International Management Report – R

advertisement

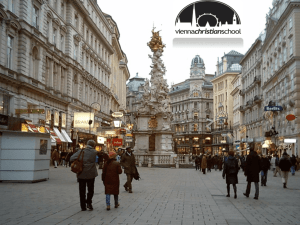

Research and Market Entry Report for Austria Krystian RONA Inc. April 17th, 2014 International Trade Management Raymond 1 Table of Contents Company and Report Overview ................................................................................................ 4 Corporate History ..................................................................................................................... 5 Executive Committee ................................................................................................................ 7 Robert Sawyer – President and CEO ..................................................................................... 7 Dominique Boies - Executive Vice President and Chief Financial Officer ............................. 7 Alain Brisebois - Executive Vice President and Chief Commercial Officer ............................ 7 Christian Proulx - Senior Vice President, HR and Communications ...................................... 8 Luc Rodier - Executive Vice President, Retail ........................................................................ 8 Market Analysis....................................................................................................................... 10 Political and Regulatory System .......................................................................................... 10 Economy .............................................................................................................................. 13 Society ................................................................................................................................. 15 Technology and Infrastructure ............................................................................................ 17 Environment ........................................................................................................................ 19 Market Entry ........................................................................................................................... 20 Human Resources................................................................................................................ 20 Products and Services ......................................................................................................... 22 Pricing Strategy ................................................................................................................... 24 Target Market and Consumer ............................................................................................. 25 Promotion and Advertising ................................................................................................. 27 Location and Distribution .................................................................................................... 29 Financial Information and Analysis ......................................................................................... 31 Expansion Risks ....................................................................................................................... 33 2 Merchandising Risk ............................................................................................................. 33 Supply Chain and Distribution ............................................................................................. 33 Liquidity Risk........................................................................................................................ 34 Credit risk ............................................................................................................................ 34 Financing and Risk Mitigation ................................................................................................. 35 Project Financing ................................................................................................................. 35 Risk Mitigation..................................................................................................................... 35 Decision and Next Steps ......................................................................................................... 37 Appendix 1.1 ........................................................................................................................... 38 Appendix 1.2 ........................................................................................................................... 39 Appendix 1.3 ........................................................................................................................... 40 Appendix 1.4 ........................................................................................................................... 41 Appendix 1.5 ........................................................................................................................... 42 Appendix 1.6 .......................................................................................................................... 42 Works Cited ............................................................................................................................. 44 3 Photo Credits to: RONA Inc. (2014). RONA Corporate. Retrieved March 5, 2014, from RONA Inc.: http://www.rona.ca/corporate and Wikimedia Commons. (2014). Wikimedia Commons. Retrieved April 12, 2014, from Wikipedia: http://en.wikipedia.org/wiki/Austria 4 Company and Report Overview RONA Inc. is one of the largest retailers in Canada focusing on the distribution and sales of hardware, building materials and renovation supplies. Its mission is to “offer the best products at the best prices, as well as expert advice in store, to allow Canadians to carry out their construction and renovation projects in total confidence” (RONA Inc., 2014) RONA is the largest Canadian retailer within the home improvement sector. It currently operates 516 outlets across Canada, employing over 25,000 people. (RONA Inc., 2014) Due to saturation across the domestic market, and strong competition within the US, RONA has turned to international markets to satisfy growth targets and reach a new consumer base. RONA has experienced consistent success within the domestic market and now looks towards the EU for long-term market development. Expanding into the EU offers the advantages of a standardized regulatory system, creating a single market economy across all EU member states. The country chosen for the initial expansion is Austria due to its stable economy and well-regulated markets. It boasts very good infrastructure and stable government and offers a significant portion of the population within RONA’s target demographics. Austria is very open to investment and provides an ideal starting point for a longterm expansion strategy within the EU. It is one of the wealthiest countries in Europe and has remained relatively stable throughout the economic crisis and is forecasted to remain stable over the long-term. RONA will enter the market through acquisition and rebranding of independent or small-chain home improvement retail outlets within the Vienna region. The city and suburbs hold a large portion of Austria’s population and provides the best access to consumers. The acquisition will focus on six outlets within strong market locations throughout the greater Vienna area. This will provide the first exploratory steps in the long-term goal of establishing strong market presence within the EU. The retail outlets will be targeted towards middle-aged, do-it-yourself consumers and those in the home renovation market. Austria is a wealthy and quality-minded nation and the new expansion outlets should reflect that by positioning themselves in the higher-end of the home improvement retail market. A new international market development division is to be created, along with an expansion of existing divisions (marketing, accounting, merchandising, etc.) to handle the increased responsibilities. Once operational, each retail location will have projected annual revenues of $7 million, totalling $210 million over five years. Restructuring and implementation costs are estimated at $6.5 million per location, totalling $39 million. 