Chapter 14 Decision Making - University of San Diego Home Pages

advertisement

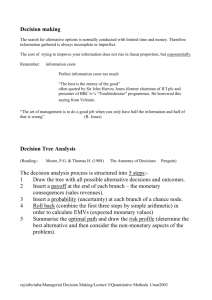

Chapter 14 Decision Making Applying Probabilities to the Decision-Making Process in the face of uncertainty. In order to make the best decision, with the information available, the decision maker utilizes certain decision strategies to evaluate the possible benefits and losses of each alternative. When making a decision in the face of uncertainty, ask: 1) What are my possible Alternatives or Courses of Action? 2) How can the future affect each action? What are my possible Alternatives or Courses of Action? Before selecting a course of action, the decision maker must have at least two possible alternatives to evaluate before making his choice. I want to invest $1 million for 1 year. I narrow my choices to three alternatives (actions): Example: Alternative 1: Invest in guaranteed income certificate paying 10%. Alternative 2: Invest in a bond with a coupon value of 8%. Alternative 3: Invest in a well-diversified portfolio of stocks. The Alternatives (Actions) are under the decision maker’s control. How can the future affect each alternative (action)? Unless you’ve got a crystal ball Future uncertainties may derail the most perfect of plans. These future events are also referred to as States of Nature Example: Economic conditions, foremost among which is interest rates. Interest rates increase. Interest rates stay the same. Interest rates decrease. To account for future uncertainties (events) We assign probabilities to measure the likelihood of a future event occurring. Example: Interest rates Increase Stay same Decrease Probabilities Probabilities .2 .5 .3 Future events (states of nature or outcomes), are out of the decision maker’s control and often strictly a matter of chance. Yet, the impact of these events Affect the payoffs/losses which determine the decision making process. Important Distinction! The action (alternative) is under the decision maker’s control. The event (state of nature) that ultimately occurs is strictly a matter of chance. Associated with each alternative (action) and event (state of nature) is a corresponding payoff or profit. Interest rates Increase Stay same Decrease GIC $100,000 $100,000 $100,000 PAYOFF TABLE Bond -$50,000 $80,000 $180,000 Stocks $150,000 $ 90,000 $ 40,000 Interest rates Increase Stay same Decrease GIC $100,000 $100,000 $100,000 PAYOFF TABLE Bond -$50,000 $80,000 $180,000 Stocks $150,000 $ 90,000 $ 40,000 If I could predict the future with certainty, I would choose the alternative with the highest payoff (profit). Instead of focusing on profits, I could look at the Opportunity Loss associated with each combination of an alternative and the economic condition affecting that alternative’s profitability. Opportunity Loss The difference between the profit I made on the alternative I chose and the profit I could have made had the best decision been made. PAYOFF TABLE Bond -$50,000 $80,000 $180,000 Interest rates Increase Stay same Decrease GIC $100,000 $100,000 $100,000 Interest rates Increase Stay same Decrease OPPORTUNITY LOSS TABLE GIC Bond $50,000 $200,000 0 20,000 80,000 0 Stocks $150,000 $ 90,000 $ 40,000 Stocks 0 10,000 140,000 NOTE: Since Opportunity Loss is the difference between two decisions, it can not be expressed as a negative number. If I could predict the future with certainty, I would choose the alternative (action) with the highest