b-hirshleifer - University of Colorado Boulder

advertisement

Do Takeovers Create Value? New Methods and Evidence

Sanjai Bhagat, University of Colorado,

Ming Dong, York University

David Hirshleifer, Ohio State University,

Robert Noah, Cambridge Finance Partners

1

The Question

Do takeovers improve target and bidder

firm value?

Other stakeholders not considered:

Employees

Customers/Suppliers

Bondholders

2

Two important challenges to estimating

value effects of takeovers

I: Truncation Dilemma (of Window Length)

» Short return window: Since not all bids succeed,

return is only a fraction of the value effects of successful

takeovers.

» Long return window: Can capture full value effects.

But, return includes greater noise, and raises questions

of benchmark specification.

3

Two important challenges to estimating

value effects of takeovers

II: Revelation Bias

» Bidder’s return at the time of bid gives a wrong

estimate of the market’s valuation of the

bidder’s gain from takeover, because

Some bidders deliberately time bid announcement

with unrelated negative announcements. Wall

Street’s version of Wag the Dog (WSJ 12/18/98).

The form of the offer and the very fact of an offer may

convey information about the bidder’s stand-alone

value.

4

“It's Wall Street's version of `Wag the Dog.’ ”

“Over the past week, both Mattel and CocaCola have announced acquisitions on the

same day they also issued warnings about

disappointing earnings. ... No one is

suggesting that either company unveiled its

acquisition solely to divert attention from its

problems... But it is also clear that the

acquisitions, like the [Iraq] bombings, helped

shift attention away from other less favorable

developments.''

» WSJ, `Heard on the Street', 12/18/98, p. C1

5

Revelation Examples

Returns to bidding firm shareholders.

Fact of an Offer

» Good news

Bidder expects high cash flow.

» Bad news

Poor internal investment opportunities.

Bidder management with empire-building propensities.

Cash vs. Exchange Offer

» Stock Offer: Bad news, lemons problem with equity

issuance

» Cash offer: Good news that not issuing equity.

6

Solution to Dilemma of Window Length problem

Probability Scaling Method

»Like traditional methods, uses short

return window.

»Method adjusts return from short window

upward to reflect the probability of

success of bid.

7

Solution to Dilemma of Window Length and

Revelation Bias problems

Intervention Method

»Focuses on the returns to the bidder

when something happens (while the bid

is outstanding) that changes the

probability of success of the bidder.

8

What might change the probability of success of a bidder?

Litigation by target firm.

Arrival of other bidders.

Objection by a government regulatory

agency (FTC, Dept. of Justice).

Defensive measures by target (poison pill,

lock-up provision).

9

Arrival of a second bidder:

Decreases probability of success of the first

bidder.

If takeover is in the interest of the first bidder, the

first bidder’s stock price declines at the arrival of

the second bidder.

If takeover is not in the interest of the first bidder, the

first bidder’s stock price rises at the arrival of the

second bidder.

Note: Decline/rise in the first bidder’s stock price is

not related to the stand-alone value of the first

bidder, but only reflects value from the takeover.

10

Findings

Value improvements (as % of combined value) from

tender offers in the competing bid subsample:

– Intervention Method: Mean of 13.1% (median of 12.4%).

– Probability Scaling Method: 14.7% (9.7%).

– Conventional combined abnormal returns: 9.0% (7.6%).

Full sample of tender offers:

– Bradley-Desai-Kim (1988): Conventional combined abnormal

returns: 5.3% (3.7%).

– Probability Scaling Method: 7.3% (4.6%).

11

Findings

Traditional methods lead to incorrect inferences about economic forces in the

takeover market.

We find that friendly offers, equity offers, and diversifying offers are

associated with lower combined bidder-target stock returns.

A conventional interpretation would be that the gains from combination

are smaller for firms involved with these types of transactions.

However, our new methods indicate that these effects reflect

differences in revelation about stand-alone value of the bidder,

not differences in the gains from combination.

For example, cash offers on average are associated with higher bidder, target and

combined abnormal returns than equity or mixed-payment offers.

In contrast, based on the intervention method, cash offers do not create higher value

improvements than mixed or equity offers.

Hence, apparent superiority of cash offers in creating shareholder value is an illusory

consequence of a more negative revelation effect for the bidder for equity or

mixed offers than for cash offers.

12

Findings

Conventional combined returns, PSM value improvements, and bidder

returns tend to be lower in diversifying acquisitions.

IM estimates of value improvements are similar in diversifying and sameindustry acquisitions.

