Perceptual mapping

advertisement

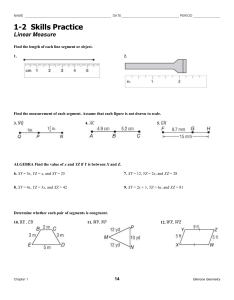

Market Segmentation Market segmentation is the subdividing of a market into distinct subsets of customers. Segments Members are different between segments but similar within. Segment–1 Segmentation Marketing Definition Differentiating your product and marketing efforts to meet the needs of different segments, that is, applying the marketing concept to market segmentation. Segment–2 Primary Characteristics of Segments Bases—characteristics that tell us why segments differ (eg, needs, preferences, decision processes). Descriptors—characteristics that help us find and reach segments. (Business markets) (Consumer markets) Industry Size Location Organizational structure Age/Income Education Profession Life styles Media habits Segment–3 A Two-Stage Approach in Business Markets Macro-Segments: First stage/rough cut Industry/application Firm size Micro-Segments: Second-stage/fine cut Different customer needs, wants, values within macrosegment Segment–4 Relevant Segmentation Descriptor Variable A: Climatic Region 1. Snow Belt 2. Moderate Belt 3. Sun Belt Fraction of Customers Segment 1 0 Segment 2 Segment 3 100% Likelihood of Purchasing Solar Water Heater (a) Segment–5 Irrelevant Segmentation Descriptor Variable B: Education 1. Low Education 2. Moderate Education 3. High Education Fraction of Customers Segment 1 Segment 2 Segment 3 0 100% Likelihood of Purchasing Solar Water Heater (b) Segment–6 Variables to Segment and Describe Markets Consumer Industrial Segmentation Bases Needs, wants benefits, solutions to problems, usage situation, usage rate. Needs, wants benefits, solutions to problems, usage situation, usage rate, size*, industrial*. Descriptors Demographics Age, income, marital status, family type & size, gender, social class, etc. Lifestyle, values, & personality characteristics. Use occasions, usage level, complementary & substitute products used, brand loyalty, etc. Individual or group (family) choice, low or high involvement purchase, attitudes and knowledge about product class, price sensitivity, etc. Level of use, types of media used, times of use, etc. Industry, size, location, current supplier(s), technology utilization, etc. Personality characteristics of decision makers. Use occasions, usage level, complementary & substitute products used, brand loyalty, order size, applications, etc. Formalization of purchasing procedures, size & characteristics of decision making group, use of outside consultants, purchasing criteria, (de)centralizing buying, price sensitivity, switching costs, etc. Level of use, types of media used, time of use, patronage at trade shows, receptivity of sales people, etc. Psychographics Behavior Decision Making Media Patterns Segment–7 Segmentation in Action A Marriott Hotel used to be a Marriott Hotel: An upscale hotel catering to business people, pleasure seekers and international and group travelers. Today, besides the Marriott Hotels (the company’s major business), there are Marriott Suites, Residence Inns, Courtyards by Marriott and Fairfield Inns—each serving a smaller, targeted segment of the market. —Lenneman and Stanton, “Mining for Niches,” Business Horizons. Segment–8 Segmentation in Action We segment our customers by letter volume, by postage volume, by the type of equipment they use. Then we segment on whether they buy or lease equipment. Based on this knowledge, we target our marketing messages, fine tune our sales tactics, learn which benefits appeal to which customers and zero in on key decision makers at a company. —Kathleen Synnot, VP, Worldwide Marketing Mailing Systems Division, Pitney Bowes, Inc. [quoted in Marketing Masters (Walden and Lawler)] Segment–9 Customers’ Diverse Needs Require Diverse Channels Kodak increases customer contact and support with a three tiered distribution system. . . . Business Imaging Division created three avenues for marketing microfilm, supplies and imaging systems and software: direct sales reps (for more complex systems); brokers and distributors (for film sales and delivery); Components Marketing Division (to sell to system integrators and VARs). —Business Marketing Segment–10 Ad in London Newspapers, 1900 Men wanted for hazardous journey. Small wages, bitter cold, long months of complete darkness, constant danger, safe return doubtful. Honor and recognition in case of success. —Ernest Shackleton, Arctic Explorer Did it work? Segment–11 Segmentation If you’re not thinking segments, you’re not thinking. To think segments means you have to think about what drives customers, customer groups, and the choices that are or might be available to them. —Levitt, Marketing Imagination Segment–12 Segmentation Marketing Implies a “Market” A market consists of all the potential customers sharing a particular need or want who might be willing and able to engage in exchange to satisfy that need or want. —Kotler, Marketing Management Segment–13 Market Definition Customer-Need Set 1 (Market 1) Product 1 Technology A Customer-Need Set 2 (Market 2) Technology B Common customer needs define a market not a product. Segment–14 Implications 1. Segmentation defines common customer needs. 