Decision tree example 2011

advertisement

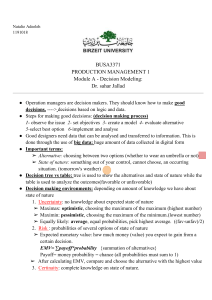

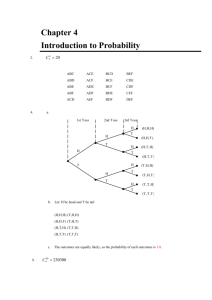

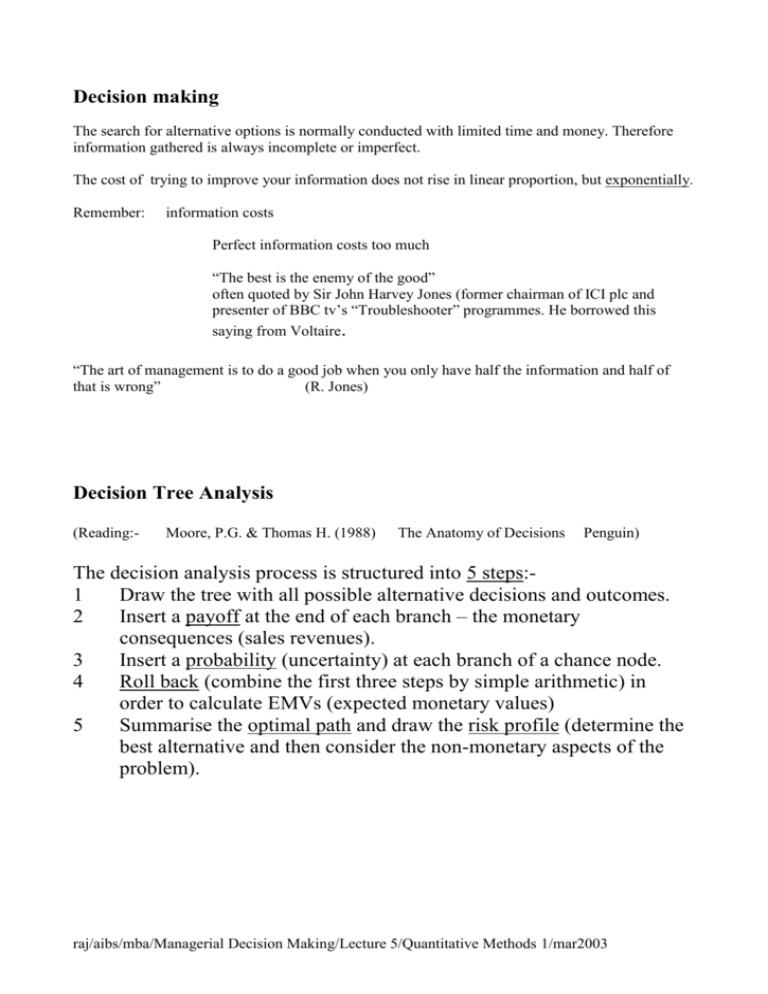

Decision making The search for alternative options is normally conducted with limited time and money. Therefore information gathered is always incomplete or imperfect. The cost of trying to improve your information does not rise in linear proportion, but exponentially. Remember: information costs Perfect information costs too much “The best is the enemy of the good” often quoted by Sir John Harvey Jones (former chairman of ICI plc and presenter of BBC tv’s “Troubleshooter” programmes. He borrowed this saying from Voltaire. “The art of management is to do a good job when you only have half the information and half of that is wrong” (R. Jones) Decision Tree Analysis (Reading:- Moore, P.G. & Thomas H. (1988) The Anatomy of Decisions Penguin) The decision analysis process is structured into 5 steps:1 Draw the tree with all possible alternative decisions and outcomes. 2 Insert a payoff at the end of each branch – the monetary consequences (sales revenues). 3 Insert a probability (uncertainty) at each branch of a chance node. 4 Roll back (combine the first three steps by simple arithmetic) in order to calculate EMVs (expected monetary values) 5 Summarise the optimal path and draw the risk profile (determine the best alternative and then consider the non-monetary aspects of the problem). raj/aibs/mba/Managerial Decision Making/Lecture 5/Quantitative Methods 1/mar2003 Step 1 – draw the tree = decision point Outcome (result) Increase Outcome Decision = chance outcome No change Decrease Increase No change Decrease Increase No change Decrease So draw the complete picture first. Then insert your figures starting at the right hand side and work back to the left hand side. Outcome Decision Step 2 – insert payoffs Outcome (result) Increase Payoff £ No change Decrease Increase No change Decrease Increase No change Decrease £ £ £ £ £ £ £ £ raj/aibs/mba/Managerial Decision Making/Lecture 5/Quantitative Methods 1/mar2003 .1 .4 .5 .3 .2 .5 Outcome Decision .2 .5 .3 Step 3 – insert probabilities Outcome (result) Increase Payoff £ No change Decrease Increase No change Decrease Increase No change Decrease £ £ £ £ £ £ £ £ Outcome (result) Increase Payoff £ No change Decrease Increase No change Decrease Increase No change Decrease £ £ £ £ £ £ £ £ Step 4 – Roll back to EMVs .5 .3 EMV EMV .1 .4 .5 .3 .2 .5 Outcome Decision .2 EMV raj/aibs/mba/Managerial Decision Making/Lecture 5/Quantitative Methods 1/mar2003 Decision Tree Analysis Example:Company X has developed a new product and wishes to launch it in the market. The cost of launching the new product is estimated to be £750,000. There are 3 options:1 Go ahead with a full launch of the product. 2 Carry out a test marketing to obtain extra information. 3 Abandon the product and cut the losses. The company’s marketing department says that it can devise a simple test in a limited market which will give an indication of favourable or unfavourable demand. Cost of test marketing = £100000 Probability (favourable test result) = 60% Probability (unfavourable test result) = 40% Financial and probability data are presented in the table below. If the product is launched fully, market research has shown that market demand can be categorised as being strong, weak or nonexistent and that the probabilities of each level of demand are 50%, 20% and 30% respectively. Test New product launch data:Market Demand Product launch cost £000 Payoff (sales) £ 000 Probabilities % Probabilities % of success No test of success test = favourable Probabilities % of success test = unfavourable Strong Weak Nonexistent 750 750 750 1750 1000 0 50% 20% 30% 70% 20% 10% 20% 20% 60% Test marketing results provide extra information which is likely to change the estimates of probabilities of different demand levels. A favourable test result would make it more likely that the demand for the product is strong. The accounting department has calculated the financial implications of different levels of demand (sales), strong, weak and non-existent. Remember that obtaining information (e.g. market research, test marketing) costs money. The risk profile reveals whether the EMV is concealing any large (especially negative) outcomes which have small probabilities. Such outcomes, even if unlikely, could be catastrophic. Do not follow EMV slavishly. It may be better to choose an option with an inferior EMV but which has a smaller downside. raj/aibs/mba/Managerial Decision Making/Lecture 5/Quantitative Methods 1/mar2003