5 Corporate History RONA was founded in Quebec in 1939 by a group of hardware retailers under the name Les Marchands en Quincailleries Ltée. The group was originally formed in order to bypass a monopoly on hardware merchandise by wholesalers, thereby giving the group direct access to manufacturers, which led to lower costs for the co-operative of retailers. Several years after its inception, two members of the group, Rolland Dansereau and Napoléon Piotte, would take charge of the organization. In 1960, the two men incorporated the company Quincaillerie RoNa Inc. The first two letters of each man’s first name would be used as the official brand for the group of stores (Ro-Na). The next several years were spent acquiring retailers and growing the upstart company. (RONA Inc., 2014) The next two decades saw RONA continue its strategy of creating purchasing alliances and performing acquisitions as it continued its steady growth across Quebec. The early 1970s saw RONA move into its current headquarters in Boucherville, Quebec, as well as change its official name to Marchands Ro-Na Inc. The early 1980s saw the introduction of specialized ‘Ambiance’ boutiques that catered to interior decorating and home improvement, which signalled a significant step forward in modernizing the company’s business model. In 1984, Ro-Na established a purchasing alliance with Ontario-based Home Hardware Stores Inc. In 1988 Ro-Na created a merger with the well-established buildings material company, Dismat, which created the Ro-Na Dismat Group. (RONA Inc., 2014) The 1990s saw the Ro-Na Dismat Group expand into the emerging big-box store sector by adding stores and more clearly defining banner positioning within different markets. In the mid1990s the Ro-Na Dismat Group created three new store banners: RONA L'entrepôt, RONA L'express and RONA L'express Matériaux, while eliminating the Le Quincailleur and Dismat names. In 1998 the corporation’s name was officially changed to RONA Inc., as it currently stands today. 1999 also saw the opening of a massive 650,000-square-foot distribution centre next to its headquarters in Boucherville. The facility doubled its warehouse capacity and created substantial cost savings for the company. (RONA Inc., 2014) 6 In the 2000s, RONA Inc. continued to grow through acquisitions, construction of new stores and in-store sales increases. RONA Inc. experienced a high pace of growth in this period as it shifted its expansion focus away from Quebec and into other markets like Ontario and Western Canada. In the first half of the decade alone, RONA acquired well over 100 locations across Canada from retailers such as Réno-Dépôt, Cashway, Lansing Buildall and Revelstoke. In 2002 RONA Inc. achieved an important milestone, entering the Toronto Stock Exchange with an initial public offering of common shares worth $150.1 million. This was a significant step forward for the company, helping to further cement itself as a major player within the Canadian home improvement industry. (RONA Inc., 2014) The past two years have seen RONA Inc. grow as a company and organization as it looks towards the future and determines its positioning and business strategy. A new business plan introduced in 2012 “acknowledges the necessity of adapting the Corporation's value proposition to the new expectations and changing habits of consumers.” The senior management of RONA Inc. realize that the market is once again beginning to change and that the organization must adapt with it or risk being left behind in the long-term. (RONA Inc., 2014) Changes in the organization have begun from the top down, with eight new members on the Board of Directors, including the appointment of Robert Chevrier as Executive Chairman. Robert Sawyer is also replacing long-time leader Robert Dutton as President and CEO of the Corporation. Mr. Sawyer will focus on implementing reorganization measures to quicken the pace of business transformation and improve the Corporation's profitability. The major banners of RONA Inc. are to be reviewed and adjusted in order to better align with the target customer base. (RONA Inc., 2014) The full list of directors can be found in appendix 1.1, along with a brief description of their professional duties. The executive management structure can be found in appendix 1.2. 7 Executive Committee Robert Sawyer – President and CEO “In March 2013, Robert Sawyer was appointed President and CEO of RONA. Before joining RONA, Mr. Sawyer was Executive Vice President and Chief Operating Officer of Metro Inc. since 2009. Mr. Sawyer joined Metro Inc. in 1979, where he held various executive positions in retail operations and distribution over the past 30 years, including Executive Vice-President, Ontario Division from 2007 to 2009, Senior Vice-President, Quebec Division from 2005 to 2007, and Senior Vice-President – Retail for the Metro and Marché Richelieu banners from 1997 to 2005.” (RONA Inc., 2014) Dominique Boies - Executive Vice President and Chief Financial Officer “Mr. Boies joined RONA in September 2011 as Executive Vice President and Chief Financial Officer. He is responsible for the Corporation’s financial orientation and oversees investor relations, accounting, financing, treasury, corporate development, information technologies and legal affairs. Prior to RONA, Dominique Boies was Senior Vice President Investments, Corporate Debt and Investment Funds groups within the Private Equity team after holding various positions during five years he spent at the Caisse de dépôt et placement du Québec. In addition, he was accountable for the strategic management of the private equity portfolio. Prior, Mr. Boies evolved for over 11 years at Royal Bank of Canada, where he held several highranking positions, including Vice President of Strategic Planning and General Manager within the Capital Markets group. Mr. Dominique Boies holds a Bachelor and a Master degree in finance from the Université du Québec à Montréal, which in 2002 awarded him a Prix Performance, one of five awarded each year by École des sciences de la gestion to alumnis who have distinguished themselves in their field.” (RONA Inc., 2014) Alain Brisebois - Executive Vice President and Chief Commercial Officer “As Executive Vice President and Chief Commercial Officer since May 2013, Alain Brisebois is responsible for improving operational efficiency and synergy among the Corporation’s purchasing, merchandising, procurement and marketing activities. Prior to joining RONA, he 8 worked at Alimentation Couche-Tard where he served as Vice President, Purchasing and Supply Chain, in 2008-2009, and then Senior Vice President of Operations until 2012. Until his latest appointment at RONA, Mr. Brisebois was Senior Vice President, Marketing and National Procurement. He has also held key positions at Metro Inc. between 1999 and 2008, including Senior Vice President for the Ontario division. Mr. Brisebois holds a bachelor’s degree in business administration from HEC Montréal.” (RONA Inc., 2014) Christian Proulx - Senior Vice President, HR and Communications “Mr. Christian Proulx joined RONA in 2007 as Senior Vice President, People and Culture and is responsible for all activities related to this sector. Before joining RONA, Mr. Proulx held key positions in human resources across Canada and abroad including Vice President, Human Resources, at TELUS Québec and TELUS Partner Solutions. For the 14 years prior to that, he worked primarily as Vice President, Human Resources, for companies including BioChem Pharma, Shire Pharmaceuticals Group plc, ID Biomedical and GlaxoSmithkline. As a human resources generalist, he has successfully taken up the challenges involved in mergers and acquisitions, change management, organizational development, executive compensation, international recruiting and labour relations over the course of his career. Christian Proulx has a Bachelor’s degree in industrial relations from Université de Montréal.” (RONA Inc., 2014) Luc Rodier - Executive Vice President, Retail “Mr. Rodier was appointed Executive Vice President, Retail in December 2011. In this role he leads RONA’s overall retail activities by region for RONA’s affiliated dealers and corporate and franchise stores across Canada. His responsibilities include RONA’s regional retail teams along with sales and support, customer experience and market development for contractor and professional sales. Luc Rodier joined RONA in 2005 as Quebec District Manager for RONA and Réno-Dépôt stores and, in 2008; he became Senior Director of the Adrenaline Project. In 2010, Mr. Rodier was appointed Ontario Regional Vice President and in 2011, he was appointed Vice President of Retail for Western Canada. Before joining RONA, he worked over eight years as Director of sales development – Canada, Europe and Asia for one of RONA’s main suppliers. Mr. 9 Rodier has a bachelor’s degree from the School of Management of Université du Québec à Montréal.” (RONA Inc., 2014) 10 Market Analysis Political and Regulatory System “Austria has been a member of the European Union since 1995. It is bordered by eight countries: Germany and the Czech Republic to the north, Switzerland and Liechtenstein to the west, Slovakia and Hungary to the east, and Slovenia and Italy to the south (see map in appendix 1.3) With the exception of Switzerland and Liechtenstein, all other countries in the region are members of the EU. (CIA, 2014) The advantages of having close economic ties with the other 26 other European Union countries is a huge advantage for Austria as having a common set of regulations is essential for the transport of goods over borders and through member countries. Free trade agreements between member states also ensures no unnecessary tariffs or taxes are levied against products that are vital to RONA’s success in the new market.” (Raymond, 2013) Austria’s government has been a democratic republic since 1920 with the formation of the country’s Federal Constitution. The government follows a parliamentary system, with nine states represented by 183 seats in the lower house of parliament, the Nationalrat. The nine states are Burgenland, Carinthia, Lower