Broadband IP

advertisement

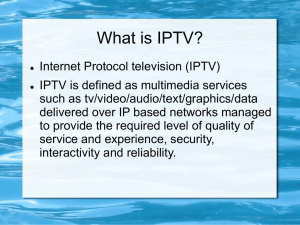

Transforming Telco to IPTV Business Models, Content Challenge, and Pay TV Competition 報告人 : 蘇瑛玟 P93747007 蔡明遠 P93747004 Agenda IPTV Technology The IPTV Proposition IPTV Economics IPTV Proposed Services New Revenue Sources Mobile TV IPTV Case Study CHT China Model Others Model Conclusion IPTV Technology 3 Forces Shaping TV’s Future Broadband IP Networks Market Opportunity Moore’s Law Market Dynamics Regulation Better Video Compression Content, Ad Models 4 Defining IPTV Accepted industry term (Internet Protocol TV) Uses IP broadband network infrastructure to deliver pay-TV services directly to TVs PCs a potential secondary target, but not a requirement Fully operator managed pay-TV service Voice over IP (VoIP) is to telephony as IPTV is to pay-TV Not a device model but a service one (monthly subscription, pay per view…) What IPTV is not TV over high-speed Internet Most countries restrict live TV over Internet Unique regulations per country Not best-effort streaming media Not “Trickle” VOD on PC or Set-Top Box (STB) Technology blurs the lines, but businesses are completely different 5 IPTV: Next Generation Television Subscription TV Services Live Media IP Network On-Demand Media Operator Access Network Operator Headend What IPTV is: Competitive TV services over managed IP networks Broadcast television All forms of on-demand Electronic program guide Connected entertainment What IPTV is not: 6 TV via STB Video streaming over the Internet Best-efforts video services Based on unproven business models High Level IPTV Network Architecture Metro CO VHE: VSO: CO: RG: VHE VSO CO Core CO VSO VSO Metro CO CO Metro CO CO CO 7 Access Network RG Video Head End Video Serving Office Central Office Residential Gateway Network Architecture Reception of content from national feed Content encoded into proper format National storage of on demand content Content is fed to regional headends Super Headend National content received from super headend Local content received and encoded Regional storage of on demand content Local advertising insertion Regional Headend Local Hub Local Hub Local Hub 8 Feeds content direct to homes Final point for local ad insertion Local storage of on demand content Full Media Value Chain Digital Copyright Control and Service Center Copyright Applying Content Producer Content Invention Copyright Register & Modify Content Processing Agency Digital Copyright Agency Content digitalize &format Content Copyrighted Copyright Control on Transfer, Circulate and Replicate Content Issuer Content Market Content packaging & Issue Digital Content Marketplace Criterion on different Content Formats and Standards Content Catalogue & Information Service Authentication & Authority when Content Consuming Security Management Information Provider Content Circulate Information Service Consuming Service Record Based on Digital Copyright Transfer and Deliver Service Consumer Content Transfer & Deliver Digital Content Exchange Center Uniform User and Dealer Management Digital Content Circulate Control and Fundamental Service Center One-Time Authentication Content consume IPTV Technology Value Chain Examples: Alcatel ANT BigBand Networks Entone Tech Harmonic Microsoft Minerva Myrio/Siemens Siemens Orca Interactive Tellabs Tandberg TV Examples: Alcatel Ericsson Lucent Marconi Siemens 10 Examples: