-14 2013-14 Rs . lakhs No of accts Rs . lakhs No of accts 1 2 3 4 5 6 6.5. Customer wise advances Based on our discussions with the branch manager, these advances belong to the same party and are considered for checking on a collective basis as slippage in one account could result in NPA status for all accounts S No Customer Name Facilities 2014-15 Rs . lakhs 1 1 2 3 2 1 2 3 3 1 2 Page 16 3 Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 6.6. Advance profiling by value S No Slab - Rs Lakhs outstanding 1 < Rs 1 lakh 2 Rs 1 – 5 lakhs 3 Rs 5 – 10 lakhs 4 Rs 10 - 50 lakhs 5 Rs 50 lakhs – Rs 1 Crore 6 Rs 1 to 2 Crores 7 Rs 2 to 5 Crores 8 Rs 5 to 10 Crores 9 > Rs 10 Crores 2014-15 2014-15 Rs . lakhs No of accts 6.7. Deposit profiling S No Category of deposit accounts 2014-15 2014-15 2013-14 2013-14 Rs . lakhs No of accts Rs . lakhs No of accts 1 2 3 4 5 6 Others Page 17 Total Deposits Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 6.8. Restructured advances The following are the advances restructured by the branch and to be reviewed for compliance with restructuring terms and conditions as per revised sanctions. Repeated restructured accounts will also be reviewed S No Account reference / Name During 2014-15 Rs . lakhs Upto 2013-14 Rs. Lakhs 2014-15 Rs . lakhs 1 2 3 4 5 6.9. Interest rate and other charges on major advances Interest % Charges % Charges % Charges % Page 18 Advances Type Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 6.10. Deposit type 6.11. Interest rate on deposits Days Interest % Any frauds reported Note on frauds reported at the branch in the last few years 6.12. Information in the public domain Page 19 We have scanned the public domain for information pertaining to the Bank and we report as under : Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 6.13. Asset Classification as of date of audit S No Category 1 Standard 2 Substandard 3 Doubtful 4 Loss 2014-15 2014-15 2013-14 2013-14 Rs . lakhs No of accts Rs . lakhs No of accts Total advances 6.14. Review of previous year Audit report and LFAR A short note on any significant issues noticed in the last years audit report , LFAR, NPA provisioning and Note on frauds / large write offs at the branch in the last few years 6.15. Any other matters for consideration to be included 7. General Ledger – Sub Ledger reconciliation The GL / SL reconciliation report to be obtained from CBS and differences if any have been investigated and reported as under Amount Page 20 Nature of discrepancy Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 8. Review Notes of Concurrent, Risk Based Audit, Inspection Reports Concurrent Audit S No Account reference / nature of issue / date of report Amount Present Status – Rectified, LFAR, MoC, Unadjusted Impact, if any on audit strategy Amount Present Status – Rectified, LFAR, MoC, Unadjusted Impact, if any on audit strategy Amount Present Status – Rectified, LFAR, MoC, Unadjusted Impact, if any on audit strategy Amount Present Status – Rectified, LFAR, MoC, Unadjusted Impact, if any on audit strategy Refer 20.1 Risk Based Internal Audit S No Account reference / nature of issue / date of report Inspection Reports S No Account reference / nature of issue / date of report Previous Year LFAR / Audit report issues Account reference / nature of issue / date of report Page 21 S No Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 9. Audit Strategy Based on our high level review of the branch data, loans and deposits CBS files and based on discussions with the Branch manager the following is proposed as the audit strategy 9.1. Top Down Approach to audit The audit strategy will envisage a top down approach which involves understanding the Balance Sheet and P & L and a drill down to perform compliance and substantive procedures at a component / transaction level 9.2. Utilisation of Other Audit reports The branch has been covered under Concurrent audits / Risk based internal audits as well as Inspections. These reports will be reviewed to gain a quick understanding of the control framework and the efficient functioning at the branch. 9.3. Sample selection CBS reports will be downloaded converted to excel and samples selected across loan types, accounting periods, rates , value slabs Understand and appreciate target related pressures and potential impact on misstatements Top accounts ( Rs 2 Crs / 5% advance ) will be checked 100% to cover all accounts Samples of ….. accounts will be taken across all categories of advances to check sanction, documentation, income accrual and monitoring controls Particular attention will be paid to the following accounts based on our review of the Concurrent / inspection reports o ……………….. o ………………. o ………………. The following unit visits will be undertaken to perform inspection of books / assets held by customers o ……………….. o ………………. o ………………. All accounts with irregularities as indicated in CBS ( based on loan balance file ) will be undertaken for review with bank manager to identify potential