Introduction

advertisement

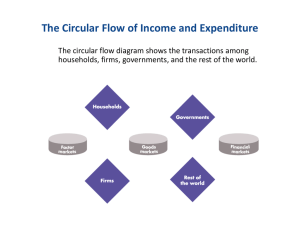

AAEC 2305 Fundamentals of Agricultural and Applied Economics Shaikh M Rahman Associate Professor, AAEC Ag. Science 307A Tel: (806) 834-0505 Email: shaikh.m.Rahman@ttu.edu AAEC 2305 Fundamentals of Agricultural and Applied Economics • Required Text: – Principles of Economics, 6th Edition (2015), by Robert Frank, Ben Bernanke, Kate Antonovics, and Ori Heffetz; McGraw-Hill Education. • Expected Learning Outcome: Explain the economic activities of individuals and firms using 7 core principles of economics • Methods of Assessing Outcomes – Exams – 84% of the final grade – Quizzes – 16% of the final grade – Class Attendance and Participation • Students with perfect attendance will receive 4 bonus points • Students with one unexcused absence will receive 2 bonus points • Every unexcused absence over two will lower final grade by 1 point. Learning Objective: The Seven Core Principles 1. The Scarcity Principle: having more of any good thing necessarily requires having less of something else 2. The Cost-Benefit Principle: an action should be taken if and only if its benefit is at least as great as its costs 3. The Incentive Principle: examine people's incentives to predict their behavior 4. The Principle of Comparative Advantage 5. The Principle of Increasing Opportunity Cost 6. The Efficiency Principle 7. The Equilibrium Principle The Circular Flow of Income and Expenditure The circular flow diagram shows the transactions among households, firms, governments, and the rest of the world. The Circular Flow of Income and Expenditure Firms hire factors of production from households. The blue flow, Y, shows total income paid by firms to households. The Circular Flow of Income and Expenditure Households buy consumer goods and services. The red flow, C, shows consumption expenditures. The Circular Flow of Income and Expenditure Households save, S, and pay taxes, T. Firms borrow some of what households save to finance their investment. The Circular Flow of Income and Expenditure Firms buy capital goods from other firms. The red flow I represents this investment expenditure by firms. The Circular Flow of Income and Expenditure The Government buys goods and services, G, and borrows or repays debt if spending exceeds or is less than taxes The Circular Flow of Income and Expenditure The rest of the world buys goods and services from us, X and sells us goods and services, M—net exports are X - M The Circular Flow of Income and Expenditure And the rest of the world borrows from us or lends to us depending on whether net exports are positive or negative. The Circular Flow of Income and Expenditure The blue and red flows are the circular flow of income and expenditure. The green flows are borrowing, lending, and taxes. The Circular Flow of Income and Expenditure The sum of the red flows equals the blue flow. That is: Y = C + I + G + X - M Expenditures • Expenditures are purchases of goods and services. • Expenditures are – – – – Consumption expenditure (C) Investment expenditure (I) Government spending (on goods and services) (G) Net Exports (X-M) • Exports (X) • Imports (M) Expenditures equal Income • Expenditures= C + I + G + X – M • All expenditures become someone’s income so • Y (income) = C + I + G + X – M Government • Government spending: – Goods and services (G) • Roads, health care, education, helicopters, police officers salaries, judges salaries. • Government revenue: – – – – Taxes (Income from Crown corporations) (Tariffs) Less Transfers to persons (part of net taxes) • GST rebates, unemployment insurance, pensions, subsidies • Interest on the debt (substantial) • NOTE: The gov’t is not buying services, so transfers are not an expenditure. Budgetary Deficits and Surpluses • Spending Goods and services (G) + Transfers to persons (Tr) • Revenue Taxes (Tx) • Net Taxes Tx – Tr = NT • Surplus G + Tr < Tx G < Tx – Tr G < NT • Deficit G + Tr > Tx G > Tx – Tr G > NT Savings and Investment • Investment is financed by savings • Savings have three sources: – Savings by households • The part of income households do not spend on consumption or net taxes. • (S = Y - C - NT) – Savings by governments • NT – G = savings – Savings of foreigners • M – X = foreign borrowing STOCKS AND FLOWS • FLOWS – Income : the goods and services produced each year – Deficits: The excess of spending over income each year – Investment: Goods produced to be used in production each year – Surpluses: The excess of revenue over expenditures each year. • STOCKS – Wealth: All the goods a person owns. Wealth is the sum of past net saving. – Debt: the sum of all past deficits less all past surpluses – Capital: All the investment goods owned. Capital is the sum of past net investment Normative and Positive Economics Normative economic principle says how people should behave – Gas prices are too high – Building a space base on the moon will cost too much Positive economic principle predicts how people will behave – The average price of gasoline in May 2010 was higher than in May 2009 – Building a space base on the moon will cost more than the shuttle program