Alcatel Ericsson Juniper Lucent Marconi Motorola Redback Networks Siemens Tellabs Examples: Amino Ericsson i3Micro Microsoft Motorola Siemens A Full Media Technical Platform (design) Producing & Management Delivery, Transfer, Consumption Service & Business Support Full Media Digital Copyright management Service Create Edit Acquire Convert I N T E G R A T I O N Management Analysis C O N T E N T Index Maintenance Storage Material digitalizing E-business Entertainment E-Directory VOD TV On Demand E-business Network Music Enforced Ad. Interactive App Interactive Education video conferencing Distance Medical EPG E-GOV Games Affairs Application G-portal M A R K E T News E-Government News,Weather Digital Broadcast Set Top Box Digital TV Content Collection Content Delivery Virtual reality Application Monitor Public Services Sports, Economics S E R V I C E s Single card pass Information Portal Streaming Media Service Platform …… Game Service Platform E X C H A N G E Edge Caching FTTB+LAN Cable Management Uniformed User Authentication Accounting Management Payment Management Shopping Booth ADSL Touch Screen Wireless Wireless Device Media Gateway Full Media Business Support Service User APANUniformed 2003,BUSAN PC Security Management System Architecture for IPTV OSS Network Headend Home Broadcast Server IP Router IP Multicast IP Unicast HTTP Application Server Operational Support System IMAP IP Router Mail Server Network Video Server IP over Fibre Database PC Home G/W IP Router STB IP Router Internet The IPTV Value Proposition 13 What’s the Buzz? Reaction ranges between two extremes: Cable is already doomed Telcos can’t do video Insufficient infrastructure Telcos will attract bundled subscribers Pay TV market is too competitive Cable architecture is inferior Service won’t be differentiated Future is IP and telcos are there first 14 Connected TV Connected Services Connected Devices Common network architecture Common back office interfaces and operations Access to personal content from multiple devices in the home Select and schedule content Connected Content and Applications Deliver the same media and applications across devices Cross-promote services in broadband bundle Integrated Experiences Reduce Churn 15 What does it mean to you? Wide Distribution Robust Protection High Quality Re-use of existing content assets Multiple on-demand options New business models Content protection with open standards Flexible rights management Connected TV experiences Windows Media high quality video Independent of number of services Scale from mobile to SD to HD 16 Why IPTV? Broadband Market Drivers Cable Financial: ROI on network upgrades Severe erosion of core telephony business: Satellite Competition Retail STB Eliminate proprietary CA Decline of lines and minutes Losses to cable, wireless, VOIP Need to grow ARPU HDTV consuming new spectrum Analog legacy Strategic shifts VOD as differentiator Increase ad revenues Regulatory: ‘All digital’ mandates Telcos Subscription TV VOD “Triple-Play” bundling Planned expansion of broadband footprint Increasing bandwidth 17 ADSL2+, VDSL, fiber IPTV Market Drivers: TELCOS Severe erosion of core telephony business: Must grow Average Revenue Per User (ARPU) Worldwide DSL Decline of lines and minutes Losses to cable, wireless, VOIP Pay-TV and VOD Need differentiated offering “Triple-Play” bundling savings Expanding broadband