BSB7302 International Finance

advertisement

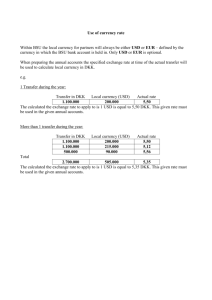

BSB7302 International Finance Group project Group members Course code Class number Semester Tutor name Fadhel AlMastoor (201100180) Mustafa Hasan (201102031) Hussain Ali (201100230) BSB7302 W01 Semester 2 (2014-2015) Latifa M. Alfadhel BSB7302 - International Finance Group report Table of Contents 1.0 Executive summary ................................................................................................................................ 3 2.0 Introduction ............................................................................................................................................ 3 3.0 Outlook and research ............................................................................................................................. 4 3.1 Factors that influence currency determination .................................................................................. 4 3.2 Currencies overview............................................................................................................................ 4 3.3 Currencies forecast ............................................................................................................................. 6 3.4 Technical analysis ................................................................................................................................ 7 3.5 Currencies correlation......................................................................................................................... 7 4.0 Hedging strategy .................................................................................................................................... 8 4.1 Investor's profile ................................................................................................................................. 8 4.2 Investment-strategy goals .................................................................................................................. 8 4.3 Investment-strategy time-line ............................................................................................................ 8 4.4 Choosing a currency pair................................................................................................................... 11 4.5 Reasoning for Choosing the forward contract for 31/3, 11/4, 12/5, 25/5 and 1/6 .......................... 11 4.6 Reasoning for choosing to deposit the amount available ................................................................ 12 5.0 Evaluation ............................................................................................................................................. 12 6.0 Suggestions ........................................................................................................................................... 21 7.0 Conclusion ............................................................................................................................................ 22 8.0 References ............................................................................................................................................ 23 9.0 Appendices ........................................................................................................................................... 25 2|Page BSB7302 - International Finance Group report 1.0 Executive summary: In the outlook and research section of the report there will be a discussion about forecasted information about the currencies expected movement in future and an overview about each currency used in the report which are: USD, GBP, JPY, KWD and EUR. Factors that influence the determination of currencies are discussed in the beginning of the section. Added to that, a technical analysis was conducted in order to use historical information to predict the future of currencies. In our investment strategy we have decided to follow a simple and safe plan of hedging and depositing our money, which correlates with our goals and plans of protecting our investment and try making profit if possible. In order to hedge our position we have entered into five forward contracts in the transactions dates which were the safest and cheapest choices for our plan; and for us to make profit we have used the spot market to benefit from and arbitrage opportunity at the beginning, and then we have deposited the amount which will be used in the forward contracts as well the amount which will not be used in the transactions in order to gain the most possible profit. The evaluation section contains types of hedging strategies used such as Arbitrage opportunity, Forward Contract, Money Market Deposit and the calculation methods used for calculating the profit amount from each transaction. It also includes a brief explanation about each hedging strategy used and the holding period at the end of finalizing all the transactions made, which was converted to USD to determine the final amount in the base currency as requested. The final section of the report includes some suggestions that can be taken in mind to improve the investment strategy proposed in this report and to assure making the largest amounts of profit as possible. The suggestions are mainly about: investment amount, currencies correlation, and risk preference. 2.0 Introduction: This report was requested by Blue Sea Cars ltd. to be submitted in the board meeting, the purpose of this report is to propose an investing strategy that will allow the company to enter currency derivatives in order to hedge its position in the foreign exchange market. The report is divided into the following sections: hedging strategy, Outlook and research about currencies' movement and technical analysis, evaluation of the methods used provided with calculations and suggestions that can be took into considerations to improve the investing strategy. 