NPA cases. The Irregular loan balance report will also be reviewed in detail and documented Page 22 9.4. Advances Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual Sanity checks of advances file will be undertaken for interest rate inconsistencies / sub rate / off standard rates for the particular categories Interest and processing charge accruals will be test checked for 10 random months across …. Loan files and CCOD files ( periodic / daily interest computation ) Large disbursements close to year / quarter end will be reviewed in detail on a test basis Clean loans / bullet loans to be reviewed in detail Special emphasis on restructured advances 9.5. Deposits Top deposit accounts will be checked to review completeness, adequacy , relevance of documentation Large deposits placed at year end will be reviewed in detail Sanity checks of advances file will be undertaken for interest rate inconsistencies / sub plr / off standard rates for the particular categories 9.6. Other items Checklist driven approach guided by key control aspects as stated in the LFAR Page 23 Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 10. Key Reports from CBS to be used for audit The following key reports have been obtained from CBS Balance sheet Profit and Loss account Loan Balance file CC OD file Deposit balance file Interest ledger NPA file SMA file Irregular loans file Previous year NPA file TDS ledgers Guarantee Commission register Page 24 Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 11. Standard Schedules 11.1. Top Notes for attention of Manager / Partner Nature of Issue Amount LFAR MoC Fraud related Final Disposal Status Page 25 S No Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 11.2. Items Adjusted –Memorandum of Changes The following MoC’s have been recommended by us based on our audit of the financial statements and on the basis of information and explanations provided to us S No Nature of Issue Debit Account Credit Account Amount Remarks Rectification of Income recognition Reclassification of NPA’s ( fresh ) Change in the status of Old NPA’s Account reclassifications within P&L: and A&L Reclassification of Loans and Advances where done differently by the branch Assets put to use and not capitalised Page 26 Any other Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 11.3. Minutes of discussions with Branch Manager including NPA review Rationale for selection for NPA review Inadequate documentation Inadequate security cover Irregularity in servicing principal and / or interest Repeated restructuring Drawing Power related issues Failed sanity checks on limits vs financial data Solitary credits in accounts Inoperative accounts Financials related issues observed Public domain information Suspected Frauds Any other reason Account reference and name Amount outstanding Remarks LFAR / MoC / Unadjusted Differences Page 27 S No Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 12. Advances and General Audit plan 12.1. Summary of advances of the branch ( as per Balance Comparison report) Amt 2014-15 Amt 2013-14 Page 28 Advance Category Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 12.2. General Audit plan for advances Page 29 12.2.1. Obtain the Loan listing as at the Date of Audit 12.2.2. Loans greater than Rs.2Crore limit or Rs 2 Cr balance outstanding to be taken up for detailed review documentation for LFAR 12.2.3. Generate the following reports: o Special Watch Report o Restructured accounts report o Suspended Accounts o NPA Listing 12.2.4. Identify samples of loans to be checked. 12.2.5. Ensure 100% of files selected for samples are available to confirm that no file is lost 12.2.6. Review loans against checklist prepared category wise in relation to o Application o Credit appraisal o Sanction letter o Disbursement o Master data updation in CBS o Interest computation o Principal repayment o Fixation of drawing power o Verification of securities o Submission of stock and book debts o Submission of financial statements o Any other documentation Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 13. Advances Verification – Large advances 13.1. Checklist for large advances Page 30 Obtain list of all large advances ( Rs 2 Crs / 5% ) and complete the following aspects Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 1 Name of the borrower 2 Date of Loan Application Whether loan application is processed duly obtaining all records / documents, Audited Financial Statements and unit inspection Date on which recommended by branch Whether approved by competent authority Date on which duly approved Nature of Limit Fund Based Cash Credit Overdraft Term Loan Bills purchase / discounting Non Fund based Letters of Credit Bank Guarantees Total Exposure Classification Priority / NPS 3 4 Date of original Sanction 5 Due Date of renewal Date of renewal / review 6 Number of days overdue since 7 Sanction terms 8 Primary security 9 Collateral security 10 Facility wise margin 11 Special terms and conditions for compliance