ch 2 key to notes

NAME

____________________________

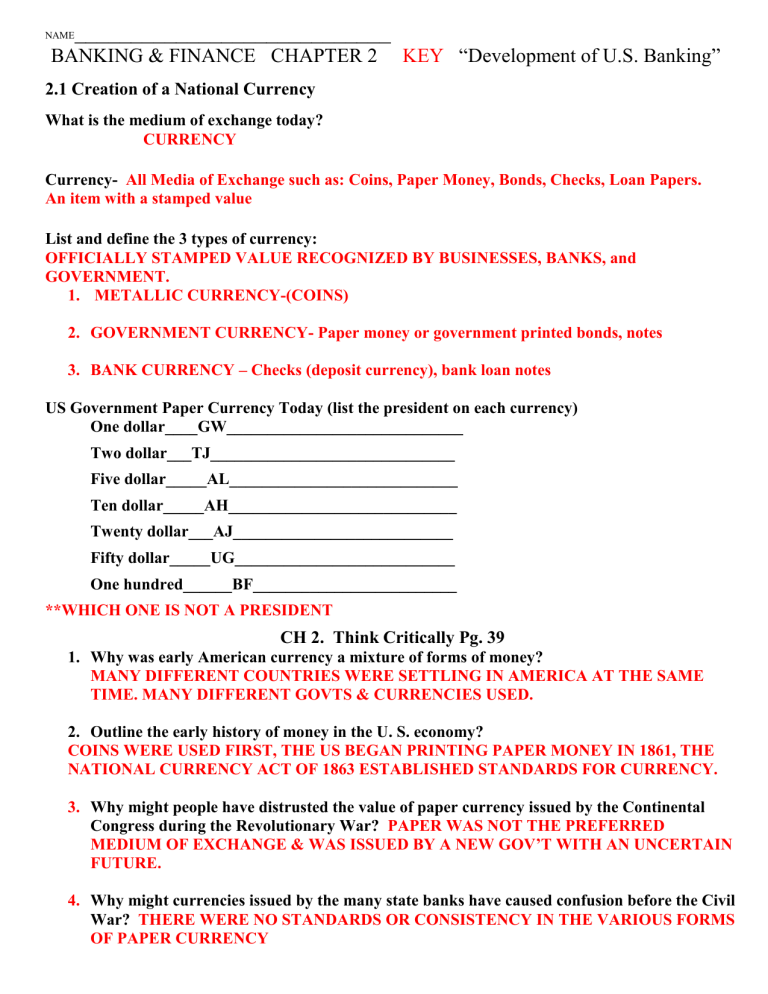

BANKING & FINANCE CHAPTER 2

KEY

“Development of U.S. Banking”

2.1 Creation of a National Currency

What is the medium of exchange today?

CURRENCY

Currency- All Media of Exchange such as: Coins, Paper Money, Bonds, Checks, Loan Papers.

An item with a stamped value

List and define the 3 types of currency:

OFFICIALLY STAMPED VALUE RECOGNIZED BY BUSINESSES, BANKS, and

GOVERNMENT.

1.

METALLIC CURRENCY-(COINS)

2.

GOVERNMENT CURRENCY- Paper money or government printed bonds, notes

3.

BANK CURRENCY – Checks (deposit currency), bank loan notes

US Government Paper Currency Today (list the president on each currency)

One dollar____GW_____________________________

Two dollar___TJ______________________________

Five dollar_____AL____________________________

Ten dollar_____AH____________________________

Twenty dollar___AJ___________________________

Fifty dollar_____UG___________________________

One hundred______BF_________________________

**WHICH ONE IS NOT A PRESIDENT

CH 2. Think Critically Pg. 39

1.

Why was early American currency a mixture of forms of money?

MANY DIFFERENT COUNTRIES WERE SETTLING IN AMERICA AT THE SAME

TIME. MANY DIFFERENT GOVTS & CURRENCIES USED.

2.

Outline the early history of money in the U. S. economy?

COINS WERE USED FIRST, THE US BEGAN PRINTING PAPER MONEY IN 1861, THE

NATIONAL CURRENCY ACT OF 1863 ESTABLISHED STANDARDS FOR CURRENCY.

3.

Why might people have distrusted the value of paper currency issued by the Continental

Congress during the Revolutionary War? PAPER WAS NOT THE PREFERRED

MEDIUM OF EXCHANGE & WAS ISSUED BY A NEW GOV’T WITH AN UNCERTAIN

FUTURE.

4.

Why might currencies issued by the many state banks have caused confusion before the Civil

War? THERE WERE NO STANDARDS OR CONSISTENCY IN THE VARIOUS FORMS

OF PAPER CURRENCY

BANKING & FINANCE CHAPTER 2 “Development of U.S. Banking”

2.2 Banking before 1913

The First Bank of the United States CHARTERED IN 1791

Who created it? ALEXANDER HAMILTON

Why did they create it?

TO ESTABLISH THE FEDERAL GOV’T AS CONTROLLER OF

MONEY

Why did it fail? AS THE NATION GREW WESTWARD, MORE PEOPLE RESENTED THE

CONTROL OF POWERFUL EASTERN BANKERS. IT LOST POLITICAL SUPPORT.