The relative superiority of same-industry acquisitions with PSM

(which does not filter out revelation effects) compared to IM (which does)

indicates that same-industry acquisitions are associated with more

favorable revelation about the bidder than cross-industry acquisitions.

This finding suggests that investors perceive diversifying acquisitions as

indicating poor investment opportunities within the bidder's own

industry.

13

Findings

Bidder announcement period returns and total value

improvements are negatively related to bidder Tobin's Q.

This result is quite different from the evidence from earlier samples

of Lang, Stulz, and Walkling (1989) and Servaes (1991),

Do bidders overpay?

– Conventional combined abnormal returns: Yes.

– Intervention and Probability Scaling Methods: No.

14

Specifics of the Intervention Method

4 dates

t = 0:

t = 1:

t = 2:

t = 3:

Time prior to first bid.

Arrival of first bid.

Time prior to arrival of competing bid.

Arrival of competing bid.

15

y : Market value of bidder not related with takeover.

t : Bidder's profit from takeover conditional on t.

Pt : Bidder's price at t.

Hence,

P1 = y + 1 ,

P3 = y + 3 .

(8)

16

V0T

: Non-takeover target value.

: Fraction of target held by first bidder prior to first bid.

VC

: Combined post-takeover value.

V0B

: Non-takeover

VI

:Value improvement from takeover.

bidder value.

Then, VI = VC – V0B – V0T(1- )

(1)

17

V1 , V3 : Post-takeover gains.

B1 , B3 : Price ultimately paid by a successful first bidder.

Hence,

1 = Pr(S|1) {V1 + (1-)[V1 + V0T - B1]},

3 = Pr(S|3) {V3 + (1-)[V3 + V0T - B3]}.

(9)

18

Assume, V3 = V1 = V .

[See footnotes 18, 19, sec. 4.5]

Also, R3 = P3 / P1 - 1.

(VI/VC) = {[R3(P1/V0)] / [Pr(S|3) - Pr(S|1)]}

{(1 - ) [l(B1/V0) + (1 - l)(B3/V0) - 1](VOT/ VC)}, (11)

where, l = Pr(S|1) / [Pr(S|1) - Pr(S|3)].

LHS of (11) is the

Intervention Method Improvement Method, IRIM.

Strong Agency / Hubris Hypothesis: IRIM = 0.

IRIM> 0. Implies joint value improvement.

19

The Probability Scaling Method of Estimating Value

Changes : IRPSM

Value Improvement = [Combined Initial Bidder and Target

Return] /

[(Probability a First Bidder arrives

and wins) +

(Probability a First Bidder arrives but

a Later Bidder wins)]

(6)

20

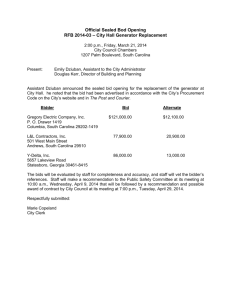

DATA

MERC and SDC datasets.

Table 1: 1018 tender offers during 1962-2001.

Figure 2 : Percentage of

•Successful takeovers,

•Multiple (two) bidder takeovers,

•Hostile takeovers,

•All cash offers.

Figures 3, 4 : Mean percentage and dollar shareholder returns to

•Bidders,

•Targets,

•Combined entity,

over various sub-periods during 1962-2001.

21

50.00

40.00

%

30.00

20.00

10.00

0.00

7/62-6/68

7/68-12/80

1/81-12/84

1/85-12/88

1/89-12/92

1/93-12/96

1/97-3/00

4/00-12/01

7/62-12/01

-10.00

Sub-period

Bidder

Target

Combined

Fig. 3. Mean shareholder returns (%). Announcement period return is the market-model cumulative abnormal return for the target,

bidder or combined, over the period five days before the first bid through five days after. Combined return is the weighted average of

target and bidder returns, where their weights are their market values as a fraction of the total target and bidder market value.

Sample includes 1018 tender offers where both bidder and target were listed on the NYSE, AMEX, or NASDAQ during 1962-2001.

22

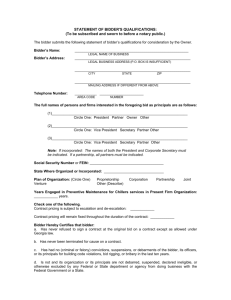

$ Million (2001 Dollars)

400.0

300.0

200.0

100.0

0.0

-100.0

7/62-6/68

7/68-12/80

1/81-12/84

1/85-12/88

1/89-12/92

1/93-12/96

1/97-3/00

4/00-12/01

7/62-12/01

-200.0

-300.0

Sub-period

Bidder

Target

Combined

Fig. 4. Mean dollar returns. Target dollar return is target market value (six days before the first bid) multiplied by target CAR; similarly

for bidder and combined dollar returns. CAR is the market-model cumulative abnormal return for the target, bidder or combined, over the

period five days before the first bid through five days after. Combined return is the weighted average of target and bidder CARs, where

their weights are their market values as a fraction of the total target and bidder market value. Sample includes 1018 tender offers where

both bidder and target were listed on the NYSE, AMEX, or NASDAQ during 1962-2001.