footprint Increasing bandwidth Major Telcos embracing IPTV, with consumer deployments underway Source: Ovum Research 18 ADSL2, ADSL2+, VDSL Momentum building in the last 6m Operators engaging vendors today IPTV Market Drivers: CABLE Financial: ROI on network upgrades Aggressive pricing DVR SD Digital, 12 Strategic shifts HDTV consuming new spectrum Analog legacy Satellite Competition Voice HSD VOD/SVOD, 4 HD Digital, 6 Regulatory: ‘All digital’ mandates VOD as differentiator Increase ad revenues Retail STB Embracing IP for VOD (backbone) Eliminate proprietary CA Unify on IP network Free, 8 Where? North America Analog, 80 19 The Value of IPTV Strategic Value: Leveraging Infrastructure & Customer Relationship High 2 4 IPTV Value added by infrastructure Video on Demand Data-sensitive ASPs Home networking IP music/radio E-commerce Low Digital TV Programming Premium Channels PPV/VOD Interactive Services Online training Online games Home video conf 1 Instant messaging Billing relationships with 3 utilities… Low High Value added by incumbents’ client relationships/brands Sources: McKinsey analysis, 2002-2005 Estimated Monthly Revenue from IPTV Services 20 TOTAL $35 $12 $8 $10 $65 Source: In-Stat/MDR 3/03 Broadband: New Opportunities Networks: Broadband IP Switched Broadcast Devices: IPTV Voice Services: Data Triple Play 21 Video Content Protection New IPTV scenarios TV-DRM, evolution of Windows Digital Rights Management (DRM) Open standards for video encryption: Kerberos, AES Windows Media Digital Rights Management Standalone licensing server Support Live and on demand scenarios Supported by major film studios and music labels Publicly license DRM to non-Windows devices Present in 100’s millions PC around the world Support for rights transfer to device CinemaNow, MovieLink, Cinenow (French), Disney, Napster 2.0 Portable Media Center Support for direct device acquisition Home devices such as STBs Smart phones 22 Rollout Challenges Acquire content (at competitive prices) Build video distribution network Hope you have enough bandwidth Get those franchise agreements lined up Capture share in a nearly saturated market 23 IPTV: Why Now? Business Model Factors Impact on Business Case Adoption of broadband 75+ million BB subscribers WW Larger addressable market Lower penetration hurdle rate Improvement in Access Technology ADSL, ADSL2+, FTTH Lower network upgrade costs Improvement in Video Compression Standard Definition Video at 1-1.5 Mbps with Windows Media 9 Lower network upgrade costs Increase customer value with more Simultaneous streams to home Reduction in CPE Cost IPTV Set-tops < $150 Lower subsidy cost per subscriber Content Owners Openness to Broadband IP Increase VOD take-rate and ARPU 24 IPTV Economics 25 IPTV Opportunity Telcos New Business Models New Audiences Expand reach Retain current customers New Applications Enter Pay TV market Compete for the Triple Play Differentiation through Video Premium subscription services New Revenue Streams Ad insertion, subscription and PPV Re-monetize content distributed to multiple channels and devices 26 WW IPTV Opportunity Asia Europe Already a growing market ~500k subscribers in Hong Kong China poised to be the largest IPTV opportunity thru 2009 Deployments and trials throughout the region FastWeb in Italy ~250k subscribers Targeting areas not accessible by satellite US Limited to small,27rural telcos today