3|Page BSB7302 - International Finance Group report 3.0 Outlook and research: 3.1 Factors that influence currency determination: There are many factors that can affect the price of a currency and determine it in the exchange market; it can be summarized in 7main factors which are: (1)Inflation rates: which means that the lower the inflation rate in the country the higher the value of its currency; hence currencies with high inflation rates tend to have lower values. (2)Interest rates: Investors tend to invest in countries with lower interest rates which, it will eventually lead to the appreciation of that country's currency against other currencies in the foreign exchange market. (3)Public debt: If the public debt of country is relatively high, investors will tend not to invest in this country and search for a better one to invest in which will lead to the devaluation of this currency and vice versa. Therefore, the lower the public debt of a country the higher value it's currency going to be. (4)Terms of trade: These terms can affect a country's currency in the way that if the total exports is higher than the total imports it will lead to increasing the country's currency against other currencies in the exchange market while on the other hand if the total imports is more than the total exports it will lead to the devaluation of the country's currency. (5)Economic performance and political stability: It plays a major role in determining a currency's value for the reason that the better the economic performance and stable political situation of a country it will encourage investors to place their money in the country which eventually will lead to an increased currency value. (6) Change in competitiveness: If one country has more attractive and competitive goods than other countries, it will have a direct positive impact on its exchange rate due to the increased demand for the currency in the exchange market. (7) Intervention from the government: Some governments tend to influence the value of their countries’ currencies. For example if the Chinese government pursues to retain its currency undervalued, they can buy assets in US Dollar which will directly increase the value of the Dollar against the Japanese Yen (Pettinger, 2013). 3.2 Currencies overview: British Pound Sterling (Sign: ₤, Code: GBP): Its known as the pound sterling which is being used as the official currency of the United kingdom and the 4th most traded currency in the foreign exchange market. GBP is subdivided into 100 4|Page BSB7302 - International Finance Group report pence. Nevertheless, the pound sterling is considered to be the world's oldest currency which had been in use since its inception. Euro (Sign: €, Code: EUR): Euro is the official currency of 19 countries of the European union which consist of a total of 28 countries. These countries are: Spain, Slovenia, Slovakia, Portugal, Netherlands, Malta, Luxembourg, Lithuania, Latvia, Italy, Ireland, Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, and Greece. It was introduced back in 1999; to replace the European Currency Unit (ECU). The currency is being managed by the European central bank that is based in Frankfurt (ECB). Kuwaiti Dinar (Sign: دينار, Code: KWD): KWD is the currency of Kuwait, it was first introduced back in 1961 to replace the Indian Rupee. Kuwaiti dinar is the highest valued currency in the world. It used to be pegged to the USD same as the other GCC countries but in 2007 Kuwait ended the Dollar peg and switched to a basket of currencies which was the first such move done by a Middle Eastern country. Right after Kuwait ended the peg with the United States, its currency rose up by 0.4% (Sharif and Brown, 2008). Japanese Yen (Sign: ¥, Code: JPY): Japanese Yen is the official currency of Japan, according to foreign market exchange statistics its considered to be the third most traded currency. Each Yen is subdivided into 100 Sen. From 1949 and until 1971, the Japanese Yen was equal to 1 USD until the exchange rate became floating later on in 1973 (Currencyinformation.org, n.d). United State Dollar (Sign: $, Code: USD): It's also referred to as the American Dollar which is the official currency of the United States of America and its territories. The Dollar is subdivided into 100 cents. The early dollars issued didn't exhibit the faces of presidents on them. Presently, the US Dollar is the most traded currency in the foreign exchange markets (Currencyguide.eu, n.d). Why do these currencies move against each other? Currencies around the world tend to move against each other as a result of the inconstant demand for the currencies; if the demand of a country's currency is high then its value will appreciate against the other currencies in the foreign exchange market. For example if the US Dollar became more attractive to investors and competitive this will cause the exchange value of the US Dollar to increase 5|Page BSB7302 - International Finance Group report due to its competitiveness. In more depth, any increase some country's currency will be balanced by a decrease in the foreign exchange market. 3.3 Currencies forecast: For the currencies forecast, technical analysis and correlation ratio the US Dollar had been set as a base currency while GBP,KWD,EUR and JPY are set as the quoted currency. Currency Forecast At the mean time the pound is trading at high levels against the USD and EURO. However its forecasted that in two weeks from now (as of USD/GBP 28th April) that the GBP is growing to decrease because of the UK General election; the average decrease in the pound during election's period in the past had been around 3% (ForexCrunch.com, 2015). According to major banks forecasts, the EUR/USD currency pair is going to decrease in the second, third and fourth quarter of 2015, the USD/EUR list of banks included 7 of the largest financial institutions which are: Barclays, HSBC, Lloyds, RBS, Morgan Stanley, Nomura, and Scotiabank; If the EUR/USD pair is going to decrease it means that the USD/EUR is going to increase as a result Ilya (Spivak, 2015). Even though the information that had been found during the research about the USD/KWD is not sufficient enough, it points out that the USD/KWD value of the USD is going to appreciate against the KWD. Furthermore, as it can be clearly identified in Appendix 1 the value of the US Dollar had been increasing for the past 2 years continually as it reached its maximum point in 22nd of April 2015 at the rate of 0.324KWD (Exchangerates.co.uk, 2015). According to currency analysts, its predicted that the value of the Yen will appreciate against the US Dollar which will lead to a decline in the USD/JPY USD/JPY currency pair as a result of the improved economical situation of Japan; Japan is having its first trade surplus since 2012 and economists believe that the country might be able to achieve an inflation rate of 2% this year (Dailyfx.com, 2015). 