Austria, Upper Austria, Salzburg, Styria, Tyrol, Vorarlberg and Vienna. The Nationalrat house seats are determined by a general election every five years, or after the lower house is dissolved. The head of state, the Federal President, is elected by popular vote, while the chairman of the government, the Federal Chancellor, is appointed by the President. (CIA, 2014) All Austrian citizens 16 years of age or older are eligible to vote in general elections. The voting age was reduced in 2007 from 18 years of age in an attempt to offset the high proportion of the population over 65 years old. (Paterson, 2008) Austria is a member of the International Center for the Settlement of Investment Disputes (ICSID), which facilitates dispute resolution and arbitration among international investors. With 157 members of the UN signed as members, it offers a generally-accepted framework of international dispute resolution that serves to mitigate non-commercial risks to investors and 11 encourage international investment. Member countries are bound to enforce rulings that result from arbitration and tribunals in accordance with its 1966 Convention on the Settlement of Investment Disputes between States and Nationals of Other States. (European Commission, 2014) Austria is also a member of World Intellectual Property Organization (WIPO), which serves to “encourage creative activity [and] to promote the protection of intellectual property throughout the world." (World Intellectual Property Organization, 2014) The WIPO is one of 17 specialized agencies within the UN and as such includes 186 members of the United Nations as members. Through 26 treaties relating to intellectual and industrial property protection, the WIPO seeks to create a harmonized legal framework that allows companies to protect their property in an international context, reducing some of the risks of international trade. The legal system within Austria is based in civil law and is based upon fundamental principles of Roman law. The court system divided into two sections: tribunals related to public law (constitutional law, asylum law, and administrative law) and ordinary courts, which deal with private matters such as criminal and civil law as well as aspects of competition law. “Case law may be considered persuasive in private law cases, though it is not binding. The highest court of the public law jursidiction is the Verfassungsgerichthof [VfGH, Constitutional Court]; the highest court of ordinary jurisdiction is the Oberster Gerichtshof [OGH, Supreme Court].” (University of Oxford, 2014) The majority of private law is regulated in a comprehensive civil law code titled the Allgemeine Buergerliche Gesetzbuch (ABGB). The ABGB would be used in most cases relating to commercial code however it does not cover labour and employment laws. The Labour Constitution Act of 1974 provides the basis for employment standards within Austria, covering issues such as collective bargaining, minimum wage, organizational rights of employees, etc. As over 80% of the population work under collective bargaining agreements, these contracts often 12 provide the basis for standards and obligations within an employment relationship. (Dimireva, 2009) 13 Economy “According to the International Monetary Fund, Austria is the 13th richest country in the world, with a per capita GDP of $49,255. (2013) It is ranked 10th in the world in terms of quality of life for a country. Austria is a member of the European Union and was a founding member of the Organization for Economic Cooperation and Development. (CIA, 2014) As part of the European Union, Austria has adopted the Euro as its official currency. The exchange rate is approximately $1.50 Canadian dollars per Euro. Though the Euro has declined in strength over the past 5 years, it has begun to recover its strength since 2013 and has shown a positive trend upwards over the past year.” (Raymond, 2013) At 31.4% of exports and 42.1% of imports, Germany remains Austria’s largest trading partner by far. Other major partners include Italy, Switzerland, France and the United States, all of whom hold less than 10% each of imports and exports. (International Monetary Fund, 2013) With Austria’s inclusion into the EU, the country has been able to decrease dependency upon the German economy, allowing Austria more economic independence and reducing its vulnerability to rapid market changes within Germany. Austria’s position within Europe makes it a good gateway to other markets within central and Eastern Europe. There has been a trend of positive growth in trade between Austria and its Eastern European counterparts over the past 20 years, resulting in good trade relationships with neighboring economies. Due to strong historical ties, Austria received a disproportionate amount of trade flows and immigration from Eastern European countries compared to other nations after the fall of the Soviet bloc. (Aiginger, Winter-Ebmer, & Zweimüller, 1995) This has a positive effect on the Austrian economy as it brings skilled workers into the labour force and channels significant investment into Austria from Eastern European companies looking to gain a foothold within the Western European markets. Austria’s labour force comprises of approximately 3.7 million people and exhibits low unemployment, around 4.9%. Austria experienced inflation of 2.2% in 2013, continuing a longterm trend of relatively stable growth within the 1-3% range. (International Monetary Fund, 2013) Interest rates in Austria remain very low, at 0.25%, exhibiting a good atmosphere for 14 investment. (Trading Economics, 2013) According to the International Monetary Fund, “Austrian banks on the whole have benefited from limited exposures to sovereign and market risks, a stable funding structure, and relatively favorable macroeconomic conditions.” (2013) The corporate tax rate in Austria is 25%, however with tax base adjustments; some financial experts estimate the actual tax burden at no more than 22%. (Dimireva, 2009) These factors indicate an attractive business environment for investing companies that are considering expansion into a European market. Austria GDP Growth (%) 1990-2015 “Before the 1980s, most of Austria’s major industries were under some sort of government control. Since then however, privatization has largely exploded, meaning that Austria is still a relatively young market in terms of expansions and foreign investment. Austria has strongly encouraged foreign investment since regulatory reforms in the 1990’s, meaning that businesses will not endure any significant hardships when entering the market, and in some cases may actually benefit and receive incentives for choosing Austria as a center for operations. “ (Raymond, 2013) “The current coalition government of the Social Democratic Party (SPO) and People’s Party (OVP) encourages economic advancement of many forms including foreign expansion and direct investment. Austria is a founding member of the Organization for Economic Co-operation and Development and as such has a strong interest in building global business relationships.” (Raymond, 2013) Economic reforms from 2000 to 2006 further liberalized markets, encouraged privatization and lowered the corporate tax rate to 25%. (CIA, 2014)These reforms illustrate the strength of Austria’s long-term market potential for investing companies like RONA Inc. 15 Society “Austria is a country of approximately 8.2 million people, located in central Europe. The official language is German and several dialects are spoken in different regions of the country. The vast majority of Austrians consider German as their first language. The ethnic background of the population is largely German-Austrian, with small minorities of Turkish and former Yugoslavian populations. The average age is about 44 years old, with 67.4% of the population between 15 and 65 years old. 43.1% of the population is between 25 and 54 years old (see appendix 1.4). The most prevalent religious view is Roman Catholic, with about 75% of the population identifying as such. Muslim and Protestant populations each accounted for less than 5% of the total population. Over 10% of the population identified as having no religious beliefs. (CIA, 2014)” (Raymond, 2013) Quality of life is high in Austria, as shown in appendix 1.5. The average life expectancy in Austria is the 13th highest in the world, at around 80 years. (CIA, 2014) A study of adults aged 25-64 showed that 82% have earned the equivalent of a high-school degree, considerably higher than the OECD average of 74%. Austrians aged 15-24 exhibit unemployment levels of 8.3%, almost half of the OECD average of 16.2%. Workers in Austria earn an average of 43,688 USD per year, approximately 9,000 USD higher than average. Citizens also work 176 hours less per year than the OECD average, working approximately 1,600 hours per year. (Organization for Economic Cooperation and Development, 2013) Austria is also shown to be a very safe country. 