GFP Fourth Quarter2013 -- Global Footwear

Update

Executive Summary.

Overall US business remains soft with GDP growth in 2013 at only 2%, and the outlook for

2014 is for more of the same – political uncertainty on key US economic policies affecting

hiring, taxes, etc. and lack of confidence in Obama are holding back investment and jobs.

Retail stores have seen customer traffic down by 3% in 2013, as internet sales seem to be

taking nearly all of the sales gains.

Of course, most stores also operate internet businesses and are sharing in the shift, but

many are rethinking their store sizes, number of locations, and upgrading their web

presence – an historic ‘tipping point’ may be in progress.

According to a reliable market survey firm, some 20% of all US shoe sales are now online,

and 75% of all shoe sales growth since 2011 is accounted for by web sales.

US shoes sales at US retailers (including their net sales) were disappointing in the 4th

quarter of 2013 while wholesale brands recorded strong growth.

China’s unit’s share of the US market fell again in 2013 to just above 81% down from 89%

in 2007 with most of the loss to Vietnam and Indonesia in the sports shoe category.

Overall, in 2013, China’s shoe exports grew sharply by some 5%, or over 500 million pair,

and grew sharply in the leather shoe category up some 3.5% in units for the year.

US Business Overview.US business slumped in the quarter ending December 31, recording only a

2.4% GDP growth rate, down from 4.1% in the third quarter, and only about 2.0% growth for the

full year.

1

Except for internet sales, most retail had a disappointing, although not dreadful, holiday

season. Harsh winter weather – exceptionally cold and snow-impacted conditions no doubt

held back sales in the holiday period and into January and February – indeed the outlook for

1st quarter 2014 is very subdued.

While housing sales have held up, auto sales seem to have peaked, and soft goods sales have

not been strong, as detailed below.

Uncertainty from Washington on taxes, health care costs, labor costs, immigration, etc., and

lack of confidence in the Obama administration continue to hold back business investment.

The unemployment rate is coming down slowly but mostly due to individuals giving up on

job hunting, opting instead for retirement, further education, etc. – total US jobs is still

lower today than it was when the Great Recession began in 2009.

Many economists have predicated a 3% GDP growth rate for the US in 2014, but the weak

1st quarter means that the rest of the year must play strong catchup to make that total—by

no means a sure thing.

General Retail Sales. The top general merchandise US retailers had a weak 4thquarter with the

better stores well outpacing the discount sector (the retailers’ 4th quarter ended January 30, 2014).

Wal-mart ended the quarter with same stores sales down by 0.4% and down 0.6% for the

full year.

Target was down 2.5% for the quarter (during the quarter, its credit card data stolen by

hackers and the resulting controversy caused a massive loss of business) and was down

0.4% for the year.

Top seller of national brands, Macy’s, recorded a same store sales increase of 2.3% for the

quarter and 2.8% for the year.

Nordstrom’s recorded a same store plus of 2.2% for the quarter and 2.5% for the full year.

Footwear Sales.

The 4th quarter sales of most US shoe retailers were not at all encouraging.

None of the leading shoe retail chains were even in the black for the quarter, with the

exception of the branded athletic giant, Footlocker, which reported a respectable same store

increase of 5.3%.

General shoe retail top companies -- including DSW, Famous Footwear and Genesco – either

broke even or were in the red on a same store basis.

The situation was different on the wholesale side.

Leading US brands -- Sketchers, Wolverine Worldwide, and Brown Shoe – all recorded

strong sales gains in the quarter of about 14%, while adidas report global sales increases of

12% and US young women’s fashion leader, Steve Madden was up some 9% for the quarter.

Changing Landscape of US Shoe Sales – Internet now dominates sales growth 2011-2013

2

US shoe sales to consumers were up 7% (about $3.5 billion) to $56 billion since 2011 –

largely driven by strong performance of branded athletic items, surging boot sales (both

women and men) and fashion sandals.

Three quarters of the growth in shoe sales since 2011 has been on line!

Overall in 2013, on line accounted for about 20% of all shoe sales or some $10.5 billion.

About 60% of on line shoe sales are by companies that operate retail stores, while 40% is

pure internet players like Zappos.

Not surprisingly, during 2013, overall retail store customer traffic fell by some 3%.

Since 2011, nearly half the shoe sales growth has been in the age group 55 and above – the

unstoppable ‘baby boomers’!(Americans born between 1946 and 1964.)

Overall shoe sales in 2013 by retail value were as follows: Women’s 51% Men’s 36% and

Kids 13%

The foregoing data was furnished by NPD, a prestigious research group that collects point of

sale information directly from the leading US retailers and then aggregates and dissects it

for the trade.

Footwear Suppliers to the US for 2013.Footwear imports for the US were up modestly for 2013 by

2.0% to 2.3 billion pairs in volume and up 3.7% in value to $24.2 billion. This was an improvement

over 2012 when pairs declined by 0.6% although value moved ahead by 5.1%.

As to prices, average import value increased by 1.8% to $10.39 per pair, with the top two suppliers,

China and Vietnam reporting flat average values – all suggesting weak pricing power by buyers and

their key suppliers.

China.Its share of US imports in volume fell to 81.5% down from 83.7% in 2012, although

its total pairs sent to the US fell only by 0.8% to 1,893.0 million. In 2007, China accounted

for 89% of total US import pairs.

o Total US import value from China was $16,629.5 million a decline of 0.8% and

average unit value was flat at $8.78 per pair.

o China’s share of total value of US shoe imports fell in 2013 to 68.8% down from

71.9% in 2012.

o Leather Shoe Shipments.As noted in the table below, China’s leather shoe

shipments to the US in 2013 fell in value by 0.9% to $7,320.3 million, still accounting

for 44% of the value of total China shoe shipments to the US with an average import

price of $17.94.

