Slides

T

ECHNICAL

C

HANGE

, C

OMPETITION

,

AND

V

ERTICAL

I

NTEGRATION

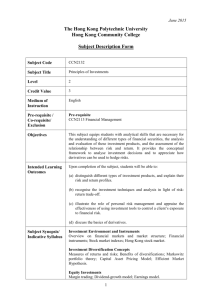

Srinivasan Balakishnan & Birger Wernerfelt

Strategic Management Journal

Vol. 7, No. 4. (Jul. – Aug., 1986) pp. 347-359

F

OCUS OF

T

HIS

P

APER

Why certain investments in the long run would be more attractive to integrated firms than to independent suppliers?

S

TRUCTURE OF THIS PAPER

A survey of the received theories of vertical integration

Extending these theories and making arguments

Building a model, making hypotheses and doing tests

Predictions and conclusions

E

XTANT IDEAS

Klein, Crawford, and Alchian (1978); and Williamson (1979)

-An integrated firm will do better than an un-integrated competitor if there are high profits in the value-added chain. (Bilateral Monopoly)

Hayes and Abernathy (1980), Porter (1980), Harrigan (1983)

-Irreversible investments are vulnerable, if there is uncertainty about their future value.

Williamson (1975)

-Uncertainty, in general, lead to more vertical integration

Tucker and Wilder (1977) and Harrigan (1983)

-Negative relationship between competition and integration, both in economics and in business policy

E

XTANT

T

HEORY

∏ (S) = R(S) – {c(S) + d(S)}

S1 = Integration strategy

S2 = Market strategy

R = Firm’s Revenue c = Firm’s Cost of Production d = Transaction Costs for the Strategy

∏= Profit of the Firm

If ∏ (S1) > ∏ (S2), Integration (S1) is preferred.

∏ (S1) > ∏ (S2), when

Competitive consideration, R(S1) > R(S2)

Production economies, c(S1) < c(S2)

Transactional economies, d(S1) < d(S2)

E

XTANT

T

HEORIES

Competitive consideration: Entry barrier and product differentiation

Production economies: Economies of scope

Transactional economies:

- Advantages of Hierarchies

- limits to corporate span

Investment in specialize assets and technological change: vertical integration implies investment with low salvage value and hence it increases the size of the capital loss, if a major innovation occurs.

A

RGUMENTS OF THIS PAPER

While uncertainty in general will make integration more effective, a particular type of uncertainty, the possibility of technological obsolescence, works the other way.

P

REMISES AND

A

SSUMPTIONS OF THIS PAPER

Premises

Strategy relates to the future and future is almost always different from the present.

Strategic decisions imply resource commitments, and few of these commitments can be revoked without incurring some costs.

Assumptions

All investments are completely irreversible

The pool of potential suppliers to be sufficiently large for the firms in our industry to set the level of integration and expect the suppliers to adjust accordingly.

M

ODEL OF THIS PAPER

– S

IMPLE

M

ODEL

∏ (v) = vps {1 – m(1 - v) - bv)}

v = fraction of invested capital; so, a change in v changes the level of the firm’s integration

s = market share; does not change with v ps = level of profitability in the industry m = profits lost in market transactions b = profits lost in bureaucratic transactions vps = available profits from integrating

{1 – m(1 - v) - bv)} = transaction costs from realizing the profits of vps

Hypothesis: A technological innovation will wipe out the investment “v”, reducing the incentive to integrate

NPV = ∏ (v) / (r + 1/T) + (i / r) (1 - v)

T = expected time to innovation; mean life of technology adopted in the industry i = rate of return on other capital invested

r = discount rate

The higher T is, the further in the future the time is, and hence the higher ∏(v) and NPV

The lower T is, the nearer the time is, and hence the lower ∏(v) and NPV

M

ODELS OF THIS PAPER

- C

ASES

Case 1: i(r + 1/T) > rps(1 - m), when “T, p or s” are very small and “i” is very large; V*=0

The industry is so unattractive relative to alternative investments that the firm would prefer a negative level of participation, implying that the existing investments in the industry, if any, would be divested.

Case 2: i(r + 1/T) < rps(1 + m – 2b), when “T, p or s” are very large and “i” is very small; V*=1

The firm would prefer to invest more than maximum feasible amount in the industry

Case 3: 0 < v* < 1, We can use the model to determine the firm’s optimal level of integration

The optimal level of integration is lower in more competitive situations where the firms market share is low (low s).

The optimal level of integration is lower when technological instability is higher (high 1/T), especially when s is low too.

The optimal level of integration is higher if the industry is more profitable (higher r and higher p), and if alternative investments are less rewarding (lower i)

The optimal level of integration is less appealing if the associated bureaucratic costs (higher b)

M

ODELS OF THIS PAPER

– E

MPIRICAL

T

EST

Measures:

V: Level of vertical integration

S: market share of a representative firm

T: analyze the effect of 1/T, technological instability

Data:

This model was estimated with data on a sample of 93 SIC-4 digit level manufacturing industries. The sample was randomly selected from among the 261 industries included in the FTC Annual Line of

Business Reports for the period 1974-1976.

M

ODELS OF THIS PAPER

– R

ESULTS

P

REDICTIONS AND

C

ONCLUSIONS

Main Results From The Paper:

Integration is affected negatively by the frequency of technological change, especially when the degree of competition is high.

The optimal level of integration depends negatively on the degree of competition in the industry.

Main Message To The Managers:

Simple-minded rules of thumb are dangerous and potentially misleading.

Managers cannot decide on integration levels for all the firm’s components simply by looking at demand fluctuations.

The likelihood of technological obsolescence must be assessed for each component and the specificity of each investment must be judged.

Across-the-board analysis is not sufficient.

F

UTURE

R

ESEARCH

Develop new topics from the existing theories