78% of people reported feeling safe walking alone after dark, higher than the OECD average of 67%. Rates of assault in Austria are the 6th lowest in the OECD. Austria also has one of the lowest homicide rates in the OECD, recording just 0.6 homicides per 100,000 people, compared to the OECD average of 2.2 homicides per 100,000 people. (Organization for Economic Cooperation and Development, 2013) As a western society, Austria would be considered low-context compared to more traditional cultures like Asian or Arab societies. Business is carried out in a very straight forward 16 manner, with little importance placed on implied meanings or subtle inferences and gestures. Austrians are a conservative people, therefore greetings should be formal, initiated by a handshake, and one can expect to be addressed by their surname or professional title. Eye contact should be used to establish trust between the two parties. Business attire is traditional and appropriate, usually dark-coloured suits or conservative dresses are the norm. (Kwintessential, 2013) Austria is also a very detail-oriented society; negotiations will be conducted according to strict protocols and any claims must be backed up by supporting evidence. Those conducting business in the country should always remember to be punctual, ethical and well-prepared when doing business with their Austrian counterparts. (Passport to Trade, 2013) 17 Technology and Infrastructure Communications systems within Austria are highly-developed and offer citizens and businesses very good telecommunications and internet capabilities. Austria has approximately 3.3 million landline telephones and over 13.5 million cellular devices currently in use. Austria has 37 internet providers presently in operation, servicing 6.7 million people within the country. Fibre-optic cables and communication lines are becoming more and more common across the country, further improving the quality of communications infrastructure within the nation. Austria also operates 15 satellite earth stations across the country, which provides the telecommunications and telemetry capability for orbiting satellites used in international communications. (CIA, 2014) (Alliance for Telecommunications Industry Solutions , 2014) Privacy regulations and laws regarding freedom of speech are well-developed within Austria, meaning citizens and businesses will not experience surveillance or censorship from the government in areas of communication, except to monitor and shut down illegal online activities. “Being a landlocked nation, Austria cannot rely on direct transport for most products. Transportation through at least one country is usually necessary; meaning a strong, uncomplicated logistical framework between member nations is a huge asset for Austria and RONA. With modern transit and roadway systems, infrastructure within Austria is among Europe’s best. With its location in central Europe, Austria has become a logistical and transport hub throughout the continent. Austria also ranks 2nd in terms of promoting railway usage and 1st in terms of e-government services. (Move Inc., 2013)” (Raymond, 2013) As a gateway to Central and Eastern European countries, Austria’s transportation framework is 18 incredibly important to the country’s economic well-being. Austria provides advanced road and rail transport capabilities for commercial and private use across the country, connecting to all eight neighboring countries. Austria has 124,508 km of roadways, all of which is paved. It also boasts 6,399 km of railway across the country. (CIA, 2014) There are 52 airports (24 paved) across the country, the largest being Vienna International Airport, which handles over 60,000 passengers per day. (Vienna International Airport, 2012) (CIA, 2014) Austria has 4 river ports on the Danube River for cargo transport. The largest of these, the port of Vienna, handles 1700 ships and 12 million tonnes of cargo per year. (Hafen Wien, 2013) 19 Environment “Austria is not a large country by land mass, with an area of only 83,871 square kilometres. Based on its location in the Alps mountain range, the country’s climate is temperate, with moderate winters and warm summers.” (Raymond, 2013) Regions of the country within the Alps at high elevation experience an alpine climate. A climate graph for Vienna, Austria can be found in appendix 1.6. Austria’s mountainous geography provides it with plentiful natural resources in the form of oil, coal, iron, copper, salt, various minerals and timber. (CIA, 2014) These natural resources help to create a robust and healthy economic system with a diverse range of industries. The climate and geography also make it a popular destination for travellers and outdoor enthusiasts, with tourism industries constituting over 10% of Austria’s GDP. (Österreich Werbung, 2007) Austria is a landlocked country and as such has no direct international access by water. Its main waterway, the Danube River, is the country’s only available route for international transport by ship. The river begins in Germany and stretches southeast for 2,872 km before dispensing into the Black Sea between Romania and the Ukraine. Cargo ships can then access the ports of Istanbul and continue through to the Mediterranean Sea. It is an invaluable means of transportation both within Europe and globally as it passes through or touches 10 Central and Eastern European countries, including 4 capital cities (Vienna, Bratislava, Belgrade and Budapest). Although indirect, the Danube provides Austria with an international transport capability that is a major asset to the Austrian economy as a whole. 20 Market Entry Human Resources Within the retail division, an expansion into Austria will require frontline and managerial staff from in-country to operate the outlets. Austria has a labour force of 3.7 million and presents a strong and stable labour market for RONA. With 1.7 million residents in Vienna, this presents RONA with a possible labour force of over 750,000 workers in the region. (CIA, 2013) Vienna is also the education capital of Austria; this region provides the highest concentrations of young, employable individuals that seek part- or full-time employment. In terms of training, frontline associates will need minimal previous experience and can be trained in areas such as cashiering and inventory management during an orientation period upon starting with the company. Management will need greater support and may necessitate the need for a training program to be designed to meet the new international scope of operations. Local store managers will have market knowledge, but must carry out duties in a way that is cohesive with the RONA corporate vision. By establishing a training program for store managers, RONA can cultivate a stronger market presence by unifying and organizing its outlets in a consistent manner. Managers should also have some previous business experience, whether managerial or administrative, as effective day-to-day operations are key to the expansion’s success. A development and management team must be created within the RONA corporate structure in order to oversee and control the Austrian expansion. Under the VP of Retail, Luc Rodier, a new international development team should be established alongside the domestic development teams. This division must receive full support from other divisions to ensure continued success. This team would initially work closely with HR and legal divisions upon beginning the expansion process to ensure legality and accordance with all Austrian laws and regulations relating to the expansion process. If international legal counsel is not readily available to RONA at this time, the company must take action to ensure that it retains expert legal counsel when attempting the expansion. Though the laws are well-developed in Austria, the legal and regulatory systems are still 21 fundamentally different in some ways. It is essential that RONA takes the steps necessary to safeguard itself against any unexpected challenges that it may face. Divisions such as marketing and accounting must be expanded in scope to include international operations. This may require the addition of personnel to various teams within the organization, including executive and management positions. Some positions may be filled internally, although garnering talent with international experience could serve as an asset to the company. As the organization lacks international experience, it may prove advantageous to acquire executive and managerial professionals with good working knowledge of European markets to help lead the expansion. 22 Products and Services Rona offers “the best service and the right product at the right price to consumers of home improvement products.” (RONA Inc., 2014) As the largest Canadian renovation and hardware retailer, Rona has a better understanding of what consumers need. Being more aware of what customers want allows Rona to better respond to market changes and builds brand loyalty with customers. RONA Inc. operates 516 corporate, franchise and affiliate stores under regional banners and formats. RONA’s flexible formatting is an asset when considering their expansion plan into European markets as it allows them to adapt quickly and easily to market needs. “With its 8 distribution centres and its specialized TruServ Canada wholesaler, RONA serves its network as well as many independent dealers operating under other banners. With close to 24,000 employees, the Corporation generated annual consolidated sales of $4.2 billion in the financial year ended December 29, 2013.” (RONA Inc., 2014) RONA offers almost 104,000 regular products using a value chain involving 2,500 suppliers. 