Problem Set Ch 13 Macro Col9e

advertisement

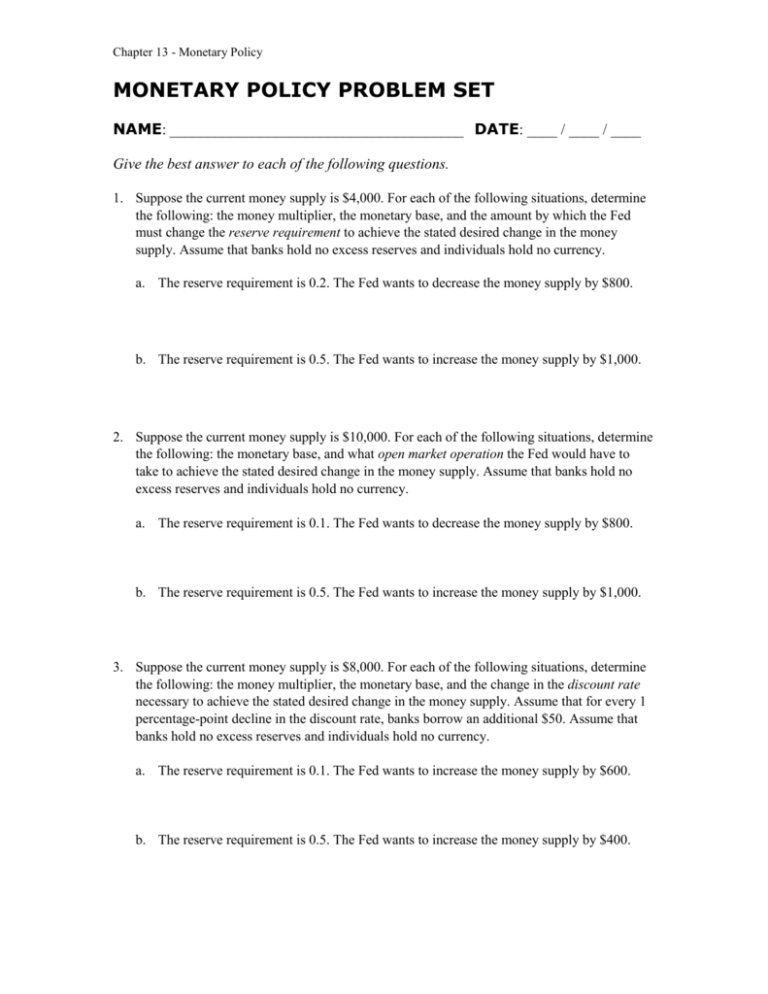

Chapter 13 - Monetary Policy MONETARY POLICY PROBLEM SET NAME: _______________________________________ DATE: ____ / ____ / ____ Give the best answer to each of the following questions. 1. Suppose the current money supply is $4,000. For each of the following situations, determine the following: the money multiplier, the monetary base, and the amount by which the Fed must change the reserve requirement to achieve the stated desired change in the money supply. Assume that banks hold no excess reserves and individuals hold no currency. a. The reserve requirement is 0.2. The Fed wants to decrease the money supply by $800. b. The reserve requirement is 0.5. The Fed wants to increase the money supply by $1,000. 2. Suppose the current money supply is $10,000. For each of the following situations, determine the following: the monetary base, and what open market operation the Fed would have to take to achieve the stated desired change in the money supply. Assume that banks hold no excess reserves and individuals hold no currency. a. The reserve requirement is 0.1. The Fed wants to decrease the money supply by $800. b. The reserve requirement is 0.5. The Fed wants to increase the money supply by $1,000. 3. Suppose the current money supply is $8,000. For each of the following situations, determine the following: the money multiplier, the monetary base, and the change in the discount rate necessary to achieve the stated desired change in the money supply. Assume that for every 1 percentage-point decline in the discount rate, banks borrow an additional $50. Assume that banks hold no excess reserves and individuals hold no currency. a. The reserve requirement is 0.1. The Fed wants to increase the money supply by $600. b. The reserve requirement is 0.5. The Fed wants to increase the money supply by $400. Chapter 13 - Monetary Policy 4. Use the Taylor Rule to predict the Fed’s target for the Federal funds rate in the following situations: a. Inflation is 3%, which is 1% above the target; output growth is 4%, which is 1% above potential. b. Inflation is 2%, which is the target rate; output growth is 4%, which is 1% above potential. c. Inflation is 1%, which is 1% below the target; output growth is 2%, which is 1% below potential. 5. Explain the effect of expansionary monetary policy in the short run in the AS/AD model. Be sure to explain why the curve(s) shift. How would your answer differ under the structural stagnation hypothesis? 6. Using the concepts of supply and demand, explain the effect of an open market sale of bonds by the Fed on the price of a bond. What happens to the interest rate associated with that bond? 7. Given each of the following situations, state whether the yield curve is inverted, standard, or flat: a. The yield on 1-year bonds is 4.0%, and the yield on 30-year bonds is 3.8%. b. The yield on 10-year bonds is 6.1%, and the yield on 20-year bonds is 9.9%. c. The yield on 3-year bonds is 3.9%, and the yield on 10-year bonds is 4.1%. d. The yield on 15-year bonds is 4.0%, and the yield on 20-year bonds is 3.3%. Chapter 13 - Monetary Policy Answers to the Problem Set The following are the correct answers to the problem set that follows on the next two pages, along with the learning objective associated with each question. The problem set is designed to be photocopied directly from this book and distributed for student use. 1. (LO1, LO2, LO3) a. Multiplier is 5. Monetary base is $800. Increase reserve requirement to 0.25. b. Multiplier is 2. Monetary base is $2,000. Decrease reserve requirement to 0.4. 2. (LO1, LO2, LO3) a. Multiplier is 10. Monetary base is $1,000. Sell $80 in bonds. b. Multiplier is 2. Monetary base is $5,000. Buy $500 in bonds. 3. (LO1, LO2, LO3) a. Multiplier is 10. Monetary base is $800. Reduce the discount rate by 1.2 percentage points. b. Multiplier is 2. Monetary base is $4,000. Reduce the discount rate by 4 percentage points. 4. (LO2, LO3, LO4) a. 6 percent; b. 4.5 percent; c. 2 percent 5. (LO1, LO2) Expansionary monetary policy reduces interest rates, which increases investment. The AD curve shifts to the right by an amount equal to the multiplier times the initial increase in investment expenditures. In the short run, the economy moves up along the SAS curve; output and the price level both increase. In the structural stagnation model, the decrease in interest rates drives up asset prices and increases a country's trade deficit. 6. (LO1, LO2, LO3) The supply curve for bonds shifts to the right by the amount of the sale. This moves the equilibrium down along the demand curve, and the price of bonds falls. Because bond prices and interest rates are inversely related, the interest rate associated with the bonds rises. 7. (LO4) a. Inverted; b. Standard; c. Standard; d. Inverted