6|Page BSB7302 - International Finance Group report 3.4 Technical analysis: In the process of analyzing currencies and securities investors use several methods which fall into two main categories which are: Fundamental analysis and technical analysis, for our investment technical analysis is going to be used which is basically a study of past trends in order to predict the future. It's a widely used research method that allows investors to use historic data in order to predict the future of a currency or other types of securities that they might be interested in investing in (Investopedia Staff, n.d). USD/GBP: The currency pair movement for the fourth quarter of 2014 and until the first quarter of 2015 was in favor of the US Dollar to the Sterling which had been decreasing in that period (Appendix 3). Thus, USD/GBP will more likely increase at the time of investment according to the technical research. USD/EUR: For the time period in between September 2014 and of January 2015 the price of the EURO had been decreasing which indicates that it will further decrease until the time of the investment which will take place in 31st of March (Appendix 4). Therefore, technical analysis indicates that USD/EUR will increase. USD/KWD: By analyzing the historical movement of the Kuwaiti Dinar against the US dollar for the past two years (Appendix 1), it can be predicted that KWD is going to decrease further against the USD as a result of the continuous devaluation. As a result its predicted that USD/KWD will increase at the time of investment. USD/JPY: The Japanese Yen had been increasing against the dollar for the past six months against the US Dollar and its predicted to continue its rise in the coming months. Hence, technical analysis points towards a decrease in the USD/JPY currency pair. 3.5 Currencies correlation: Currency pair Correlation coefficient USD/GBP 0.287 USD/KWD -0.083 7|Page BSB7302 - International Finance Group report USD/EUR 0.156 USD/JPY -0.035 The table above illustrates how the currency pairs move according to their correlation coefficients, a positive correlation coefficient indicates that the two pair moves with each other whether it's an increase or a decrease while a negative correlation shows that the two pairs move in the opposite directions as when one currency appreciate the other one depreciate. Thus, both USD/EUR and USD/GBP have a positive correlation of 0.287 and 0.156 which means that both of them move in the same direction while USD/KWD and USD/JPY have a negative correlation of -0.083 and -0.035; therefore the two pairs tend to move in the opposite direction (OANDA, n.d). 4.0 Hedging strategy: 4.1 Investor's profile: Enterprise name: Blue Sea Cars Privet Ltd Investor type: risk averse Investment amount: USD 7,750,000 4.2 Investment-strategy goals: Achieve 3% as a total investment net profit in the period between (1st March to 1st of June) Hedge our position against the possible risks involved in the upcoming transactions in the (31stMarch, 11th April, 12thMay, 25th May, 1st June) Generating profit using the Foreign Exchange market as an alternative investment tool other than car dealing, in order to improve Blue Sea Cars profitability. 4.3 Investment-strategy time-line: Starting date (1/3/2015) As it is required, the planning stage for the investment strategy will start before the first of March; and therefore all the research and the forecasts used in this report are based on these 8|Page BSB7302 - International Finance Group report dates. This strategy is build based on two main goals which determines all of our plans, and these goals are to protect our position first and make profit if possible. The investing strategy will start by benefiting from the arbitrage opportunity which has been found on the 1st of March; as we will start by using the full amount USD 7,750,000 into a spot transaction USD/JPY, and then a spot transaction JPY/GBP and finally a change the amount back to USD by entering into a spot transaction GBP/USD. And as we have done so we have generated a profit of USD 6,723.375. Before the 31st of March: As it's expected to pay EUR 465,000 at that date, it had been decided to enter into a 1 month forward contact to hedge our position; based on the forecasted information that we have found which indicates that the EUR will depreciate against the Dollar; and although we might have to pay less as the EUR will deprecate but we have decided to hedge our position by entering into a forward contract in order to be in a safe position. Forecast (USD/EUR): according to the research, the value of the EUR is expected to reach parity against the USD The amount which will be used in the forward contract that equals to USD 520,646.722 is intended to be paid at the end of the period on the 31st of March; therefore we have decided to invest this amount before the payment of the forward contract. The amount will be invested in a 28 days term deposit “WEEKLY” in UniCredit bank with 2.75% p.a. interest rate and an expected profit of USD 1,113.6 at maturity. and by doing so, we have protected our position and gained profit as well. Before the 11th of April: We are required to pay JPY 1,500,000 on the 11th of April, and as we have found through the forecasts research, the JPY will appreciate against the USD in the coming months. If so the forecast hold its value, then we will pay more outflow of the USD against JPY, therefore we will hedge our position to avoid any possible changes in the price. We will hedge our position by entering into a 1 month forward contract on 11th of April. 