payoff or lowest loss. Interest rates Increase Stay same Decrease GIC $100,000 $100,000 $100,000 Interest rates Increase Stay same Decrease PAYOFF TABLE Bond -$50,000 $80,000 $180,000 Stocks $150,000 $ 90,000 $ 40,000 OPPORTUNITY LOSS TABLE GIC Bond $50,000 $200,000 0 20,000 80,000 0 Stocks 0 10,000 140,000 In many decision problems, it is impossible to assign Empirical probabilities to the economic events, or states of nature, that affect profits and losses. In many cases, probabilities are assigned Subjectively. Interest rates Increase Stay same Decrease Probabilities .2 .5 .3 Using probabilities, we calculate the Expected Monetary Value for each alternative or action. Expected Monetary Value (EMV) Interest rates Increase Stay same Decrease GIC $100,000 $100,000 $100,000 Interest rates Increase Stay same Decrease PAYOFF TABLE Bond -$50,000 $80,000 $180,000 Stocks $150,000 $ 90,000 $ 40,000 Probabilities .2 .5 .3 EXPECTED MONETARY VALUE EMV (GIC) = .2(100,000) + .5(100,000) + .3(100,000) = $100,000 EMV (Bond) = .2(-50,000) + .5(80,000) + .3(180,000) = $84,000 EMV (Stocks) = .2(150,000) + .5(90,000) + .3(40,000) = $87,000 To maximize profits, choose the Alternative with the highest EMV. EXPECTED MONETARY VALUE EMV (GIC) = .2(100,000) + .5(100,000) + .3(100,000) = $100,000 EMV (Bond) = .2(-50,000) + .5(80,000) + .3(180,000) = $84,000 EMV (Stocks) = .2(150,000) + .5(90,000) + .3(40,000) = $87,000 What does the EMV represent? If the investment is made a large number of times (infinite) with bonds, * 20% of the investments will result in a $50,000 loss, * 50% will result in an $80,000 profit, and * 30 % will result in $180,000 profit. The average of all these investments is the EMV of $84,000. Expected Opportunity Loss Decision (EOL) Expected Opportunity Loss (EOL) Interest rates Increase Stay same Decrease Interest rates Increase Stay same Decrease OPPORTUNITY LOSS TABLE GIC Bond $50,000 $200,000 0 20,000 80,000 0 Stocks 0 10,000 140,000 Probabilities .2 .5 .3 EXPECTED OPPORTUNITY LOSS (EOL) DECISION EOL (GIC) = .2(50,000) + .5(0) + .3(80,000) = $34,000 EOL (Bond) = .2(200,000) + .5(20,000) + .3(0) = $50,000 EOL (Stocks) = .2(0) + .5(10,000) + .3(140,000) = $47,000 To minimize losses, choose the Alternative with the lowest EOL. EXPECTED OPPORTUNITY LOSS (EOL) DECISION EOL (GIC) = .2(50,000) + .5(0) + .3(80,000) = $34,000 EOL (Bond) = .2(200,000) + .5(20,000) + .3(0) = $50,000 EOL (Stocks) = .2(0) + .5(10,000) + .3(140,000) = $47,000 Example A vendor at a baseball game must determine whether to sell ice cream or soft drinks at today’s game. The vendor believes that the profit made will depend on the weather. Based on past experience at this time of year, the vendor estimates the probability of warm weather as 60%. Event Cool Weather Warm Weather ACTION Sell Soft Drinks ($) 50 60 Sell Ice Cream ($) 30 90 Event Cool Weather Warm Weather ACTION Sell Soft Drinks ($) 50 60 Sell Ice Cream ($) 30 90 1) Compute the EMV for selling soft drinks and selling ice cream. 2) Compute the EOL for selling soft drinks and ice cream. 