Training Handout Answers

advertisement

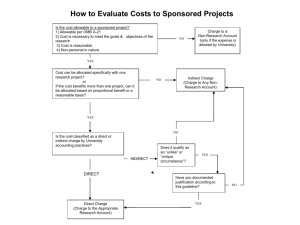

Supplemental Handouts (Answers to Activities) 1 ANSWERS TO H-4: ALLOWABLE/UNALLOWABLE COSTS Directions: With your table team, review the following list of selected cost items and decide for each item if it is allowable or not allowable under federal grants and contracts, as specified in EDGAR Part 76 and OMB Circular A-87. FOR EACH COST ITEM ON THE LEFT, CIRCLE COST ITEM EITHER ALLOWABLE OR UNALLOWABLE Advertising/Public Relations Alcoholic Beverages Bad Debt Communications Depreciation and Use Donations and Contributions Drug Testing Employee-Employer Relations Entertainment Fines and Penalties Lobbying Maintenance/Repair of Existing Structures Meals for Entertainment Meals for Meetings/Conferences Meetings/Conferences Pension Plans Remodeling/Renovation/Building Additions Rent of Building/Equipment Repair of Building/Facilities Selling and Marketing Student Recruitment Taxes Training and Education Travel Costs Allowable with restrictions Unallowable Unallowable Allowable Allowable with restrictions Unallowable Unallowable Allowable Unallowable Unallowable Unallowable Allowable with restrictions Unallowable Allowable with restrictions Allowable with restrictions Allowable with restriction Unallowable Allowable with restrictions Allowable Unallowable Allowable Allowable with restrictions Allowable with restrictions Allowable with restrictions 2 ANSWERS to H-9a—b: Visual Puns 1. Dandy lions 2. Assaulted peanut 3. Eggplant 4. Doctor Pepper 5. Pool table 6. Tap dancers 7. Card Shark 8. The King of Pop 9. I-Pod 10. Gator-Aide 11. Knight mare 12. Hole Milk 13. Light Beer 3 ANSWERS to Financial Jeopardy Game (SH-31) Category: Terms & Definitions Answer for $200: This refers to the expenses of doing business that are not readily identified with a particular grant or contract, but are necessary for the general operation of the organization and the conduct of activities it performs. [source: ed.gov] Question: What is an indirect cost rate? Answer for $400: This is the regulatory term for the State or agency that is responsible for the performance or administration of all or part of a Federal award. Question: What is a grantee? Answer for $600: This is a cost that is directly identifiable and assignable to a specific activity that supports the purposes of adult education. Question: What is a direct cost? Answer for $800: This is a "contribution other than cash," as defined under federal guidelines. Question: What is in-kind contribution (or in-kind service)? Answer for $1000: This is an allowable cost that actually benefits grant or contract activities to which they are assigned. Question: What is an allocable cost (or charge)? 4 Category: Monitoring & Planning (SH-3b) Answer for $200: This is an ongoing process of contact between the state and subgrantees to ensure legal compliance and ongoing performance of a grant. Question: What is monitoring? Answer for $400: These are options under EDGAR that a state has if a local program fails to comply with the terms of its grant. Question (Must offer at least 2 of the following): What are withhold cash payments, deny use of funds and matching credit, suspend or terminate the award, and take other legal action? Answer for $600: This is the only answer a state may give when a subgrantee has been disbarred or suspended and requests a subward. Question: What is “no”? Answer for $800: This is a term for the consequence, or worst-case scenario, that occurs when a grantee or subgrantee does not comply with the terms of an award. Question: What is termination (or suspension)? Answer for $1000: This document describes standards for Federal audits and areas to examine when auditing adult education grants. Question: What is OMB Circular A-133 Compliance Supplement? 5 Category: Cost Principles & Budgeting (SH-3c) Answer for $200: This is a minimum of 33 percent of the Federal grant amount or 25 percent of the total funds used. Question: What is the state match (matching)? Answer for $400: This is the fiscal effort per student or the aggregate expenditures that each eligible agency makes for adult education. Question: What is Maintenance of Effort? Answer for $600: The State may use no more than 10 percent of pass-through Federal funds for this. Question: What are services to institutionalized adults? Answer for $800: This is the amount a state agency may spend on administrative costs from the Federal AEFLA award. Question: What is greater, 5% of a state’s total Federal award, or $65,000? Answer for $1000: This is the general term that refers to costs that are legal, reasonable, and allocable. Question: What is allowable, or allowable costs? 6 Category: Auditing & Reporting (SH-3d) Answer $200: There are two of these required: an initial and a final. Question: What is the Financial Status Report (FSR)? Answer $400: This is the amount that states must pass-through to eligible providers for services from their Federal grant. Question: What is not less than 82.5 percent? Answer for $600: This is the governmental Act that offers a method for auditing local programs. Question: What is the Single Audit Act? Answer for $800: This is based on actual, after-the-fact activity of each employee that accounts for total activity for which an employee is compensated. Question: What is Time and Effort documentation? Answer for $1000: This covers the first year of the grant and is due 90 days after the program year ends. Question: What is an Initial FSR? 7 Category: Miscellaneous (SH-3e) Answer for $200: These are the 3 printed sources to turn to for guidance on finance-related issues in adult education. Question: What are AEFLA, EDGAR, and OMB Circulars? Answer for $400: This is what a State must do if it does not obligate all its Federal funds during the Tydings Amendment period. Question: What is return funds to the Federal government? Answer for $600: This is the term used in statute that mandates that Federal funds may not be used to pay for services, staff, programs, or materials that would otherwise be supported by state or local funds. Question: What is “Supplement-not-Supplant?” Answer for $800: This is the period of time for which a grantee must keep fiscal records. Question: What is 3 years after the grant end date (or five years after grant award)? Answer for $1000: This is what happens when a state cannot meet its MOE. Question: What is a reduction in the federal allocation to the state? Final Jeopardy Answer: This is what the acronym EDGAR stands for. Question: What is Education Department General Administrative Regulations? 8