As we can see here from the graph, Greece real GDP growth

advertisement

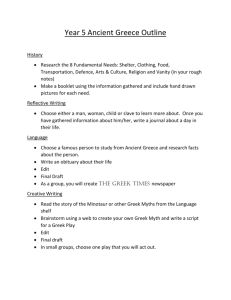

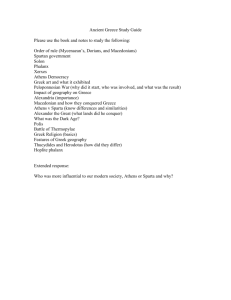

UNIVERSITY OF IOANNINA DEPARTMENT OF ECONOMICS COURSE: ENGILSH FOR ECONOMIST IV INSTRUCTOR: THEODORA TSELIGKA TOPIC : Greek/World economic crisis and Eurozone & its currency KARIOFILLIS IOANNINS A.M.: 2411 PANAGIOTIS KAPARTZANIS A.M.: 2405 ACADEMIC YEAR 2013-2014 SEMESTER: D CONTENTS 1. INTRODUCTION 2. Economic crisis and Eurozone 3. 2.1. The causes 2.2. The timeline of the crisis in the Eurozone 2.3. Funding from the Eurozone and the IMF The Greek crisis 3.1. Main causes 3.2. The role of currency at the Greek crisis 4. Conclusion 5. References 1. Introduction Since the 2008 the economies of the world started a down spiral into an unexpected crisis and the prospect of a ‘domino’-like collapse of the biggest economies made its appearance. But what lead to this economic disaster? Here we explore the deeper causes of the crisis in Eurozone, the timeline of the crisis in the Eurozone, and the role of Eurozone and IMF funding in the development of the crisis. Also t explore the deeper reason of the Greek crisis and the role of the currency for the Greek crisis. 2. Economic crisis and Eurozone 2.1. The causes Now almost 5 year since the beginning of the crisis in the Eurozone we are able to identify the causes of a ‘domino’ -like collapse of the Eurozone’s economies. One of the most important causes of the collapse of many of the Eurozone’s economies is a decade of low interest rates. The low interest rates fuelled domestic spending and raised inflation in wages and goods, which in the end made exports more expensive and imports cheaper. This made the some economies to run unsustainable current-account deficits. When the crisis hit the interest rates surged, which set off a spiral in falling bond prices, weakening banks and slowing growth. Another reason is that the common currency and the common monetary policy were applied to economies that they were very different from one another. This lead the economies to be subjected to a series of economic shocks. Also the monetary policy of the European Central Bank did not take into consideration the diversity of the economies and its decisions were too tight for some countries and too loose for other, giving them an advantage in being competitive to the others and having a faster growing economy. 2.2. The timeline of the crisis in the Eurozone On August 9, 2009 the ECB (European Central Bank) announced that there are liquidity shortages worldwide due to the US mortgages. Almost a year later the Lehman Brothers files for bankruptcy on September 15, 2008 kicking the global financial crisis into a higher gear. The following year on October 18, 2009 the Greek government reveals a massive black hole in the nation’s accounts. The Greek deficit reached the 12.7% of GDP. During the following months the rating agencies kept downgrading the credit rating of the country. During 2010 the Greek government turned to the Eurozone countries and the International Monetary Fund for a loan of 45 billion euro. After the Greek economy the Spain and Portugal economies fell apart. announcing slashed pension and cuts to the public employees. Apart from these two countries , Ireland also asks for a loan from the European Commission and the IMF reaching the total amount of 85 billion euro. The following year the euro-crisis deepens. On April 7, 2011 Portugal requests a bailout loan of up to 78 billion euros from European Financial Stabilization Mechanism, the European Financial Stability Facility and the IMF. On October 27, the euro-area country agrees to write down the Greek debt by 50 percent and increase the leading capacity of the bailout fund. Except from that, Hungary also falls to the euro-crisis even without having adopted the euro, and asks for assistance from the IMF. On January 6, 2012 the ECB stepped in and purchase Italian and Spanish bonds after yielding at 7,12 percent on 10 years bonds. During this summer the Cyprus became the fifth Eurozone country to request a bailout loan of 10 billion euro. During this period the Greek government kept passing austerity measures in order to fulfill its requirements to the lenders. The following year the European Central Bank abridged the bank rate to 0.5 percent on May 8 reaching the astonishing 0.25 percent in order to aid the recovery from the crisis. 2.3. Funding from the Eurozone and the IMF After revealing the massive ‘black’ hole in the nation’s accounts the market stops to lend to the Greek government because serious doubts about its ability of paying of have started to rise rapidly. So the Greek prime minister does not have any other choice than to resort to the other members-countries of the Eurozone and the International Monetary Found for help. After long discussion the Greek government takes the approval of 80 billion euros from the Eurozone as a Loan Facility Agreement and another 30 billion euros from the IMF as a Stand-by Agreement. Except from the loan the government has to take a series of measures of cutting the wages in the public sector and raising the taxes. The following period the Greek crisis gets from bad to worse. The income is in a ‘free fall ‘ and the unemployment is skyrocketing. All these led to a new round of leading. The new loan agreement includes a new loan of 158 billion euros. From these the 109 billion will be from the Eurozone and the IMF, 37 billion euros will be from the private sector and finally the rest 12 billion will come from re buying Greek bonds. Once again cutting wages and taxes need to be implemented but this time cutting in the pensions , radical changes in the taxation system , extension of the labor reserve in the public sector and the opening of all the ‘closed’ professions took place. All these are part of the first Memorandum of Understanding. But still the country could not to deal with its obligations. So the summit of the European Union decided to cut the Greek debt by 50 percent and give 130 billion euro loan . From these the 30 billion will be given for the recapitalization of Greek banks. 