Documentation Execution of Hypothecation and other documents Registration of Charges if company Legal opinion Valuation report copy Audited financial Statements Margin requirement and additional capital infusions others Disbursement – is it done directly in term loan accounts Are there bullet disbursement in Housing loan for construction Deficiencies in disbursements 12 Prepared By : Remarks Page Number ref 31 Particulars Page Sl No Reviewed By : Bank Branch Audit Working Paper Manual 15 16 17 32 14 Whether the Sector wise classification is correct Prepared By : Page 13 Is the operative account allowed to be utilised in single disbursement Ensure end use of funds Verify and if applicable, Report diversion of funds at the point of disbursement Post disbursement monitoring Is the facility operated with the limit, identify number of days when it is beyond limit / DP Verify adhoc and the manner of adjustment of adhoc Deviation from sanction terms Whether stock statements are being obtained regularly Whether book debt statements duly certified by CA’s / as per terms are obtained regularly Is the Drawing power correctly marked in the system Is there delay in obtaining the above Whether penal interest is charged for delay in submission of stock / book debt statements Whether stock statement are perused and checked by branch officials Whether stock inspections are carried out by branch officials / concurrent auditors Report of inspections / Concurrent auditors Is the stock statement / book debt statement as at 31st March of previous year tallying with the Audited Financial Statement of the same date. Deviations if any, how dealt with If the deviation is significant whether it has any impact on the drawing power determination and consequent asset classification Whether insurance cover is obtained Is it fully insured or under insured – quantum of under insurance Whether RC book, Key and transfer forms obtained for vehicle loans Whether term loan disbursements are done directly Whether receipts of payments made to vendors obtained Operation in the account Whether operation in the account is satisfactory Whether frequent overdrawing is authorised / approved Whether term loan repayments are regular If overdue, number of instalments and whether any instalment is regularised by way of additional facility or accomodation Any other observation / deficiency in the account Whether processing and inspection charges are charged and recovered Reviewed By : Bank Branch Audit Working Paper Manual 18 Whether the securities offered are in place to ensure correctness of security wise classification 19 Whether asset classification is correctly made 20 Whether interest and legal charges on NPA accounts are not debited to borrowers account. Samples and Matters for Consideration Page 33 13.2. Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 14. Special Note on Audit of Restructured Advances 14.1. Indicative Checklist Obtain a general understanding of the type of advance which has been restructured – project / non project advances, prior to or after Commencement of Commercial production etc as per the RBI master circular which deals in detail on manner and mode of treatment of restructured advances Restructured advances to be reviewed with reference to revised terms of sanction properly approved by the relevant sanctioning authority Repeated restructuring to be reviewed for NPA classification All terms of revised sanction are complied with ( including but not limited to revision in commercial production, interest rate revision, rescheduling of repayments, additional security cover, promoters contribution enhancements, escrow requirements etc ). In case of non-compliance, appropriate reclassifications have been considered Verification and results Page 34 14.2. Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 15. Advances Verification – Cash Credit and overdraft accounts 15.1. Indicative Checklist Financial Statements and solvency / capability of borrower / limit Unaudited financial statements have been furnished for balances < Rs 1 lakh Audited financial statements have been furnished for balances > Rs 1 lakh Audited financial statements have been furnished for corporate borrowers Income tax returns have been furnished Limit fixation and approval Proposal for assessment of Working capital needs is available Sanction as per limits of branch If immovable property has been offered as security , EC for continuous period is available and is clear Title Deeds have been deposited with the bank If immovable property , EM regn > Rs 25 lakhs Legal opinion is available and indicates clean title deeds Valuation report is present and is commensurate Valuation report is less than three years old Insurance policy available, adequate and comprehensive Security of stock and book debts / other collaterals Demand Promisory note has been furnished Hypothecation agreement for stocks and Drs Guarantee Agt has been executed properly ROC regn of charge for cos for