Principles & Practice of Sport Management

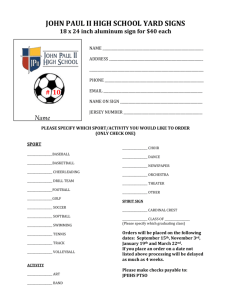

advertisement

Financial and Economic Principles Applied to Sport Management Chapter 4 Introduction • The sport industry is a multibillion dollar industry. • Financial aspects of sport industry shown in the media can seem staggering to the average person. • Sport industry is definitely a major force in North American business, though it is difficult to get an accurate, reliable measure of its magnitude. • Financial boom has created a great need for people with training in finance. “Sales” vs “Value-Added” • There is a difference between an industry’s “sales” and its “value-added.” • “Value-added” is a more accurate statistic. • Cost of raw materials and manufacturing are considered when calculating “value added.” Key Concepts: What Is Finance? • No single, universally agreed upon definition • Generally refers to two primary activities of an organization: 1. How an organization generates the funds that flow into that organization 2. How these funds are allocated and spent once they are in the organization Key Concepts: Revenues vs Expenses • Revenues: – Funds raised by an organization through a variety of sources including tickets, merchandise, services, sponsorships, etc. • Expenses: – Funds spent to operate an organization such as salaries, equipment, utilities, food, travel, insurance, etc. Key Concepts: Profit • Profit: More revenues than expenses • Can be enhanced by increasing revenues, decreasing costs, or both • Income Statement: Summarizes an organization’s revenues, expenses, and profits over a given time period (fiscal year) Key Concepts: Assets • Assets: Anything an organization owns that can be used to generate future revenues (facility, equipment) • Teams can fund or “finance” assets in many ways: – Owners’ Equity: The amount of their own money owners have invested in the firm – Debt: Money an organization borrows (bonds) – Franchise ownership groups – Corporate conglomerates (See Table 4-1) – Publically traded sport companies (See Table 4-2) Key Concepts: Debt • Define Debt (*liability) – The amount of money an organization borrows from banks or other lenders in the market (bonds) – Organization is legally obligated to pay back the original amount borrowed (principal) plus interest. • Bonds – Financial instruments that allow the borrower to both borrow large dollar amounts over an extended period of time (20 or more years) – Issued by government and/or corporate entities – Often used to fund stadium construction Key Concepts: Credit Facilities • Define Credit – Some professional leagues maintain “credit facilities” (loan pools) backed by league revenues. – Individual teams can borrow from the loan pools at better interest rates. – NFL debt has highest credit rating = lowest credit risk = can borrow at lowest interest rate Key Concepts: Balance Sheet • Balance Sheet: A financial statement that summarizes an organization’s assets, liabilities, and owner’s equity at any given point in time Key Concepts: Return on Investment (ROI) • Define Return on Investment – The expected dollar value return on each alternative investment, stated as a percentage of the original cost of each investment – Example: ROI of 9% = the organization would recover all of the initial investment plus an additional 9% – Note: There is “risk” associated with all investments – Example: Professional Sport Franchise Values Key Concepts: Risk • Define Risk – Because the future is uncertain, the future benefits of any investment cannot be known with certainty at the time the investment is made. – Level of risk must be considered by sport managers prior to any future investment. – Significant risk associated with how to fund significant investments – Equity vs. Borrowed money? Key Concepts: Economics of Sports • The general field of (micro) economics examines how an industry organizes itself and how this industry structure affects competition and profits among firms in the industry. • Example: Spectator Sport Industry - Teams compete on the field but cooperate financially off of the field; more like partners. - Mutual existence has positive financial impact on the other (Red Sox and Yankees) Key Concepts: Economics of Sports – Sport leagues considered legal monopolies • Face no direct competition from rival leagues • Gives them greater bargaining power when dealing with stakeholders (e.g., players, broadcasters, corporate sponsors, and local governments) and allows them to potentially charge higher prices • Allows them to earn much higher profits than would otherwise be the case, as well as enact financial policies (e.g., salary caps, revenue sharing) that would not be possible with direct competition Key Skills • No matter what type of sport organization involved, the finance function is crucial. • Those interested in a career in sports should have solid grounding in: – Corporate finance – Managerial and financial accounting – Advanced use of spreadsheet software • For those interested in working in spectator sports, familiarity with sport economics is beneficial. Current Issues: Can Growth Continue? • There has been an explosion of spending on recreational and fitness activities. – The U.S. population has aged, overall affluence has increased, and societal concerns about healthrelated issues have grown. • For individual segments of non-spectator sport industry, predicting trends is a factor. Capital investments are made now, payoff occurs later. • Spectator sport industry has had tremendous revenue growth in past 15 years as the result of increased popularity, premium ticketing, broadcast contracts, sponsorship sales, stadium naming rights, and so on. Current Issues: Can Growth Continue? • Increasingly large capital investments are needed to be able to continue to generate revenues and growth. • Concern: College athletics, taken as a whole, continues to be unprofitable. – The revenue-generating abilities of football and men’s basketball are insufficient to compensate for deficits of all other sports. Current Issues: Can Growth Continue? (cont.) • Competitive balance – Entertainment value connected to “uncertainty of outcome” – Differences in market sizes cause differences in revenue potential, which cause differences in ability to pay players, which cause differences in on-field performance – Salary cap, revenue sharing, luxury tax Summary • The past two decades have been very financially lucrative for many facets of the sport industry. • The financial “boom” has increased the need for sport managers with specialized financial skills. • Analytical skills and tools will be needed by sport managers of the future to help create new revenue streams and solve financial problems faced by sport organizations.