CS-18: Risk Metrics

advertisement

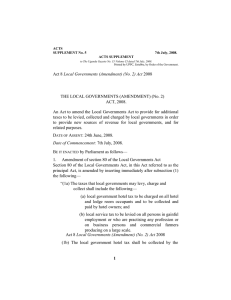

CS-19: Risk Tolerances and Limits Fred Tavan, FSA FCIA Assistant Vice President, Canada Life ERM Symposium, Washington DC July 29, 2003 1 Introduction • • • • Net Risk Uses of Exposure Limits Application types Determination of Limits 2 Net Risk • • • • Net Risk = Inherent Risk mitigated by Controls Inherent Risk = Severity * Probability Both Severity and Probability are levers Can put exposure limits on the severity and/or probability 3 Exposure Limits • RM technique of placing limits on risk exposure metrics to achieve strategic or operational objectives • Used to reduce expected cost of risk • May also be used to reduce variance of cost of risk • Can be applied in many different ways 4 Application Types • Limit cost of specific event by setting max. acceptable loss • Limit exposure to a specific risk type as a % of total risk • Limit exposure in any specific instance of a risk type • Limit exposure in contractual agreements 5 Application Types • Limit exposure by placing a cap or floor on a specific risk metric • Limit exposure through pricing by adjusting prices up or down • Limit operational risk 6 Limiting Specific Event(s) • Example: – Company should not expose itself to any loss on any one risk in an amount exceeding more than 10% of its surplus 7 Limits that vary by Mgmt. Level • Examples: – Exposure to any one risk exceeding 8% of surplus requires Board approval – Exposure to any one risk exceeding 5% of surplus requires Sr. Mgmt. approval – Exposure of any one risk exceeding 1% of surplus requires approval of Business Line Mgmt. 8 Limits on specific instance • Examples: – Company shall not acquire more than 3% of its admitted assets in investments of all kinds issued or guaranteed by a single person – $10 million acquisition limit on investment grade and $5million on high yield bonds • Limit is on management actions and not on actual exposure 9 Contractual Limits • Examples: – – – – Retention limits on life insurance Cap on disability benefits Cap on dental benefits Exclusion clauses 10 Limits on various Risk Metrics • Examples: – Limit on exposure to interest-rate risk set in terms of duration mismatch – May have separate limits for key rate duration – Limit may involve combination of duration and dollar duration 11 Limits on Product Exposure • Example: – Co. has a certain planned target risk-based capital ratio – Co.’s plan based on certain amount of capital being allocated to the GIC line – The GIC line has a minimum ROC target – If sales are better than expected then ROC target raised and vice versa 12 Limits on Operational Risk • Examples: – No more than 24 hour downtime for critical systems used in day-to-day operations – Systems can include cheque writing systems, call center, web site – Turnover of key staff limited to no more than 20% per year – No more than 5 unsigned reinsurance treaties at any one time 13 Determination of Limits • Depends on a number of factors: – – – – Are there any regulatory limits? At what level of management will limits apply? What are the company’s competencies? What is the company’s tolerance for publicly reporting large losses? – What is the purpose of setting the limit? 14 Determination of Limits (cont’d) – – – – How bad can things get? What are the available data and resources? How do limits impact capital requirements? What is the impact on operations? 15 SOA Website • Detailed paper can be found at: – http://www.soa.org/sections/rmtf/exposure_limi tations. 16