IPTV Economics Component Solutions Local/Cable Networks Service Management VOD Streaming $/Sub $/Stream Digital Video Recording System $/STB Program Guide Software Applications $/STB Security IPTV Software Integration Microsoft TV’s Solution $/Sub and/or $/STB Up front License Fees+ $/STB Up front Professional Fees 28 Increased Cost with Increase VOD/Unicast Concurrency All Included $/Sub IPTV Forecast WW IPTV Subscribers (M) 35 30 25 20 15 10 5 0 2004 2005 2006 APJ WE 2007 US ROW 2008 2009 China is the major wildcard Huge growth in 2009 Over 70% of AP subs 29 50% of WW IPTV subs Operator Landscape Today 123 Million broadband subs worldwide (June 04) 3+ million new subs per month 2005: Broadband passes dialup subs worldwide 2003: Broadband passes DTV Subscribers Worldwide 200 Million With advanced video compression, 75% of European homes capable of receiving IPTV services. Broadband Subs — Datamonitor Digital TV Subs 100 Million Source: IDC 2004 2002 2004 2006 2008 30 In 2004, 68% of broadband households in Europe capable of >3MB/sec. — Jupiter Research Integration of communication and broadcasting Broadband Internet extension Film Major - prepare Internet service Extension of Internet streaming market Saturation of broadband Internet subscription Need next step to maintain initiative Lack of killer applications Internet terminal variation increment of TV and Mobile Integration of communication and broadcasting A/V entertainment market extension Restructuring of Webcasting business Propagation of home Network, digital TV Portal – Audio/video service extension Internet video streaming service World-wide Trend Profitable Business modelling Digital broadcasting deployment Network upgrade 全球寬頻影音服務市場持續成長 03~08年全球寬頻視訊服務用戶數 03~08年全球寬頻視訊服務市場規模 37億 4千2百萬 $4,000.0 50,000,000 $3,500.0 40,000,000 $3,000.0 用 30,000,000 戶 數 20,000,000 $2,500.0 百 萬 美 元 1千萬 10,000,000 0 $2,000.0 $1,500.0 6億 $1,000.0 $500.0 2003 North America 2005(f) Europe 2007(f) Asia ROW $0.0 2003 2004 North America 2005(f) 2006(f) 2007(f) 2008(f) Europe Asis ROW 全球影音服務市場規模從2005年起開始明顯成長,03~08年CAGR達81.8%。 受到各國政策與寬頻服務業者紛紛宣示,將在05年佈建完成IP網路,預估 06~07年間,寬頻影音服務市場營收將以倍數成長,年成長率達116.9% 寬頻影音進軍家庭客廳 全球TVoD佔VOD用戶數比例 VOD 17500 全球TVoD佔VOD營收比例 TVoD 千 15000 戶 12500 10000 7500 5000 2500 0 2003 2004 2005(f) 2006(f) 2007(f) 北美、西歐與亞太為目前全球前三 2008(f) 1800 百 1600 萬 1400 美 1200 元 1000 800 600 400 200 0 其他 2003 5% 亞太 24% VOD 2004 2005(f) 2006(f) 2007(f) TVoD 2008(f) 北美 46% 大,其中西歐市場規模僅次北美, 寬頻基礎建設的加快佈建與豐富內 容將成市場發展重要助力 西歐 25% 05年TVoD over IP市場用戶分佈 以家庭娛樂為主的隨選視訊(Video on Demand;VOD),05年全球總營收預估達 5.5億美元,市場商機開啟。 受到IP網路建置完善與普及,家庭娛樂市場需求刺激使用地點由書房轉戰客廳。 電腦不再是主體,電信業者跨足廣電產業,將帶動寬頻影音應用的範疇擴大。 資料來源: In-Stat/MDR;工研院IEK-ITIS計畫整理(2005/03) Connected Devices in the Home Planned for Future Releases: Access Personal Content through TV Whole Home DVR Music Photos Home Videos Access recordings from any TV in Home Search and schedule through PC Mobile Media Centers Integrated Communications Caller ID, message notification on TV PCs Gateways Broadband IP Gaming 34 Digital TV 亞太寬頻影音市場後勢可期 亞太TVoD佔VOD用戶數比例 VOD 10000 亞太TVoD佔VOD營收比例 TVoD VOD TVoD 百 1000 萬 美 800 元 千 戶 8000 6000 600 4000 400 2000 0 200 2003 2004 0 2005(f) 2006(f) 2007(f) 2008(f) 亞太地區成為TVoD全球市場成長規 模第二高地區,僅次於西歐 亞太地區受各國政府積極佈建寬頻網 路以及ISP業者競相投入之影響,寬 頻影音服務將成未來發展重點 市場商機開啟,大陸市場將成焦點 2004 2005(f) 2006(f) 2007(f) 2008(f) 04~08 TVoD亞太地區用戶數分佈 27% 1% 19% 32% 3% 13% 15% 11% 29% 日本 資料來源:工研院IEK-ITIS計畫(2005/03) 2003 南韓 50% 大陸 台灣 其他 Market Trend and Prediction 截至2004年底,全球網路電視用戶已達190萬戶,市場收入6.42億美元 ,其中IPTV用戶數最多的兩大運營商分別是義大利的Fast Web和中國 香港的電訊盈科(PCCW)。 