Payout Policy in the 21st Century - Duke University's Fuqua School

October 2004

Q-Group Fall Conference,

La Quinta Resort & Club

The Economic Implications of

Corporate Financial Reporting

John R. Graham

Duke University, Durham, NC USA

Campbell R. Harvey

Duke University, Durham, NC USA

National Bureau of Economic Research, Cambridge, MA USA

Shiva Rajgopal

University of Washington, Seattle, WA USA

1

Graham/Harvey/Rajgopal: Corporate Reporting

Background

1. Graham and Harvey conduct a survey on capital structure and project evaluation

– “Theory and Practice of Corporate Finance: Evidence from the Field” appears in JFE 2001

2. Brav, Graham, Harvey & Michaely survey on dividend and repurchase policy

– “Payout Policy in the 21 st Century” forthcoming in JFE

2004

3. Graham, Harvey and Rajgopal survey on corporate financial reporting

2

Graham/Harvey/Rajgopal: Corporate Reporting

Methodology

General goals our research program:

•

To examine assumptions

•

To learn what people say they believe

•

To provide a complement to the usual research methods: archival empirical work and theory

3

Graham/Harvey/Rajgopal: Corporate Reporting

Methodology

Approach contrasts with Friedman’s (1953) “The

Methodogy of Positive Economics”

•

Goals of positive science are predictive

• Don’t reject theory based on “unrealistic assumptions”

•

Also, rejects notion that all the predictions of a theory matter to its validity – goal is “narrow predictive success”

4

Graham/Harvey/Rajgopal: Corporate Reporting

Narrow goals

Insight on following issues:

•

Importance of reported earnings and earnings benchmarks

•

Are earnings managed? How? Why?

–

Real versus accounting earnings management

– Does missing consensus indicate deeper problems?

•

Consequences of missing earnings targets

•

Importance of earnings paths

•

Why make voluntary disclosures?

5

Graham/Harvey/Rajgopal: Corporate Reporting

Strengths and limitations

Strengths :

• Surveys enable us to ask decision-makers specific qualitative questions about motivations

•

Less of a variable specification problem

• Complements large sample analyses

• A unique angle to confront theories with data

Limitations :

• Questions may be misunderstood

• Truthful responses?

• Non-response bias

•

Friedman (1953)

6

Graham/Harvey/Rajgopal: Corporate Reporting

Method

Survey and Interview Design

• Draft survey instrument “refereed” by both finance and accounting researchers as well as experts in survey design

•

Interviewed structured to adhere to best scientific practices of interviews, e.g. Sudman and Bradburn

(1983)

•

IRB certification for human subject research

7

Graham/Harvey/Rajgopal: Corporate Reporting

Sample

• 401 usable survey responses

– response rate of 10.4%

• 25% response rate at a practitioner conference

• 8% response rate to Internet survey

•

Interview 20 CFOs

–

40-90 minutes in length

–

More give and take than in the survey

–

Interviewed firms are much larger, more levered and more profitable than the average Compustat firm.

• Relative to Compustat firms

– Surveyed firms are larger, more levered, greater dividendyield, fewer firms report negative earnings

–

Similar B/M and positive P/E

8

Graham/Harvey/Rajgopal: Corporate Reporting

Sample

Firm characteristics (self reported)

•

Agency

– CEO age, tenure, education

–

Inside ownership

• Size

– Revenues

– Number of employees

• Growth opportunities

– P/E

– Growth in earnings

9

Graham/Harvey/Rajgopal: Corporate Reporting

Sample

Firm characteristics (self reported)

•

Free cash flow effects

–

Profitability

– Leverage

• Informational effects

– Public/private

–

Which stock exchange

•

Industry

•

Credit rating

10

Graham/Harvey/Rajgopal: Corporate Reporting

Sample

Firm characteristics (self reported)

•

Financial reporting practices

– Number of analysts

– Do they give “guidance”?

•

Ticker symbol!

