H&M Cefor Seminar oslo October

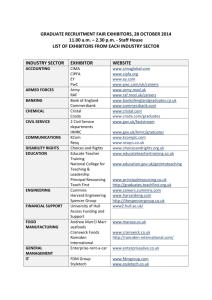

advertisement

HULL & MACHINERY Tron Nummedal Bjørn Skaar Learning goals Able to identify and understand the main H&M objectives. Able to review a broker’s H&M presentation. Able to structure received information. Able to take an underwriting decision. How to follow up the business. C1 Agenda C4 The H&M business model. The H&M risk aspects. The H&M underwriting decisions. The H&M service and follow up work. C2 C3 The H&M scream of our time? The Nordic Association of Marine Insurers The business model - Four C’s - Risk distribution - Underwriting guide lines - Insurance Conditions TYPES OF INSURANCES: HULL AND MACHINERY P&I (PROTECTION AND INDEMNITY) COVERS DAMAGE TO THE HULL. COVERS DAMAGE TO MACHINERY OIL SPILL DAMAGE TO OTHER VESSELS CARGO CLAIMS DAMAGE TO FIXED AND FLOATING OBJECTS. CREW INJURIES The Nordic Association of Marine Insurers The H&M insurance market The Nordic Association of Marine Insurers The Nordic Association of Marine Insurers Gross written H&M premium Cefor - Gross written premium (MUSD), Hull, 2012 Total sum hull = 810.6 MUSD Alandia 29.6 / 3.8% Møretrygd 12.3 / 1.6% Tromstrygd 5.0 / 0.6% Gjensidige 31.7 / 4.1% If 50.3 / 6.5% Gard 244.0/ 31.4% Gerling 55.5 / 7.1% Swedish Club 65.6 / 8.4% Codan 76.4/ 9.8% The Nordic Association of Marine Insurers Norwegian Hull Club 208.0 / 26.7% Hulls runs red as it sails th into the 17 year of losses. Tradewinds 11th September 2013 The Nordic Association of Marine Insurers TradeWinds article 11th September 2013 Hull runs red as it sails into 17th loss year The hull market shows all the signs of being stuck in a deep rut It has become an annual tradition for the chairman of IUMI’s Ocean Hull Committee to warn underwriters that the market is in the red for yet another year. This year, the task falls to Lars Rhodin, managing director of the Swedish Club, who took over the chairmanship of the committee midterm. The Nordic Association of Marine Insurers 2007 CEFOR Nordic Marine Insurance Statistics – Part 3 As of 31 December 2007 Hull Net Loss Ratio, as reported per 31.12.07 (2007 incl. IBNR) 250% 224% 207% 200% 150% 151% 150% 134% 134% 124% 123% 100% 98% 116% 124% 115% 117% 90% 50% 47% 48% 110% 100% 78% 74% 110% 98% 54% To be continued! 0% 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 L/R est. final (2006, 2007 incl. IBNR) 100% Hull Net Loss Ratio, as reported per 31.12.07 (2007 incl. IBNR) 250% 224% 207% 200% 150% 150%151% 134% 134% 124% 123% 100% 98% 116% 124% 115%117% 50% 47% 48% 110% 100% 78% 74% 110% 98% 90% 54% 0% 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 L/R est. final (2006, 2007 incl. IBNR) 100% Net loss record 140 120 100 ? ? 80 60 Loss record Linear (Loss record) 40 20 0 2007 2008 2009 2010 2011 2012 2013 Source :IUMI article TradeWinds 21.09.12. Cefor Hull Claims Trends Update as of 30 June 2013: Claim frequency and cost back to pre Costa Concordia levels Increasing risk exposure to high-value vessels • The claim frequency shows a positive to stable trend after the peak in 2008. The frequency of total losses shows a long-term positive trend after some increase in 2012. • The average repair cost, excluding total losses, reached in 2012 its lowest level since 2004. • Some increase in 2013 is mainly due to two major losses in the first half year of 2013, which were no total losses. • But despite a further decrease of insured value, the risk exposure to major losses remains high, due to an increasing share of high-value vessels in the portfolio. The Nordic Association of Marine Insurers TradeWinds article 18th September 2013 Underwriters admit to hull pricing problems. About three-quarters of underwriters believe hull insurance is priced significantly below the level that business models suggest is necessary. The International Union of Marine Insurance (IUMI) conference this week took advantage of electronic voting technology to run the first ever poll of delegates’ perception of the market. One-quarter voted that hull and machinery premiums were 50% below the level required. A further 48% said rates were 25% below the necessary price. And 15% voted that pricing was 10% too low. So 88% of those who voted acknowledge hull premiums are too low, but sadly there was no follow-up question on whether underwriters are minded to do anything about it. The Nordic Association of Marine Insurers Profiling Risk? “underwriters to price risk based on their overall portfolios.” Are the Deductibles the solution? TradeWinds 13.09.2013 “Underwriting oversupply haunts the hull markets” The Nordic Association of Marine Insurers How are our clients doing? The Nordic Association of Marine Insurers How is the shipowners’ freight market? The Nordic Association of Marine Insurers The Nordic Association of Marine Insurers The Nordic Association of Marine Insurers The current situation! “Underwriting oversupply haunts the hull markets” “Clients have been through the worst shipping market ever” The Nordic Association of Marine Insurers PARIS MOU 2012 REPORT Port State Control - Taking port State control to the next level The poorest performing flags are Bolivia, Tanzania and Togo. Performance of Recognized Organizations For several years the Committee has closely monitored the performance of classification societies acting as Recognized Organizations for flag States. Among the best performing recognized organizations were: ■ American Bureau of Shipping (ABS) ■ Det Norske Veritas (DNV) ■ Lloyd’s Register (UK) (LR) The lowest performing organizations were: ■ Phoenix Register of Shipping (Greece) (PHRS) ■ INCLAMAR (Cyprus) ■ Register of Shipping (Albania) (RSA) The Nordic Association of Marine Insurers From a DNV vessel a few weeks ago! Guess which class? The Nordic Association of Marine Insurers PARIS MOU 2012 REPORT Port State Control - Taking port State control to the next level The poorest performing flags are Bolivia, Tanzania and Togo. Performance of Recognized Organizations For several years the Committee has closely monitored the performance of classification societies acting as Recognized Organizations for flag States. Among the best performing recognized organizations were: ■ American Bureau of Shipping ■ Det Norske Veritas (DNV) ■ Lloyd’s Register (UK) (LR) The lowest performing organizations were: ■ Phoenix Register of Shipping (Greece) (PHRS) ■ INCLAMAR (Cyprus) ■ Register of Shipping (Albania) (RSA) (ABS) SMA – Scandinavian Marine Agency AS Broker’s Competitive edge? This Guy or this guy? Or maybe she? • • • • • From: Peter Smart Sent: 2. april 2008 09:16 To: Haakonsen, Mona GIS N; Basthus, Morten GIS N Cc: Tony Ascot Subject: Blue Shipping, Greece. Typical Request. • • • Dear Mona / Morten We are pleased to give you the opportunity to quote for the above account which renews for 12 months with effect from 1st of May. The fleet used to be 4 vessels and is now 2 vessels. They are both Panamax bulkers and are valued USD 85m and 25m respectively. • The owner is Mr . Tuscot Papalacis. This is a very long standing small but high quality account which we are particularly keen to win and very much hope that you will share our enthusiasm for. Blue Shipping have confirmed in writing that they have had a clean loss record for 17 years on vessels managed by them. They had a generator damage 18 years ago. • We have attached a spreadsheet that lists two vessel schedule and our rating suggestion \ target. It is important that we maintain the existing deductible and that you pitch your indication per (or as close as possible) our target. We are aware of the existing price so the target (incl returns) is set at a level where we can achieve an order. • Vessel details : • Alfa Runner • • • • • 2004 bulk carrier. LR class. Flag Panama. Hull value $ 68m and IV $ 17m. ITC clauses and amendments to be advised. Ex collision liability. Hull deductible USD 75k. • Beta Swimmer • • • • • 1984 bulk carrier. ABS class. Flag Cyprus. Hull value $ 20m and IV $ 5m. ITC clauses and amendments to be advised. Ex collision liability. Hull deductible USD 90k. • The current broker is H Merit and the risk is placed into Lloyds (we think Beazley) plus London companies : Aspen, Wurt and HCC. • We very much look forward to receiving your indication as soon as possible. • Best Regards • Peter Smart • • • • • From: Peter Smart Sent: 2. april 2008 09:16 To: Haakonsen, Mona GIS N; Basthus, Morten GIS N Cc: Tony Ascot Subject: Blue Shipping, Greece. Typical Request. • • • Dear Mona / Morten We are pleased to give you the opportunity to quote for the above account which renews for 12 months with effect from 1st of May. The fleet used to be 4 vessels and is now 2 vessels. They are both Panamax bulkers and are valued USD 85m and 25m respectively. • The owner is Mr . Tuscot Papalacis. This is a very long standing small but high quality account which we are particularly keen to win and very much hope that you will share our enthusiasm for. Blue Shipping have confirmed in writing that they have had a clean loss record for 17 years on vessels managed them. They had a generator damage 18 years ago. by • We have attached a spreadsheet that lists two vessel schedule and our rating suggestion \ target. It is important that we maintain the existing deductible and that you pitch your indication per (or as close as possible) our target. We are aware of the existing price so the target (incl returns) is set at a level where we can achieve an order. • Vessel details : • Alfa Runner • • • • • 2004 bulk carrier. LR class. Flag Panama. Hull value $ 68m and IV $ 17m. ITC clauses and amendments to be advised. Ex collision liability. Hull deductible USD 75k. • Beta Swimmer • • • • • 1984 bulk carrier. ABS class. Flag Cyprus. Hull value $ 20m and IV $ 5m. ITC clauses and amendments to be advised. Ex collision liability. Hull deductible USD 90k. • The current broker is H Merit and the risk is placed into Lloyds (we think Beazley) plus London companies : Aspen, Wurt and HCC. • We very much look forward to receiving your indication as soon as possible. • Best Regards • Peter Smart Our Reply • • • • • • -----Original Message----From: Haakonsen, Mona GIS N Sent: 2. april 2008 09:35 To: Peter Smart ;Basthus, Morten GIS N Cc: Tony Ascot, Subject: RE: Blue Shipping, Greece. • Dear Peter, • Reference is made to your e-mail earlier today. • Regret to inform you that in respect of this account there is not much enthusiasm from our side. We used to write this account until 2005 when we were cut off without any explanation. • We would also strongly suggest that you reapproach your Client and ask them about the following incidents: • • 28/10/06 Papa Jogger 11/10/05 Captain Sleeper • This Client seems eager to play games, changing brokers and withhold claims information and we do not want such Clients in our portfolio. • Trust you can understand our position. • • Best regards, Mona Maine Engine dmg Collision USD 307.207 USD 202.280 Conclusion? “This is not a business for the average guy” Lars Rhodin Tradewind 21.09.12. The Nordic Association of Marine Insurers The risk -Information, “Need to have and nice to have”. (Hand out, exercise) -Premium calculations. * Scale. *Burning costs. * Deductible and bonuses. The final underwriting decisions. -Premium, -Deductible. -Conditions. -Share The final underwriting decisions -Premium, -Deductible. -Conditions. -Share The follow up work -Underwriting service. -Claims handling and adjusting. -Loss Prevention. “Miso Rakan” December 2010 – March 2011 Encounter ice Problems Engine Damage Dec 2010 Jan 2011 Vessel Repaired