Open

advertisement

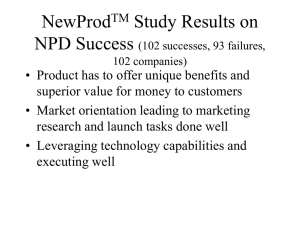

NHS Tayside NPD Workshop 10 Oct 2007 Mikko AJ Ramstedt - FPU Edward Yescombe - PUK Paul Moseley - FPU Agenda – am • • • • • Policy context NPD vs Equity Model Bidding process Evaluation methodology Preparation & Resources What is NPD about? • Securing Expertise • Maximising VfM • Stakeholder Transparency SG experience of NPD • 5 projects to date • Concept & principle deliverable • Contractual structures bankable Context for NPD development • SFT = – Cheaper funding – Recycling of profits – Stakeholder participation • Starting point - > NPD NPD development Objectives: – Optimum funding structures – Transparent incentivisation – Increased economies & efficiencies – Potential for more defined surplus stream SFT development • Framework • Scope • Timetable NPD - Next Steps • NHS Tayside Adult Mental Heath Developments Project • Review of other sectors • SFT: – Scoping -> Development -> Implementation 1. NPD v. Equity Model What are the are the areas that it is thought can be improved in the PFI equity model? What is an NPD? • Non-profit distributing organisation • Providing economic or social infrastructure • Funded by debt only • No equity dividends → capped rate of return for investors • Enhanced corporate governance 1. NPD v. Equity Model How could an NPD help to solve the equity model issues? SG basic criteria for an NPD: • At least as good value for money (VfM) as available under the equity-based model • Minimal disturbance to PFI standard documentation (e.g. same risk transfer) • Surplus revenues applied for VfM benefit of the Authority[1] • NPD’s assets remain off the balance sheet of the Authority (under FRS5) [1] N.B.: This is a generic term used for the public-sector body which signs the Project Agreement. 1. NPD v. Equity Model Most of an NPD’s “building blocks” are the same as the equity model: • Project company (SPV) • Project Agreement with the Authority • Construction and FM sub-contractors • Limited-recourse finance (i.e. no corporate finance option available) 1. NPD v. Equity Model But: • Wholly debt-funded, instead of (say) 90% senior debt and 10% equity (NPD debt funding likely to be 90% senior debt and 10% [higher-risk] junior debt) • Surplus cash flow paid to a Charity (e.g. to benefit healthcare in Tayside) • Project Company controlled by junior lenders (using a nominal shareholding which does not pay dividends—N.B.: could be CLG)—principle of private-sector management and control. (N.B. Junior debt is “stapled” to shares.) • Greater transparency and influence over day-to-day operation for the public sector through the presence and activities of the Independent and Stakeholder Directors 2. The Bidding Process • • • Substantially similar in both models. But the NPD model is unfamiliar and needs careful explanation to bidders at all stages of the procurement, including pre-OJEU. Financing issues for OJEU: – Funding / hedging competition – Refinancing / SFT issues 3. Evaluation Methodology Financing: • To get the best terms for financing, the basic principles for any project financing must be observed, e.g.: – – – • • Basic familiarity of the model: banks or bondholders do not like too much innovation Risk limitation (“A banker is a man who lends you an umbrella when it is not raining”) Cash-flow surplus → debt cover ratio Therefore most of the debt likely to be senior debt on terms substantially similar to those for standard PFI equity-based projects. Roughly 10% of the debt likely to be “junior”—higher-risk and more expensive than senior debt—new type of financing. 3. Evaluation Methodology Two possible models of junior debt: • Mezzanine debt: – – – • “Debt-like” structure Total debt cover ratio (e.g. 1.05x) Priced in mezzanine debt market Subordinated debt – – – – “Equity-like” structure No TDCR (i.e. cover 1:1) Priced akin to equity—but return is capped, unlike equity investment Used on all deals so far N.B.: Not the only possibilities, e.g. • preference shares • one tranche of debt (“blended” structure). 3. Evaluation Methodology Comparison between models / types of junior debt: Mezzanine Debt – – – Lower WACC, but cover ratio requirement may make Unitary Charge higher Payment of surplus revenues to Charity more important Direct mezzanine lenders’ controls over Project Company Subordinated debt – – – – Higher WACC, but no cover ratio may mean Unitary Charge is lower No surplus paid to charity in Base Case until “tail” period “Thin capitalisation” issue Indirect controls though board membership Junior debt rate Equity IRR Unitary charge Mezzanine Debt 10.5% n/a 84.5 Subordinated Debt 12.5% n/a 81.9 Equity Model n/a 12.5% 81.8 Senior Debt Cover Ratio Senior debt proportion Total Debt Cover Ratio 1.18 92% 1.05 1.15 92% 1.00 1.15 92% n/a NPV of Unitary Charge NPV of Surplus Net NPV Cost 1,107 52 1,055 1,073 7 1,066 1,071 n/a 1,071 6.7% 6.8% 1,001 6.4% n/a n/a 981 5.9% n/a n/a WACC 6.3% (taking payments to the Charity into Account) Post-Refinancing Net NPV Cost WACC 80% Senior Debt from PWLB Net NPV Cost WACC 3. Evaluation Methodology – Evaluating the surplus – Effect on risk transfer – Balance-sheet treatment 4. Resources, early preparation and market awareness – Templates and experience from Argyll & Bute and Falkirk schools projects – Need to prepare detailed NPD structure and documentation (including corporate constitutional documentation) to be issued to bidders as part of ITCD. It is important to realise this is not just about a few changes to the Project Agreement (which the NPD is designed to disturb as little as possible). Agenda – pm • • • • • Reference case Corporate governance Charity Project Agreement Pre OJEU & ITPD review requirements 5. Reference Case – Purpose and structure – Rights and responsibilities of junior lenders: » Board control » Management of the NPD – Subject to checks where there are conflicts of interest N.B.: Too much Authority influence can lead to public-sector classification. 5. Reference Case Refinancing – – Basic SoPC principle of 50:50 sharing But • • – Lenders have little incentive to refinance If junior loan has prepayment penalties could wipe out any gain Independent Director controls refinancing • Protection for junior lenders against a “fake” refinancing – – Agreed tendering and evaluation procedures (“Refinancing Protocol”) No further refinancing within a year 6. Corporate Governance – Corporate v. Project Agreement (“nuclear bomb”) controls – Appointment and rôles of Stakeholder and Independent Directors / size of board – Conflicts of interest – Management incentives (possibly different approaches during construction and operation) 7. Charity • Existing or specially-formed? • Cash flow to charity—annual or at the end? 8. Project Agreement - NPD variant • • Process & timetable Key changes – – – – Protection of NPD structure Unitary Charge adjustments Compensation on termination Refinancing protocols 9. Pre OJEU / ITCD requirements • SG review procedure • Timetable

![Your [NPD Department, Education Department, etc.] celebrates](http://s3.studylib.net/store/data/006999280_1-c4853890b7f91ccbdba78c778c43c36b-300x300.png)