Stock Market PowerPoint - Middletown Public Schools

advertisement

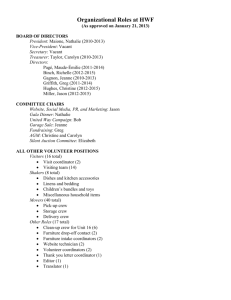

Rachel’s Super Stock (Informational) Slide Show Devon trying to steal my hardearned money My Companies In what companies did I use my $10,000 to initially invest? Red Hat, Inc. J. Crew Group, Inc. Alltel Corp. Honda Motor Corp. Sony Corp. United Postal Service Red Hat, Inc. I chose to invest in Red Hat, Inc. because it is a relatively new business. I researched it for one of our assignments, and found that it may see success in the future because of its recent technological advancements. New, risky businesses are very appealing to me. J. Crew Group, Inc. I love everything about J. Crew. They have very cute clothes, which was what first attracted me. After I researched them, I realized they are planning for some major expansion in the coming year, promising success. Alltel Corporation When I researched this company, I read that they are encroaching on Verizon and AT&T’s territory, attracting new customers because of their flexible plans and convenience. It also announced in May this year that it would be going private, which made it more attractive, because its stock prices were sure to increase. The only thing was that the date the deal would be finalized was not announced, and it kind of snuck up on me. Honda Motor Corporation I chose to invest in Honda Motor Corporation because I had read in a news article that its quarterly profit had risen 63%. I thought it would be one of my more stable investments with still more opportunity to excel. Sony Corporation I decided to invest in Sony merely because their stock prices were low. When I bought the stocks, there were widespread fires in California, damaging some of Sony’s property. This (along with some existent debt) led to lower prices, so I figured it would be a good time to buy it because a successful company like Sony was bound to bounce back. United Postal Service The main reason I decided to invest in the United Postal Service is because of the quickly approaching holiday season. More and more people shop online for its convenience, therefore increasing the business (and income) of shipping industries. Increased profits will make this corporation more attractive to investors, thus increasing the demand for its stock. Trades I Made On November 26, 2007, I traded 5 shares of J. Crew stock (total value $197.60) for 12.063 shares of Xerox Corp. stock ($197.59). -The only reason I decided to make a trade at all was that we were required to. Of course, Mr. R decided to change the rules as soon as I traded, but it’s ok! -Xerox seemed like a good choice because they have been growing tremendously. The week before I invested in Xerox Corp. they announced their first-ever dividend, making it an even more appealing choice. On December 10, 2007, I traded all of my Alltel shares (25 of them, for a total sale of $1,786.50.) I used the money from this sale to buy 36.018 more J. Crew shares, for a sale price of $1,786.49. -This was because the privatization of Alltel was finalized on November 16, 2007, thus causing it to be removed from the NYSE. I had no choice but to sell all the stocks. (The price wasn’t going up, so what would be the point in keeping them?) -I bought more J. Crew shares, because in the past month, http://www.trading-naked.com/images/NQoosTradingNaked.JPG their stock has increased more than $10.00 in value. I suspect the price will continue to rise, which will allow me a greater profit. Company Research Used The thing I relied most on to make my decisions was recent news and current events. J. Crew Group, Inc. had many positive articles published regarding their success, so that (combined with their plans for major expansion) encouraged me to invest my money there. The plans each corporation had for the future also played a big role in how I invested. I knew Alltel was going to go private (although I didn’t know exactly when), which helped me make the decision to buy their stock. One other thing I looked at, but not as much, was the general trends of the stocks. When I purchased shares of Red Hat, Inc. their 3-month graph showed a very positive trend. I was hoping this would continue during my time as a “shareholder,” but as it turns out, the stock actually declined in value. This shows that just viewing trends is usually not enough to make an informed decision. The Effect of Current Events One current event that significantly affected my stock portfolio is the extremely high prices for gasoline. Many car companies have benefited greatly from engineering vehicles that use less gas, and even electricity to power them. Honda, however, has not had any great advancements in this department, which is why I think its stocks have been declining so much lately. Companies like Toyota, which developed the Prius, are seeing success with their stocks, whereas Honda (which I invested in) is not. I think one “current event” that greatly impacted my stock portfolio, as well as the entire stock market, is the approaching holiday season. Businesses that sell things like clothes and electronics have not seen as much profit lately because people have been more careful with their money. However, upcoming holidays are proving to dissuade this thriftiness, increasing revenue for many corporations, and therefore also increasing the price of their stock. One of the current events I read about for class discussed the scandals within Crocs, Inc. They lied about their earnings in order to falsify their success so people would continue to invest