根據MRG的報告預測,隨著歐洲、亞洲和北美IPTV試驗、部署及技術 競爭的加劇,全球IPTV市場呈現加速成長趨勢,預計到2008年,全球 IPTV用戶將達2600萬 根據大陸廣電總局針對大陸地區大中城市所進行的調查顯示,有74%以 上的民眾願意在既有的收視費用之外,額外支付費用享受數位電視節目 。 根據IDC的預測資料顯示,2003年到2008年中國的(TV based)IPTV 用戶年複合增長率將達到245%,其中2005、2006年都將是400%的高速 增長,到2008年IPTV用戶將達到855萬(而2003年為近2萬戶) 據業界預測,到2008年,中國的(PC based)IPTV用戶總數將達到一 億,用戶人均年消費將達1000元。市場超過一千億元。 The IPTV world operators Area Vendors Services Star Time Subscribers Japan Softbank BBTV 2003 Hong Kong PCCW 2003 Taiwan Singapore Italy UK CHT SingTel Fastweb Video Networks France Telecom FreeDSL Telefonica SaskTel Now Broadband TV Big TV iTV Fastewb TV HomeChoice ≒100 thousand 440 thousand 2004 2001(Test) 2002 1999 55 thousand <50 thousand 560 thousand 17 thousand Maligne TV 2003 <20 thousand Free IPTV Telefonica TV Max Front Row 2003 2002 2002 <20 thousand 71 thousand 70 thousand France Spain Canada Source: 拓墣產業研究所整理,2005/09 IPTV Proposed Services 38 IPTV Proposed Services TV Services Entertainment/ Interactive Services Integrated Services Broadcast Video Services Gaming Integrated Telephony (i.e. TV Caller ID) Digital Video Services Gambling Integrated Internet Services (TV Email, IM, Messaging, Web browsing) Pay-Per-View Karaoke Program Guide Advertising Network-stored Video Services (VoD) Distant Learning Standard Definition Streams Security Applications High Definition Streams 39 Better TV Better Selection and Quality Better Access to Programming Better Control and New Services Standard and High Def, Live and On-Demand Multimedia Program Guide 40 Picture-in-Picture, Instant “Zapping” Media-Rich Program Guide Software based tuning Live Picture-in-Picture 41 Virtual Picture-in-Picture - Without the cost of additional hardware 42 Scalable Video on Demand 43 Scalable Video on Demand 44 Enhanced DVR 45 New Applications and Services 46 New Photo Sharing Services Order Print ^ - Sharing among PC, TV and Mobile Phones - Photo printing and47 storage services New revenue sources Member benefits (more content, convenient times) New audience revenue (relationship building, underwriting) User compensation for access to niche, premium or hard-to-find programming Assets in permanent distribution build record of community value, important for tax-based, foundation and philanthropic funding B2B revenues (rights to distribute, marketing content for derivative works) Distribution services (datacasting, load balancing, “my time” traffic) Mobile TV The Global Digital Transformation Film DVD High Definition Interactivity Online Distribution Television Consumer Devices Cell Phones Digital TV HDTV IPTV Multi-function Intelligence Networking Data Services Multimedia Intelligence Photography Music Networking/Delivery Film Digital Instant Gratification Sharing Online Surround Sound Online Distribution Albums Singles Broadband Datacasting Wireless Home Networking 52 Prospects for Mobile Video Services The number of consumer mobile data users in the US is expected to grow from 24 million (22% of subscribers) in 2003 to 43 million (36% of subscribers) by 2007. US Consumer Mobile Data Revenues U.S. lags the rest of the world in terms of mobile data usage Revenues from consumer use of mobile data were $1.3B in 2003 (2% of total service revenues) and are expected to grow to $6.6B in 2007, or 