9|Page BSB7302 - International Finance Group report And while the amount which will be paid in the forward contract will be available in our account until the execution date of the forward contract; we have decided to deposit the money which equals to USD 12,386.253 in a 1 month term "Classic" deposit inUnicredit Bank with an interest rate of 5.50% and expected profit of USD 56.77 Before the 12th of May: On 12/5/2015, we are required to pay GBP 900,000 and according to our research it is forecasted that GBP will depreciate against the USD, which means that the USD will appreciate and that would be beneficial for us as that could lead us to be in a position where we are required to pay less of USD as the GBP value decline. But we have decided to hedge our position by entering into a 1 month forward contract as the market changes are unpredictable. And before the due date of the forward contract, we will be investing this amount which equals to USD 1,324,639.77 in a 2 month term "Classic" deposit with the UniCredit Bank and an interest rate of 5.75% and we will receive a profit of USD 12,694.46 Before the 25th of May: As we have already researched about the USD/JPY forecast, it is expected from the JPY to appreciate against the USD, which leaves us in a risky position as we might be required to pay more USD against the JPY on the 25th of May. And as we already have discussed, the best possible solution for this position is hedge ourselves by inter into a 1 month forward contract to protect our investment. And before the execution date of the forward contract on the 25th of May, we will use this amount USD 92,450.95 to inter into a 2 month term deposit with UniCredit, with and interest rate of 5.75% and a profit of USD 885.98 Before the 1st of June: In 1/6/2015 we are expecting to receive a total of KWD 175,000. And based on the forecast research done on the currency pair USD/KWD it is found that the research is insufficient and therefore unreliable. Which leave us in uncertain position of whether we will be affected or not in the coming months and receive less in case the value of the KWD decreased. But, based on the 10 | P a g e BSB7302 - International Finance Group report historical data and the forecasted information on the USD it is expected that the USD will appreciate against KWD Therefore we have deiced to enter into a 3 month forward contract in order to protect our investment against any changes and minimize our losses. Between the 1st of March to the 1st of June: The total amount which will be used in the forward contracts is equal to 1,950,123.70and as a result, the total amount given to us which equals to USD 7,750,000 will not be used in full. Therefore, we have decided to invest the remaining amount which equals to USD 5,799,876.305 in a 3 month term deposit in the (bank name) with an interest rate of 6% which will generate a profit of 86,998.144 by the end of the 3 month deposit. 4.4 Choosing a currency pair: The following pairs (USD/EUR), (USD/GBP), (USD/JPY) and (USD/KWD) are chosen for the reason that they will be used in the coming outflows and inflows and has a major impact on our business transactions; therefore it is essential to study the movement of these pairs in order to protect ourselves from market changes. 4.5 Reasoning for Choosing the forward contract for 31/3, 11/4, 12/5, 25/5 and 1/6: It was deiced to choose forward contracts for these dates to hedge our position as the forecasted information provided to us are predicting almost certain changes in the coming months which can affect our position and the amount received at the end highly. We are expecting to receive less amount in the 11/4, 25/5 and 1/6 therefore we see that the best option is to hedge our position by using forward contracts. And in the following dates 31/3 and 12/5 although we are expecting to receive more due to USD appreciating against other currencies but it wouldn’t be a good position to remain unhedged and the second best option is to use forward contracts. 11 | P a g e BSB7302 - International Finance Group report 4.6 Reasoning for choosing to deposit the amount available, between the transactions as well as the remaining amount: First of all it was decided to choose UniCredit to deposit our money as this bank offers the highest term deposit rates amount the other banks. And the reason behind choosing to deposit the money rather than investing it in any other investment tools is because deposits are very safe and offer attractive interest rates. Bank PrivatBank HSBC Canada UniCredit $5,000 Blue shore financial $500 Minimum deposit $ 270,000 Maximum deposit $ 500,000 - - - 8-14 days 15-21days 22-28 days 1 months 3 % (31 days) 0.05% 0.20% 2.25% 2.50% 2.75% 5.50% 2 months 3 months 3% 3 % (183 days) 0.10% 0.15% 0.25% 0.30% 5.75% 6.00% 200 USD 5.0 Evaluation: On 31st of March: Arbitrage opportunity: While researching for an arbitrage opportunity from the following currencies : (USD, GBP, EUR, JPY, and KWD), It had been found in the following order: 1) USD/JPY: 119.70512 (7,750,000 * 119.70512) = 927,714,680 (Exchange-rates.org, 2015) 2) JPY/GBP: 0.00542 (927,714,680 * 0.00542) = 5,028,213.5656 (Exchange-rates.org, 2015) 3) GBP/USD: 1.54264 (5,028,213.5656 * 1.54264) = 7,756,723.375 (Exchange-rates.org, 2015) The following Currencies’ rates were taken for 1st of March Spot price, and from the calculations made USD 6,723.375 profit were made from this arbitrage opportunity which can maximize the amount of profit of any firm’s capital. However, in order to benefit from this opportunity a huge amount of capital must be invested in because, these arbitrage opportunities come from small change the decimals 12 | P a g e BSB7302 - International Finance Group report numbers in the currencies exchange rates (Appendix 6). From the strategies mentioned above, our strategy is to use a forward contract to hedge our position for exchange rate risk and market volatility. Basically a forward contract is about setting an agreed exchange of currencies in a future date specified for a spot price of the contract, if the forward contract Bid points is smaller than the Ask points then we add the points to the spot rate, and in opposite if the forward contract Bid points is bigger than the Ask points than we subtract the bid and ask points from the spot rate. Where 1 forward point equal to 0.0001 for most currencies except for Yen where 1 point equal to 0.01 point. On the 31st of March we are going to pay a EUR 465,000 thus, we are going to enter into 1 Month USD/EUR Forward contract for today’s 1st of March spot rate which is 1 USD/EUR 