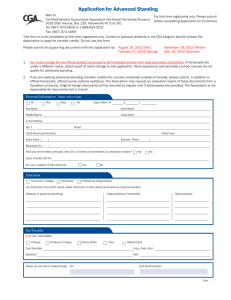

Personal Tax Representation Letter Template

advertisement

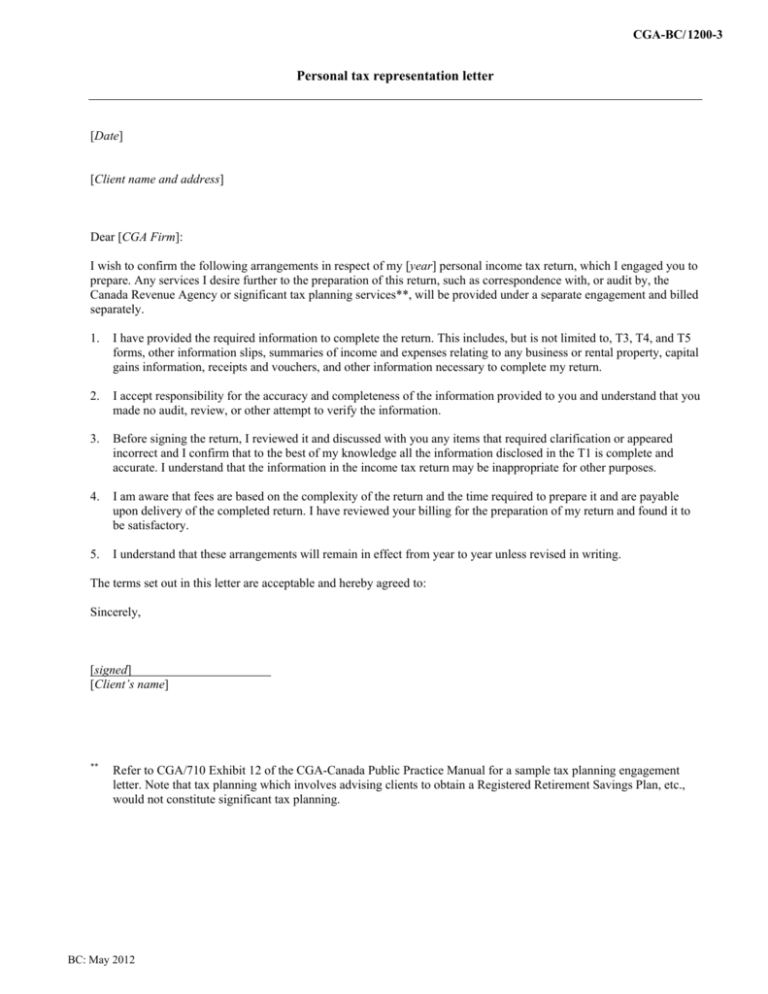

CGA-BC/1200-3 Personal tax representation letter [Date] [Client name and address] Dear [CGA Firm]: I wish to confirm the following arrangements in respect of my [year] personal income tax return, which I engaged you to prepare. Any services I desire further to the preparation of this return, such as correspondence with, or audit by, the Canada Revenue Agency or significant tax planning services**, will be provided under a separate engagement and billed separately. 1. I have provided the required information to complete the return. This includes, but is not limited to, T3, T4, and T5 forms, other information slips, summaries of income and expenses relating to any business or rental property, capital gains information, receipts and vouchers, and other information necessary to complete my return. 2. I accept responsibility for the accuracy and completeness of the information provided to you and understand that you made no audit, review, or other attempt to verify the information. 3. Before signing the return, I reviewed it and discussed with you any items that required clarification or appeared incorrect and I confirm that to the best of my knowledge all the information disclosed in the T1 is complete and accurate. I understand that the information in the income tax return may be inappropriate for other purposes. 4. I am aware that fees are based on the complexity of the return and the time required to prepare it and are payable upon delivery of the completed return. I have reviewed your billing for the preparation of my return and found it to be satisfactory. 5. I understand that these arrangements will remain in effect from year to year unless revised in writing. The terms set out in this letter are acceptable and hereby agreed to: Sincerely, [signed] [Client’s name] ** Refer to CGA/710 Exhibit 12 of the CGA-Canada Public Practice Manual for a sample tax planning engagement letter. Note that tax planning which involves advising clients to obtain a Registered Retirement Savings Plan, etc., would not constitute significant tax planning. BC: May 2012