90% of products sold in Canada come from suppliers having a place of business in Canada, however much of the product is manufactured and imported from overseas. (RONA Inc., 2014) This means that RONA’s supply chain is very flexible in terms of routing existing supply chains to the new market. RONA will experience no significant difficulties in managing its supplier relationships and acquiring the necessary retail products when conducting its expansion. The organization also controls several brands under the brand names of “RONA”, “UBERHAUS”, and “FACTO”. UBERHAUS in particular is a line of higher-end furnishings and renovation materials in a European style. (RONA Inc., 2014) This brand may be expanded to be featured within the Austrian retail division as it lends itself well to the market in both name and 23 target market. It can also be considered for the overall theme and brand name of Austrian outlets as it represents the higher-end market that RONA seeks and also provides branding that may be appealing and self-identifying (roughly translates in German to ‘better house’) to the Austrian consumer. Main competitors in the market are bauMax (65 locations) and Hornbach (11 locations). These retail companies have the two largest market shares in the home improvement market in Austria. The retail company bauMax is a larger chain of 158 home improvement stores across nine countries, mostly within Eastern Europe as well as Turkey. Hornbach is a smaller national retailer with outlets in the main cities of Austria. These companies operate hyper-market style retail divisions, offering ‘one-stop-shop’ capabilities for consumers, much like RONA’s home building centre formats within the domestic market. RONA’s business strategy differs from its competitors within the Austrian market in that it will attempt to fill an unfulfilled need within the higher-end of the renovation and home improvement industry. It will focus on higher quality products and materials for do-it-yourself minded individuals, designers and contractors. In terms of after-sales service, RONA will offer standard return policies of 14 to 30 days on most products that it will carry. This applies to products returned in original condition with proof of purchase. Warranties will be offered directly through manufacturers and suppliers where applicable. 24 Pricing Strategy When entering the Austrian market, RONA will use competitive and market-oriented pricing to gain market share relatively quickly. With analysis of competitor pricing and selection, RONA can tailor its operations to fill underserved segments within the higher-end market and offer competitive pricing on the related products that competing companies sell. Elements of penetration pricing within certain product segments (such as renovation materials) may be used to establish the company within the market. This strategy will allow RONA to better judge the consumer market and competing companies upon entry and allow them to modify their product selections to maximize the company’s success in the Austrian market. When developing a pricing strategy for a new market, there are four essential points that an organization must consider: "anticipated demand for the product or service; perceived value of the product or service by the customer; ability of the customer to pay a certain price; and price offering of the competition for a similar product or service." (FITT, 2013) By modifying its product line and pricing to target underserved segments within the home improvement markets, RONA can maximize the demand for its retail products as well as counter competition effectively. Offering higher-quality products within the market and focusing on a specific customer base allows RONA to create higher perceived value for its goods and services. A worker in Austria makes $9,000 USD more per year than the OECD average for member nations. (OECD, 2013) As inhabitants of the 13th richest country in the world, Austrians have a significantly higher ability to spend than the average citizen in the developed world. (CIA, 2014) 25 Target Market and Consumer As Austria has roughly a similar climate to Canada, RONA can expect comparable seasonality concerns within its product and service offerings. “First quarter and last quarter sales are typically weaker than sales in the other two quarters, due to the low level of activity in the renovation/construction sector in winter. In addition, bad weather can impact sales, particularly those of seasonal products.” (RONA Inc., 2014) As RONA has extensive experience in operating in a seasonal type of industry, it can be seen as an asset as the company moves forward with its international expansion. RONA has good knowledge of how to manage its product mix throughout the year and has strategies in place to maximize its profitability throughout all seasons. Good supplier relationships allow RONA to have the flexibility to change and adjust its product mix regularly without compromising its product line over the short or long-term. The target consumer is a middle-aged homeowner with a do-it-yourself mindset that has relatively highlevels of disposable income. Middle- or upper middleclass homeowners may choose to invest disposable into home improvement and renovation projects instead of spending on consumer products. This can hold true even during economic downturn, where home improvement is seen as a form of investment rather than an expense. RONA’s target consumer would be a quality-minded individual who may be willing to spend more in exchange for a higher-quality offering. As a smaller, more specialized outlet, RONA’s Austrian stores will focus more on design and finishing products that appeal to the wealthier consumer base. RONA must develop a product mix that serves the renovation needs of the average Austrian consumer while attracting the consumers who seek higher-end materials and products for their home improvement needs. 26 Within Austria, there are approximately 3.4 million households. As the Vienna region holds approximately 20% of the country’s population, an estimated 850,000 households exist. 43.1% of the Austrian population is between 25 and 54 years old (see appendix 1.4), which is within the age range of potential consumers. Among this range, RONA will target the top earning 65% of the population range. This gives RONA an estimated customer base of 190,000 consumers within the Vienna region, or just over 11% of the region’s population. This provides an adequate customer base on which to build operations and provides the opportunity for further growth within the region in the future. 27 Promotion and Advertising Within Austria, most conventional advertising channels are used including television, radio and print advertisements as well as billboards, signage and other forms of visual promotion. The most significant advertising channels (measured in share of advertising revenue) are: print media (45%), television (18%), and radio (5%). (Advantage Austria, 2012) These constitute the most important channels when connecting with consumers, though advertising online is becoming increasingly important in the modern age. Around 80% of the Austrian population was reported to be using the internet in 2012. Furthermore online shopping was found to be used by around 45% of internet users. (Advantage Austria, 2012)It is becoming increasingly important to have a good online presence as it can have a significant positive impact on sales and the overall success of the company. RONA should create a German language web page for the Austrian market to connect wth consumers and establish its market presence. Within the Austrian television broadcasting industry, the Austrian Broadcasting Corporation (ORF) remains the leader in viewership among the population. “ORF has four national TV stations and it was 2003 before terrestrial television was opened up to private broadcasters.” (Advantage Austria, 2012) The ORF holds a viewership share in the broadcasting industry of over 36% for its top two stations alone. “The newspaper with the highest circulation is Neue Kronen Zeitung with a share of 44.9%. It is followed by Österreich, Kleine Zeitung, Heute and Kurier.” (Advantage Austria, 2012) Neue Kronen Zeitung is a daily newspaper covering both national and international news stories and events. (Krone, 2014) RONA’s promotion timeline will begin with signage and billboards around the site locations during the acquisition and rebranding phase of the expansion process. A German language website will also be created. This will serve to build interest and introduce the brand to the general public. One month before opening the facilities, RONA will begin print and billboard 28 advertisements to promote the grand openings. The print advertisements will be featured in Austria’s national newspaper, Neue Kronen Zeitung, while the billboards will be selected based on proximity to locations and consumer visibility. Once operational, television promotion will be used to supplement the print advertisements and signage. RONA should negotiate a deal with the Austrian Broadcasting Corporation to display RONA’s advertising campaigns on the Corporation’s two most popular channels, ORF 1 and ORF 2. This general promotion strategy will ensure that RONA can adequately represent itself within the market and will serve to support the company as attempts to gain traction within the industry. All advertising channels must be stable to ensure that RONA can effectively connect to consumers with the market. Good relationships with media providers are essential to ensure that RONA can consistently reach consumers and promote the business. Tentative advertising budgets for the year are set at $1 million, subject to review and adjustment where necessary. RONA should be prepared for increased promotional spending as it attempts to build market share and consumer confidence within the Austrian market. 