The Second Bank of the United States 1816

Why was is created? TO CREATE A CENTRAL BANK WITHIN THE US ECONOMY

Why did it fail? PEOPLE WERE AFRAID OF THE BANKS POWER TO CONTROL THE

ECONOMY

Describe the National Banking Act of 1864: (What is the Act and what is it used for)

Think Critically Pg. 43

1.

Do you agree with Hamilton or Jefferson about the creation of a private bank to handle government banking? Explain.

2.

How did conflicting political views ultimately cause the demise of the first two Banks of the United

States?

3.

Prior to the Federal Reserve Act of 1913, what factors made the banking system and the economy unstable?

CHAPTER 2

INTERNET ACTIVITY

Counterfeiting is an ongoing problem associated with paper currency since the government first began printing it. Visit the U.S. Bureau of Engraving and Printing’s web site at

www.moneyfactory.gov

On this site you can learn about anti-counterfeiting measures. What challenges does modern technology present and what steps does the Bureau take to meet them.

INTERNET ACTIVITY- FEDERAL RESERVE

Visit the Federal Reserve Board of Governors’ web site at

www.federalreserve.gov

From the General Information link, find the District Reserve Bank that serves your area. Find and visit that bank’s site, and discover what materials it makes available for citizen education. List those resources:

CHAPTER 2

INTERNET ACTIVITY

Define:

FEDERAL RESERVE SYSTEM (what is their purpose and function)?

HOW MANY FEDERAL RESERVE BANKS DOES THE US HAVE?

NAME ALL LOCATIONS

DRAW THE FEDERAL RESERVE PYRAMID

Google Federal Reserve Pyramid (use amosweb.com site)

BANKING & FINANCE CHAPTER 2 “Development of U.S. Banking”

2.3 Banking in the 20

th

Century

DEFINE

Federal Reserve Act- Established in 1913, a government regulated system of central banks which member banks could borrow money. The Federal Reserve board (FEDS) has the power to control and regulate these member banks.

The Great Depression- began in 1929 and lasted about 10 years. The 1920’s was a decade of extreme prosperity. Many people borrowed money from the banks to buy stocks. Banks were lending to everyone plus they were invested in the market. When the stock market crashed so did many of the banks. MARKET CRASHED & BANKS FAILED

Margin- borrowing money to buy stocks (only paying a fraction of the actual cost then selling it later for a profit without ever paying the full purchasing price)- many brokerage firms still practice this but with strict regulations.

Federal Deposit Insurance Corporation (FDIC)-

The FEDS guarantee the money if a member bank fails (up to a certain limit- usually 100K)

Inflation- a collective rise in the supply of money, incomes, and prices. The historical average inflation is around 3% a year in a healthy economy. Any extremes either way can be negative.

Stagflation- High inflation rates but low performing economy-stagnant

Deregulation- Regulations start to ease up to give banks more freedom, government releases partial control.

The loosening of the GLASS STEAGALL ACT of 1933 which placed heavy regulations and restrictions on banks after the GREAT DEPRESSION.

THINK CRITICALLY 2.3 PG 49

1.

Why couldn’t Congress just allow a free market to determine monetary policy?

2.

Why do you think the Federal Reserve Act attempted to remove the members of its board from the pressures of partisan politics?

3.

How did consumer fear help cause the bank failures of the Great Depression?

4.

Why is inflation particularly hard on those who save money well?

5.

Inflation is still with us, although the rates are far lower than they were 30 years ago.

Anticipating inflation is part of financial planning. If this year’s inflation rate is 2.7%, and you placed $2000 in a savings account at the beginning of the year earning 2% interest, how much must you deposit in the account at the end of the year to hold the same purchasing value?

FINANCE CHAPTER 2 “Development of U.S. Banking”

2.4 THE FEDERAL RESERVE SYSTEM

Structure of the Fed (define each) CHAIRMAN

1.

Member banks- Any bank that is part of the Federal Reserve System BOARD

2.

District Reserve Banks- The 12 regional FED banks of the US

DISTRICT

3.

Board of Governors- The 7 FED Board members-selected by the President MEMBER

4.

The Chairman- The top FED Board member- currently BEN BERNANKE

What are the 4 functions of the Federal Reserve: a

1.

THE GOVERNMENTS BANK- Loan money (or store money) for US Government

THE BANKS’ BANK- Loan money to member banks

BANK SUPERVISION- Supervise member banks

MONETARY POLICY- Set interest rates and deposit requirements

List the 3 functions of Bank Supervision-

Conduct bank examinations (CAMELS)

Supervise International Banks

Protect Consumers

CAMELS- Bank examination criteria – 6 functions of safety and soundness

C CAPITAL ADEQUACY

A ASSET ADEQUACY

M MANAGEMENT

E EARNINGS

L LIQUIDITY

S SENSITIVIY to RISK

MONETARY POLICY:

Open market- The FED buys and sells government securities

(EXAMPLE: Sell EE savings bonds to the public)

Federal funds rate- the rate at which banks borrow from each other

Discount rate- the rate of interest that the FED charges member banks for loans

(short term- usually overnight)

Federal Open Market Committee (FOMC)- Sets discount rates in response to economic conditions

THINK CRITICALLY 2.4 PG 55

1.

Why do you think only national banks are required to be members of the Federal Reserve

System?

2.

Why are Federal Reserve District Banks distributed across the nation?

3.

How does increasing a bank’s required reserve result in less money circulating in the economy?

4.

Why doesn’t the government legislate the value of money and set interest rates by law?