Adjusting Accounts & Preparing Financial Statements

advertisement

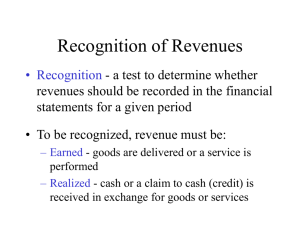

Adjusting Accounts & Preparing Financial Statements Chapter 3 Accounting period Time principle period – Specific time periods for accounting activities – Fiscal year • Consisting of any 12 months period other than ending on December 31 – Natural year • Ends December 31 Accounting basis Accrual basis – Uses the adjusting process to recognize revenues when earned and to match expenses with revenues Cash Basis – Recognized revenues when cash is received and records expenses when cash is paid Revenue Recognition Matching principle – Aims to record expenses in the same accounting period as the revenues that are earned as a result of these expenses Adjustments Adjusting entries – To correct for transactions and events that extend over more than one period • Deferred – wait till cash is paid • Accrual – – Rule • Debit the expense • Credit the asset or liabilities • For the amount used up Prepaid insurance Suppose that we purchase $2,400 for insurance for one year on May 1. Record the adjustments on December 31. $2,400/12 = $200 x 8months = $1,600 Insurance expense 1600 Prepaid insurance 1600 Supplies Suppose that supplies account has a balance of $4,000 and inventory shows $1,000. Record the supplies used up. Balance 4,000 Inventory1,000 Used up 3,000 Supplies Supplies expense 3,000 Supplies 3,000 Depreciation Plant assets/Fixed Assets – Assets which are tanigble and long lived – Building and machinery Depreciation – The reduction in value of an asset due to its use Depreciation Depreciation expense – Annual reduction in value of asset Accumulated depreciation – Contra asset – Increases with a credit – Total reduction in value of an asset Unearned revenues Refers to cash received in advance of services provided Suppose that unearned revneue has a balance of $7,000 but records shows only $3,000 is unearned Balance $7,000 Should be 3,000 Earned 4,000 Unearned Revenues Unearned revenues – A liability – If we do not complete the work then we are liable to refund the monies. – Once the work is completed then the liability does not exist Unearned revenues 4,000 Fees earned 4000 Accrued expenses Refers to costs that are incurred in a period that are unpaid and unrecorded Accrued salaries – Salaries owed at the end of the period to be made next period – Suppose year ends on Wed, do we pay on Wed or wait until Friday Salaries Suppose salaries at year end is $400 Salaries expense 400 Salaries payable 400 Accrued revenues Refers to revenues earned in a period that are both unrecorded and not yet received in cash Unrecorded accounts receivable Trial Balance Unadjusted trial balance – is a list of account balances before adjustments – Used to make adjusting entries Adjusted trial balance – Used to prepare financial statements Financial Statements Four basic financial statements – Income statement – Statement of Retained Earnings – Balance Sheet – Statement of Cash flows Income Statement •Results of operations for a business •Shows revenues minus expenses Rob Co Income Statement For period ending 12/31/04 Revenues Sales $75,000 Expense Salaries exp $25,000 Rent exp $10,000 Total exp Net income 35,000 $40,000 Statement of Retained Earnings Changes in net worth and equity Rob Co Statement of Retained Earnings For period ending 12/31/04 Beginning Retained Earnings +Net income -Dividends Ending Retained Earnings $60,000 40,000 100,000 20,000 $80,000 Balance sheet Rob Co Balance Sheet December 3, 2004 Assets Cash Truck $45,000 75,000 Total Assets $120,000 Liabilities Accts pay $10,000 Total liab. $10,000 Stockholder’s Equity Common Stock $30,000 Retained Earnings $80,000 Total S.E. $110,000 Total S.E. & Liabilities $120,000 Statement of Cash Flows Inflows and outflow of cash from – Operations – Investments – Financing Accounting Cycle Record entries in the journal Post to ledger Prepare unadjusted Trial Balance Record and post adjusting entries Prepare adjusted trial balance Prepare financial statements Record and post closing entries Closing Entries Temporary accounts – Accumulate data related to one accounting period • • • • Revenue Expense Dividends Income summary Close revenues Revenues – Income summary DR Cr Debit whatever revenue accounts you have on the trial balance for their ending balance and the total is credited to income summary Close Expenses Income summary Expenses DR CR Credit each expense account separately for the amount of the balance in the account and debit income summary for the total Close Income Summary Income Summary DR Retained earnings CR For the balance in the income summary account Income Summary Debit Total expenses Credit Total revenues Net income Close Dividends Dividends reduce the equity of the business and the amount retained in the business Retained earnings DR Dividends CR For the amount of the balance in the dividend account Transactions Fees earned $50,000 Rent expense 10,000 Supplies expense 5,000 Dividends 2,000 Retained earnings $30,000 Record the closing entries Close revenues Fees earned 50,000 Income summary 50,000 Close Expenses Income Summary $15,000 Rent expense Supplies expense $10,000 5,000 Close Income Summary Income Summary $35,000 Retained earnings $35,000 Income Summary DR Expenses $15,000 CR $50,000 Revenues $35,000 net income Close Dividends Retained earnings $2,000 Dividends $2,000 Retained Earnings DR $2,000 Dividends CR $30,000 Balance $35,000 net income $63,000 ending balance Classification of Accounts Current assets – Expected to be collected in less than one year – Cash – Accounts receivable – Supplies – Inventory Plant Asset – Long lived tangible assets – Factory building – Machinery and equipment