29 Location and Distribution Due to Austria’s landlocked position within Europe, the country has had to rely on other methods of transportation within the country and throughout Europe; As a result, Austria’s transportation networks are very well developed both within the nation and in terms of connectedness with neighbouring countries. Austria has extensive road networks between surrounding countries and has established open borders with all eight neighboring nations. Austria has 124,508 kilometres of roadways, all of which is paved. This includes 1,719 km of expressways across the nation. 6,400 kilometres of commercial and industrial railways also exist within the country. Austria also boasts 58 airports, 24 of which are paved. (CIA, 2014) This provides a well-established air network that transports people and cargo internationally. The largest airport, The Vienna International Airport, handled over 22 million passengers in 2011. (Vienna International Airport, 2012) For a landlocked country, Austria boasts a remarkably well-established marine transport system on the Danube River, which connects Austria to ten Central and Eastern European cities and provides Austria indirect access to international ports and ocean transport. (CIA, 2014) When expanding operations into Austria, RONA will be able to retain much of its supply network, as it operates with an international system of 2,500 suppliers that operate in areas all over the world. Much of the supply network can be routed into Austria quite easily, via EU transportation systems and overland transport. In some cases, new supplier relationships may be formed in order to take advantage of EU manufacturers and suppliers to decrease transportation and distribution costs. Transportation and related supply costs may in fact be lower than domestic operations based on product supply routes and distance from the manufacturer to the market. 30 In terms of retail locations, RONA must identify and select six existing retail locations for rebranding and restructuring. Other than the top two retail competitors, Hornbach and bauMax, the home improvement market within Austria is highly fragmented, with many smaller chains and individual retail outlets operating in the market. RONA must identify key market locations and then select outlets that the company can potentially acquire and rebrand. The focus of acquisitions will be on retail outlets in good market locations that may financially benefit from the sale of an outlet location. 31 Financial Information and Analysis CAD Thousands Statement Date Historical Company Projections 02/28/2010 02/28/2011 02/28/2012 02/28/2013 02/28/2014 02/28/2015 Actual Actual Actual Projected Projected Projected 4,819,589 4,804,584 4,884,016 5,128,216.8 5,384,627.64 5,653,859.02 - (.31%) 1.65% 5.00% 5.00% 5.00% Income Statement Revenue Growth Gross Profit 1,371,821 1,349,283 1,331,676 1,398,259.8 1,468,172.79 1,541,581.43 GM % 28.46% 28.08% 27.27% 27.27% 27.27% 27.27% EBITDA 336,318 240,555 162,363 208,900 240,300 278,475 Operating Profit 223,206 (31,443) 41,295 91,295 141,295 191,295 Net Income 142,821 (74,773) 19,083 28,455 43,296 62,300 RONA was hit hard during the tail-end of the recession, consequently causing contraction in the 2011 fiscal year. With a projected bounce-back in growth, revenues are expected to return to healthy levels, allowing for the proper financial support needed by the international expansion. Net Income continues its strong climb upwards as the company implements its new development strategies focusing on efficiency and effective store management. Once operational, the Austrian expansion is expected to have a significant positive impact on revenues and profitability, allowing RONA to build more value for shareholders. Balance Sheet Cash 75,577 17,149 21,600 22,680 23,814 25,005 Total Assets 2,921,620 2,780,378 2,806,458 2,946,781 3,094,120 3,248,826 Total Liabilities 1,009,823 824,754 922,882 969,026.1 1,017,477.4 1,068,351.3 467,430 256,710 328,040 344,442 361,664.1 379,747.3 1,911,797 1,883,576 1,977,754.8 2,076,642.5 2,180,474.7 1,955,624 1,911,797 1,883,576 1,977,754.8 2,076,642.5 2,180,474.7 1.4 2.9 2.9 - 1.1 3.1 3.1 25.7 1.6 3.7 3.7 16.3 2.2 4.2 4.2 18.2 2.1 4.4 4.4 19.4 Debt Equity TNW Total Debt / EBITDA Debt / Equity Debt/TNW EBITDA / Int. Exp. 1,955,624 2.4 3.9 3.9 18.5 RONA shows a good propensity to pay its debt as seen through the total debt / EBITDA ratio. The ratio shows the amount of years necessary to pay back all debt given constant debt and earnings figures. The ratio shows RONA’s aboveaverage ability to pay down its debt. The debt/equity ratio analyzes the organization’s leverage and the amount of growth derived from debt. RONA’s ratio is high, indicating a reliance on debt to create growth; however a high debt/equity is not unheard of within the industry. RONA has a relatively high debt/TNW ratio, signifying its use of debt in relation to physical assets. The high ratio is less concerning given the established reputation of RONA and the amount of fixed assets and inventory that it holds in conducting its day-today operations. The EBITDA / Interest Expense ratio is used to determine the durability of a company by analyzing its ability to pay interest. The high ratio shows that RONA was able to pay its interest 16 times over in 2012, exhibiting the company’s strong propensity to pay its debts. 32 CAD Thousands Historical Company Projections 02/28/2010 02/28/2011 02/28/2012 02/28/2013 02/28/2014 02/28/2015 Actual Actual Actual Projected Projected Projected CFO 138,070 230,245 125,547 156,450 196,200 223,746 CAPEX (86,370) (109,420) (146,280) (153,594) (161,274) (169,337) Free Cash Flow 51,700 120,825 (20,733) 2,856 34,926 54,409 Dividends 9,119 2,527 2,258 1,984 1,765 1,420 Mandatory Debt Repayments 176,482 159,489 143,987 151,186 158,746 166,683 Free Cash After Dividends & Debt Repayment 75,577 17,149 21,600 22,680 23,814 25,005 - - - 25,000 - - Current Ratio 2.62 2.41 2.42 2.45 2.45 2.49 Quick Ratio 0.8 0.81 0.78 0.8 0.8 0.8 Statement Date Cash Flow Analysis New Debt Issuance RONA’s cash flow from operations (CFO) has remained strong and is forecasted to maintain its stability over the medium-term. Strong CFO shows RONA’s ability to create consistent positive income from its retail operations. RONA’s free cash flow (FCF) is expected to bounce back considerably after the company’s downturn in 2011, allowing RONA to pursue the European investment opportunity in a manner that is healthy for the company. Historically, RONA has had high FCF, exhibiting its ability to generate positive cash flows. The company had a new debt issuance in 2013 but this has not created significant negative effects for the company. RONA had a current ratio of 2.42 in 2012 and has remained relatively stable historically. This reflects RONA’s solid ability to pay off short-term liabilities with its short-term assets like cash, receivables or inventory. RONA’s current ratio exhibits good liquidity for the company. RONA’s quick ratio was 0.78 in 2011, which is in line with industry standards. Due to the high inventory necessary for operations, the quick ratios within the home improvement industry are usually substantially lower than the current ratios. The ratios show that RONA is a healthy organization able to operate in an effective way. 33 Expansion Risks RONA has developed an overview of four key risks when developing an expansion that applies both domestically and internationally. This list provides some of the main factors to consider when developing a risk management strategy. RONA would be well-served to develop an extensive risk management strategy in order to tackle the European expansion in an effective and well-though out manner. A good risk management strategy is necessary for a company as it aims to predict future obstacles and develop methods of dealing with those impediments before the issues arises. Merchandising Risk “There is a risk that the Corporation could offer products or services that customers or dealer-owners do not want and that do not fit with current consumer trends or behaviours, or regional preferences, or that prices are