8% of service revenues. (IDC Mar/Apr 2003) Messaging (SMS, MMS, IM, email) is likely to make up majority of wireless data revenues until 2007, when Applications and Content may play a greater role. Currently, the vast majority of wireless data use is SMS The primary use of mobile Internet is to send and receive email Source: IDC, March 2004 Forecasts for mobile video services vary a great deal. Gartner is not optimistic, believing that mobile video services, hampered by technical and social factors, will not take off until 2010. (No numbers provided… Gartner, May 18, 2004) InStat is very optimistic and projects US mobile video services (such as news, sports, movie clips, etc.) to generate $5.4 billion in revenues by 2009, or 14.9% of total wireless data revenues (for both business and consumers). (InStat, Mobile Consumers Data and Multimedia Services, May 2004) Strategy Analytics forecasts revenues for mobile video content in N.A. to grow from $890,000 in 2003 to $580M in 2007. (The firm estimates that worldwide revenues from mobile video services will generate $4.6 billion by 2008.) It is our opinion, that Strategy Analytics is the more likely scenario given current US consumer demand for wireless data, which is focused on communications and still 53 growing in terms of penetration. US Data Revenues from Messaging/Content* Strategy Analytics, October 2003 *Includes both consumer and business. Mobile Video Services (continued) Mobile video market drivers (Forrester, July 2004): Increased bandwidth of wireless service networks for “DSL-type bandwidths” Advances in compression technology Increased penetration of multimedia-capable handsets Mobile video market barriers (Gartner, May 2004; Strategy Analytics, March 2004): High cost and low penetration of video-capable handsets Small mobile phone screen often inappropriate for video Likely to limit types of content (“It is hard to enjoy sports when the ball is only one pixel wide”; Gartner) Likely to limit a viewing session to 1-2 minutes Technical limitations (low frame rates, broken connections, artifacts caused by compression methods) Production costs are high (cost of professional editing of news and sports feeds to display on small screen) Cost of service, video feed or download End User Survey 2003: Interest in Value Added Services While adoption of data services in the US has been slow, the revenue and growth potential is substantial, but the potential for video services is less clear. Bandwidth and technology realities Installed base of video-enabled handsets Value proposition: compelling content at the right price Consumer demand may not be there 54 Source: Strategy Analytics, January 2004 IPDC/DVB-H Business Model B2C product groups can be divided into three categories Source: DVB-H Project Swisscom, 2005 Mobile TV Broadcasting Services B2C product groups can be optimally enhanced with additional services Source: DVB-H Project Swisscom, 2005 Mobile TV Content/ Service Categories Possible interactive services for mobile TV can be grouped into five categories Source: DVB-H Project Swisscom, 2005 Mobile TV Content/ Service Categories Source: SIEMENS mobile broadcast, 2005 Any Interest in PMP is for Movie Content If consumers are interested in purchasing a portable media player – it is for movies Three-quarters of PC users wanted to store movies Close to one-half of PC users wanted to store recorded TV programs “If you purchased a portable digital media player, what type of video(s) would you want to store and view on the device? Select all that apply.” 