For 2013, China’s share of US import value of leather shoes fell to 59.8% of

total US leather shoe imports, down from a 63% share in 2012.

China’s total leather pair shipments to the US in 2013 fell to 408.2 million

pair (accounting for 21.6% of total China pair shipments to the US in 2013)

from 411.9 million pair in 2012, while its leather shoe market share in pairs

fell to 68.2% in 2013 from 70.7% in 2012.

o As to the RMB/Dollar ratio for 2014, the betting is still on a modestly stronger RMB.

Recent RMB declines against the dollar seem to be engineered by Beijing to

undermine the ‘one way’ bet (in favor of a constantly appreciating RMB

versus the dollar) in anticipation of a broader daily trading range, and likely

stronger RMB down the road.

Big Gainers.

o Among major US suppliers, Vietnam and Indonesia both sport shoe specialists,

recorded pair increases of some 20% each, no doubt at the expense of China, which

continues to lose athletic shoe exports to these rivals.

o Cambodia, despite labor unrest at the end of 2013, increased shipments to the US by

over 60%, although overall the number was only 5.8 million pair, or about 3.1% of

China’s shipments to the US.

o In the better leather sector, India was the standout with shipments to the US

topping 16 million pair, up over 21% for the year with an average price of some

$17.50. Italy, Spain and Mexico also recorded modest gains for the year with the first

two recording average unit values of $80.18 and $52.77 respectively.

3

o Ethiopia more than doubled its shipments to the US in 2013, mostly women’s

leather casual types made of local sheep or goatskins, to 1.3 million pair, up from 66

thousand pair in 2011, as Chinese investment in the Ethiopian shoe sector is

beginning to ramp up.

China’s Global Shoe Export Performance in 2013.Overall for 2013, China’s global export

performance was outstanding with pair exports up 5.0% to 10,577 million, an increase from 2012

of over 500 million pair, the largest pair export increase since 2010.

o Total global shipments also recorded an all-time record of $48.1 billion up 8.5% over 2012.

o Surprisingly exports of leather shoes globally from China increased in value to $12.0 billion

or nearly 10% over 2012, while units were up by 3.5% to more than 865.4 million pair or

more than 8% of total pair exports for 2013.

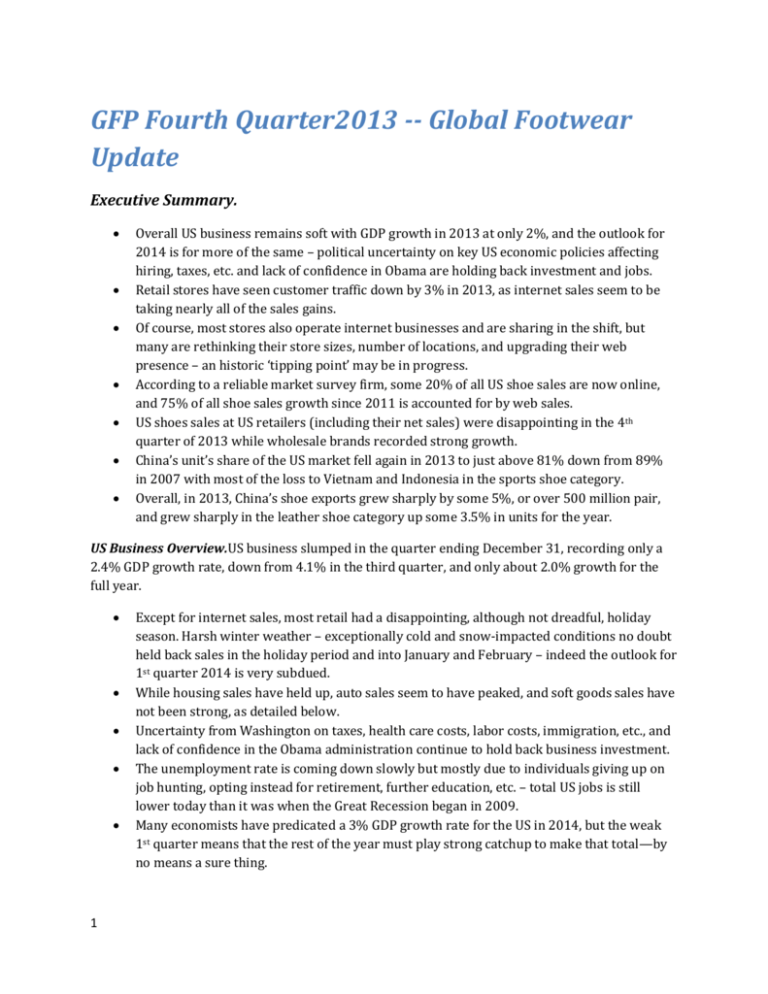

US and China 2013 Imports into the US of Leather Goods (in millions of US dollars)

US Total Imports

US Imports from China

Category

2013

Footwear

12,231.8

Apparel

2012

% of Change

11,721.8

4.4

2013

2012

7,320.3

7,389.1

% 0f Change

-0.9

558.0467.919.2262.3226.615.8

Gloves 391.5 392.6 0.0286.3291.3

-1.7

Other 580.4 569.4 1.9374.1360.3 3.8

Finished

Total

2,098.8 2,166.6 -3.1 72.3

65.6 10.2

15,860.515,318.33.58315.3 8332.9-0.2

Peter T. Mangione, Global Footwear Partnerships LLC, Washington, DC, March 14, 2014

Copyright@Global Footwear Partnerships LLC. All rights reserved. No reproduction without written

permission.

4