higher than customers or dealer-owners are willing to pay, or that are outperformed in the marketplace by competing products. If merchandising does not have the requisite effectiveness, the Corporation’s profitability could be affected. It is vital that the Corporation provide quality products in order to protect customer safety and reduce the risk of recalls that could harm the Corporation’s reputation.” (RONA Inc., 2014) Supply Chain and Distribution RONA must ensure that retail outlet’s need for merchandise remains satisfied through effective supply-chain management and solid supply chain knowledge and relationships. RONA requires timely delivery, reasonable pricing and product quality that meets the company’s standards. “Furthermore, it is important for RONA to establish solid and lasting relationships with its suppliers in order to avoid stock-outs or unexpected changes in the price of merchandise. Because of the Corporation’s particular business model and historical growth through acquisitions, its information technology structure is particularly complex. Supply management is a key component of proper inventory management and is a priority for the Corporation. Inability to detect, correct and prevent obsolescence and to maintain an adequate level of inventory could lead to losses and operational inefficiencies including the inability to effectively deploy the appropriate stocks across the network.” (RONA Inc., 2014) 34 Liquidity Risk Liquidity risk is the risk that the Corporation will be unable to fulfill its obligations on a timely basis or at a reasonable cost. Liquidity risk refers to a company’s inability to fulfill its obligations in a timely or reasonable manner. (FITT, International Trade Finance, Sixth Edition, 2013) “The Corporation manages its liquidity risk by monitoring its operating requirements and using various funding sources to ensure its financial flexibility. The Corporation prepares budget and cash forecasts to ensure that it has sufficient funds to fulfill its obligations. In recent years, the Corporation financed the growth of its capacity, increase in sales, working capital requirements and acquisitions primarily through cash flows from operations, a debenture issue and the use of its revolving credit on a regular basis.” (RONA Inc., 2014) Credit risk Credit risk refers to the possibility that parties to a financial instrument may not fulfill their obligations, thereby negatively affecting RONA’s financial condition. (FITT, International Trade Finance, Sixth Edition, 2013) “The main risks relate to trade and other receivables and the Corporation’s loans and advances. The Corporation may also be exposed to credit risk from its cash and its foreign exchange forward contracts, which is managed by only dealing with reputable financial institutions. To manage credit risk from trade and other receivables and loans and advances, the Corporation examines their financial stability on a regular basis. The Corporation records allowances for doubtful accounts, determined on a client-per-client basis, at the end of the reporting date to account for potential losses.” (RONA Inc., 2014) 35 Financing and Risk Mitigation Project Financing It is necessary to acquire adequate funding for an expansion project to prevent a severe constriction on cash flow and to allow the organization to grow in a way that is healthy for all segments of the business. “Limited availability of financing may affect…RONA’s ability to pursue its growth objectives or prevent it from acquiring other stores or delay investment in existing stores.” (RONA Inc., 2014) RONA will receive financing through its banking institution for a term loan of $20 million over 10-year period (interest compounded quarterly, principal and interest payments annually). This is in line with the institution’s requirements as well as RONA’s financial capabilities. The remaining $19 million and all other overages and expansion-related costs will be covered by RONA as it moves forward. The loan will be used for the acquisition and rebranding phase of the expansion project in conjunction with the independent financing provided by RONA Inc. The organization will utilize its free cash flow and growing cash reserves to finance the expansion as it moves towards operational status. Risk Mitigation “The Corporation must be able to react quickly in order to resume essential operations and not affect profitability adversely. Information system continuity and other contingency plans have been put in place to mitigate this risk. Furthermore, the Corporation has insurance programs which provide coverage for this risk.” (RONA Inc., 2014) Risk insurance for an international expansion is absolutely critical to ensure the safety and well-being of the company moving forward. Export Development Canada, one of Canada’s leading providers of international risk insurance, offers several different types of insurance based on need such as: political risk insurance, accounts receivable insurance or single buyer insurance. These cover different types of business situations and typically provide up to 90% of the value of losses incurred. (Export Development Canada, 2014) 36 RONA may be well-served to purchase contract frustration insurance, which is a multifaceted coverage program offered by EDC for companies entering new foreign markets. This type of insurance provides companies with protection against contract cancellation, customer bankruptcy and default, permit cancellation and market hostility, among other things. This provides well-rounded coverage to companies like RONA who aim to successfully expand abroad. (Export Development Canada, 2014)As a safe and stable country, RONA can be less concerned with major political risks, therefore it may wish to delay the purchase of political risk insurance plans until conditions begin to change or if they wish to enter new, less stabilized markets in the future. 37 Decision and Next Steps After analysis of all the market and company data, it is concluded that RONA would be wellserved by undertaking the expansion opportunity presented and would likely see positive benefits that it would not otherwise see by continuing operations in the domestic market. Austria presents a market that is economically stable and financially wealthy. Austria’s overall infrastructure is very good and offers a good business environment for foreign companies. The Vienna region offers RONA a densely populated target market on which to build its operations and provides a sufficient number of target consumers to support future growth over the long-term. The climate and seasonal nature of operations is very similar to Canada, allowing RONA to utilize key elements of its product planning in the new market. This gives RONA the ability to conduct operations in a familiar and predictable way. Expanding into an EU member state offers the advantages of a standardized regulatory system and facilitates access to other markets in the future. Currency risks are minimized as the Euro presents a stable and consistent currency on which to build the business. Austria has remained relatively stable throughout the economic crisis and is forecasted to remain stable over the long-term. Distribution channels within the market are strong and offer RONA the ability to offer a complete product mix for Austrian consumers, with shipping and transport costs lower than the domestic market in some cases. RONA is financially healthy and will be able to undertake the expansion with no adverse effects on current operations or company value. Moving forward, RONA Inc. should begin its expansion process by restructuring and expanding its corporate divisions to outline the tasks, responsibilities and corporate direction for management and executives. The newly-formed international market development team will then be tasked with identifying six suitable expansion locations and commencing the acquisition and rebranding phase within the Vienna region. The promotional strategy will then commence to inform and engage the target market over the course of rebranding and opening the outlets. Once operational, another report is to be submitted, reviewing the expansion process and revising and addressing operational goals and concerns. 