3) Based on the previous results, which should the vendor sell, ice cream or soft drinks? Why? EMV EMV (soft drinks) = .4(50) + .6(60) = 20 + 36 = $56 EMV (ice cream) = .4(30) + .6(90) = 12 + 54 = $66 Sell ice cream Stay tuned The Value of Additional Information If we knew in advance which future event or state of nature would occur, we would capitalize on this knowledge and maximize our profits/minimize our losses. But our “knowledge” of future events or states of nature is sometimes tenuous at best. Leaving us to ask ourselves, “Am I making the best decision?” To determine which course of action (alternative) to select, we assign probabilities to the likelihood of each future event occurring. Probabilities are assigned based on : • past data, • the subjective opinion of the decision maker, • Or knowledge about the probability distribution that the event may follow. Better information makes better decisions. But what are you willing to pay? Data is costly to acquire: * Money & time • Cognitive energy • Staff effort • Opportunity costs of failing to do other things with the money or time. Goal is to gather data as long as: the MARGINAL COST is NO MORE than the MARGINAL BENEFITS of the additional data. At some point, data gathering must stop and the decision must be made. The Value of Additional Information Expected Payoff with Perfect Information (EPPI) EPPI is the maximum price that a decision maker should be willing to pay for perfect information. With perfect information, I would know what to expect so I would select the optimum course of action for each future event. Expected Payoff With Perfect Information (EPPI) EPPI is also known as Expected Profit under Certainty. Interest rates Increase Stay same Decrease Interest rates Increase Stay same Decrease GIC $100,000 $100,000 $100,000 PAYOFF TABLE Bond -$50,000 $80,000 $180,000 Stocks $150,000 $ 90,000 $ 40,000 Probabilities .2 .5 .3 EPPI = .2(150,000) + .5(100,000) + .3(180,000) = $134,000 EXPECTED PROFIT UNDER CERTAINTY is the expected profit you could make if you have perfect information about WHICH event will occur. If the Expected Profit Under Certainty (EPPI) is the profit I expect to make if have perfect information about which event will occur, how much should I be willing to pay for this “perfect” information? EPPI = .2(150,000) + .5(100,000) + .3(180,000) = $134,000 The $134,000 does NOT represent the MAXIMUM amount I’d be willing to pay for perfect information because I could have made an expected profit of EMV= $100,000 WITHOUT perfect information. Expected Value of Perfect Information EVPI = EPPI – EMV* = $134,000 - $100,000 = $34,000 If perfect information were available, the decision maker should be willing to pay up to $34,000 to acquire it. Besides profits & losses, is there something else we should consider? Variability! When comparing two or more actions, especially with vastly different means, evaluate the relative risk associated with each action. Coefficient of Variation (CV) Return to Risk Ratio (RRR) Coefficient of Variation (CV) Measures the relative size of the variation compared with the arithmetic mean (EMV). CV = σ ÷ EMV σ = √Σ (x- µ)2 · P (X) Where µ = EMV* Interest rates Increase Stay same Decrease Interest rates Increase Stay same Decrease GIC $100,000 $100,000 $100,000 PAYOFF TABLE Bond -$50,000 $80,000 $180,000 Stocks $150,000 $ 90,000 $ 40,000 Probabilities .2 .5 .3 EXPECTED MONETARY VALUE EMV (GIC) = .2(100,000) + .5(100,000) + .3(100,000) = $100,000 EMV (Bond) = .2(-50,000) + .5(80,000) + .3(180,000) = $84,000 EMV (Stocks) = .2(150,000) + .5(90,000) + .3(40,000) = $87,000 CV = σ ÷ EMV σ = √Σ (x- µ)2 · P (X) Where µ = EMV* Interest rates Increase Stay same Decrease GIC $100,000 $100,000 $100,000 PAYOFF TABLE Bond -$50,000 $80,000 $180,000 Stocks $150,000 $ 90,000 $ 40,000 EMV* = $100,000 σstocks = √Σ (x- µ)2 · P (X) = √(150,000 – 100,000) 2 (40,000 – 100,000) 2 (.3) = 40,373 (.2) + (90,000 – 100,000) 2 (.5) + Interest rates Increase Stay same Decrease GIC $100,000 $100,000 $100,000 PAYOFF TABLE Bond -$50,000 $80,000 $180,000 Stocks $150,000 $ 90,000 $ 40,000 EMV* = $100,000 σbonds = √Σ (x- µ)2 · P (X) = √(-50,000 – 100,000) 2 (180,000 – 100,000) 2 (.3) = 81,363 (.2) + (80,000 – 100,000) 2 (.5) + Coefficient of Variation CVstocks = (σ ÷ EMV) 100% = (40,373 ÷ 100,000) 100% = 40.4% CVbonds = (σ ÷ EMV) 100% = (81,363 ÷ 100,000) 100% = 81.4% Return-to-Risk Ratio (RRR) RRR = EMV ÷ σ RRR stocks = 100,000 ÷ 40,373 = 2.48 RRR bonds = 100,000 ÷ 81,363 = 1.23 Although Bonds & stocks have a comparable EMV, the RRR for stocks is substantially higher than bonds & the stocks’ CV much smaller than that of bonds. EXPECTED MONETARY VALUE EMV (GIC) = .2(100,000) + .5(100,000) + .3(100,000) = $100,000 EMV (Bond) = .2(-50,000) + .5(80,000) + .3(180,000) = $84,000 EMV (Stocks) = .2(150,000) + .5(90,000) + .3(40,000) = $87,000 RRR stocks = 100,000 ÷ 40,373 = 2.48 RRR bonds = 100,000 ÷ 81,363 = 1.23 Homework A baker must decide how many specialty cakes to bake each morning. From past experience, she knows that the daily demand for cakes ranges from 0 to 3. Each cake costs $3.00 to produce and sells for $8.00, and any unsold cakes are thrown in the garbage at the end of the day. Set up a payoff table to help the baker decide how many cakes to bake. Payoff Table Produce Demand Bakeo Bake1 Bake2 Bake3 Sello 0 -3.00 -6.00 -9.00 Sell1 0 5.00 2.00 -1.00 Sell2 0 5.00 10.00 7.00 Sell3 0 5.00 10.00 15.00 Opportunity Loss Table Produce Demand Bakeo Bake1 Bake2 Bake3 Sello 0 3.00 6.00 9.00 Sell1 5.00 0 3.00 6.00 Sell2 10.00 5.00 0 3.00 Sell3 15.00 10.00 5.00 0 Assuming probability of each event is equal: Sell = .25 EMV(0) = $ 0 EMV(1) = .25(-3) + .25(5) + .25(5) + .25(5) = $3.00 EMV(2) = .25(-6) + .25(2) +.25(10) + .25(10) = $4.00 EMV(3) = .25(-9) + .25(-1) +.25(7) + .25(15) = $3.00 EMV* decision is to bake 2 cakes. Assuming probability of each event is equal: Sell = .25 EOL(0) = .25(0) + .25(5) + .25(10) =.25(15) = $7.50 EOL(1) = .25(3) + .25(0) + .25(5) =.25(10) = $4.50 EOL(2) = .25(6) + .25(3) + .25(0) =.25(5) = $3.50 EOL(3) = .25(9) + .25(6) + .25(3) =.25(0) = $4.50 EOL* decision is to bake 2 cakes. EVPI = EPPI – EMV* EPPI= .25(-3) + .25(5) + .25(10) + .25(15) = $6.75 EMV = $4.00 EVPI = $6.75 – 4.00 = $2.75 Homework The manager of a large shopping center in Buffalo is in the process of deciding on the type of snow clearing service to hire for his parking lot. Two services are available. The White Christmas Company will clear all snowfalls for a flat fee of $40,000 for the entire winter season. The Weplowmen Company charges $18,000 for each snowfall it clears. Set up the payoff table to help the manager decide, assuming that the number of snowfalls per winter season ranges from 0 to 4. Payoff Table Demand Flat Fee Pay per snowfall # of Snowo -40,000 0 # of Snow1 -40,000 -18,000 # of Snow2 -40,000 -36,000 # of Snow3 -40,000 -54,000 # of Snow4 -40,000 -72,000 Using subjective assessments, the manager has assigned the following probabilities to the number of snowfalls. Determine the optimal decision. • • • • • p(0) = .05 p(1) = .15 p(2) = .30 p(3) = .40 p(4) = .10 EMV (flat fee) = - $40,000 EMV (pay per snowfall) = .5(0) + .15(-18,000) + .3(-36,000) + .4( -54,000) + .1(-72,000) = -$42,000 EMV* is flat fee Hopefully, something hit home