Financial Management

advertisement

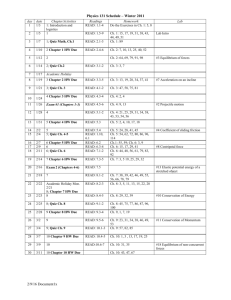

ABASYN UNIVERSITY PESHAWAR CAMPUS DEPARTMENT OF MANAGEMENT SCIENCES FINANCIAL MANAGEMENT COURSE CODE MG 301 FALL SEMESTER 2014 INSTRUCTOR: Miss Faryal Raheem Email: faryal.raheem@abasyn.edu.pk, COURSE DESCRIPTION: The module aims at building competence in corporate finance further by extending the coverage in Business Finance module to include three more of the finance functions – financial planning and control, working capital management and financing sources. It continues to emphasize on strategic decision making techniques that best serve the interests of shareholders, which is to maximize the value of the company. INDENTED LEARNING OUTCOMES: At the end on this course the student will be able to understand: 1. Role of financial planning and control– financial forecasting and cash budgeting tools – in planning for the firm’s short term financial requirements. 2. Working capital and its components, applications of different techniques that managers can use to manage various aspects of working capital – cash and liquidity, credit and receivables, inventories, etc. 3. Short term sources of financing. 4. Long term financing –venture capital, equity, debentures etc 5. Different theories of capital structure, their predictions about optimal capital structure and the limitations of using debt in the firm’s capital structure. CLASS POLICY: 1. All students must reach the classroom in time. 2. Students failing to secure 75% attendance shall not be allowed to sit in the Final Examination. 3. Students, who are absent on the announcement date of assignment/ test or any other activity, must get the topic/ chapter of the test/ assignment/ or any other activity confirmed through their peers. 4. Assignment submission deadline must be observed. In case of late submission, the assignment will be marked 10% less out of total marks. 5. Mobile phones should be switched-off or maybe put on silent mode in the classroom. 6. Course-books and relevant course-material is available in the Library for reference and photocopying. 1 TEXT BOOKS: Lecture notes, Handouts. Horne.C.V. Fundamentals of Financial Management. Latest Edition REFERENCE BOOKS/MAGAZINES/JOURNALS: The NEWS Business Page. Professional Journal like Wall Street, Business Week etc. ASSIGNMENTS: It is recommended to every student that assignment will be given in each class so in case of absence take note from the classmates. MAJOR EXAMINATION: Mid Term: Final Exam: Week no. 08 As per University schedule GRADING: Mid Term : 25% Quiz : 5% Assignments : 15% Presentation : 5% Final Term : 50% ______________________________________ TOTAL : 100% ______________________________________ 2 COURSE CONTENTS: WEEKS 01 Lecture# 01 Lecture # 02 02 03 04 05 06 07 08 09 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 10 11 12 13 14 15 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 Lecture# 01 Lecture # 02 DESCRIPTION Meaning and Scope of Financial Management. Finance and financial management Scope of Financial management The Goal of the Firm Business organizations Organization of the finance function Finance management vs. other managerial functions The Finance manager and the financial environment Financial Markets Financial Intermediaries Agency and Agency Problem in Corporation Time Value of Money Simple Interest CHAPTER# Chapter 1 Chapter 1 Chapter 2 Chapter 2 Chapter 3 Exercises QUIZ NO. 01 Compound Interest Exercises Annuity and Annuity Due Exercises RISK AND RETURN IN CORPORATE PERSPECTIVE QUIZ NO. 02 Working for Term Paper MID TERM TOOLS FOR FINANCIAL ANALYSIS AND PLANNING A brief overview to Financial Statements A POSSIBLE FRAME WORK FOR ANALYSIS Balance Sheet Ratio Exercises QUIZ NO. 03 Income statement Ratio Exercises Trend Analysis and Vertical Analysis Exercises QUIZ NO. 04 CAPITAL BUDGETING TECHNIQUES Exercise Exercise CASE STUDY/RESEARCH PAPER Presentations Submitted by: Miss Faryal Raheem Dated : 3 Sept, 2014 Chapter 3 Chapter 3 Chapter 4 Chapter 6 Chapter 6 Chapter 6 Chapter 6 Chapter 13 HOD/Incharge: ________________ 3