Introduction To Foreign Exchange

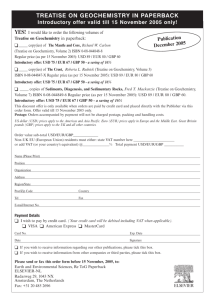

advertisement

Introduction To Foreign Exchange Saeed Amen Introduction We present a brief introduction to the foreign exchange market What are the major currencies? How are they quoted? What is relative liquidity of different currency pairs? Brief description on how FX options are quoted. Foreign Exchange Market Volume $3.5tr FX spot - $1tr Outright FX forwards - $350mm Calls, put, straddles, strangles (buy OTM call and put) risk reversals (buy OTM call & sell put) most common vanillas More exotic instruments – barrier options, one touches, volatility swaps, correlation swaps etc. Centres UK 34% - open during both Asian (morning) and American timezones (afternoon) US 17% Singapore 6% Switzerland 6% Japan 6% Buying (selling) spot and selling (buying) forward date Common usage is to roll spot positions overnight through tom/next contract FX options - $200bn Buying currency for future delivery – for example 1M delivery FX swaps - $1.7tr (FX spot + FX forward) Buying currency for immediate delivery – settlement usually T+1 Source BIS 2007 & Wikipedia Major Currencies Double counting given FX transactions involve two currencies – base/terms quote G10 (official name and “trading” name) EUR (37%) - euro, GBP (15%) – sterling/British pound, AUD (6.7%) – Australian dollar Aussie, NZD (1.9%) – New Zealand dollar - Kiwi, USD (86.3%) – US dollar - dollar, CAD (4.2%) – Canadian dollar – cad (loonie), CHF (6.8%) – Swiss franc - Swiss, NOK (2.2%) – Norwegian krone - Nokkie, SEK (2.8%) – Swedish krona - Stokkie, JPY (16.5%) Japanese yen Written in quotation order Eg. EUR always first, JPY always last Correct quotations EUR/GBP, AUD/NZD, CHF/JPY etc. Generally USD crosses traded more (except EUR/scandis) EUR/USD (27%), USD/JPY (13%), GBP/USD (12%), AUD/USD (6%), USD/CHF (5%), USD/CAD (4%), USD/SEK (2%), USD/other (19%) EUR/JPY (2%), EUR/GBP (2%), EUR/CHF (4%), EUR/other (4%) Other crosses (4%) – eg. AUD/NZD, NOK/SEK Can trade any cross indirectly if direct equivalent not traded eg. CHF/SEK = EUR/CHF and EUR/SEK Emerging Market Currencies Double counting given FX transactions involve two currencies Usually traded against USD (except CEE) Most Asian and Latam currencies are traded as NDF – non-deliverable forwards settled in USD Many currencies in EM are pegged or are managed currencies that trade within a band that central bank supports Common “trading” name also given Latam MXN – Mex (1.3%), BRL* (0.4%) - Brazil, CLP* - Chile, COP* - cop EMEA CEE – PLN (0.8%) - Poland, CZK - Czech, HUF – huf traded mostly EUR/CEE ZAR – rand (0.9%), RUB* - rouble (0.8%), TRY - Turkey, ILS - shekel, ISK (against EUR – very illiquid now) Asia HKD (2.8%) – Hong Kong, KRW* (1.1%) - Korea, INR* (0.7%) - India, CNY* (0.5%) China, TWD* (0.4%) - Taiwan, SGD - sing, MYR* - Malaysia, IDR* - Indonesia Terminology Investors can trade FX leveraged E.g put on a margin of $10mm USD to cover losses and trade $20mm USD notional Greater leverage is more risky Long/short Going long EUR/USD Borrow USD which is sold, and used to buy EUR Due to arbitrageurs cross rates consistent at nearly all time levels (eg. EUR/JPY = EUR/USD rate * USD/JPY) aaa/bbb = 1 / aaa/bbb aaa/bbb = aaa/ccc * ccc/bbb Liquidity Liquidity concentrated during London hours Most liquidity between 12 – 16 LDN (London and NY open) Dependent on local markets (eg. Scandis illiquid during Asian time, similarly EM Asian currencies illiquid during NY time) Illiquidity reduces sizes that can be traded and increases spreads Major USD crosses such as EUR/USD are liquid all the time Market opens approx 2200 LDN Sunday evening in Sydney and continues trading till 5pm NY on Friday evening Amount that can be executed depends on time of day and currency cross $100mm USD in EUR/USD is not big amount, but in USD/NOK it is a big amount Recent market turmoil has reduced liquidity Who trades FX markets? Not everyone is an FX speculator Corporations repatriating profits Investors buying assets in foreign countries Foreign equities and bonds, businesses Tourists visiting other countries Governments Central banks Intervening in market to strengthen/weaken currency Mostly EM countries However, some G10 countries have intervened in the past Recently Russia has intervened to try and support RUB (sell USD reserves and buying RUB) UK unsuccessfully tried to defend GBP in 1992 Also diversify currency reserves Speculators trying to predict future exchange rate (also help liquidity) Hedge funds Retail investors Banks Market Makers Market makers provide liquidity Commercial and investment banks – DB, UBS, Barcap, Citi, RBS, JPMorgan, HSBC, LEH/NOM, GS, MS (order of liquidity) FX mostly traded over-the-counter Some futures are traded on exchanges (eg. at CME) G10 FX spot bid/ask spreads are very small in most liquid crosses EUR/USD 1 or 2 pips G10 FX spot is high volume, low margin business (compared to many other assets) In EM, volumes are lower, hence spreads are wider given that it is more difficult to hedge out risk High liquidity is an attraction for investors Interbank FX brokers Interbank electronic platforms – EBS & Reuters What influences exchange rates? Fundamental factors Interest rates Higher interest rates attract overseas capital Carry trade – investors taking advantage of carry differential between two currencies Economic situation Current account GDP Inflation Unemployment Raft of other economic indicators – surveys, new auto sales etc. Terms of Trade Effects State of the market Investor sentiment – during periods of poor investor sentiment (like now) people are not prepared to take as much risks, hits currencies that are considered risky like Turkish Lira What influences exchange rates? Technical factors Momentum (trend following) and mean reversion (range trading) Positioning in currencies Charting – areas of resistance, support etc. Market will focus on different aspects at different times, sometimes totally ignoring factors. Need to adapt to changes in the market. Each trader has a different take – some look at fundamentals, others at technical factors, but most at a mixture of both. There is no “right” way to view the market. FX Options Traders typically quote implied vols for different tenors (ON, 1W, 1M etc.) ATM implied vol – what strike ATM is depends on the currency pair and tenor! 10d and 25d risk reversals – give the skewness of the smile – call & put OTM RR 25d = IV(25d call) – IV(25d put) – roughly 10d and 25d strangles – gives the curvature of the smile – call & put OTM SM 25d = (IV(25d call) + IV(25d put))/2 - ATM Can create a vol surface from these quotes to price any strike & tenor options Calculate option price using a model like Black-Scholes Rationale is that spot is very volatile, where as vols are not, so don’t need to keep updating prices Smile is not sticky, moves with spot NOT like in equities where a price is quoted by traders and we back out implied vol from price Terminology USD/JPY call = USD call / JPY put NOT USD put / JPY call Clearly a big subject! Peter Carr has good presentation that introduces FX options http://www.samsi.info/200506/fmse/workinggroup/lp/Presentations/Carr2.pdf