2. Those common needs may be satisfied by similar or dissimilar technologies or have different solutions. Ex: Customer dissatisfaction at long delays at supermarket checkout. Solution 1: Faster UPC scanner systems. Solution 2: Entertainment/Sales systems on checkout lines. Note: Total solution defines (competitive) market, not product or technology. Segment–15 Market Definition Approaches Customer-Behavior: Demand cross elasticity Brand/product switching Perception/Judgment: Engineering/technological substitution Customer judgments/ perceptual mapping Segment–16 Why is Market Definition Important? Strategy (What to focus on). Resource allocation (How much/where/when?). Feedback/performance measurement (How well are we doing? How can we learn from our actions?). Segment–17 Electric Typewriter Market 1980 1981 1982 1983 1984 1985 A (Us) 403,027 495,192 548,905 550,351 541,388 515,000 B 369,916 388,520 349,396 323,005 342,197 297,000 Other 367,057 324,010 343,885 370,374 202,495 129,070 Total 1,140,000 1,207,722 1,242,186 1,243,730 1,086,080 941,070 Shipments Market Shares (%) A (Us) 35.4 41.0 44.2 44.2 49.8 54.7 B 32.4 32.2 28.1 26.0 31.5 31.6 Other 32.2 26.8 27.7 29.8 18.6 13.7 Segment–18 Word Processor Market 1980 1981 1982 1983 1984 1985 A (Us) 403,027 495,192 548,905 550,351 541,388 515,000 B 369,916 388,520 349,396 323,005 342,197 297,000 Other Electric Electronic Word 367,057 324,010 343,885 370,374 202,495 129,070 60,040 112,220 209,800 392,352 733,699 1,372,016 1,200,040 1,319,942 1,451,986 1,636,082 1,819,778 2,313,086 Shipments Processors Total Market Shares (%) A (Us) 33.6 37.5 37.8 33.6 29.8 22.3 B 30.8 29.4 24.1 19.7 18.8 12.8 Other Electric Electronic Word Processors 30.6 24.5 23.7 22.6 11.1 5.6 5.0 8.5 14.4 24.0 40.3 59.3 Segment–19 Market Definition by Switching Behavior Current Purchase Occasion Coke Diet Coke Coke 53% Last Diet Coke Purchase Pepsi Occasion Diet Pepsi Sprite Diet Sprite Pepsi Diet Pepsi Sprite Diet Sprite Total 9% 27% 4% 5% 2% 100% 12% 61% 4% 15% 2% 5% 100% 24% 3% 58% 9% 5% 1% 100% 4% 14% 11% 63% 2% 6% 100% 21% 2% 17% 3% 52% 6% 100% 2% 15% 2% 12% 7% 61% 100% Segment–20 STP as Business Strategy Segmentation Identify segmentation bases and segment the market. Develop profiles of resulting segments. Targeting Evaluate attractiveness of each segment. Select target segments. Positioning Identify possible positioning concepts for each target segment. Select, develop, and communicate the chosen concept. … to create and claim value Segment–21 How STP Adds Value to a Firm Segmentation Identify segments Targeting Select segments Positioning Create competitive advantage Marketing resources are focused to better meet customers needs and deliver more value to them Customers develop preference for brands that better meet their needs and deliver more value Customers become brand/supplier loyal, repeat purchase, communicate favorable experiences Brand/supplier loyalty leads to increased market share and creates a barrier to competition Fewer marketing resources needed over time to maintain share due to brand or supplier loyalty Profitability (value to the firm) increases Segment–22 STPing the Market for Eggs Segments: Disinterested consumers Casual Egg Users Health conscious consumers Enthusiastic users Profiles: Beliefs Attitudes Lifestyles Health/Nutrition consciousness Media habits Consumption habits Demographics —Frank and Phillips, Agribusiness, July 1990 Segment–23 Targeting and Positioning Strategy Casual Users Health Conscious Consumers Positioning Convenient and useful in many situations. Ideal and natural food, good for the family. Traditional food with many applications. Very convenient, good for the family. Copy Visuals Informal settings. Health-oriented personality or situation. Larger family setting. Major meal, possibly with guests. Copy Tonality Easy pace, relaxed atmospher. Fresh, clean setting, very natural. Reinforcing, emphasis on benefits and wide use. Promotions Reminders at checkout, egg display, or dairy. Matter-of-fact information on the nutritional