11

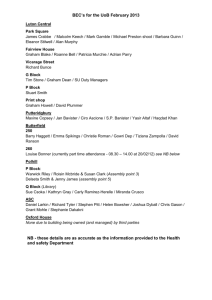

Corporate Financial Reporting

Performance measurements

(earnings, cash flows): Sec 3.1,Table 2

Voluntary disclosure

Earnings benchmarks

Sec 3.2, Table 3

Earnings trends :

Why disclose ?

Sec 6.1,Table 11

Why not disclose ?

Sec 6.2, Table 12

Timing

Sec 6.3

Table 13

Why meet benchmarks ?

Sec 3.3, Table 4

What if miss benchmarks ?

Sec 3.4, Table 5

Why smooth earnings ?

Sec 5.1, Table 8

How to meet benchmarks :

Sec 4.1, Table 6

Value sacrifice to meet benchmarks :

Sec 4.2, Table 7

Fig. 1 Flowchart depicting the outline of the paper

Value sacrifice for smooth earnings

Sec 5.2, Table 9

12

Corporate Financial Reporting

Performance measurements

(earnings, cash flows): Sec 3.1,Table 2

Voluntary disclosure

Earnings benchmarks

Sec 3.2, Table 3

Earnings trends :

Why disclose ?

Sec 6.1,Table 11

Why not disclose ?

Sec 6.2, Table 12

Timing

Sec 6.3

Table 13

Why meet benchmarks ?

Sec 3.3, Table 4

What if miss benchmarks ?

Sec 3.4, Table 5

Why smooth earnings ?

Sec 5.1, Table 8

How to meet benchmarks :

Sec 4.1, Table 6

Value sacrifice to meet benchmarks :

Sec 4.2, Table 7

Fig. 1 Flowchart depicting the outline of the paper

Value sacrifice for smooth earnings

Sec 5.2, Table 9

13

Graham/Harvey/Rajgopal: Corporate Reporting

Motivation

DeGeorge, Patel, Zeckhauser, JB 1999 14

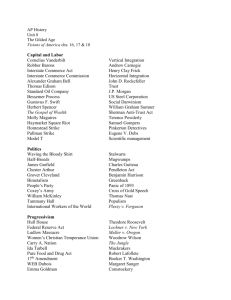

Graham/Harvey/Rajgopal: Corporate Reporting

Earnings benchmarks

Same quarter last year EPS

Analyst consensus EPS forecast

Reporting a profit (i.e. EPS >0)

Previous quarter EPS

0% 20% 40% 60% 80% 100%

Percent of respondents

Responses to the question: “How important are following earnings benchmarks?” based on a survey of 401 financial executives.

15

Graham/Harvey/Rajgopal: Corporate Reporting

Earnings benchmarks

Conditional: Consensus is relatively more important for

•

Firms with more analysts

•

Firms that give guidance

•

Large firms

•

More levered firms

[Table 3]

16

Corporate Financial Reporting

Performance measurements

(earnings, cash flows): Sec 3.1,Table 2

Voluntary disclosure

Earnings benchmarks

Sec 3.2, Table 3

Earnings trends :

Why disclose ?

Sec 6.1,Table 11

Why not disclose ?

Sec 6.2, Table 12

Timing

Sec 6.3

Table 13

Why meet benchmarks ?

Sec 3.3, Table 4

What if miss benchmarks ?

Sec 3.4, Table 5

Why smooth earnings ?

Sec 5.1, Table 8

How to meet benchmarks :

Sec 4.1, Table 6

Value sacrifice to meet benchmarks :

Sec 4.2, Table 7

Fig. 1 Flowchart depicting the outline of the paper

Value sacrifice for smooth earnings

Sec 5.2, Table 9

17

Graham/Harvey/Rajgopal: Corporate Reporting

Why meet earnings benchmarks?

build credibility with capital market maintain or increase our stock price external reputation of management convey future growth prospects to investors reduce stock price volatility assures stakeholders business is stable employees achieve bonuses achieve desired credit rating avoid violating debt-covenants

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100

%

Percent agree or strongly agree

Responses to the statement: “Meeting earnings benchmarks helps …” based on a survey of 401 financial executives.