3. The Greek crisis 3.1. Main causes GDP growth rates: As we can see here from the graph, Greece real GDP growth rate from 2009 until 2012 is negative. That is that main problem that Greek government had to cope with. An economy, which does not produce, cannot be healthy at all. As we can see from 2000 until 2008 the GDP growth rate for Greece was positive and in most times bigger than 4%. Although from 2009 Greece Real GDP has fallen as a result the negative growth rate in 2009, 2010, 2011 and 2012. Government Deficit Another huge problem of the Greek economic crisis was Greek government’s deficit. Here we have a graph with government deficits from 1995 until 2012: The Greek government has deficits every year since 1995. This forces the country to take loans continuously and in conjunction with the negative GDP growth rate leads the public debt at very high levels. As we can see, especially from 2008 the budget deficit is more than 10%, something that makes the economical situation even more difficult for the Greek government. We have to observe that deficits began to grow more than before in 2001 after the introduction of Euro in Greek economy. Greek Government Debt level As we saw, the continuously deficits made the necessity for Greece to loan more and more powerful. All these loans lead the country to growth its debt. The percentage of the debt to GDP is continuously and very fast increased from 2009 until 2012. In 2006 Greece debt was in 100% of the GDP and after the crises came to the country it reached in 2010 in 129,4 % of GPD. Finally the biggest debt of the last years is in 2012 where Greece owes the 165,3 % of the GDP. Statistical credibility We have seen many times problems with the reliability of Greek statistic companies. In 2005-2009 every year Eurostat noted a difference between its statistical numbers and Greece ones. Especially in 2009 discovered that Greek statistics about the GDP growth, deficit and the public debt were worse than the reality. 3.2. The role of currency at the Greek crisis In 2001 Greece joined the European Monetary Union and since the uses Euro as currency. From this time as we can see Greek deficits are growing with bigger rate than before. Euro provided Greece with an access to competitive loan rates and also low rates at the Eurobond market. This fact helped the country to increase the consumer spending. The country averaged 4% of Growth during 1997-2007. Many economists said that the solution for Greece was to leave Euro and default. A move like this was not easy and also it was a wrong option at that time. Because if Greece were to leave Euro now other countries like Spain, Portugal and Ireland would follow this move. This would lead to a banking crisis in all these countries, by holding their debts, which might lead to banking crisis in UK and Germany, which would put all of Europe in crisis. on the other hand if Greece does not leave Euro at this time, when the economy is already weak there is a huge risk that the economy will fall down in a deep crisis. In conclusion it will be very difficult for Greece to leave Euro and return in drachma in this time. Euro has many benefits for Greece but also caused some problem in the crisis. For example it increased citizen’s consumption and made easier for the government to loan with lower interest. Conversely, if Greece returns to its own currency, could make imports more expensive and exports cheaper. This would have as s result that Greek economy would be competitive again. 4. Conclusion In conclusion we can understand better the causes of the European crisis and the deeper causes of the Greek crisis. We are able to comprehend the help that our euro-partners have give to us and why the Greece cannot sustain it self outside from the Eurozone. REFERENCES ● The Guardian ,14 August 2013, http://www.theguardian.com/business/interactive/2012/oct/17/eurozone-crisisinteractive-timeline-three-years ● The rooftop market http://www.rooftopmarket.com/how-did-the-financial-crisis-start.php ● The Economist,5 September 2013, http://www.economist.com/news/schoolsbrief/21584534-effects-financial-crisisare-still-being-felt-five-years-article ● Econbrowser, 19 March 2012, http://econbrowser.com/archives/2012/03/athe_eurozone_i ● The economist, 12 November 2011, http://www.economist.com/node/21536871 ● Wikipedia, 21 May 2014, http://en.wikipedia.org/wiki/Greek_government-debt_crisis ● Spiegel, 14 May 2012, http://www.spiegel.de/international/europe/why-greece-needs-toleave-the-euro-zone-a-832968.html ● Wikipedia, 15 May 2014 http://el.wikipedia.org/wiki/%CE%95%CE%BB%CE%BB%CE%B7%CE%BD%CE%B9% CE%BA%CE%AE_%CE%BA%CF%81%CE%AF%CF%83%CE%B7_%CF%87%CF%8 1%CE%AD%CE%BF%CF%85%CF%82_2010#.CE.A7.CF.81.CE.B7.CE.BC.CE.B1.CF. 84.CE.BF.CE.B4.CF.8C.CF.84.CE.B7.CF.83.CE.B7_.CE.B1.CF.80.CF.8C_.CF.84.CE.B F.CE.BD_.22.CE.9C.CE.B7.CF.87.CE.B1.CE.BD.CE.B9.CF.83.CE.BC.CF.8C_.CE.A3.C F.84.CE.AE.CF.81.CE.B9.CE.BE.CE.B7.CF.82.22