23

Table 3, Model B: Entry of second bidder

significantly lowers probability of success of

first bidder.

24

ESTIMATES OF VALUE IMPROVEMENTS

(VI/VC) = {[R3(P1/V0)] / [Pr(S|3) - Pr(S|1)]}

{(1 - ) [l(B1/V0) + (1 - l)(B3/V0) - 1](VOT/ VC)}, (11)

where, l = Pr(S|1) / [Pr(S|1) - Pr(S|3)].

LHS of (11) is the

Intervention Method Improvement Method, IRIM.

R3 : Bidder abnormal return at entry of second bidder = -.43%.

P1/V0 : Size of bidder relative to initial combined value = .656

(median = .690).

25

Pr(S|1) : Unconditional probability of success of

first bidder = 690/1018 =.6778.

Pr(S|3) : Probability of success of first bidder given arrival of

competing bid = 38/147 =.2585.

: Fraction of target's equity owned by first

bidder = .024 (median = .000).

B1/V0

: Average price at which first bidder wins in

full sample = 1.407 (1.384).

B3/V0

: Average price at which first bidder wins

given arrival of competing bid = 1.514 (1.421).

26

Table 4

IRIM : Implicit market estimates of the value improvement

as a result of the takeover.

CIBR : Combined Initial Bid Return = target CAR* (target

market value/target and bidder market values) + bidder

CAR * (bidder market value/target and bidder market

values). CAR is the market-model cumulative abnormal return for the target

or bidder over the period five days before the first bid through five days after.

IRPSM : (CIBR)/(Probability the first bidder succeeds

unconditionally + Probability a later bidder succeeds).

All improvement ratios are expressed as a percent of target and bidder market

values.

27

Table 4

Value improvement measures and comparisons by sub-periods

7/626/68

Median (%)

Binomial p

Sample size

15.79

0.00

18

Median (%)

Binomial p

Sample size

6.42

0.00

63

Median (%)

Binomial p

Sample size

8.57

0.01

18

Median (%)

Binomial p

Sample size

8.42

0.00

63

Median (%)

Binomial p

Sample size

1.25

0.00

63

Median (%)

Binomial p

Sample size

-4.98

0.81

18

Sub-period

7/681/811/851/891/9312/80

12/84

12/88

12/92

12/96

IRIM

12.33

8.51

14.26

9.24

9.99

0.00

0.01

0.00

0.04

0.01

36

12

37

9

11

CIBR

4.20

8.22

3.97

1.76

4.04

0.00

0.00

0.00

0.10

0.00

159

44

212

82

137

IM

IR – CIBR

4.53

-2.37

3.71

7.36

8.37

0.07

0.77

0.51

0.18

0.23

36

12

37

9

11

PSM

IR

5.49

8.82

5.16

2.07

5.19

0.00

0.00

0.00

0.10

0.00

159

44

212

82

137

PSM

IR

– CIBR

0.46

1.08

0.35

0.01

0.38

0.00

0.00

0.00

0.19

0.00

159

44

212

82

137

PSM

IM

IR

- IR (Estimated Revelation Bias)

-1.71

15.90

2.94

-5.35

-5.45

0.62

0.04

0.19

1.00

0.23

36

12

37

9

11

1/973/00

4/0012/01

Total

7/6212/01

9.70

0.01

14

11.48

0.13

4

12.38

0.00

141

2.93

0.00

204

3.00

0.17

75

3.69

0.00

976

2.66

0.42

14

4.47

1.00

4

3.74

0.00

141

3.22

0.00

204

3.17

0.17

75

4.63

0.00

976

0.10

0.00

204

0.00

0.09

75

0.22

0.00

976

4.79

0.79

14

-3.88

1.00

4

1.10

0.61

141

28

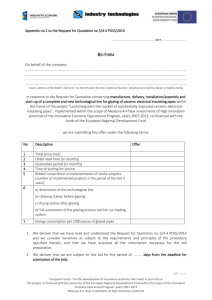

A. Histogram of CIBR

300

Frequency

250

200

150

100

50

0

-20

-15

-10

-5

0

5

10

15

20

25

30

35

40

More

CIBR (%)