18

Graham/Harvey/Rajgopal: Corporate Reporting

Why meet earnings benchmarks?

Stock price motivation

• 86% of CFOs say “builds credibility”

•

80% maintain or increase stock price

19

Graham/Harvey/Rajgopal: Corporate Reporting

Why meet earnings benchmarks?

Stakeholder motivations

•

Firms enhance reputation with stakeholders, such as customers, suppliers, creditors

•

Conditional analysis shows this is important for small, tech, inside dominated, young and not profitable

20

Graham/Harvey/Rajgopal: Corporate Reporting

Why meet earnings benchmarks?

Employee bonus

•

Survey evidence not significant

•

Interviews suggest that internal targets more important for managers (“stretch” and “budget” greater than consensus)

21

Graham/Harvey/Rajgopal: Corporate Reporting

Why meet earnings benchmarks?

Career concerns

•

External reputation very important

•

This motivation was prominent in interviews.

Executive labor market important. Failure to deliver on targets inhibits intra-industry mobility.

22

Graham/Harvey/Rajgopal: Corporate Reporting

Consequences of missing benchmarks creates uncertainty about our future prospects outsiders think there are previously unknown problems have to spend time explaining why we missed increases scrutiny of all aspects of earnings releases outsiders might think firm lacks flexibility increases the possibility of lawsuits

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%

Responses to the statement: “Failing to meet benchmarks…” based on a survey of 401 financial executives.

23

Graham/Harvey/Rajgopal: Corporate Reporting

Consequences of missing benchmarks

Uncertainty

•

Uncertainty about future prospects is thought to be priced

24

Graham/Harvey/Rajgopal: Corporate Reporting

Consequences of missing benchmarks

Cockroach problem

• “You have to start with the premise that everyone manages earnings”

• If you can’t come up with a few cents, there must be some previously unknown serious problems at the firm

• “If you see one cockroach, you immediately assume there are hundreds behind the walls, even though you have no proof that this is the case”

25

Graham/Harvey/Rajgopal: Corporate Reporting

Consequences of missing benchmarks

Mitigation of negative reaction

•

Explain miss is due to specific accounting accrual

•

Miss quarterly but confirm annual guidance

•

Nonfinancial indicators suggest good future performance

Other factors

• Conference call becomes negative; investors become defensive

26

Corporate Financial Reporting

Performance measurements

(earnings, cash flows): Sec 3.1,Table 2

Voluntary disclosure

Earnings benchmarks

Sec 3.2, Table 3

Earnings trends :

Why disclose ?

Sec 6.1,Table 11

Why not disclose ?

Sec 6.2, Table 12

Timing

Sec 6.3

Table 13

Why meet benchmarks ?

Sec 3.3, Table 4

What if miss benchmarks ?

Sec 3.4, Table 5

Why smooth earnings ?

Sec 5.1, Table 8

How to meet benchmarks :

Sec 4.1, Table 6

Value sacrifice to meet benchmarks :

Sec 4.2, Table 7

Fig. 1 Flowchart depicting the outline of the paper

Value sacrifice for smooth earnings

Sec 5.2, Table 9

27

Graham/Harvey/Rajgopal: Corporate Reporting

Actions taken to meet benchmarks

0% 20% 40% 60% 80% 100%

Decrease discretionary spending (e.g. R&D, advertising, maintenance, etc.)

Delay starting a new project even if this entails a small sacrifice in value

Book revenues now rather than next quarter (if justified in either quarter)

Provide incentives for customers to buy more product this quarter

Draw down on reserves previously set aside

Postpone taking an accounting charge

Sell investments or assets to recognize gains this quarter

Repurchase common shares

Alter accounting assumptions (e.g. allowances, pensions etc.)

