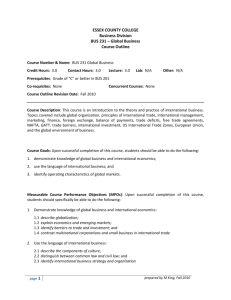

Control Policies

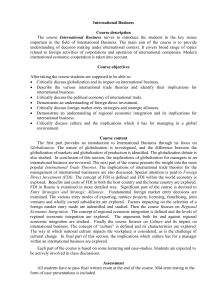

advertisement

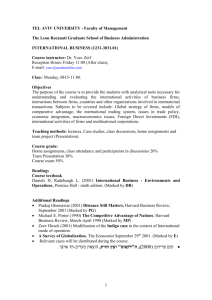

Karol I. Pelc NOTE: Some lecture materials are based on or adapted from the C. A. Bartlett and P. W. Beamish textbook “Transnational Management” McGraw-Hill 2011, and use some slides for that book. Those lectures are marked with a dual copyright note. Copyright © 2015 Karol Pelc; Copyright © 2011 McGraw-Hill Irwin 1-1 1 Lecture 1 The process of globalization Copyright © 2015 Karol Pelc; Copyright © 2011 McGraw-Hill Irwin 1-2 Initial questions: 1. What are potential advantages of business globalization ? 2. What are potential risks and negative effects of business globalization? 3. Can globalization be avoided? Why or why not? Copyright © 2015 Karol Pelc; Copyright © 2011 McGraw-Hill Irwin 1-3 • Substantial direct investment in foreign countries (not just an export business) • Active management of these offshore assets (not simply holding them as a passive financial portfolio) • Management integration of operations located in different countries 1-4 • Multiple operating environments • Diverse pattern of consumer preferences, channels, legal frameworks, etc. • Political demands and risks • Need to mesh corporate strategy with host country policies 1-5 • Global competitive game • Multiple markets, new strategic options • Currency fluctuation and exchange risk • Economic performance measured in multiple currencies • Organizational complexity and diversity • Need to manage complex demands across barriers of distance, time, language and culture 1-6 • Largest MNEs are as large as (and perhaps more influential than) mid-sized countries • Exxon Mobil value-added 2006: $112 billion • Hungary value-added 2006: $113 billion • Some industries completely dominated by MNEs, including automobiles, computers and soft drinks 1-7 • Traditional motivations • Market seeking: Fill capacity, develop scale • Resource seeking: Secure supplies, exploit factor cost differences • Emerging motivations • Competitive positioning (or “global chess”): Need global operations to pre-empt others, secure profit sanctuaries • Global scanning: Access emerging trends, new technologies and best skills worldwide 1-8 Pre-1970 Market and Resource Seeking • • • • Secure raw materials Exploit factor cost differences Protect exports Provide growth 70s/80s Competitive Positioning • • • • Match competitors Capture global scale Preempt markets Play “Global Chess” 90s/00s Global Scanning/ Learning • • • Global intelligence scan Access scarce knowledge Recruit skills, expertise 1-9 • International Capital Theories: FDI driven by return equalization, portfolio diversification • Location Theories: FDI driven by countries’ comparative advantage • Product Cycle Theory: FDI driven by firms’ management of the global product life cycle • Oligopolistic Behavior Theories: FDI driven by firms’ search for, or defense of, competitive advantage • Internalization Theory: FDI driven by organizations’ internal transaction efficiency (hierarchy vs. markets) • Eclectic Theory: FDI driven by many shifting forces 110 • Foreign countries must offer location-specific advantages • To motivate the company to invest there • Company must have strategic competencies or ownership-specific advantages • To counteract its relative unfamiliarity with foreign markets • Company must have organizational capabilities • To get better returns from leveraging strengths internally rather than through external market mechanisms such as contracts and licenses 111 • Classic internationalization process: • Incremental process of increasing commitment and understanding of foreign market (Uppsala Model) • Today many companies short-cut this process • In an Internet Age, many are even “Born Global” 112 • Export • Indirect • Direct (e.g. agent) • Controlled (e.g. sales branch) • Investment • Contractual • • • • License Franchise Management/Service Contracts Cooperation Agreements • • • • Greenfield Acquisition Joint Venture Capital Participation 113 Control over foreign activities High Wholly-owned subsidiary Franchising Joint venture (local partner) Licensing Export (agent or distributor) Low Indirect Export Low High Amount of resources committed to foreign market 114 • Multinational Perspective: Overseas markets a portfolio of local opportunities; managed as a decentralized federation • International Perspective: Leverages its domestic capabilities worldwide; managed as a coordinated federation • Global Perspective: Views world as a single unit of analysis; operations managed centrally • Transnational Perspective: Simultaneously responds to local needs, global demands, and cross-border learning opportunities; managed as an integrated network 115 High Global Integration Global Transnational International Multinational Low Low National Responsiveness High 116 • Forces for cross-border integration and coordination • Forces for national differentiation and responsiveness • Forces for worldwide innovation and learning 1-17 • Economies of Scale • Economies of Scope • Factor Costs • Increasingly Liberalized Environment for Trade • Expanding Spiral of Globalization 1-18 • Cultural differences • Consumer tastes and preferences • Ways of doing business • National infrastructure • Technical standards (e.g., voltage, TV broadcast, etc.) • Distribution channels (e.g., supermarkets vs. bazaars) • Government demands • National laws and regulations • Host country pressures and demands • Local competitors • Appeal to nationalism 1-19 MNC • Motivators • Strategic viability: global competitiveness • Operational viability: profit • Objectives • Freedom to integrate operations globally • Ability to market and ability to transfer resources freely across borders • Measures (primarily financial) • Profit • ROI • Market share Host Government • Motivators • National independence: social, economic, political • International competitiveness • Objectives • Protect national sovereignty from external influence • Capture global benefits of export markets, efficient industrial base, leading edge technology • Measures (social/economic/political) • Social cost/benefit • Political return • Industrial policy “fit” 1-20 • Increased need for rapid and coordinated worldwide innovation driven by: • Shortening product life-cycles • Increased cost of R&D • Emergence of global technology standards • Competitors’ ability to develop and diffuse innovation globally 1-21 • Strength of forces vary by industry; three typical models • Global industries (consumer electronics) • Multinational industries (branded packaged goods) • International industries (telecom) 1-22 Consumer Electronics Telecom Switching Global Integration Branded Packaged Products Cement National Responsiveness 1-23 SUMMARY 1. Multinational Enterprise (MNE) and multinational management; Influence on global economy 2. Internationalization of business: motives, means and process 3. Foreign Direct Investment (FDI): theories 4. Evolving perspectives on internationalization 5. Global and national forces in globalization process 124