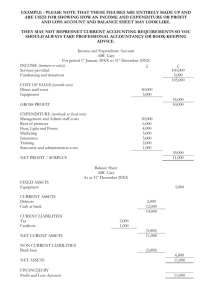

Statement of Accounts for year 2013-14

advertisement