Within what is permitted by GAAP, which of the following choices might your company make?”

Graham/Harvey/Rajgopal: Corporate Reporting

Actions taken to meet benchmarks

Real versus accounting actions

•

80% would reduce discretionary spending, R&D, maintenance, advertising

•

55.3% would delay starting a new project even if it entailed a small sacrifice in value

• Not as much support for “accounting actions”

29

Graham/Harvey/Rajgopal: Corporate Reporting

Actions taken to meet benchmarks

Real versus accounting actions

•

Little research on real actions

–

Dechow and Sloan (JAE 1991); Bartov (TAR 1993);

Bushee (TAR 1998), R&D or asset sales

– Roychowdhury (WP 2003) over produce and sales discounts to meet targets

30

Graham/Harvey/Rajgopal: Corporate Reporting

Actions taken to meet benchmarks

Real versus accounting actions

•

Significantly more likely to say they are taking real rather than accounting actions

• In contrast, most of the work on “earnings management” has focused on accruals

31

Graham/Harvey/Rajgopal: Corporate Reporting

Actions taken to meet benchmarks

Why real versus accounting actions?

•

Aftermath of Enron-Worldcom along with S-Ox

•

Any hint of accounting questions could have devastating effect on stock prices

•

More willing to admit to real actions

• Auditors can’t second guess real actions

32

Graham/Harvey/Rajgopal: Corporate Reporting

Sacrificing long-term value

Hypothetical scenario: Your company’s cost of capital is 12%. Near the end of the quarter, a new opportunity arises that offers a 16% internal rate of return and the same risk as the firm. The analyst consensus EPS estimate is $1.90. What is the probability that your company will pursue this project in each of the following scenarios?

Actual EPS if you do not pursue the project

Actual EPS if you pursue the project

The probability that the project will be pursued in this scenario is …

(check one box per row)

0% 20% 40% 60% 80% 100%

$2.00

$1.90

$1.80

$1.40

$1.90

$1.80

$1.70

$1.30

33

Graham/Harvey/Rajgopal: Corporate Reporting

Sacrificing long-term value

0% 20% 40% 60% 80%

If you take project, you will exactly hit consensus earnings

If you take project, you will miss consensus earnings by $0.10

If you take project, you will miss consensus earnings by $0.20

If you take project, you will miss consensus earnings by $0.50

Probability of accepting project 34

100%

Graham/Harvey/Rajgopal: Corporate Reporting

Sacrificing long-term value

EPS if you do not pursue

EPS if you pursue

$2.00

$1.90

$1.80

$1.40

$1.90

$1.80

$1.70

$1.30

0%

4%

10%

14%

20%

20%

4%

14%

12%

13%

Probability that the project will be pursued: (Percent of respondents indicating)

40% 60% 80% 100%

5%

10%

13%

12%

10%

20%

21%

15%

32%

28%

22%

20%

45%

18%

17%

19%

Only 45% would take the project for sure – even if they are projected to meet consensus

[Table 7]

35

Average probability of pursuing

Graham/Harvey/Rajgopal: Corporate Reporting

Sacrificing long-term value

Reminiscent of Brav, Graham, Harvey and Michaely

•

Sacrifice positive NPV projects before cutting dividends

36

Graham/Harvey/Rajgopal: Corporate Reporting

Sacrificing long-term value

4e: Fund externally, rather than cut

3e: Fund externally, rather than cut

4a: Investment decision made 1st

3a: Investment decision made 1st

7h: Good alternative investments

6h: Good alternative investments

7j: M&A strategy

6j: M&A strategy

0% 10% 20% 30% 40% 50% 60% 70% 80%

Percent of CFO's who rate choice as +1 or +2 (on scale of -2 to +2)

Repurchases

Dividends

37

Graham/Harvey/Rajgopal: Corporate Reporting

Other insights on meeting benchmarks

Interviews

•

18/20 interview mentioned trade off of short-run earnings and long-term optimal decisions

•

Investment banks offer products that create accounting income with negative cash flow consequences

38

Graham/Harvey/Rajgopal: Corporate Reporting

Other insights on meeting benchmarks

Guidance

•

Goal of guidance is to meet or exceed consensus every quarter

•

Analysts complicit in game of always meeting or exceeding

• Large positive surprises lead to “ratchet-up effect”

•

Asymmetric

39

Graham/Harvey/Rajgopal: Corporate Reporting

Other insights on meeting benchmarks

Break out of the game

•

Why not declare that you will not play the earnings management game?