0.89270/0.89356. The one month forward points are quoted 4.200/4.550, the EUR forward points equal to 0.0001 thus dividing the forward points over 10,000. The calculation will be adding the forward bid and ask points to the spot outright rate which will be: Spot bid rate + Forward bid quoted point = Forward Bid Rate 0.89270 + (4.200/10,000) = 0.89312 Spot bid rate + Forward Ask quoted point = Forward Ask Rate 0.89356 + (4.550/10,000) = 0.894015 Because we are the market takers, the market maker will always buys the base currency at cheaper rate and sells it at higher rate. Thus, we will buy the EUR for higher rate which is the bid side which will get the 0.89312 forward rates. By entering into the forward contract we will be need to pay EUR 465,000 which will be in USD: EUR 465,000 *1/0.89312= USD 520,646.722 (Appendix 7&8) Deposits: First Deposit on 1st of March: Deposit the remaining amount from subtracting all the Forward contracts: (7,750,000 – 1,950,123.70) = USD 5,799,876.305 Deposit Profit Formula: Principle* Interest Rate* Days/ (360*100) = USD 5,799,876.305 * 6% * 90 Days/360*100 = USD 86,998.144 13 | P a g e BSB7302 - International Finance Group report total amount plus profit: USD 5,799,876.305 + 86,998.144 = USD 5,886,874.45 Second Deposit on 1st of March Deposit the Forward contract amount prior to payment day to seek profit Deposit Profit Formula: Principle* Interest Rate* Days/ (360*100) = USD 520,646.722 * 2.75% * 28 Days/360*100 =USD 1,113.6 520,646.722 + 1,113.6 = USD 521,760.322 Third Deposit on 11th of March: 30 Days Deposit the Forward contract amount prior to payment day to seek profit Deposit Profit Formula: Principle* Interest Rate* Days/ (360*100) = USD 12,386.253 * 5.5% * 30 Days/360*100 =USD 56.77 USD 12,386.253 + USD 56.77 = USD 12,443.023 Fourth Deposit: On 12th of March: 60 Days Deposit the Forward contract amount prior to payment day to seek profit Deposit Profit Formula: Principle* Interest Rate* Days/ (360*100) = USD 1,324,639.77* 5.75% * 60 Days/360*100 =USD 12,694.46 USD 1,324,639.77 + USD 12,694.46 = USD 1,337,334.23 Fifth Deposit on 25th of March 60 Days Deposit the Forward contract amount prior to payment day to seek profit Deposit Profit Formula: Principle* Interest Rate* Days/ (360*100) = USD 92,450.95 * 5.75% * 60 Days/360*100 =USD 885.98 14 | P a g e BSB7302 - International Finance Group report USD 92,450.95 + USD 885.98 = USD 93,336.93 11th of April: We are expected to pay JPY 1,500,000 and through analyzing he forests it was concluded that the JPY is going to depreciate against the USD which means paying less outflow of USD. However, remaining unhedged has a huge risk since market is changing everyday and the forecast may not hold its value at the end. For that on 11th of March we are going to enter into a 1 Month USD/JPY Forward contract to hedge our position since it’s less risky and cover our position if the market changes, the 11th of March spot rate is USD/JPY 121.44/121.46, and the one month forward points are quoted 33.800/32.700. Each forward Point for the JPY will be equal to 0.01, thus dividing the forward points over 100. Forward contract rate can be calculated as following: Spot bid rate + Forward bid quoted point = Forward Bid Rate 121.44 + (-33.800/100) = 121.102 Spot bid rate + Forward Ask quoted point = Forward Ask Rate 121.46 + (-32.700/100) = 121.133 Because we are the market takers, the market maker will always buy the base currency at cheaper rate and sells it at higher rate. Thus, we will buy the JPY for higher rate which is the bid side because the market maker will buy the USD at lower rate, which will get the 121.102 forward rates. By entering into the forward contract we will be need to pay JPY 1,500,000 which will be in USD: JPY 1,500,000 * 1/121.102 = USD 12,386.253 (Appendix 9&10) On 12th of May: We are going to pay GBP 900,000, and according to our analysis of the forecasts it shows that the GBP is going to depreciate in value against the USD. However, relaying only on forecasts will not guarantee our position since market rates changes every single day and the risk to that is great, thus we are going to enter into a 1 Month USD/GBP Forward Contract to hedge our position in any price changes since both USD and GBP considered to be an international currencies. For that on 12 th of April we are going to enter into a 1 Month USD/GBP Forward contract to hedge our position since it’s less risky and cover our position if the market changes, the 12th of April spot rate is USD/GBP 0.68328/0.68361, and 15 | P a g e BSB7302 - International Finance Group report the 1 month forward points are quoted 38.500/34.300. Each forward Point for the GBP will be equal to 0.0001, thus dividing the forward points over 10,000. Forward contract rate can be calculated as following: Spot bid rate + Forward bid quoted point = Forward Bid Rate 0.68328 + (-38.500/10,000) = 0.67943 Spot bid rate + Forward Ask quoted point = Forward Ask Rate 0.68361 + (-34.300/10,000) = 0.68018 For the reason that we are market takers, the market maker will always buys the base currency at cheaper rate and sells it at higher rate. Thus, we will buy the GBP for higher rate which is the bid side because the market maker will buy the USD at lower rate, which will get the 0 .68704 forward rates. By entering into the forward contract we will be need to pay GBP 900,000 which will be in USD: GBP 900,000 * 1/0.67943 = USD 1,324,639.772 (Appendix 11&12) On 25th of May: We are expected to in JPY again however with bigger amount of JPY 11,000,000, following the previous forecast of JPY that it’s going to depreciate against the USD and remaining unhedge may result in paying less in JPY. However, this amount is huge compare to the last JPY amount and also the market is active these days and it’s volatility high where the JPY can appreciate against the USD in any day, thus increasing the risk of paying a higher amount of JPY at the end. Entering into a forward contract can solve the volatility of the market and secure our position to minimize our losses and market risk, for that on 25th of April we are going to enter into 1 month USD/JPY Forward contract, where the spot rate is 119.32/119.34 and the 1 month USD/JPY Forward contract quoted as 33.800/32.700. Each