for the lecture - Gresham College

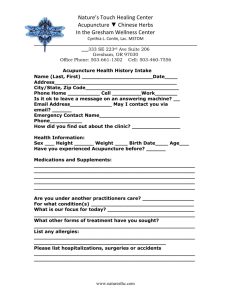

advertisement

Mercers’ School Memorial Professor of Commerce Michael Mainelli “New Learning” Liquidity: Finance In Motion Or Evaporation? Barnard’s Inn Hall Holborn London EC1N 2HH © Gresham College 2007 www.gresham.ac.uk Tel: +44 (0)20 7831-0575 Fax: +44 (0)20 7831-5208 Email : michael_mainelli@zyen.com Outline Fluidity in definition Time, value, probability and money Settled dis-equilibria Small holes Liquidity and lucidity Liquidity crises Black holes, white bubbles Trading on ice © Gresham College 2007 www.gresham.ac.uk “Get a detailed grip on the big picture.” Chao Kli Ning Fluidity In Definition “the probability that an asset can be converted into an expected amount of value within an expected amount of time” liquidity = certainty (value, time) © Gresham College 2007 www.gresham.ac.uk Who Needs Liquidity? © Gresham College 2007 www.gresham.ac.uk Caught Short (In Time) Accounts receivable turnover = total credit sales average accounts receivable Accounts payable turnover = total credit purchases average accounts payable Inventory turnover = total cost of sales average inventory Acid-test = © Gresham College 2007 www.gresham.ac.uk Current ratio = cash + securities + accounts receivable current liabilities current assets current liabilities Caught Short (In Value) © Gresham College 2007 www.gresham.ac.uk Caught Off-Guard (In All Probability) Certainty = % likelihood [value fall/rise + time fall/rise] Example: watch = [£1,000 – 50%(£500), 1 week + 50%(2 weeks)] = [£750, 2 weeks] © Gresham College 2007 www.gresham.ac.uk Liquid Measures Resilience Depth Tightness © Gresham College 2007 www.gresham.ac.uk [Source: Holl and Winn, 1995] Monnaie des Sources © Gresham College 2007 www.gresham.ac.uk [Source: http://www.bankofengland.co.uk/] Where Has All The Money Gone? © Gresham College 2007 www.gresham.ac.uk [Source: OECD] Back To Basics © Gresham College 2007 www.gresham.ac.uk [Source: http://en.wikipedia.org/wiki/Supply_and_demand] Rising Price Lifts All Boats P Demand Supply P2 P1 Q1 Q2 © Gresham College 2007 www.gresham.ac.uk Q Liquidity P’s, T’s & Q’s P Demand Supply P2 P1 Q1 Q2 © Gresham College 2007 www.gresham.ac.uk Q Not Smooth Curvature P Demand Supply P2 P1 Q1 © Gresham College 2007 www.gresham.ac.uk Q2 Q Not Continuous P Demand Supply P2 P1 Q1 © Gresham College 2007 www.gresham.ac.uk Q2 T Liquidity Clouds Demand Supply P © Gresham College 2007 www.gresham.ac.uk ‘Normal’ liquidity risk Q Predicting Price Movements Y Axis: Share Identification Code X Axis: Actual & Predicted Price Movement Bands – the length of the yellow link indicates the difference between the prediction and the actual value - the longest links represent the anomalous trades © Gresham College 2007 Z Axis: The Difference between Actual & Predicted Price Movement Bands www.gresham.ac.uk [Source: Z/Yen Group Limited, 2005] Liquidity Holes Demand Supply P © Gresham College 2007 www.gresham.ac.uk Q Small versus Large © Gresham College 2007 www.gresham.ac.uk [Source: Z/Yen Group Limited, 2002] Bull or Bear? © Gresham College 2007 www.gresham.ac.uk Dark Liquidity Pools © Gresham College 2007 www.gresham.ac.uk Liquidity or Lucidity? Price Formation Liquidity Capital at Risk © Gresham College 2007 www.gresham.ac.uk Spreads Transparency Trading Competition Regulation Exchange Competition Volatility Price Formation With Apologies To Jonathan Swift So, financiers observe, small pools suck larger pools’ liquidity; yet tinier pools drain other drops, and so on to aridity. © Gresham College 2007 www.gresham.ac.uk Liquidity Crisis 2007? “Water, water, everywhere, nor any beer to sink.” © Gresham College 2007 www.gresham.ac.uk An Historical Perspective Holy Roman Empire currency 1622 Tulips 1636 South Sea Scheme 1720 Northern Europe 1763 East India Company 1772 Emerging markets 1809-1838 Railways 1847-1873 Commodities 1890-1920 Great Crash of 1929 Bretton Woods collapse 1973 Savings & Loans 1980 © Gresham College 2007 www.gresham.ac.uk A Modern Perspective © Gresham College 2007 www.gresham.ac.uk Third World Debt 1982 Black Monday 1987 Junk Bonds 1988 Japanese Bubble 1990s US Bond Crash 1994 Mexican Crisis 1995 Asian Crisis 1997 Russian Crisis 1998 Long Term Capital Management 1998 Dotcom Crash 2000 September 11 Disruption 2001 Argentine Crisis 2002 Credit Crunch 2007 Bubble, Bubble, Toil and Trouble Hyman Minsky’s Waterfall Hedge Speculative Ponzi © Gresham College 2007 www.gresham.ac.uk Ponzi Borrowers © Gresham College 2007 www.gresham.ac.uk Black Holes and White Bubbles © Gresham College 2007 www.gresham.ac.uk Modelling Financial Black Holes P Demand Supply P2 P1 © Gresham College 2007 www.gresham.ac.uk Q Black Hole ‘Event Horizon’ Simple Really Brasil, India, Russia, China economic activity goods companies consumers markets access characteristics confidence & trust savings liquidity = certainty (value, timing) assets property credit: default rates & rating agencies © Gresham College 2007 www.gresham.ac.uk financial institutions leverage regulators equities commodities money supply Avoiding Liquidity Traps © Gresham College 2007 www.gresham.ac.uk [Source: www.moneyfiles.org] Discussion 1. 2. © Gresham College 2007 www.gresham.ac.uk Are all liquidity crises unique, or irrelevant, or useful - or are things different today? When new markets emerge, from where does the liquidity come? Liquidity: Finance In Motion Or Evaporation? Thank you! © Gresham College 2007 www.gresham.ac.uk “Get a big picture grip on the details.” Chao Kli Ning