40

Corporate Financial Reporting

Performance measurements

(earnings, cash flows): Sec 3.1,Table 2

Voluntary disclosure

Earnings benchmarks

Sec 3.2, Table 3

Earnings trends :

Why disclose ?

Sec 6.1,Table 11

Why not disclose ?

Sec 6.2, Table 12

Timing

Sec 6.3

Table 13

Why meet benchmarks ?

Sec 3.3, Table 4

What if miss benchmarks ?

Sec 3.4, Table 5

Why smooth earnings ?

Sec 5.1, Table 8

How to meet benchmarks :

Sec 4.1, Table 6

Value sacrifice to meet benchmarks :

Sec 4.2, Table 7

Fig. 1 Flowchart depicting the outline of the paper

Value sacrifice for smooth earnings

Sec 5.2, Table 9

41

Graham/Harvey/Rajgopal: Corporate Reporting

Smoothing

96.9% and 20/20 interviews prefer smooth earnings over more volatile holding cash flows constant

42

Graham/Harvey/Rajgopal: Corporate Reporting

Smoothing

0% 20% 40% 60% 80% 100%

Is perceived as less risky by investors

Makes it easier for analysts/investors to predict future earnings

Assures customers/suppliers that business is stable

Reduces the return that investors demand (i.e.

smaller risk premium)

Promotes a reputation for transparent and accurate reporting

Conveys higher future growth prospects

Achieves or preserves a desired credit rating

Clarifies true economic performance

Increases bonus payments

Responses to the question: “Do the following factors contribute to your company preferring a smooth earnings path?”

43

Graham/Harvey/Rajgopal: Corporate Reporting

Smoothing

Reasons

• Lowers “risk”; increased predictability; lower “risk” premium

•

Clear from survey and interviews that CFOs believe that this risk is priced

• Possible link to literature on: estimation error, disagreement in asset pricing, information risk premium, and behavioral literature on risk versus uncertainty

44

Graham/Harvey/Rajgopal: Corporate Reporting

Sacrificing value for smoothing

0% 20% 40% 60% 80% 100%

None

Small sacrifice

Moderate sacrifice

Large sacrifice

Responses to the question: “How large a sacrifice in value would your firm make to avoid a bumpy earnings path?” 45

Graham/Harvey/Rajgopal: Corporate Reporting

Other insights on smoothing

Interviews

•

Volatile earnings will create trading incentives for speculators, hedge funds and legal vultures

•

Volatile earnings mean that you will have a number of misses – which CFOs want to avoid

Smoothing example

46

Graham/Harvey/Rajgopal: Corporate Reporting

Marginal investor

7% 2%

2%

36%

53%

Institutions

Analysts

Individuals

Rating Agencies

Hedge Funds

Responses to the statement: “Rank the two most important groups in terms of setting the stock price for your company”

47

Graham/Harvey/Rajgopal: Corporate Reporting

Marginal investor

Price setters

•

Institutional investors

•

Analysts have important short-term impact

•

Retail investors important because they are potential customers and are less likely to flip stock

48

Graham/Harvey/Rajgopal: Corporate Reporting

Marginal investor

Critique of analysts, institutions

•

Young, do not have sense of history

•

Contagion: bandwagon effect important given relative performance measurement

•

Quantitative hedge funds issue sell signal if you miss

–irrespective of fundamental information

CFOs believe idiosyncratic risk is priced

49

Corporate Financial Reporting

Performance measurements

(earnings, cash flows): Sec 3.1,Table 2

Voluntary disclosure

Earnings benchmarks

Sec 3.2, Table 3

Earnings trends :

Why disclose ?