value and health attributes of eggs in recipes and leaflets. Simple reminders to buy eggs. Enthusiastic Users Segment–24 Overview of Marketing Engineering Methods for STP Clustering and discriminant analysis (PDA2001 exercise) Choice-based segmentation (ABB Electric) Perceptual mapping (G20 exercise) Segment–25 Segmentation (for Carpet Fibers) Perceptions/Ratings for one respondent: Customer Values Strength (Importance) A,B,C,D: Location of segment centers. Typical members: A: schools B: light commercial C: indoor/outdoor carpeting D: health clubs .. . . .A. .. .. . B. . .. .. . . .. . . . . . D. . . ... .... . C. . .. . .. . .. . . . . Distance between segments C and D Water Resistance (Importance) Segment–26 Targeting Segment(s) to serve Strength (Importance) .. . . . .... . . . .. ... . .. . . . . .. ... . .. . . . . .. ... . .. . . Water Resistance (Importance) Segment–27 Positioning Product Positioning .. . Comp 1 Comp 2 Strength (Importance) . . .. ... . .. . . Us . . .. ... . .. . . . . .. ... . .. . . Water Resistance (Importance) Segment–28 A Note on Positioning Positioning involves designing an offering so that the target segment members perceive it in a distinct and valued way relative to competitors. Three ways to position an offering: 1. Unique (“Only product/service with XXX”) 2. Difference (“More than twice the [feature] vs. [competitor]”) 3. Similarities (“Same functionality as [competitor]; lower price”) What are you telling your targeted segments? Segment–29 Steps in a Segmentation Study Articulate a strategic rationale for segmentation (ie, why are we segmenting this market?). Select a set of needs-based segmentation variables most useful for achieving the strategic goals. Select a cluster analysis procedure for aggregating (or disaggregating customers) into segments. Group customers into a defined number of different segments. Choose the segments that will best serve the firm’s strategy, given its capabilities and the likely reactions of competitors. Segment–30 Total Customer Value = Functional Value Price/Performance (What does this product do for me?) + Supplier/Service Value Advertising Selling Service Efforts What does the product mean to me? (What is the insurance? service? psychological? value of the product or supplier?) Segment–31 Customer Needs and Customer Value Measurement Customer Needs and Buying Process Behaviors Ignore Present State Postpone Functional Perceived and Economic Needs and Psychological Needs Desired State Engage in Purchase Process •Search for options •Evaluate options •Choose option •Purchase Option •Use Option Motivation Customer Value Measurement Approaches Objective Measures of Value Perceptual Measures of Value Behavioral Measures of Value Customer Value Assessment Procedures Customer Value Attitude-Based Direct Questions Unconstrainted • Focus groups • Direct survey questions • Importance and attitude ratings • Rule-based system/AI/expert systems Behavior-Based • Choice models • Neural networks • Discriminant analysis Inferential/Value Based • Internal engineering assessment • Indirect survey questions • Field value-in-use assessment Indirect/(Decompositional Methods) • Conjoint analysis • Preference Regression Constrained/Compositional Methods • Multiattribute value analysis • Benchmarking Segment–33 Segmentation: Methods Overview Factor analysis (to reduce data before cluster analysis). Cluster analysis to form segments. Discriminant analysis to describe segments. Segment–34 Cluster Analysis for Segmenting Markets Define a measure to assess the similarity of customers on the basis of their needs. Group customers with similar needs. The software uses the “Ward’s minimum variance criterion” and, as an option, the K-Means algorithm for doing this. Select the number of segments using numeric and strategic criteria, and your judgment. Profile the needs of the selected segments (e.g., using cluster means). Segment–35 Cluster Analysis Issues Defining a measure of similarity (or distance) between segments. Identifying “outliers.” Selecting a clustering procedure Hierarchical clustering (e.g., Single linkage, average linkage, and minimum variance methods) Partitioning methods (e.g., K-Means) Cluster profiling Univariate analysis Multiple discriminant analysis Segment–36 Doing Cluster Analysis a = distance from member to cluster center b = distance from I to III • Dimension 2 • • • • Perceptions or ratings data from one respondent III b • I • • • a • • • II Dimension 1 Segment–37 Single Linkage Cluster Example Distance Matrix Co#1 Co#2 Co#3 Co#4 Co#5 0.00 1.49 3.42 1.81 5.05 0.00 2.29 1.99 4.82 0.00 1.48 4.94 