1. Microsoft, Portable Media Center Research Summary, October 2003. N=1433 PC users 59 Worldwide Installed Base Development Key Handheld Devices Millions Sets In Active Use Flash-Based MP3 HDD-Based MP3 & Video Sony PSP PSP Adds HDD In 2006? Source: U&S Digital Consumer Electronics Service 60 Wireless Will Compete For Content Markets Millions Sets In Active Use Worldwide 3G Mobiles* Flash-MP3 HDD-MP3/Video PSP * CDMA2000 1xEV & W-CDMA only Source: U&S Digital Consumer Electronics Service 61 Fragmented Competitive Landscape for Portable Media Players Forrester, Portable Media Players, 5/12/04 62 Mobile Broadcasting Poised For Growth Market Uptake Parallel Broadcast: DVB-H, DMB, MediaFlo Cell Broadcast, Hi Speed Download 3G Streaming: TV & ‘TV-Like’ Services 2005 2006 2007 63 2008 2009 Portable Digital Video Market is Just Beginning First digital media players introduced two years ago; next generation devices offer new features Microsoft Portable Media Center (PMC) will spawn devices from Creative Technology, iRiver, and Samsung 1 Archos Pocket Video Recorder AV400 plays back MP3, WMA or WAV and records TV shows 2 Hurdles remain before gaining mainstream appeal Ease and relatively short transfer time from DVR, Media Center PC, online movie services, etc. (Jupiter, March 2004) “It cannot cost the user more energy to get content on a portable media device than it takes to consume the content.” Needs universally adopted, flexible, easy-to-understand DRM Need at least 20 GB, 8.9cm color screen, simple UI, lightweight, decent battery life & simple mechanism to load content onto the player 1 Consumer demand may be less than music 1 Movies viewed less frequently Movies require focus, while music is background activity 1. Forrester Research, Portable Media Players, 5-12-04 2. news.com, “Archos queues up video player”, 7-1-04 64 CHT Carrier Case Studies 65 66 CHT Player: Chunghwa Telecom, Taiwan Service Name: iTV MOD (Multimedia On Demand) Service Launch Date: Trial launch in March 2004; official launch in August 2005 IPTV Access Technology: ADSL, migrating to VDSL by Alcatel and ZyXEL Equipment Vendor Partners: Alcatel’s Open Media Suite; Orca RiGHTv middleware; STBs from Acer and Ambit; STB solutions from SetaBox Technology and Hwacom 67 Competition CHT Is the Dominant Market Player CHT controls 80% of Taiwan’s broadband market Seednet, the second-largest ISP in Taiwan, launched a pay-TV service in July/August in 2004 by working with EZ Interactive Network. The service is dubbed Digital Family Center and had accumulated 7,000-8,000 subscribers at the end of September 2005. This service allows users to access the Internet via their TV sets at home to view broadband TV content The company reported to have 210,000 ADSL subscribers by the end of the third quarter in 2005, accounting to 5% of the total market share in Taiwan. Seednet has not yet allocated considerable resources into Digital Family Center; the bulk of the operations, such as applications, customer care, the provision of the STBs and content sourcing, are taken care of by its partner EZ Interactive Network. 