forward Point for the JPY will be equal to 0.01, thus dividing the forward points over 100. Forward contract rate can be calculated as following: Spot bid rate + Forward bid quoted point = Forward Bid Rate 119.32 + (-33.800/100) = 118.982 Spot bid rate + Forward Ask quoted point = Forward Ask Rate 119.34 + (-32.700/100) = 119.013 16 | P a g e BSB7302 - International Finance Group report Because we are the market takers, the market maker will always buys the base currency at cheaper rate and sells it at higher rate. Thus, we will buy the JPY for higher rate which is the bid side because the market maker will buy the USD at lower rate, which will get the 118.982 forward rates. By entering into the forward contract we will be need to pay JPY 11,000,000 which will be in USD: JPY 11,000,000 * 1/118.982 = USD 92,450.959 (Appendix 13&14) On 1st of June: The company will receive an equivalent of KWD 175,000 and in order to receive more amount in USD we have to benefit from the exchange rate changes, thus entering into a Forward contract seems the best option. Where exercising the Forward contract could lead in receiving a higher amount in USD, thus reducing the risks associated with market volatility. On 1st of March, the company will enter into a 3 Months USD/KWD Forward Contract, where the spot rate is 3.31082/3.32149 and the 3 months USD/KWD Forward contract quoted as 35.000/65.000. Each forward Point for the USD will be equal to 0.0001, thus dividing the forward points over 10,000. Forward contract rate is calculated as the following: Spot bid rate + Forward bid quoted point = Forward Bid Rate 3.31082 + (35.000/10,000) = 3.31432 Spot bid rate + Forward Ask quoted point = Forward Ask Rate 3.32149 + (65.000/10,000) = 3.32799 Because we are the market takers, the market maker will always buys the base currency at cheaper rate and sells it at higher rate. Thus, we will sell the KWD for lower rate which is the bid side because the market maker will buy the USD at lower rate, which will get the 3.31432 forward rates. By entering into the forward contract the company will receive KWD 175,000 which will be in USD: KWD 175,000 * 3.31432 = USD 580,006 (Appendix 15) Holding at the end of the period (In USD): Maturity Date of Transactions 1st of March ( Method Used Calculations Currency Arbitrage ( USD 7,750,000) 17 | P a g e USD/JPY: 119.70512 BSB7302 - International Finance Group report Arbitrage Opportunity) 1st of March 1st of March ( 28 Days period) 31st of March Used to convert it to JPY, then convert the amount from JPY to GBP, then Convert the Amount to USD profit amount from the transaction: 7,750,000 – 7,756,723.375 = USD 6,723.375 (7,750,000 * 119.70512) = 927,714,680 Deposit the remaining amount from subtracting all the Forward contracts: (7,750,000 – 1,950,123.70) = USD 5,799,876.305 total amount plus profit: USD 5,799,876.305 + 86,998.144 = USD 5,886,874.45 Deposit the Forward contract amount prior to payment day to seek profit Deposit Profit Formula: Principle* Interest Rate* Days/ (360*100) = 520,646.722 + 1,113.6 = USD 521,760.322 USD 520,646.722 * 2.75% * 28 Days/360*100 =USD 1,113.6 1 Month USD/GBP Forward Contract Spot bid rate + Forward bid quoted point = Forward Bid Rate 0.89270 + (4.200/10,000) = 0.89312 Spot bid rate + Forward Ask quoted point = Forward Ask Rate 0.89356 + (4.550/10,000) = 0.894015 Holding 1: 7,756,723.375 - 520,646.722 = USD 7,236,076.653 JPY/GBP: 0.00542 (927,714,680 * 0.00542) = 5,028,213.5656 GBP/USD: 1.54264 (5,028,213.5656 * 1.54264) = USD 7,756,723.375 USD 5,799,876.305 * 6% * 90 Days/360*100 =USD 86,998.144 Deposit Profit Formula: Principle* Interest Rate* Days/ (360*100) = EUR 465,000 *1/0.89312= USD 520,646.722 11th of March 12th of March 25th of March 30 Days Deposit the Forward contract amount prior to payment day to seek profit USD 12,386.253 + USD 56.77 = USD 12,443.023 60 Days Deposit the Forward contract amount prior to payment day to seek profit USD 1,324,639.77 + USD 12,694.46 = USD 1,337,334.23 60 Days Deposit the Forward contract amount prior to payment day to seek profit 18 | P a g e Deposit Profit Formula: Principle* Interest Rate* Days/ (360*100) = USD 12,386.253 * 5.5% * 30 Days/360*100 =USD 56.77 Deposit Profit Formula: Principle* Interest Rate* Days/ (360*100) = USD 1,324,639.77* 5.75% * 60 Days/360*100 =USD 12,694.46 Deposit Profit Formula: Principle* Interest Rate* Days/ (360*100) = BSB7302 - International Finance Group report 11th of April USD 92,450.95 + USD 885.98 = USD 93,336.93 1 Month USD/JPY Forward Contract Holding 2 : USD 7,236,076.653 - USD 12,386.253 = USD 7,223,690.4 12th of May 1 Month USD/GBP Forward Contract Holding 3 : 7,223,690.4 – USD 1,324,639.772 =USD 5,899,050.628 USD 92,450.95 * 5.75% * 60 Days/360*100 =USD 885.98 Forward contract rate can be calculated as following: Spot bid rate + Forward bid quoted point = Forward Bid Rate 121.44 + (-33.800/100) = 121.102 Spot bid rate + Forward Ask quoted point = Forward Ask Rate 121.46 + (-32.700/100) = 121.133 JPY 1,500,000 * 1/121.102 = USD 12,386.253 Spot bid rate + Forward bid quoted point = Forward Bid Rate 0.68328 + (-38.500/10,000) = 0.67943 Spot bid rate + Forward Ask quoted point = Forward Ask Rate 0.68361 + (-34.300/10,000) = 0.68018 GBP 900,000 * 1/0.67943 = USD 1,324,639.772 25th of May 1 Month USD/JPY Forward Contract Holding 4 : USD 5,899,050.628 - USD 92,450.959 = USD 5,806,599.669 Spot bid rate + Forward bid quoted point = Forward Bid Rate 119.32 + (-33.800/100) = 118.982 Spot bid rate + Forward Ask quoted point = Forward Ask Rate 119.34 + (-32.700/100) = 119.013 JPY 11,000,000 * 1/118.982 = USD 92,450.959 1st of June 3 Months USD/KWD Forward Contract Spot bid rate + Forward bid quoted point = Forward Bid Rate 3.31082 + (35.000/10,000) = 3.31432 Holding 5 : 5,806,599.669 + USD 580,006 Spot bid rate + Forward Ask quoted point = =USD 6,386,605.669 Forward Ask Rate 3.32149 + (65.000/10,000) = 3.32799 KWD 175,000 * 3.31432 = USD 580,006 1st of June Final Holding Period: USD 6,386,605.669 + 101,748.95 + 6,723.98 = USD 19 | P a g e ( 1 - Principle amount – 2- all the Forward Contracts ) = 6,386,605.669 + BSB7302 - International Finance Group report 6,495,078.599 3- all terms deposits = 1,113.6 + 56.77 + 12,694.46 + 885.98 + 86,998.144 = USD 