0.00 4.83 0.00 Company #1 Company #2 Company #3 Company #4 Company #5 Resulting Dendogram 1 2 Company 3 4 5 1 2 3 Distance 4 5 Segment–38 Ward’s Minimum Variance Agglomerative Clustering Procedure First Stage: A = 2 Second Stage: Third Stage: Fourth Stage: Fifth Stage: B = AB = 5 C = 9 4.5 BD = 12.5 AC = 24.5 BE = 50.0 AD = 32.0 CD = 0.5 AE = 84.5 CE = 18.0 BC = DE = 12.5 8.0 CDA = 38.0 CDB = 14.0 AE = 85.0 BE = 50.5 ABCD = 41.0 CDE = 20.66 ABE= 93.17 D = 10 AB = E = 15 5.0 CDE = 25.18 ABCDE = 98.8 Segment–39 Ward’s Minimum Variance Agglomerative Clustering Procedure 98.80 25.18 5.00 0.50 A B C D E Segment–40 Interpreting Cluster Analysis Results Select the appropriate number of clusters: Are the bases variables highly correlated? (Should we reduce the data through factor analysis before clustering?) Are the clusters separated well from each other? Should we combine or separate the clusters? Can you come up with descriptive names for each cluster (eg, professionals, techno-savvy, etc.)? Segment the market independently of your ability to reach the segments (ie, separately evaluate segmentation and discriminant analysis results). Segment–41 Profiling Clusters Two Cluster Solution for PC Data: Need-Based Variables 1 Design Means of Variables 0 Business –1 size power office use LAN color storage wide periph. budget needs connect. Segment–42 Which Segments to Serve? —Segment Attractiveness Criteria Criterion I. Size and Growth 1. Size 2. Growth Examples of Considerations • Market potential, current market penetration • Past growth forecasts of technology change II. Structural Characteristics 3. Competition 4. Segment saturation 5. Protectability 6. Environmental risk III. Product-Market Fit 7. Fit 8. Relationships with segments 9. Profitability • Barriers to entry, barriers to exit, position of competitors, ability to retaliate • Gaps in the market • Patentability of products, barriers to entry • Economic, political, and technological change • Coherence with company’s strengths and image • Synergy, cost interactions, image transfers, cannibalization • Entry costs, margin levels, return on investment Segment–43 Selecting Segments to Serve E Strong Firm’s Competitive Position B Medium D A C Weak Low Average High Segment Attractiveness Segment–44 Discriminant Analysis for Describing Market Segments Identify a set of “observable” variables that helps you to understand how to reach and serve the needs of selected clusters. Use discriminant analysis to identify underlying dimensions (axes) that maximally differentiate between the selected clusters. Segment–45 Two-Group Discriminant Analysis Price Sensitivity X-segment x = high propensity to buy o = low propensity to buy XXOXOOO XXXOXXOOOO XXXXOOOXOOO XXOXXOXOOOO XXOXOOOOOOO Need for Data Storage O-segment Segment–46 Interpreting Discriminant Analysis Results What proportion of the total variance in the descriptor data is explained by the statistically significant discriminant axes? Does the model have good predictability (“hit rate”) in each cluster? Can you identify good descriptors to find differences between clusters? (Examine correlations between discriminant axes and each descriptor variable). Segment–47 Behavior-Based Segmentation Traditional segmentation (eg, demographic, psychographic) Needs-based segmentation Behavior-based segmentation (choice models) Segment–48 Choice Models 1. Observe choice: (Buy/not buy => direct marketers Brand bought => packaged goods, ABB) 2. Capture related data: demographics attitudes/perceptions market conditions (price, promotion, etc.) 3. Link 1 to 2 via “choice model” => model reveals importance weights of characteristics Segment–49 Choice Models vs Surveys With standard survey methods . . . preference/ choice predict importance weights observe/ask perceptions observe/ask But with choice models . . . choice observe importance weights infer perceptions observe/ask Segment–50 (ABB) Behavior-Based Segmentation Model Stage 1: Screen products using key attributes to identify the “consideration set of suppliers” for each type of customer. Stage 2: Assume that customers (of each type) will choose suppliers to maximize their utility via a random utility model. Uij = Vij + eij where: Uij = Utility that customer i has for supplier j’s product. Vij = Deterministic component of utility that is a function of product and supplier attributes. eij = An error term that reflects the non-deterministic component of utility. Segment–51 Attributes in ABB’s Choice-Segmentation Model Invoice price Energy losses Overall product quality Availability of spare parts Clarity of bid document Knowledgeable