3 Task Team of FUNDAMENTAL ACCOUNTING, Business School

advertisement

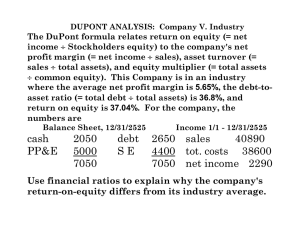

Lesson 10 Understanding and Using Financial Statements Task Team of FUNDAMENTAL ACCOUNTING School of Business, Sun Yat-sen University Outline Demand and supply of financial analysis Basic analytical procedures Analysis methods Comprehensive analysis of financial ratios The limitations of financial analysis 2 What’s wrong with accounting information? 3 Demand and supply of financial analysis Demand Investors Managers Employees Customers auditors Government/regulatory agencies Supply Internal analysts Intermediaries Financial analysts Bond rating agencies 4 Basic analytical procedures Determine objective Contrive analysis scheme Collect data Analyze data Conclude 5 Techniques of Financial Statement Analysis Horizontal analysis Comparative financial statements are presented side by side Trend analysis Vertical analysis Common-size financial statement Ratio analysis 6 Horizontal analysis X Company Comparative Balance Sheet December 31, 2004 and 2005 December Increase or Decrease 31 2004 2005 Amount Percentage Asset - - - - Liabilities and Stockholders Equity 7 Trend Analysis Comparing a company’s financial condition and performance across time Cash 1000000000 800000000 600000000 Cash 400000000 200000000 0 1999 2000 2001 Year 2002 2003 8 Vertical analysis Vertical analysis is used to show the relationship of the component parts to the total in a single statement In the vertical analysis of the balance sheet, each asset or equity item is stated as a percent of total assets; In the vertical analysis of the income statement, each item is stated as a percent of net sales; 9 A example of vertical analysis Year ended 2003 2002 2001 Net Sales 100.00 100.00 100.00 Less: Cost of goods sold 854.96 85.61 87.88 Gross profit on sales 15.01 14.39 11.40 Selling expenses 11.29 11.01 11.41 Administrative expenses 2.71 2.59 2.40 Interest expenses 0.20 0.15 -0.81 Total expenses 14.20 13.75 13.00 Income before taxes 0.81 0.64 1.40 Income taxes 0.02 0.03 0.06 Net income 0.89 0.61 1.34 10 Ratio Analysis Financial ratio analysis is the calculation and comparison of ratios which are derived from the information in a company's financial statements Profitability analysis Activity analysis Liquidity analysis Long-term debt-paying ability analysis Market Strength 11 Profitability analysis Return on total assets Return on longterm capital Return on net assets Operating margin Net income Average total assets Net income Average long-term debt+average owner’s equity Net income average stockholders’ equity Gross income Net sales 12 A compare of company profitability Return on net asset Return on total assets 0.08 0.25 0.07 0.20 0.06 0.05 0.15 Company A Company B 0.10 Company A Company B 0.04 0.03 0.02 0.05 0.01 0.00 0.00 1999 2000 2001 2002 2003 1999 2000 2001 2002 2003 13 Activity analysis Asset turnover total revenue average total assets Accounts receivable turnover Sales revenue Average accounts receivable Average collection period of accounts receivable 365(days) Accounts receivable turnover Inventory turnover Cost of goods sold Average inventory 14 A compare of company efficiency ratios Accounts receivable turnover Inventory turnover 8.00 7.00 80.00 70.00 60.00 50.00 40.00 30.00 20.00 10.00 0.00 6.00 5.00 Company A Company B Company A Company B 4.00 3.00 2.00 1.00 0.00 1999 2000 2001 2002 2003 1999 2000 2001 2002 2003 15 Liquidity analysis Current ratio Current assets Current Liabilities Quick ratio Quick assets Current liabilities Cash ratio Cash+ Short-term investment Current liabilities 16 A compare of company Liquidity ratios Quick Ratio Current Ratio 2003 2003 2002 2001 2000 0.00 1999 0.50 Company A Company B 2002 Company A Company B 2001 1.00 2000 1.50 1.40 1.20 1.00 0.80 0.60 0.40 0.20 0.00 1999 2.00 17 Long-term debt-paying ability analysis Debt-equity ratio Total liabilities Total owner’s equity Debt-to-total asset Total liabilities Total Asset Times interest earned Net income +interest expense +taxes Interest expense 18 A compare of Long-term debt-paying ability Debt-to-total assets 0.80 0.60 Company A 0.40 2003 2002 2001 2000 0.00 Company B 1999 0.20 Company A 19 Market Strength Earning per share Net income shares of common stock outstanding Priceearnings ratio Market price per share Earnings per share Dividend yield Dividend per share Market price per share 20 A compare of market strength P/E Ratio 2003 Company B 2002 Company A 2001 2000 1999 0.00 10.00 20.00 30.00 21 Dupond Analysis ROE=Net Margin X Asset Turnover X Leverage Factor Assets Owner’s equity Net income Net Sales Net income owner’s equity Sales Assets 22 Dupon analysis for five firms Firm Net Asset Margin Turnover ROA Leverage Factor ROE A 8.36% 0.56 4.65% 2.43 11.31% B 22.83% 0.12 2.80% 1.82 5.11% C 3.87% 0.86 3.34% 1.96 6.52% D 1.42% 1.36 1.94% 3.64 7.04% E 4.24% 1.12 4.74% 1.32 6.25% 23 Why ratio analysis is useful? They facilitate inter-company comparison; They downplay the impact of size and allow evaluation over time or across entities without undue concern for the effects of size difference; They serve as benchmarks for targets such as financing ratios and debt burden; They help provide an informed basis for making investment-related decisions by comparing an entity’s financial performance to another; …… 24 How is ratio analysis limited? It is restricted to information reported in the financial statements; It is based on past performance. Comparability is hampered when accounting policies are not uniform across an industry; The past may not predict the future; 25 How is ratio analysis limited? (cont) Trends and relationships must be carefully evaluated with reference to industry norms, budgets, and strategic decisions; Because of some potential problems in standard, comparison must be careful; 26 Standards of comparison for financial statement analysis Standard of comparison Potential problem Prior years’ results May include inefficiencies or reflect different operating policies than in effect in the current year. Industry averages May not be representative or desirable for this firm. Internal projections or budget May not be available; may be based on different or budgets operating policies than in effect in the current year. 27 What should an analyst keep in mind about financial analysis? An overview of all ratios can provide important information concerning the strategic decisions of a company and the nature of its business; However, accounting information can only provide so much data. An analyst must proceed with caution; 28 Summary Users of financial statements often gain a clearer picture of the economic condition of an entity by the analysis of accounting information; The analytical measures obtained from financial statements are usually expressed as ratios or percentages; 29 Summary Financial analysis techniques work best when they are used to confirm or refute other information. When using analytical tools to evaluate a company, the analyst should keep in mind the limitations of analysis 30 Discussion questions What is the advantage of using comparative statements for financial analysis rather than statements for a single date or period? What does an increase in the number of days’ sales in receivables ordinarily indicate about the credit and collection policy of the firm? Why would the dividend yield differ significantly from the rate earned on common stockholders’ equity? 31 The End of Lesson 10