Supplementary Problems -

advertisement

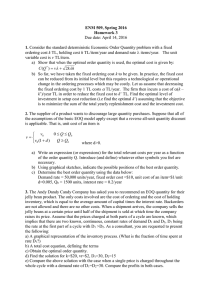

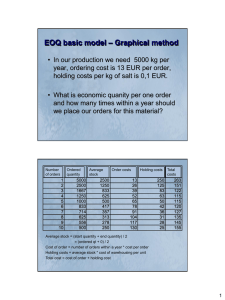

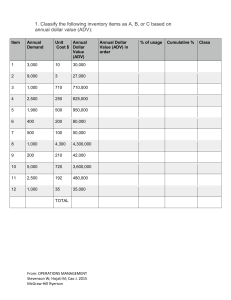

SCM 463 Waters Ch. 4 Supplementary Problems 1. Your company has the following figures: Revenue $10,000,000 Cost of Goods Sold 5,000,000 Inventory on hand 2,000,000 Purchasing Dept. Budget Orders processed Cost of insurance Borrowing rate Shrinkage Obsolescence 300,000 2,000 3% 15% 2% 12% What are your current turns, cost of ordering, and cost of holding inventory 2. Reordering cost = $200, Unit cost = $50, Holding cost = 20% (0.2 $/$/yr) , Demand = 3,000 per year. Find the EOQ. 3. Reordering cost = $60, Holding cost = 30% 0.3 $/$/yr, Demand = 500 / year. Find the EOQ. 4. In problem 2, your choices are to order 400 or 500 units at a time. How much of a change from the optimal order does each represent, and how much of a change in total costs? 5. In problem 3, your choices are to order 100 or 200 units at a time. How much of a change from the optimal order does each represent, and how much of a change in total costs? 6. The reordering cost is $300, Unit cost = $12, Holding cost = 25%, Demand = 4,000. Find the EOQ. You have to choose between ordering 500 or 1700 units at a time. Which do you choose? 7. You order 100 units at a time, and demand is 5200 units per year, (you are only open 5 days a week). What is your reorder point if the lead time is 2 days, 4 days, 6, days, 10 days? 8. Your cost of reordering is $400, holding cost is 20%, demand is 44,000 / year, and the unit cost is $40. Your supplier offers the following discount schedule: order >= 0 3,000 6,000 10,000 price 40 38 35 32 What is the optimal order quantity? 9. You are ordering stereo systems that are made by a supplier in the Far East. Each container shipped costs $1500, and holds 1,000 stereo units. Holding costs are 20% of the unit cost of $250. Demand is 20,000. How many stereos should you order at a time? 10.The product you order from the corporate DC cost $5.00, and the reorder cost is $200. Demand is 20,000 units per year. Holding cost is 10%. What is the EOQ? HQ decides that you have not been paying the full cost of transportation, and decides to add an additional cost of $0.50 per unit for shipping. Now what is your EOQ? 11.Demand for your computers is 10,000 / year. They cost you $1,500 to make, and you sell them for $1,700. The holding cost is 50%, due to high obsolescence costs. Shipments cost $10,000, because the computers are made in SE Asia and you bring them into the U.S. via air-freight. Is this a profitable product for you to carry? 12.Your office superstore currently sells 10,000 of a certain toner cartridge per year. The current price is $60. Your supplier is offering a sale price of $50. Ordering cost is $68. Holding is 23% of value. How many should you buy at the special price? Stepping back from the mathematically optimal solution, does this seem like a good business decision?