CIBR: Combined Initial Bid Return

B. Histogram of IRPSM

300

200

150

100

50

0

-20

-15

-10

-5

0

5

10

15

20

25

30

35

40

More

IRPSM (%)

IRPSM: Improvement Ratio based on Probabilty Scaling Method

C. Histogram of IRIM

35

30

Frequency

Frequency

250

25

20

15

10

5

0

-20

-15

-10

-5

0

5

10

15

20

25

30

35

40

More

IRIM (%)

IRIM: Implicit Market estimates of the value to the bidder of the takeover

29

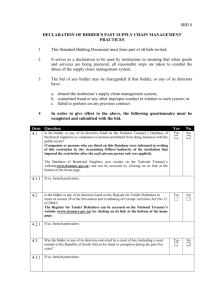

Table 8

Determinants of returns and value improvements (t-statistics in parentheses).

Independent Variable

CIBR

Hostile

1.05

(1.12)

2.69

(3.05)

-4.81

(-2.20)

2.98

(0.84)

2.31

(1.72)

1.37

(1.78)

Dependent Variable

IRPSM

Bidder

CAR

7.63

-1.63

(6.00)

(-1.83)

3.86

2.28

(3.22)

(2.71)

-5.20

-2.41

(-1.76)

(-1.16)

7.18

4.54

(1.49)

(1.34)

2.48

-0.05

(1.36)

(-0.04)

1.47

2.11

(1.42)

(2.89)

-2.53

(-11.14)

-0.65

(-2.41)

-0.28

(-2.66)

0.12

(0.74)

11.64

(6.13)

634

.2242

-3.10

(-10.06)

-0.50

(-1.38)

-0.39

(-2.73)

0.14

(0.62)

11.93

(4.63)

634

.2751

Cash

Stock

Pre-Williams Act

Post-March 2000

Same Industry

Log of Relative Size

Log of Target Size

Bidder Tobin’s Q

Target Tobin’s Q

Constant

Sample Size

Adjusted R2

-0.36

(-1.69)

-0.61

(-2.40)

-0.38

(-3.72)

0.13

(0.83)

2.71

(1.50)

636

.0530

Target

CAR

5.93

(2.46)

2.77

(1.22)

-16.05

(-2.86)

-1.04

(-0.11)

11.22

(3.24)

0.79

(0.40)

3.58

(6.13)

-1.16

(-1.69)

-0.16

(-0.57)

-0.97

(-2.26)

28.47

(5.84)

635

.1147

30

Table 5, Panel B; Table 6, Panel B

IRPSM - IRIM (Estimated Revelation Bias)

Hostile

Mean (%)

t-statistic

Median (%)

NonHostile

Cash

Mixed

Stock

6.06*** -4.42***

2.06**

0.64♦

-13.21 ♦**

-2.75

2.32

1.95

-7.88

1.24

0.18

-2.70

-0.81

1.50

1.36

-0.72

2.98

-2.75

5.42*** -4.01***

♦♦

♦♦

PrePostPreWilliams Williams March

Act

Act

2000

PostMarch

2000

1.77***

-3.38

-11.76 ***

-4.98

1.70

1.10

-3.88

Binomial p

0.02

0.07

0.37

0.54

0.29

0.81

0.47

0.61

1.00

Sample size

82

59

100

24

8

18

123

137

4

CrossIndustry

Mean (%)

t-statistic

Median (%)

SameIndustry

(4-digit)

6.48*

1.91

5.72*

CrossIndustry

0.39*

0.25

-0.02*

SameIndustry

(3-digit)

7.87***

2.63

6.52***

Binomial p

Sample size

0.15

31

1.00

109

0.07

38

0.77

102

-0.55***

-0.35

-1.17***

31

Table 9

Bidder Overpayment: The difference between value improvement measures

and toehold-adjusted bid premium (ToePrem).

ToePrem = (1-alpha) * (bid premium) * Target market value/Combined bidder and target market value, where alpha is the fraction of pre-bid target shares held

by the bidder. All improvement ratios are expressed as a % of combined target and bidder market value.