hyp of stock and book debts - Form 8 ROC regn of charge for cos for hyp of immov property ROC search report once in 3 years Others Page 35 Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual Monitoring Actions Submission of stock stts Maintenance of drawing limit based on Working capital statements Qtrly book debts certf by CA Stock audit once a year by CA for > Rs 1 cr Godown visit by banker - monthly or qtrly Repayments / TOD / One off credits Review of accounts to ensure continuous operation Review of accounts featuring in Irregular report as per CBS One off credits to be investigated Drawing in excess of sanctioned limit on a continuous basis Consistent excess over drawing power as per sanction CBS Updation Loan details recorded correctly in CBS Test of repayments done Test of interest accrual done Sample verification and results Page 36 15.2. Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 16. Advances Verification – Housing loans 16.1. Indicative Checklist Samples verified Page 37 16.2. Loan application is available Loan application is signed and properly executed Sanction letter is available Loan proposal indicating projections etc Title deeds lodged with bank Assessment of repayment capability - Sal cert / it returns / pl acct etc Margin at XX% ( Land cost + constrn cost ) EC available Legal opinion Approved Building plan Insurance policy Pledge deed All documents refer to the same survey number EM creation by deposit of title deeds EM registered for Rs 25 lakhs Direct payment to vendor of land / contractor If client own construction, stage payment subj to original bills cert by civil engg for work done Inspection of property by bank Final valuation cert for completed properties Valuation report is less than three years - available from expert Loan details recorded correctly in CBS Construction not completed in 2 years Test of repayments done Test of interest accrual done Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 17. Advances Verification – Educational loans 17.1. Indicative Checklist Samples verified Page 38 17.2. Loan application is available Loan appln is signed and properly executed Sanction letter is available Loan for Grad / PG Loan - Inland – Foregin Plus 2 pass proof Asst of repayment of parent For loan to minor , parent should sign the application and all documents for self and on behalf of Where minor > 18 yrs after disbursement, AOD and LOU counter signed by parent Parent IT return Parent Salary certificate / PL acct profit Ceiling based on course Not given for capitation fee Margin maintained at X% Less than max ceiling , Rs 25K no sec Rs 25 - 50K - surety apart from parent > Rs 100 K – collateral EM creation by deposit of title deeds EM registered for . Rs 25 lakhs All documents refer to the same survery number Valuation report is less than three years - available from expert Approved plan Inspection of property by bank, if collaterial Interest to be serviced before completion of course for loans to employed Persons Valuation report is less than three years - available from expert Loan details recorded correctly in CBS Test of repayments done Test of interest accrual done Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 18. Advances Verification – Vehicle loans 18.1. Indicative Checklist Samples verified Page 39 18.2. Loan application is available Loan appln is signed and properly executed Sanction letter is available DPN Hypothecation agreement Loan proposal indicating projections etc Financials of the borrower prior to loan date IT returns for period before loan sanc. Date RC book - certified true copy RC endorsed in favour of bank - Hypothecation endorsement Loan is sanctioned net of margin for 'Cost and Accessories" not for charges Disbursement amount , tenure and tenor as per sanction Duplicate keys Original invoice Direct payment to dealer for vehicle Guarantor signature Comprehensive insurance - live now and bank clause in fav of Ind Bank For second hand vehicle - valn report from approved valuer Higher margin requirement for second hand vehicle Loan details recorded correctly in CBS Test of repayments done Test of interest accrual done Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 19. Advances Verification – Jewel Loans 19.1. Indicative Checklist Total packets to be tallied to total loans All expired loans to be classified as NPA where balance is outstanding ( where such loans are bullet loans repayable at the end of the specific tenor ) Special emphasis to be paid to expired loans Loan to packet and packet to loan verification to be done for test cases Say 25 both ways to ensure that wrong packets have not been redeemed Specific Loan agreement is available and properly executed Jewel packet verified for weight and purity Letter of pledge is available Rate of interest updated properly Loan details recorded correctly in CBS Test of repayments done Test of interest accrual done Samples verified Page 40 19.2. Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 20. Advances Verification – Loans against Own Deposits 20.1. Indicative Checklist Samples verified Page 41 20.2. Letter of pledge is available Nature of security - RD / FD Lien is marked in system against the FD Deposit receipt is available with bank and discharged Loan closed after due date of deposit Loan details recorded correctly in CBS Test of repayments done Test of interest accrual done Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 21. Advances Verification – Loans against financial assets 21.1. Indicative Checklist Samples verified Page 42 21.2. Loan application is available Loan appln is signed and properly executed Loan amount original sanctioned is within powers Securities in the name of the borrower In case security not in the name of the borrower , consent letter is available Shares - demat and pledged noting in demat LIC - Assignment in favour of bank and regd Govt instruments tfd as "Sec to Ind Bank " - NSC / KVP Loan is within margin limits of surr. Value Loan is within margin limits of mkt. Value for shares Loan is within margin limits of face value for govt notified instmts Shares erosion in market value LIC erosion in surr. Value due to unpaid premium has been cognised for Loan details recorded correctly in CBS Test of repayments done Test of interest accrual done Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 22. NPA Review 22.1. General Audit plan for NPA review 22.2. The NPA file was obtained from CBS as at date of audit The Specially Marked Accounts files were obtained The irregular files were obtained The files were cross referenced to the loan balance and CCOD file Clean loans – top value were test checked to ensure that there are no impairments Loans featuring in any of the above reports – NPA / SMA and IRR were considered for the review The accounts were reviewed individually with the Branch manager to determine the extent of slippage, possibility of recovery and the need for reclassification Additionally, accounts identified as potential NPA based on documentation / security lapses were also considered for the review and rectification before the Balance Sheet date Restructured accounts listing was obtained and reviewed in detail Details of MoC’s S No Nature of Issue Debit Account Credit Account Amount Remarks Rectification of Income recognition Reclassification of NPA’s ( fresh ) Change in the status of Old NPA’s Account reclassifications within P&L: and A&L Page 43 Reclassification of Loans and Advances where done differently by the branch Assets put to use and not capitalized Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 23. Verification of Deposits 23.1. General Audit plan for deposits Details of Sample selected Page 44 23.2. Date of deposit If SB acct holder, give SB ref Application form and complete Photograph ID proof and age proof Address Proof Introducer Pan copy Pan related documentation Rate as per norm CBS updation done correctly Interest Computation is accurate Deposit file has been reviewed for interest rates on a substantive basis ( sanity checks ) Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 24. Interest Verification Loan type Interest verified For loans, check interest computation on PNR basis as per agreement terms For CC OD check interest by Daily balance method Document all interest verified Check one month interest ledger to ensure that interest is accounted for all loan accounts. Sample if interest considered at the correct rate Page 45 Interest Amount Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 25. Check list for Long Form Audit Report A.ASSETS: 1 Cash - - Obtain a schedule of denomination of cash Physically verify the existence of cash and tally with the (and tally with the) above schedule Tally physical balance with Cash Scroll and the General Ledger as on the date of verification Ascertain the retention limit of cash fixed by the head office. In case the balance exceeds the Retention Limit the same may be reported in the following format: Cash Balance in excess of Rs. - 2 Balances with other Banks - Verify whether the branch has any balances with other banks. - Obtain confirmatory letter from the bank or branch wherever applicable. - Ensure whether BRS is prepared periodically. - Verify BRS on a test check basis. Check for unresponded credits/debits found in the BRS and report the same. - - Check for appropriate authorization issued by H.O/ Controlling Authority - Conduct physical verification of investments and tally with the above schedule Advance - Ensure that monitoring of slippage of accounts from standard to sub- standard/doubtful is done and reported promptly to the Controlling Authority. - Ensure that recovery measures are promptly taken. - 46 4 Investments - Obtain the schedule of investment held by the branch. Page 3 Date: Amount Rs. Verify the insurance cover taken on transit cash. Verify whether cash is maintained in effective joint custody of two or more persons Ensure that are responsible official verifies physical