their money. After I read this, I recall reading two other recent stories about similar incidents with different companies. I think immoral behavior like this among corporation VIPs can lead people to believe that the stock market is fraudulent and discourage them from investing. I think recent news like this has also negatively affected the stock market lately. What Have I Learned???? ABSOLUTELY NOTHING!!!!!!! Just Kidding, Mr. R!!!!! (Did you already mark me down for a 0 for this project?) I’ve actually learned a ton and can’t wait to start investing my money for real. I think the most important thing I’ve learned from the portfolio is to always, always, ALWAYS research companies before investing. I thoroughly researched each of the corporations I chose to invest in, and overall, it paid off. Although I had some stragglers (namely Honda Motor Corporation), I feel my in-depth research definitely paid off. Something else I learned is to never be completely trusting of every business you research. There are more companies than I thought that forge their records in order to get more money. Although you should be generally safe when looking at company records, I learned that it’s important to just keep in mind they could be lying. Sometimes common sense can save you from disaster. (For example, anyone with half a brain would realize that nobody buys Crocs in the fall and winter. Obviously the company would have back stock of the product, so they had to be lying when they reported ridiculously low numbers of inventory. Call it hindsight bias if you want…) http://www.littlecarotte.com/image/bindercover/Binder-SustM_2005-2.jpg More Money!! If given $10,000 more, I’m not sure I would do very much differently. However, there are a few things… -First of all, I would follow my intuition more and take more risks. I was originally going to buy about 150 J. Crew stocks, but I didn’t want to risk being completely burned so I cut that number almost in half, and only got 85. Had I done what I thought would be successful, I would be nearly $1000 richer. -I also would invest in more new, risky companies. I probably would buy more Red Hat, Inc. stocks (although they’ve been decreasing in value) because they have big plans for the future and are bound to be one of the leading technology providers in America. Also, I would probably buy a bunch of cheap-o stocks (like Devon’s beloved IMAX, for example) that have moneymaking potential. -One thing I might NOT do as much is depend on the season or time of year to influence my selected stocks’ prices. I chose UPS just because Christmas was coming, and it hasn’t really paid off. At press time (of this AWESOME PowerPoint…) my 20 UPS shares have made me a whopping $0.80. Saving For My Kids To Go To College………………? Seeing as I’m never going to get married or have kids, this probably won’t be an issue for me. I’d rather live in solitude for the rest of my life and make other people miserable. That said, if I were investing my money for an important longterm goal (probably to buy something cool, like a super-sized robotic slinky), I would invest a little bit differently. Although I am gung-ho on participating in the stock market, I think it’s important to have some other type of security. I would more than likely buy a vast amount of stable bonds so I would be sure of some profit over time. I think I would also buy risky bonds (but not depend on them) that showed some promise. I would definitely still invest in the stock market, but I would also use my money elsewhere. Speaking of College…. Tiger till 2012!! But anyways… Game vs. Life I noticed many differences between the game and real-life investing: -First of all, I wasn’t dealing with real money. I was definitely much more willing to take risks because in reality, there was nothing to lose. - Second, I didn’t have to pay brokerage fees. A lot of the money I used on stock in the game probably would have had to go to my broker, so I would have had less profit. -Third, there were no taxes involved in the game. (Thankfully!) -And finally (fourth!!), we didn’t receive dividends. When Alltel went private, shareholders received between 80 and 81 cents per share. Because this was just a game, I didn’t get this benefit. I would have twenty extra bucks to invest with! No fair!! My Future As An Investor (Are you scared yet, Mr. R? Your retirement money in the hands of people like me….) As soon as I strike it rich as an international businesswoman, I am definitely going to be an investor! When I invest my money, I now know there are many factors to consider when deciding how to do so. Time frames describe how much time usually needed to make an effective investment. Stocks are generally considered to be long-term investments, about 5-18 years. Regular bonds also have long-term time frames. If I were looking for something with a shorter time frame, I would put my money into a savings account. Dollarbased investing would also be something to think about. If I opted to invest this way, I could buy, say, $200 worth of selected stock each month. This would ensure steady investments over the long-term, and would most probably lead to profit. The value of the dollar is also going to be important when I invest my money. If the value of the dollar is low compared to the Euro or Yin, I would probably invest more in the stock market, in hopes of improving our economy. If this were the case, I would probably steer clear of international markets. Risk factors will also come into play. Investing in a newer, more low-key business, such as Red Hat, Inc. has a high risk factor since it is not a stable, firmly established corporation. Although there is great opportunity for success in new businesses, there is also a chance that it will fail altogether. However, a corporation such as the United Postal Service is much more stable, so would be considered a low-risk investment. Everyone uses shipping industries, and that will more than likely never change. For this reason, it is very improbable that UPS would fail as a business. This was actually my 2007 Halloween costume….. I dressed up as my physics teacher! Haha 3 VERY Important Concepts 1. 