7/626/68

7/6812/80

1/8112/84

Sub-period

1/851/8912/88

12/92

Mean (%)

Median (%)

% positive

p-value of mean

Binomial p

Sample size

-0.11

0.35

54.2

0.91

0.60

59

-4.41

-2.33

34.5

0.00

0.00

145

-2.34

-4.73

27.3

0.31

0.00

44

-4.26

-3.13

31.8

0.00

0.00

211

-3.53

-2.61

30.9

0.00

0.00

81

Mean (%)

Median (%)

% positive

p-value of mean

Binomial p

Sample size

3.70

3.46

64.4

0.02

0.04

59

-1.71

-0.23

49.0

0.17

0.87

145

2.77

-1.82

45.5

0.32

0.65

44

-1.62

-1.59

42.2

0.07

0.03

211

-2.04

-1.04

39.5

0.06

0.07

81

Mean (%)

Median (%)

% positive

p-value of mean

Binomial p

Sample size

5.46

6.42

82.4

0.00

0.01

17

0.03

1.67

58.1

0.99

0.47

31

-2.47

-7.09

16.7

0.76

0.04

12

-7.27

-3.82

29.7

0.02

0.02

37

3.86

2.32

66.7

0.21

0.51

9

Mean (%)

Median (%)

% positive

p-value of mean

Binomial p

Sample size

-1.15

-0.62

47.1

0.67

1.00

17

-3.51

-1.74

35.5

0.04

0.15

31

0.83

-7.04

33.3

0.92

0.39

12

-10.48

-5.74

27.0

0.00

0.01

37

-2.67

-1.64

33.3

0.26

0.51

9

Mean (%)

Median (%)

% positive

p-value of mean

Binomial p

Sample size

3.41

3.34

58.8

0.37

0.63

17

-0.25

0.37

54.8

0.90

0.72

31

14.78

6.50

75.0

0.09

0.15

12

-2.17

-1.13

48.6

0.52

1.00

37

2.33

-0.48

44.4

0.63

1.00

9

Total

1/974/007/623/00

12/01

12/01

CIBR – ToePrem (full sample)

-1.05

-1.53

-1.96

-2.66

0.57

-1.62

-0.84

-1.93

54.7

42.2

47.3

40.0

0.21

0.02

0.20

0.00

0.31

0.03

0.73

0.00

137

204

74

955

IRPSM – ToePrem (full sample)

0.29

-0.33

-1.70

-0.59

1.19

-0.93

-0.78

-0.48

58.4

45.6

47.3

48.0

0.74

0.67

0.28

0.14

0.06

0.23

0.73

0.22

137

204

74

955

IRIM – ToePrem (competing bid sub-sample)

-0.90

-3.38

7.79

-1.45

3.14

-2.07

6.64

-0.07

54.5

42.9

100.0

49.6

0.84

0.30

0.08

0.27

1.00

0.79

0.13

1.00

11

14

4

135

CIBR – ToePrem (competing bid sub-sample)

-8.32

-4.03

-1.26

-5.06

-5.60

-3.14

4.47

-2.95

36.4

42.9

50.0

35.6

0.12

0.19

0.89

0.00

0.55

0.79

1.00

0.00

11

14

4

135

IRPSM – ToePrem (competing bid sub-sample)

-7.55

2.73

-0.10

0.91

-5.24

2.98

5.06

0.56

45.5

57.1

50.0

54.1

0.17

0.50

0.99

0.56

1.00

0.79

1.00

0.39

11

14

4

135

1/9312/96

32

SENSITIVITY ANALYSIS

1. Sensitivity of mean of estimated IRIM to simultaneous

variation in each of the estimated parameters [Pr(S|1),

Pr(S|3), B1/V0 , B3/V0] in the direction of lower IRIM:

Mean IRIM remains positive with simultaneous 12% shift in

all four estimated parameters.

2. Parameter estimates from

Bhagat-Shleifer-Vishny (1990): IRIM = 9.0% (9.9%).

Parameter estimates from Betton-Eckbo (2000):

IRIM = 17.5% (15.3%).

33

SENSITIVITY ANALYSIS

3. Model Specification: Table 10

•If the arrival of a competing bid causes an upward

revision in the expected post-takeover value of the

target to the first bidder => K > 1.

•If the first bidder fails to acquire the target, the first

bidder will successfully acquire another similar target at

a similar premium=> g > 0.

•An unsuccessful first bidder can sometimes profit by

selling its holdings to a successful competing bidder=>

Pr(S2|3) > 0.

K

1.00

1.10

1.20

1.30

1.40

IRIM (%)

mean/median

14.8/13.8

15.8/15.2

17.5/16.9

18.4/19.0

19.0/20.8

g

0.0

0.2

0.4

0.6

1.0

IRIM (%)

mean/median

14.8/13.8

14.5/13.5

14.3/14.1

14.0/14.6

13.4/14.3

Pr(S2|3)

0.0

0.1

0.3

0.5

0.7

IRIM (%)

Mean/median

14.8/13.8

14.9/13.8

15.3/14.2

15.6/14.3

15.9/14.8

34