101,748.95 + 4- arbitrage opportunity profit = USD 6,723.38 Currency Future Contract: Is a contract between two parties where, they agree on a specified exchange rate agreed upon on the day of the contract for a future date. Where it is more standardized and has a higher liquidity than Forward contract, because these types of contracts gets traded in an organized exchange centers, one key benefits of the future contract that the agreeing party can eliminate the obligation in the contract, by entering into another future contract oppositely prior to the expiry date. Another benefit of Future contract is that don’t have credit risk, where the exchange organization act as a clearing house in case of credit default (Investopedia, n.d). The EUR/US dollar contract for instance, demonstrates a base value augmentation of .0001, and a relating tick estimation of $12.50. This shows that every time there is a .0001 development in value, the estimation of the agreement will change by $12.50 with the quality subject to the course of the value change. On the off chance that that same long exchange moves to 1.3968, the value move would be worth $125.00 ($12.50 X 10 ticks). Future currency contract must rundown details including the size of the agreement, the base value price and the relating tick value. These details help merchants focus position estimating and record prerequisites, and also the potential benefit or misfortune for distinctive value developments in the agreement (Investopedia, n.d). Currency Forward Contract: Forward contracts are similar to future Contracts in usage for setting the exchange rate of the contract day for a future agreed day. Furthermore, the main difference is that forward contracts are private and made between parties where they set all the rules of the contract, not only this but have a higher credit risk because of not having the exchange clearing house in case of credit default (Investopedia, n.d). If the market exchange rate prices change every day, a company can hedge from market risk volatility by entering into forward contracts to guarantee today’s price for a future date, thus if the 20 | P a g e BSB7302 - International Finance Group report other currency depreciate in value against their base currency, the company will receive higher amount in their base currency because of the forward contract. Currency Option Contract: is a contract that make the holder of it to have the right to buy in case of Call Option or sell in case of Put Option, and the other party have the obligation to buy it or sell it depending of the contract. The option contracts have something called premium which is the right of having this contract and the amount of the premium depends on the size of the contract (Investopedia, n.d). Option contracts considered to be one of the most common used contracts where it have an advantage where it can consider to be a disadvantage also, in case of exercising the contract the holder will pay the premium plus the amount agreed on the contract. If the holder of the contract doesn’t exercise the contract will result in losing only the premium which can be huge depending on the size of the contract. Arbitrage Opportunity: Is considered to be an easy way to make profit in an overnight transaction, where one can benefit from changes in a currency's spread to seek potential profit. It all depends on currency pair where holding one currency till it appreciate in value against another currency, thus buying it and looking for alternative appreciating value to exchange the currency again and then finally convert it to the first base currency to see if the amount invested in the beginning increased or not. It all depends on the principle amount because the spread changes slightly thus in order to benefit from it must be invested in with a high amount (Investopedia, n.d). 6.0 Suggestions: In order to improve the investment strategy proposed above there are many suggestions that can be took in mind. First of all the company should borrow more money to invest; borrow an extra amount from a country that offer low interest rates on loans and then invest it in another country which their interest rate on deposits is relatively high; after receiving the deposit amount with profits the company can repay the loan plus its interest and will have an extra amount that is the net profit. Moreover, its advised to study more about the correlation of the currencies before entering into the foreign exchange market; currencies correlation will help in determining the company's position and minimizing the risks associated with investing in the foreign exchange market. Added to that, it's also 21 | P a g e BSB7302 - International Finance Group report suggested to take more risk and use a variety of investment tools rather than sticking with using forward contracts and interests from deposits in order to profit from; even though the investing tools proposed in the report are associated with lower risk, there are other tools that are associated with higher risk but at the same time unlimited profiting potential. 7.0 Conclusion: To conclude, using the derivatives market hedging tools such as forward contracts, options, and currency arbitrage helped to minimize the risk exposure of exchange rate risks. Thus, it also resulted in paying less amount of USD to the following currencies: EUR, GBP, JPY because all forecasts estimated a appreciated value of the USD in the coming months, which eventually came true where the USD currency got depreciated against those currencies. Using the hedging tools plus the money market deposit resulted in having a total amount of USD 6,495,078.599, where if staying unhedged and entering into a spot market would resulted in having an holding at the ending period of : EUR 465,000 1st of March Spot rate (0.89270) Outflow (Appendix 18) JPY 1,500,000 1st of March Spot rate (119.53) Outflow (Appendix 19) GBP 900,000 1st of March spot rate(0.64739) Outflow (Appendix 20) JPY 11,000,000 1st of March spot rate (119.53) Outflow (Appendix 19) KWD 175,000 1st of March spot rate (3.37211) Inflow to USD (Appendix 21) Holding at the end of period unhedged (Spot rate ) USD 520,891.67 USD 12,549.15 USD 1,390,197.56 USD 92,027.10 USD 590,119.25 = USD 1,425,546.23 - Principle amount (7,750,000) = USD6,324,453.77 Hence, from the table above a conclusion can be made that by using the proposed hedging strategy the company managed to get a holding period of USD 6,495,078.599. If the company decided to stay unhedged and use the spot market, this will result in having a holding period of USD 6,324,453.77. An amount of USD6,495,078.599 - USD6,324,453.77= USD 170,624.829 was made by using hedging tools correctly. Also to be mentioned, the holding period in the spot market may decrease or increase depending on the market and its risk volatility. 