2. 3. Supply & Demand. This is what fuels the economy throughout the entire world. If a product becomes popular, the demand increases, so more of the product is made. If a business is unable to fully meet the demands, consumers are willing to pay more to get what they want. On the other hand, if a company produces too many of a product when there is a low demand, the company will probably face economical losses. Balancing supply and demand is vital to all levels of economy. Stock Market Indices. Before this class, I had no idea what a “DOW” was or meant. But now, I know that the DJIA is comprised of 30 of the largest and most widely-held corporations on the NYSE. It is computed by dividing the sum of all 30 stock by an adjustable divisor. It is an important indicator of the overall trend of the stock market, though it is important to understand that just because the DJIA moves one way, does not necessarily mean a given stock will move the same way. When the stock market had a mini-slump during our game, some of my stocks actually increased in value. Other indices include: S & P 500, Amex Composite, and Russell 1000. Risk-Return Tradeoff. This is the idea that your potential return rises with a riskier investment. Basically, in order to maximize your profit you have to take a lot of risk. Investing with a low-risk corporation is safe, but has little potential to make you rich. This is important because investors need to know that they can’t always play it safe. Without any risk, there would be no stock market. Section II Rachel’s Super Stock Portfolio Proportion of Shares Owned At The End In The Beginning… 20, 9% 15.022, 7% 12.063, 5% Red Hat, Inc 15.022, 6% 20, 8% 46, 21% 85, 39% 46, 19% 116.018, 50% Red Hat, Inc 29, 12% J. Crew Group Inc. 29, 13% Alltel Corp. 25, 11% Honda Motor Co. Sony Corp. United Postal Service I sat here for 30 minutes trying to get them to look the same, but it obviously wouldn’t work. J. Crew Group Inc. Honda Motor Co. Sony Corp. United Postal Service Xerox Corp. Portfolio Value Over The Weeks Value of Rachel's Super Stock Portfolio From Week 9-Week 15 $11,500.00 $11,000.00 Value $10,500.00 $10,000.00 $9,500.00 $9,000.00 Week 9 Week 10 Week 11 Week 12 Week 13 Week 14 Week 15 Value $9,999.99 $9,930.90 $10,166.50 $10,182.75 $10,496.71 $11,282.87 $11,286.21 Week My Three Key Companies J. Crew Group, Inc. Sony Corporation Honda Motor Corporation Progress of My 3 Key Stocks Values Of J. Crew, Sony, and Honda $60.00 Value of Stock $50.00 $40.00 $30.00 $20.00 $10.00 $0.00 Week 9 Week 10 Week 11 Week 12 Week 13 Week 14 Week 15 J. Crew Group Inc. $36.45 $38.32 $39.37 $39.52 $40.42 $49.60 $49.25 Sony Corp. $48.48 $47.04 $48.72 $50.97 $54.62 $54.51 $56.11 Honda Motor Co. $37.25 $34.79 $34.91 $33.54 $34.18 $35.09 $34.49 Week J. Crew Group, Inc. INFO – CEO: Millard S. Drexler ($1.80M salary) – Company HQ: New York, New York – Product Line: Men’s haberdashery, Italian cashmere collection, J. Crew’s wedding & party dresses, Italian leather accessories – Subsidiaries: J. Crew Operating Corporation, J. Crew Inc., Grace Holmes Inc., H.F.D. No 55 Inc., J. Crew Virginia Inc., J. Crew International Inc., J. Crew Intermediate Inc., ERL Inc., J. Crew Services, Inc. – Employees: 7,600 – Countries: United States, Japan – Top Competitors: Gap, Lands’ End, L.L. Bean STATS – – – – 2005 2006 2005 2006 Net Income: $3.8M Net Income: $77.8M Sales: $953.1M Sales: $1.15B Sony Corporation INFO – CEO: Howard Stringer – Company HQ: Tokyo, Japan – Product Line: Home video game systems, digital and video cameras, Walkman stereos, audio equipment, and semiconductors – Subsidiaries: Aiwa Business Center, Sony Corp. of America, Sony Ericcson Mobile Communications. 913 total. – Employees: 163,000 – Countries: Japan, United States, England. 80 total countries worldwide. – Top Competitors: Matsushita Electric, Philips Electronics, SANYO STATS – – – – 2005 2006 2005 2006 Net Income: $1.09B Net Income: $1.11B Sales: $66.26B Sales: $73.19B Honda Motor Corporation INFO – – – – CEO: Takeo Fukui Company HQ: Tokyo, Japan Product Line: motorcycles, automobiles, and power products Subsidiaries: Honda North America Inc., Cardington Yutaka Technologies Inc., Honda Engineering Co., Ltd., Honda Trading Corp. – Employees: 167,231 – Countries: Japan, United States, England, Vietnam. 160 total countries worldwide. – Top Competitors: Ford Motor Co., General Motors Corporation, Toyota Motor Corp. STATS – – – – 2005 2006 2005 2006 Net Income: $5.27M Net Income: $5.23M Sales: $87.41M Sales: $ 97.81M THE END!! References www.finance.google.com www.hoovers.com www.youngmoney.com www.cbronline.com www.finance.yahoo.com www.sony.com www.honda.com The song is “Price of Gas” by Bloc Party! One Last Reference I would just like to point out that without the help of Mr. David Reynolds, the production of this PowerPoint would not have been possible. The monay masta himself http://www.cs.cityu.edu.hk/~hwchun/Images/PowerPoint%20Learning.png