Sec 6.1,Table 11

Why not disclose ?

Sec 6.2, Table 12

Timing

Sec 6.3

Table 13

Why meet benchmarks ?

Sec 3.3, Table 4

What if miss benchmarks ?

Sec 3.4, Table 5

Why smooth earnings ?

Sec 5.1, Table 8

How to meet benchmarks :

Sec 4.1, Table 6

Value sacrifice to meet benchmarks :

Sec 4.2, Table 7

Fig. 1 Flowchart depicting the outline of the paper

Value sacrifice for smooth earnings

Sec 5.2, Table 9

50

Graham/Harvey/Rajgopal: Corporate Reporting

Voluntary disclosure

Types

•

Conference calls, meetings, press releases, and disclosure of more than mandated information in regulatory filings

•

Healy and Palepu (2001) say that motivations for voluntary disclosure “important unresolved question for future research”

51

Graham/Harvey/Rajgopal: Corporate Reporting

Voluntary disclosure

Drivers

•

Information asymmetry

•

Increased analyst coverage

•

Corporate control contest

•

Stock compensation

• Management talent

•

Limitations of mandatory disclosure

52

Graham/Harvey/Rajgopal: Corporate Reporting

Voluntary disclosure

Contraints

•

Litigation risk

•

Proprietary costs

•

Political costs

•

Agency costs

• Setting a precedent that may be hard to maintain

53

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

0% 20% 40% 60% 80% 100% promotes a reputation for transparent/accurate reporting reduces the “information risk” that investors assign to our stock provides important information to investors that is not included in mandatory financial disclosures increases the predictability of our company’s future prospects attracts more financial analysts to follow our stock corrects an under-valued stock price increases the overall liquidity of our stock increases our P/E ratio reveals to outsiders the skill level of our managers reduces our cost of capital reduces the risk premium employees demand for holding stock granted as compensation

Survey responses to the question: Do these statements describe your company's motives for voluntarily communicating financial information?

54

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

Information asymmetry: Information risk

•

Diamond Verrecchia (1991) voluntary disclosure reduces asymmetry between informed and uninformed, increases liquidity.

– 81.9% agree – only 4.3% disagree

– Related 56.2% agree that predictability of company’s future prospects is enhanced

55

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

Information asymmetry: Information risk

• Interviews distinguish between “information risk” and “inherent risk”

•

Believe that both command a risk premium

•

Releasing bad news quickly can be beneficial in reducing information risk

56

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

Information asymmetry: Reputation

•

92.1% agree with reputational benefit for transparent reporting (scores the highest)

•

Interviews:

–

Correct investors misperceptions

– Create an environment of trust so strategic actions more easily taken in the future

–

Trust may be important in gaining access to future capital

57

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

Information asymmetry: Cost of capital

•

While only 39.3% point to cost of capital, the information risk is linked to cost of capital

•

P/E lift 42% might be similar to the cost of capital

•

Interviews:

– A number mentioned “reducing analysts disagreement” and linked that to cost of capital

58

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

Information asymmetry: Liquidity

•

Motivation especially for small firms

59

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

Increased analyst coverage:

•

Bhushan (1989a,b) and Lang and Lundholm (1996)

•

50.8% agree

•

More agreement with small and insider dominated firms

60

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

Stock price motivation:

•

48.4% use disclosure to try to correct undervalued stock

61

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

Stock compensation:

•

Managers want to reduce contracting costs with employees where there is information asymmetry, otherwise employees will demand a risk premium

•

No support, half disagree

62

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

Management talent signaling:

•

Trueman (1986)

•

More support for small firms plus other questions suggest that this is important

63

Graham/Harvey/Rajgopal: Corporate Reporting

Motivations for voluntary disclosure

Limitations of mandatory disclosures (new):

•

72.1% say that voluntary corrects gaps in mandatory

•

Interviews:

– Some mandatory “confuse rather than enlighten”

– “Some of our own footnotes related to off-balance sheet items and securitizations are so complex, even I don’t understand them.”