22 | P a g e BSB7302 - International Finance Group report 8.0 References: Arif Sharif and Matthew Brown. (2008). Kuwait Ends Dollar Peg, Pressuring Region to Follow. Retrieved from: http://www.bloomberg.com/apps/news?pid=newsarchive&sid=axpON9NWC0W4 BlueShore Financial. (2015). Term Deposit Rates. Retrieved from: https://www.blueshorefinancial.com/Rates/TermDeposits/ Currencyguide.eu. (n.d). United Stated Dollar (US$) General information. Retrieved from: http://currencyguide.eu/usd-en/usd-en.html Currencyinformation.org. (n.d). History of the Japanese Yen. Retrieved from: http://www.currencyinformation.org/world-currency-information/japanese-yen/history-of-thejapanese-yen Dailyfx.com. (2015). USD/JPY Japan to post first trade surplus since 2012. Retrieved from: http://www.dailyfx.com/forex/fundamental/forecast/weekly/jpy/2015/04/18/USDJPY-EyesMarch-Low-Japan-to-Post-First-Trade-Surplus-Since-2012.htm Exchangerates.co.uk. (2015). USD to KWD exchange rate history. Retrieved from: http://www.exchangerates.org.uk/USD-KWD-exchange-rate-history.html Exchange-rates.org. (2015).Japanese Yen exchange rates for March 1,2015 against currencies in Europe. Retrieved from: http://www.exchange-rates.org/HistoricalRates/E/JPY/3-1-2015 Exchange-rates.org. (2015). US Dollar exchange rates for March 1,2015 against currencies in Asia and Pacific. Retrieved from: http://www.exchange-rates.org/HistoricalRates/P/USD/3-1-2015 Exchange-rates.org. (2015). British Pound exchange rates for March 1,2015 against currencies in North and South America. Retrieved from: http://www.exchange-rates.org/HistoricalRates/A/GBP/3-1-2015 ForexCrunch.com. (2015).GBP/USD Forecast May 4-8. Retrieved from: http://www.forexcrunch.com/category/forex-weekly-outlook/gbp-usd-outlook/ Fxstreet.com. (2015). USD/JPY Forward rates. Retrieved from: http://www.fxstreet.com/rates-charts/forward-rates/?id=usd%2fjpy Fxstreet.com. (2015). GBP/USD Forward rates. Retrieved from: http://www.fxstreet.com/rates-charts/forward-rates/?id=gbp%2fusd HSBC. (2015). U.S. Dollar Term Deposits. Retrieved from: https://www.hsbc.ca/1/2/personal/investing/products-and-services/term-deposits/us-dollar 23 | P a g e BSB7302 - International Finance Group report Ilya Spivak. (2015). EUR/USD Technical Analysis: Euro Bounce May Yet Happen. Retrieved from: http://finance.yahoo.com/news/eur-usd-technical-analysis-euro-235500135.html Investing.com. (2015). USD/KWD forward rates. Retrieved from: http://www.investing.com/currencies/usd-kwd-forward-rates Investopedia.com. (n.d). Currency arbitrage. Retrieved from: http://www.investopedia.com/terms/c/currency-arbitrage.asp Investopedia.com. (n.d). Currency option. Retrieved from: http://www.investopedia.com/terms/c/currencyoption.asp Investopedia.com. (n.d). Introduction to currency futures. Retrieved from: http://www.investopedia.com/articles/forex/10/introduction-currency-futures.asp Investopedia.com. (n.d). Futures versus Forwards. Retrieved from: http://www.investopedia.com/exam-guide/cfa-level-1/derivatives/futures-versus-forwards.asp Investopedia.com. (n.d). Currency future. Retrieved from: http://www.investopedia.com/terms/c/currencyfuture.asp Investopedia Staff. (n.d). Basics of Technical Analysis. Retrieved from: http://www.investopedia.com/university/technical/ Jason Van Bergen. (n.d). 6 Factors that influence exchange rates. Retrieved from: http://www.investopedia.com/articles/basics/04/050704.asp OANDA. (n.d). Currency Volatility Chart. Retrieved from: http://fxtrade.oanda.com/analysis/currency-volatility Oanda.com. (2015). Currency converter. Retrieved from: http://www.oanda.com/currency/converter/ Privatbank. (2015). Deposits in Privatbank. Retrieved from: http://privatbank.com.cy/en/deposits/ UniCredit Bank. Deposit "Classic". Retrieved from: http://en.unicredit.ua/pcdeposits/view/15/ UniCredit Bank. Deposit "Weekly". Retrieved from: http://en.unicredit.ua/pcdeposits/view/276/ TejvanPettinger. (2013). Factors which influence the exchange rate. Retrieved from: http://www.economicshelp.org/macroeconomics/exchangerate/factors-influencing/ 24 | P a g e BSB7302 - International Finance Group report 9.0 Appendices: Appendix (1) USD/KWD rate for the last 2 years: Appendix (2) EUR/USD major banks forecasts: Appendix (3) GBP/USD currency rate movement 10/09/2014 - 09/03/2015: 25 | P a g e BSB7302 - International Finance Group report Appendix (4) EUR/USD currency rate movement 19/09/2014 - 16/01/2015: Appendix (5) JPY/USD currency rate movement 29/04/2014 - 12/02/2015: 26 | P a g e BSB7302 - International Finance Group report Appendix (6) Currency pairs correlation coefficient: Appendix (6): USD/JPY, JPY,GBP, and GBP/USD rates as in 1/3/2015 Appendix (7) USD/EUR exchange rate 1/3/2015: 27 | P a g e BSB7302 - International Finance Group report Appendix (8) EUR/USD 1 month forward: Appendix (9) Forward rates: 28 | P a g e BSB7302 - International Finance Group report Appendix (10) USD/JPY currency details 11/3/2015: 29 | P a g e BSB7302 - International Finance Group report Appendix (11) USD/GBP currency details 12/4/2015: Appendix (12) GBP/USD 1Month forward: 30 | P a g e BSB7302 - International Finance Group report Appendix (13) USD/JPY currency details 25/4/2015: Appendix (14) USD/JPY 1Month forward: 31 | P a g e BSB7302 - International Finance Group report Appendix (15) USD/KWD Forward rates: Appendix (16) UniBank Classic deposit conditions: 32 | P a g e BSB7302 - International Finance Group report Appendix (17) UniBank Weekly deposit conditions: Appendix (18) USD/EUR rate: 33 | P a g e BSB7302 - International Finance Group report Appendix (19) USD/JPY rate: Appendix (20) USD/GBP rate: Appendix (21) USD/KWD rate: 34 | P a g e