salespeople Maintenance requirement Ease of installation Warranty Segment–52 Specification of the Deterministic Component of Utility Vij = Wk bijk k where: i = an index to represent customers, j is an index to represent suppliers, and k is an index to represent attributes. bijk = i’s perception of attribute k for supplier j. wk = estimated coefficient to represent the impact of bijk on the utility realized for attribute k of supplier j for customer i. Segment–53 A Key Result from this Specification: The Multinomial Logit (MNL) Model If customer’s past choices are assumed to reflect the principle of utility maximization and the error (eij) has a specific form called double exponential, then: ^ eVij pij = –––––– ^ Vik e k ^ where: pij = probability that customer i chooses supplier j. Vij = estimated value of utility (ie, based on estimates of bijk) obtained from maximum likelihood estimation. Segment–54 What Does This Result Imply? Interval-level utility measurements are good enough. That is: ^ eVij ^ eVij + a pij = –––––– = –––––– ^ ^ Vik Vik + a e e k k The marginal impact of an attribute is highest when the probability of choosing an option j is 0.5. Segment–55 What Does This Result Imply? (cont’d) dPil wk Pil* (1 Pil* ) dbijk Marginal Impact of an Attribute on the Probability of Choosing an Option 0.5 Probability of Choosing the Option Segment–56 Applying the MNL Model in Segmentation Studies Key idea: Segment on the basis of probability of choice— 1. Loyal to us 2. Loyal to competitor 3. Switchables: loseable/winnable customers Segment–57 Switchability Segmentation Loyal to Us Losable Winnable Customers Loyal to Competitor (business to gain) Current Product-Market by Switchability (ABB Procedure) Questions: Where should your marketing efforts be focused? How can you segment the market this way? Segment–58 Using Choice-Based Segmentation for Database Marketing A Customer Purchase Probability B Average Purchase Volume C Margin D Customer Profitability =ABC 1 30% $31.00 0.70 $6.51 2 2% $143.00 0.60 $1.72 3 10% $54.00 0.67 $3.62 4 5% $88.00 0.62 $2.73 5 60% $20.00 0.58 $6.96 6 22% $60.00 0.47 $6.20 7 11% $77.00 0.38 $3.22 8 13% $39.00 0.66 $3.35 9 1% $184.00 0.56 $1.03 10 4% $72.00 0.65 $1.87 Segment–59 Managerial Uses of Segmentation Analysis Select attractive segments for focused effort (Can use models such as Analytic Hierarchy Process or GE Planning Matrix). Develop a marketing plan (4P’s and positioning) to target selected segments. In consumer markets, we typically rely on advertising and channel members to selectively reach targeted segments. In business markets, we use sales force and direct marketing. You can use the results from the discriminant analysis to assign new customers to one of the segments. Segment–60 Checklist for Segmentation Studies Is it values, needs, or choice-based? Whose values and needs? Is it a projectable sample? Is the study valid? (Does it use multiple methods and multiple measures) Are the segments stable? Does the study answer important marketing questions (product design, positioning, channel selection, sales force strategy, sales forecasting) Are segmentation results linked to databases? Is this a one-time study or is it a part of a long-term program? Segment–61 Concluding Remarks In summary, Use needs variables to segment markets. Select segments taking into account both the attractiveness of segments and the strengths of the firm. Use descriptor variables to develop a marketing plan to reach and serve chosen segments. Develop mechanisms to implement the segmentation strategy on a routine basis (one way to do this is through information technology). Segment–62 Choosing a Value Assessment Method Criterion Amount of customer information needed Number of customers Good in dynamic/ changing markets? Past purchase data available? Analysis time frame Cost Value Based Method Behavior Compositional or Based Decompositional Unconstrained High Low Medium Low Low Yes High No Medium+ Partly* Any Partly* Needed Medium Medium Not necessary Long/Medium High Not necessary Short Low Medium No Moderate High Yes Moderate Low No Low Not necessary Long Very high/ respondent Insight Very high Appropriate for lead users? Yes Predictive of behavior? High * If customers can reliably report how they will behave after change. Segment–63 Related Models Described in the Marketing Engineering Book To develop “needs” variables Conjoint Analysis (Chapter 7) Other segmentation methods Preference-based segmentation (PREFMAP in Chapter 4) To help evaluate and select segments Analytic Hierarchy Process (Chapter 6) GE Planning Matrix (Chapter 6) Segment–64