sol11

advertisement

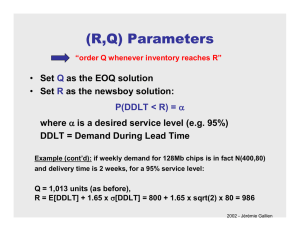

CHAPTER 11 Solution 1. MICHAEL TRACI a. Optimal order quantity using the EOQ model: EOQ 2C p A CH Where: CP = $30 (preparation cost per order) A = 30 units demand period CH = $2.00 carrying cost per period EOQ = optimal order lot size EOQ 2$3030units 30 units $2.00 b. Average cycle stock = 30 units /2 = 15 units c. 12 periods x 30 units = 360 units (annual unit demand) 360 units /30 units per order = 12 orders 12 orders x $30 = $360 ordering cost per year 15 units x $2.00 x 12 periods = $360 carrying cost per year Total = $720 per year 2. LOUIE’S LOBSTER POTS a. Here is one spreadsheet layout. The formulae for the expected number of units short differ for each value of R. Probs: .05 .15 Demand During LT 20 21 Cum. Prob. .05 .20 Pr D > DDLT .95 .80 Expected No. Short 2.90 1.95 Shortage cost for R = 20 is $72.50 .20 22 .40 .60 1.15 .30 23 .70 .30 .55 .10 24 .80 .20 .25 .15 25 .95 .05 .05 .05 26 1 0 0 Probs: .2 .4 Demand During LT 20 21 Cum. Prob. .20 .60 Pr D > DDLT .80 .40 Expected No. Short 1.50 .70 Shortage cost for R = 20 is $37.50 .2 22 .80 .20 .30 .1 23 .90 .10 .10 .1 24 1 0 0 .0 25 1 0 0 .0 26 1 0 0 b. 11-1 3. THE ICU OPTICAL CLINIC a. Demand / Month Probability 12 .10 13 .15 14 .15 15 .20 16 .20 17 .10 18 .05 19 .05 Average Monthly Demand: EOQ Expected Demand / Month 1.20 1.95 2.10 3.00 3.20 1.70 .90 .95 15.00 2$251215 35units $.25$30 b. ROP 15 *16 17 18 19 Buffer Stock = ROP - 15 = 1 Expected Numbers of Stockouts .75 .35 .15 .05 .00 Service Level .979 .990 .996 .999 1.000 *Selected ROP c. The annual cost of carrying buffer stock is $7.50 (one unit). 5. THE SELDOM SEEN RANCH a. The Z value for a .10 probability of stocking out is 1.282: Safety Stock = (1.282)(1)(1.25)(40) = 64 bales b. Order Point = 1,000 + 64 = 1,064 bales c. SL = 1-0.1= 99% d. Horace should place an order for 2,500 bales whenever the number of bales on hand goes below 1,064. 11-2