38 Appendix 1.1 Members of the RONA Inc. Board of Directors ‘Robert Chevrier, FCA Executive Chairman of the Board of Directors of RONA, Chairman of the Board of Directors of Uni-Sélect (independently owned auto parts dealers) and former Chairman of the Board of Directors of Richelieu Hardware Ltd. (distributor, importer and manufacturer of specialty hardware and complementary products) Suzanne Blanchet President and Chief Executive Officer of Cascades Tissue Group (papermaker) and Corporate Director Réal Brunet Corporate Director and former Audit Partner and Senior Advisory Partner at Ernst & Young (professional services organization) Eric Claus President and Chief Executive Officer of Red Apple Stores Inc. (value retail stores) and former President and Chief Executive Officer of the Great Atlantic and Pacific Tea Company (supermarkets chain) Bernard Dorval Corporate Director and former Group Head of Insurance and Global Development of TD Bank Financial Group and Acting President of TD Canada Trust Guy Dufresne Corporate Director and former President and Chief Executive Officer of ArcelorMittal Mines Canada Inc. (mining company) Barry Gilbertson Principal with Barry Gilbertson Consultancy (strategic business and real estate advisory firm) Jean-Guy Hébert Corporate Director and President of Maximat Inc. (holding company), Maximat Granby Inc. (holding company), Horizon Devcow Inc. (real estate) and 9060-4976 Québec Inc., (operating under the RONA L’entrepôt banner in Granby), Vice President of 9066-7403 Québec Inc. (operating a store under the RONA L’entrepôt banner in Saint-Hyacinthe) and Rocvale Inc. (concrete products) James Pantelidis Chairman of the Board of Directors of EnerCare Inc. (energy heating), Parkland Fuel Corporation (energy downstream) and Corporate Director Robert Paré Corporate lawyer and Partner at Fasken Martineau Dumoulin LLP (law firm) and Corporate Director Steven P. Richardson Corporate Director and former member of the Board of Directors, Chair of the Corporate Governance and Compensation Committee and member of the Audit Committee of Sterling Shoes Inc. (footwear stores) and Director, Co-Chair of Compensation Committee, Chair of Special Committee and member of the Audit Committee of easyhome Ltd. (financial services supplier) Robert Sawyer President and Chief Executive Officer of RONA and former Executive Vice President and Chief Operating Officer of Metro Inc. (Canadian food company) Wesley Voorheis Corporate Director and Partner at Voorheis & Co. LLP (law firm), Managing Director of VC & Co. Incorporated” (RONA Inc., 2014) 39 Appendix 1.2 RONA Inc. Executive Management Structure Accounting Treasury VP, CFO Finance Legal IT Merchandising VP, Operations CEO Procurement Marketing Market Development VP, Retail Franchise Management Relations VP, Human Resources Compensation Recruitment 40 Appendix 1.3 Map of Austria Showing Locations of Major Cities and Towns Map of Austria. (2013). Retrieved April 7, 2013, from Lonely Planet : http://www.lonelyplanet.com/maps/europe/austria/ 41 Appendix 1.4 Population Age Pyramid for Austria - 2012 CIA. (2013). Central Intelligence Agency. Retrieved March 20, 2013, from The World Factbook: https://www.cia.gov/library/publications/the-world-factbook/ 42 Appendix 1.5 Table Displaying Countries Rated According to Their Corresponding Quality of Life Index – 2013 Numbeo. (201). Quality Of Life Index for 2013. Retrieved April 4, 2014, from Numbeo: http://www.numbeo.com/quality-of-life/rankings_by_country.jsp 43 Appendix 1.6 Climate Graph Displaying Average Weather Conditions for Vienna, Austria ClimaTemps. (2013). Austria. Retrieved April 7, 2014, from ClimaTemps: http://www.austria.climatemps.com/ 44 Works Cited Advantage Austria. (2012). Advertising and Media. Retrieved April 15, 2014, from Advantage Austria: http://www.advantageaustria.org/international/zentral/business-guideoesterreich/exportieren-nach-oesterreich/werbung-und-medien.en.html#content=p1 Aiginger, K., Winter-Ebmer, R., & Zweimüller, J. (1995). Eastern European Trade and the Austrian Labour Market. Vienna: Austrian Central Bank. Alliance for Telecommunications Industry Solutions . (2014). About ATIS Solutions. Retrieved February 11, 2014, from ATIS: http://www.atis.org/index.asp Asher, G. (2013, November 18). Europe's Potential Economic Contagion. Retrieved November 15, 2013, from Oye Times: http://www.oyetimes.com/news/europe/54505-europe-spotential-economic-contagion CIA. (2013). Central Intelligence Agency. Retrieved March 20, 2013, from The World Factbook: https://www.cia.gov/library/publications/the-world-factbook/ CIA. (2014, January 28). Central Intelligence Agency. Retrieved February 3, 2014, from The World Factbook: https://www.cia.gov/library/publications/the-world-factbook/ ClimaTemps. (2013). Austria. Retrieved April 7, 2013, from ClimaTemps: http://www.austria.climatemps.com/ Dimireva, I. (2009, October 8). Austria Investment Climate. Retrieved February 6, 2014, from EU Business: http://www.eubusiness.com/europe/austria/invest/ European Commission. (2014). Institutions and Bodies. Retrieved April 10, 2014, from EUROPA: http://europa.eu/about-eu/institutions-bodies/court-justice/index_en.htm Export Development Canada. (2014). Our Solutions. Retrieved April 12, 2014, from Export Development Canada: http://www.edc.ca/EN/Our-Solutions/Insurance/Pages/default.aspx FITT. (2013). International Market Entry Strategies, Sixth Edition. Ottawa: Forum for International Trade Training. FITT. (2013). International Marketing, Sixth Edition. Ottawa: Forum for International Trade Training. FITT. (2013). International Trade Finance, Sixth Edition. Ottawa: Forum for International Trade Training. 45 FITT. (2013). International Trade Management, Sixth Edition. Ottawa: Forum for International Trade Training. FITT. (2013). International Trade Research, Sixth Edition. Ottawa: Forum for International Trade Training. Hafen Wien. (2013). Port of Vienna. Retrieved February 11, 2014, from Hafen Wien: http://hafenwien.com/en/home/hafen Index Mundi. (2013, February 21). Austria Demographics Profile 2013. Retrieved March 2, 2013, from index mundi: http://www.indexmundi.com/austria/demographics_profile.html International Monetary Fund. (2013). Austria: Financial Sector Stability Assessment. Washington: International Monetary Fund. International Monetary Fund. (2013, October). Economic Report for Austria. Retrieved February 4, 2014, from International Monetary Fund: http://www.imf.org/external/pubs/ft/weo/2013/02/weodata/weorept.aspx?sy=2007&ey =2017&scsm=1&ssd=1&sort=country&ds=.&br=1&c=122&s=NGDP_RPCH%2CNGDPD%2C NGDP_D%2CNGDPDPC%2CNGAP_NPGDP%2CPPPGDP%2CPPPPC%2CNID_NGDP%2CNGSD _NGDP%2CPCPI%2CPCPIPCH%2CPCPIE%2CPCPIEPCH% Krone. (2014). Retrieved April 15, 2014, from Krone.at: www.krone.at Kwintessential. (2013). Austria - Language, Customs, Culture and Etiquette. Retrieved February 10, 2014, from Kwintessential: http://www.kwintessential.co.uk/resources/globaletiquette/austria-country-profile.html Move Inc. (2013). Austria Facts and Stats. Retrieved April 1, 2013, from Moving to Austria: http://www.moving2austria.net/facts-and-stats/demographics.html OECD. (2013). OECD Library. Retrieved April 4, 2013, from Organization for Economic Co-operation and Development: http://www.oecd-ilibrary.org/content Organization for Economic Cooperation and Development. (2013). Austria - Better Life Index. Retrieved February 5, 2014, from OECD Better Life Index: http://www.oecdbetterlifeindex.org/countries/austria/ Österreich Werbung. (2007). Trade and Industry in Austria. Retrieved February 8, 2014, from Austria Info: 46 http://web.archive.org/web/20071127125951/http://www.austria.info/xxl/_site/uk/_are a/417080/_subArea/417098/home.html Passport to Trade. (2013). Austrian business culture. Retrieved February 10, 2014, from Passport to Trade 2.0: http://businessculture.org/western-europe/business-culture-in-austria/ Paterson, T. (2008, September 26). Austria Opens the Polls to 16-year-olds. Retrieved February 9, 2014, from The Independent: http://www.independent.co.uk/news/world/europe/austria-opens-the-polls-to16yearolds-943706.html Raymond, K. (2013). Market Research: Austria. Ottawa. RONA Inc. (2014). RONA Corporate. Retrieved March 5, 2014, from RONA Inc.: http://www.rona.ca/corporate Statistics Canada. (2013). Government of Canada. Retrieved October 24, 2013, from Statistics Canada: http://www.statcan.gc.ca/start-debut-eng.html The World Bank. (2013). Economy Rankings. Retrieved October 13, 2013, from Doing Business: http://www.doingbusiness.org/rankings Trading Economics. (2013). Economic Indicators. Retrieved October 3, 2013, from Trading Economics: http://www.tradingeconomics.com/ Transparency International. (2013). Corruption Perception Index. Retrieved October 28, 2013, from Transparency International: http://cpi.transparency.org/cpi2012/results/ University of Oxford. (2014, January 21). Austrian Law. Retrieved March 18, 2014, from Oxford LibGuides: http://libguides.bodleian.ox.ac.uk/content.php?pid=334374&sid=2735022 Vienna International Airport. (2012). Press and News. Retrieved February 4, 2014, from Vienna International Airport: http://www.viennaairport.com/jart/prj3/va/main.jart?rel=de&contentid=1351048408438&news_beitrag_id=1357856078464 Vienna4U. (2013, 2013). Vienna Info and Orientation. Retrieved April 4th, 2013, from Vienna4U: http://www.vienna4u.at/orientation.html White, T. (2013). Thomas White - Global Investing. Retrieved April 7, 2013, from Austria: Powerful Link to Central and East Europe: http://www.thomaswhite.com/explore-theworld/austria.aspx 47 Wikimedia Commons. (2014). Wikimedia Commons. Retrieved April 12, 2014, from Wikipedia: http://en.wikipedia.org/wiki/Austria World Intellectual Property Organization. (2014). Convention Establishing the World Intellectual Property Organization. Retrieved March 17, 2014, from World Intellectual Property Organization: http://www.wipo.int/treaties/en/text.jsp?file_id=283854 Yahoo Finance. (2014). Currency Exchange. Retrieved March 28, 2014, from Yahoo Finance Canada: https://ca.finance.yahoo.com/echarts?s=%5EGSPTSE#symbol=%5EGSPTSE;range=