cash on a daily basis. Check whether the cash balance has been verified periodically by the Branch Manager in addition to the Head cashier. Prepared By : Reviewed By : 5 Other Assets Bank Branch Audit Working Paper Manual Stationery/Stamps - Obtain schedule of Stationery Stocks - Ensure that the physical balance tallies with the above schedule. - Suspense Accounts/Sundry Assets. Obtain an schedule/return of suspense account and verify the items for long outstanding items. Report unusual/long outstanding items. - Verify transfer to H.O during the year Does the scrutiny of accounts under various sub-heads reveal balances, which in your opinion are not recoverable and would require provision/ write off. B. LIABILITY: Bills payable, Sundry deposits etc., - Does the scrutiny of account sunder various sub-heads reveal odd balances? Report the number of items and aggregate of amount of old outstanding item spending for 3 or more years - Check amount received against suite filled accounts - Check unidentified deposits e g. Excess cash found in the branch etc., C. PROFIT AND LOSS ACCOUNT - Ensure that the branch has followed the income recognition norms stipulated by RBI - Test check calculations of interest on deposits for excess/short credit of material amount if so give details thereof. - Study preceding 2 years half year returns for divergent trends in major items of income and expenditure and report those which are not satisfactorily explained by the branch Indicate the effect of changes if any in accounting policies on the items of income and expenditure. D. GENERAL House keeping - Ensure whether the branch is regular in furnishing a house keeping return to the Controlling Authority. - Verify whether the branch maintains the books and records properly in accordance with the H.O guidelines. - Ensure that the balances are duly linked and properly authenticated by responsible official /authorised signatories? Page 47 - Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual - Report the lapses in balancing procedures - Report differences in crystallised balances lying unattended Ensure that the control and subsidiary records have been reconciled at the year-end or at the prescribed intervals Inter Branch Accounts Are there any double responses or wrong responses in H.O A/c. Indicate the outstanding entries in the inter branch accounts together with a statement of reasons for their remaining outstanding and the steps taken by the management in respect thereof. - - Are there any frauds discovered during the year under audit and report if any. - Does the examination of the accounts indicate possible window dressing? - Are there any matter ,which you as branch auditors would like to bring to the notice of the management or the central statutory auditor. - Tax Audit U/s 44AB ofI.TAct,1961 - Audit Report to be made in form3CA - Obtain verify and certify particulars required in form3CD - Other Certifications 1. PMRY, SEEUY and SEPUP scheme certification Ensure that correct claim/subsidy is calculated - - - 3 Ensure that the certificates required are within the scope of audit e g. Certification that the debts are fully secured. Page 48 - 2.DICGCscheme Verify whether the information furnished is correct according to the books/records maintained by the Branch. Verify whether the recoveries effected in the Claims Received A/c have been proportionately remitted to the corporation. Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 26. Profit and Loss Account – Analytical review procedures Description 2014-15 2013-14 Amount Rs . lakhs Amount Rs . Lakhs % Change 2013-14 2013-14 Nos Nos % Change Total Advances Total Deposits Interest on advances Interest on deposits Other Incomes Profit / Loss NPA Amount Ratios Interest to advances Interest to deposits 27. Certification Related Working papers Asset Liability Management Jilani committee and Ghosh committee Capital adequacy ratio PMRY / SEEUY SLR / CRR – 12 odd dates Compliance with RBI Norms on IRAC DICGC / ECGC Interest subvention schemes TUF schemes Certification of Provision for Restructured Accounts Certificate of Sensitive Sector and CRE Other Certificates 28. Tax Audit Workings Page 49 1.1. Tax audit report 1.2. Audit program 1.3. Samples Prepared By : Reviewed By : Bank Branch Audit Working Paper Manual 29. Other Working papers Any other relevant information 30. 31. References Branch Audit guidance document as received from the HO / CO Bank Authority levels for sanction limits for loans and advances Loan manual IRAC norms relevant for this audit RBI master circular – July 2, 2013 Other RBI Circulars relevant for the purpose of this audit Guidance Note on Bank Branch audit as issued by the ICAI Revised SA700, 705 and 706 for modification in reporting Appendices Appendices 2014-15 Appointment Letter 2 Engagement Letter 3 Previous Auditor Communication 4 Management representation letter 5 Checklist for advances 6 Other appendices on a need to basis Page 50 1 Prepared By : Reviewed By :