– Quarterly mandatory disclosures lack timeliness

–

Mandatory ignores intangibles

64

Graham/Harvey/Rajgopal: Corporate Reporting

Constraints on voluntary disclosure

0% 20% 40% 60% 80% 100% avoid setting a disclosure precedent that may be difficult to continue avoid giving away “company secrets” or otherwise harming our competitive position avoid possible lawsuits if future results don’t match forward-looking disclosures avoid potential follow-up questions about unimportant items avoid attracting unwanted scrutiny by regulators avoid attracting unwanted scrutiny by stockholders and bondholders

Survey responses to the question: Limiting voluntary communication of financial information helps…

65

Graham/Harvey/Rajgopal: Corporate Reporting

Constraints on voluntary disclosure

Precedent (new)

•

The most popular response with 69.6% agreeing

•

Most important for insider dominated firms

•

Start a practice that you might want to abandon later

66

Graham/Harvey/Rajgopal: Corporate Reporting

Constraints on voluntary disclosure

Litigation costs

•

Threat of litigation makes managers disclose bad news quickly

•

46.4% agree; especially important for young and tech

67

Graham/Harvey/Rajgopal: Corporate Reporting

Constraints on voluntary disclosure

Proprietary costs

• Might jeopardize firm’s competitive position

•

58.8% agree

•

More agreement with small firms and those with few analysts

68

Graham/Harvey/Rajgopal: Corporate Reporting

Constraints on voluntary disclosure

Agency costs

•

We know that career concerns and external reputation important for meeting benchmarks

•

Information may be limited to reduce the chance of undue focus by stakeholders

• Not much support – for this agency cost angle

69

Graham/Harvey/Rajgopal: Corporate Reporting

Constraints on voluntary disclosure

Political costs

•

Disclosure may be limited to avoid unwanted attention of regulators

•

No support on average – but this question, in particular, is difficult to interpret

70

Graham/Harvey/Rajgopal: Corporate Reporting

Good news versus bad news

Bad news faster

No difference

Good news faster

Survey responses to the question: Based on your company's experience, is good news or bad news released to the public faster?

71

Graham/Harvey/Rajgopal: Corporate Reporting

Good news versus bad news

0% 20% 40% 60% 80% 100%

Disclosing bad news faster enhances our reputation for transparent and accurate reporting

Disclosing bad news faster reduces our risk of potential lawsuits

Good news is released faster because bad news takes longer to analyze and interpret

Good news is released faster because we try to package bad news with other disclosures which can result in a coordination delay

Survey responses to the question: Do the following statements describe your company's motives related to the timing of voluntary disclosures?

72

Graham/Harvey/Rajgopal: Corporate Reporting

Conclusions

• Consensus earnings factors into decisions

•

Strong desire to meet benchmarks – cockroach problem

•

It is routine to sacrifice long-term value to meet these benchmarks

• Meeting benchmarks is important both for the firm’s stock price and managers reputation and mobility

•

Agents optimizing over short-term horizon

73

Graham/Harvey/Rajgopal: Corporate Reporting

Conclusions

• Having predictable smooth earnings is thought to both reduce the cost of capital and enhance manager reputation

• Voluntary disclosure is an important tool in manager’s arsenal

• Disclosure can potentially reduce information risk and enhance a manager’s reputation

74

Graham/Harvey/Rajgopal: Corporate Reporting

Future research

Last survey instrument!

•

We are thinking of administering the identical survey before it is published to non-management members of

Boards of Directors.

Also…

• “Detection of Financial Earnings Management”

• “Detection of Real Earnings Management”

We have the tickers for 107 firms many of which admit to both financial and real earnings management

75