68 Major Conglomerates and Their Affiliates in the Telecommunications and Cable-TV Markets in Taiwan 69 China Model PCCW Model Subscribers to Netvigator broadband service receive TV package at no incremental cost with 12 month commitment A La Carte channels as competitive entry strategy, migrating to “mini packs” retaining choice Consumers pay only for what they want PCCW Results – subscribers & ARPU 上海模式 大寧模式: 大寧多媒體寬頻公司、上海文廣、上海電信以及一些設 備商,使用Revenue Share。 網路建設採一線通三網,用戶接收頻寬直播使用4M, 支援H.264標準。 費用:早期用戶包月30元人民幣或更低,推廣後可能升為 60~80元人民幣,部份節目點播按次付費。 哈爾濱模式: 哈爾濱網通、上海文廣及UT斯達康。 內容提供50多個頻道、上萬小時的VOD。使用MPEG4 1.2M至1.5M,用戶頻寬要求2M。 用戶需繳納調測費200元人民幣,並由通信公司免費提供 終端接入設備,基本月使用費60元人民幣,對非市話用 戶,則加收每月20元人民幣專線使用費。 杭州模式 杭州模式同時建立廣播式的數字節目平台和交互式 的增值業務平台,將廣播電視的公共服務和市場服 務分開,公共服務為市場服務建立用戶基礎,市場 服務為公關服務獲得盈利保障。 杭州模式的特殊之處在於杭州網通本來就是杭州廣 電網改造的,杭州市數字電視網目前是有線電視傳 輸網和寬帶網雙網合一,在系統、網路、終端上已 經全面實現了雙向交互傳輸功能。用戶10M頻寬。 杭州數字電視採用有線電視加IPTV的方式,免費 贈送機頂盒,基本收視費14元不變,付費電視和視 頻點播等增值服務由市場定價。目前杭州模式的收 費有四個來源:基本收視費、付費電視費、互動點 播費和信息發布費,主要收入來自互動點播,預計 3到5年可以收回投資。 Others Model Fastweb Integrated Services 服務名稱 Fastweb 商用化時間 1999高速接取、2000年底語音與視訊影像服務 經營公司名稱 e.Biscom S.p.A(於義大利米蘭) 營運模式 提供高速接取(數據)、VoIP(語音)、VOD、 PVR、 Broadcast Video over IP等影音服務 用戶端設備有Home Access Media Gateway 與IP STB(Private IP) Streaming Video的服務以Dedicated Network的方式提 供,以MPEG-4的方式壓縮, 提供2~4Mbps頻寬 視訊服務可利用PC或TV作為接收裝置 影音服務包括有Live TV、VOD、PVR、語音 影像服務 透過DSL+FTTB提供服務 費用 Live TV與VOD則按頻道或依片依次計費 影音內容 Live TV約有120個以上的頻道 VOD約有3000多部影片 Fastweb服務提供架構圖 資料來源:Fastweb;工研院IEK-ITIS計畫整理(2005/03) BB Cable TV Services 服務名稱 BB Cable TV 商用化時 間 2003.3(02’11開始為期一個月試驗)於東京23區展開 經營公司 名稱 BB Cable Coporation(為一有線電視業者, 2001.12創立於東京,資本額兩億日圓,持有一般二 類電信業者執照) •IP-Based的服務 •使用ADSL線路 •用戶可在一般家電量販 店或上網申請即可 營運模式 透過DSL來提供Yahoo! BB會員寬頻電視服務,並以 電視為終端設備 除初裝設定費外,以收取每月每戶月租費為主,另有 付費頻道(依頻道收費)及PPV影片(依片計次收費 ) BB Cable TV服務提供方式 費用 初裝設定費9800日圓,月租費2525日圓(2000日圓/ 含21個基本頻道,與525日圓/STB租賃費及一本節目 目錄) 影音內容 基本頻道(22個頻道,2100日圓)、付費頻道(約3 個,每頻道約900日圓)、PPV影片(每片約300日圓 ) 資料來源:BB Cable TV;工研院IEK-ITIS計畫整理(2005/03) France Telecom 法國電信於2003年12月推出IPTV業務 與兩家主要的衛星運營商在LiveTV上開 展了合作 適用於點播節目 系統實施驅動因素 法國電信正在與積極創新的ISP展開激烈 競爭 需要引入新的業務來保留用戶和增加收 入 業務捆綁(話音/視頻/互聯網)成為基本 要求 業務價格:每月10-20歐元 用戶數量 2004年9月2萬,2004年12月10萬,計劃 到2006年達到100萬。 每月增加1000名新用戶,2004年秋季新 開通22個城鎮 Client reference: Disney Moviebeam Includes receiver, or a front-end antenna Receives video bits from the analog spectrum and pushes them onto a hard disk drive used for storing 100 films and additional content. A chip encodes the video for playback on the device, which allows people to rewind, fastforward and pause films like a DVD Deployed in 3 cities across the US Deliver 10 new release movies per week Always at least 100 movies to choose from No late fees All trick play features (pause, ff, rewind etc.) Network could reach over 85% of the homes in the US. (Datacast) 結論 Global Entertainment Media Expenditure Scenario Annual Consumer Spend $Bn CAGR % 10% 45% $314Bn $497Bn Mobile Content & Broadcasting Broadband/Internet Access 12% Online Content 45% Packaged Content (Video, Music Games) 5% -3% Box Office 10% Subscription TV & Radio* * Basic & Premium, excludes receiver licenses & advertising Source: U&S Digital Distribution Of Entertainment Service 81 Television Today and Tomorrow Today Tomorrow Mostly Analog All Digital Broadcast Transmission Two Way Networks Same Media for All Media is Targeted, Personal Delayed & Inferred Viewing Stats Real-Time Viewing Statistics On-Demand is Add-On On-Demand is Integral Proprietary Encryption Open Encryption Business Models Limited by CAS Flexible Business Models 82