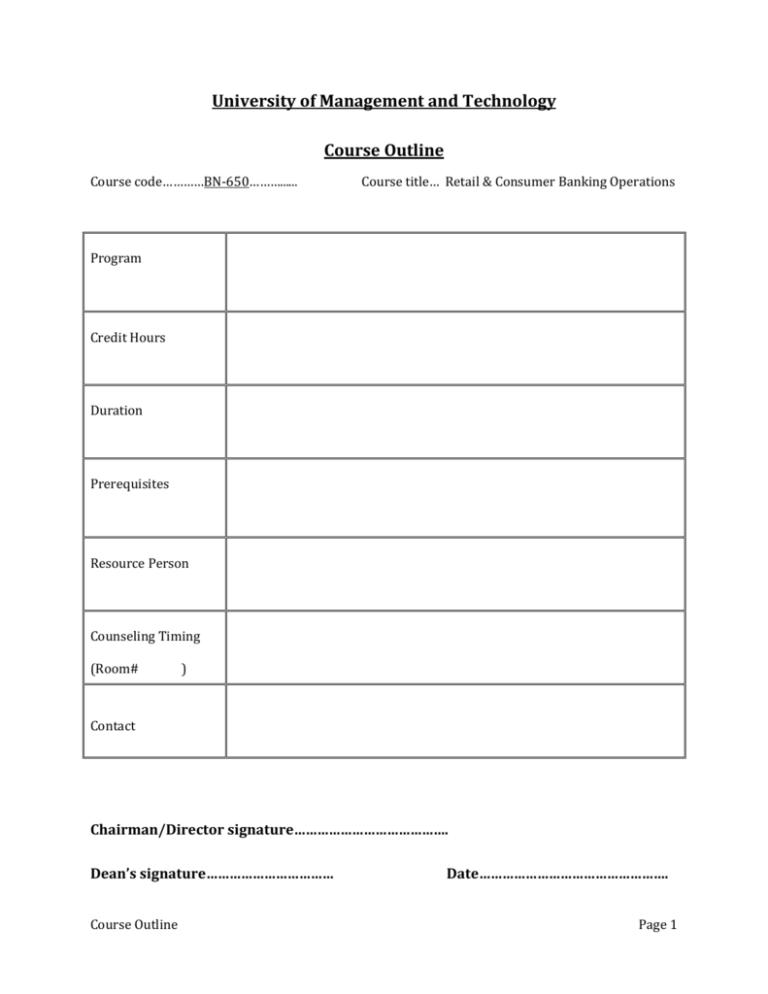

Course title… Retail & Consumer Banking

advertisement

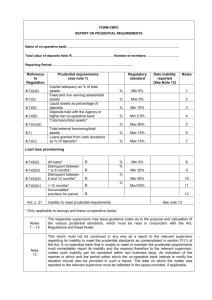

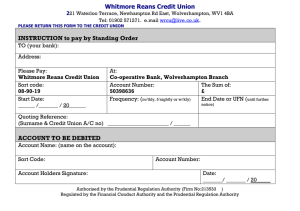

University of Management and Technology Course Outline Course code…………BN-650………...... Course title… Retail & Consumer Banking Operations Program Credit Hours Duration Prerequisites Resource Person Counseling Timing (Room# ) Contact Chairman/Director signature…………………………………. Dean’s signature…………………………… Course Outline Date…………………………………………. Page 1 Learning Objective: The focus of the course shall be as follows: Knowledge about Retail banking and its basic operations. Development of practical insight amalgamated with analytical management skills on the students of consumer banking. Since consumer banking is radically on the risk, therefore entrepreneurs already working in different organization shall stand to gain through it. Advancement of professional competence in the careers especially related to the areas of banking and commerce. Learning Methodology: The course The course shall be covered as stipulated in the outline. Regularity & Punctuality Regularity & Punctuality will be very strictly observed. All participants have an allowance of # of absences as per University policy. This includes the leaves approved by your Batch Adviser. In this regard SBE policy will be strictly applied. Regarding punctuality, you will be marked present only if you arrive in the class within five minutes of the scheduled time and will attend whole class. Any absence during the presentations sessions will result in deduction of 1 point each from the class participants marks. This means that the class participation marks can go into the negative as well. If your group is making assignment and you are not there then you will get a zero. If you miss a Quiz you get zero in that quiz and on late submission of assignment you will lose 1 point/day. Book Readings & Pre-study System The learning process is based on independent work with texts, textbook, and cases supported by lectures and assignments/cases - see schedule. Class Participation Positive and constructive class participation will be monitored for each class. Particular emphasis will be given during the presentation sessions. The manner in which the question is asked or answered will also be noted. Your behaviour, as business executive will contribute to the class participation marks. Course Outline Page 2 Consultancy During the semester, consider me as your consultant for this course. However, to avoid inconvenience setting up of appointment is recommended. But counselling will hours will be announced in class for your convenience. Grade Evaluation Criteria Following is the criteria for the distribution of marks to evaluate final grade in a semester. Marks Evaluation Marks in percentage Quizzes 10% Assignments 10% Mid Term 25% Attendance & Class Participation 10% Term Project 05% Presentations 05% Final exam 35% Total Recommended Text Books: Quarterly journals from Institute of Bankers of Pakistan. SBP’s Latest Prudential Regulations Handouts Publications/Journals Course Outline Page 3 Calendar of Course contents to be covered during semester Week 1 Course Contents Evolution of Banking & Depository Institutions. Evolution of banking Institutions Types of Banks State Bank of Pakistan • History • Functions Banking Sector Reforms In Pakistan 1. Privatization of Nationalized Commercial Banks 2. Corporate governance. 3. Capital Strengthening. 4. Improving Asset quality. 5. Liberalization of foreign exchange regime 6. Consumer Financing 7. Mortgage Financing 8. Legal Reforms 9. Prudential Regulations 10. Micro financing 11. SME Financing 12. Taxation 13. Agriculture Credit 14. E-Banking 15. Human Resources 16. Credit Rating 17. Supervision and Regulatory Capacity 18. Payment Systems 2 Reference Chapter(s) Handouts Retail banking accounts and relationship types Banker Customer Relationship Nature of relationship Rights of customer Duties of customer Rights of bank Duties of bank Handouts Type of relationships between a banker and his customer: Debtor and Creditor Creditor and Debtor Principal and Agent Bailer and Baillie Mortgagor and Mortgagee Pledger and Pledgee Course Outline Page 4 3 4 Quiz 1 General Requirements for opening an account. The bank account types and their likely users. • Business accounts • Saving accounts • Deposit accounts • Special purpose accounts Bank Lending Retail banking services Negotiable Instruments Meaning of Negotiable Instruments Types of Negotiable Instruments i. Promissory Note ii. Bill of Exchange iii. Cheques Types of Cheque a) Open cheque, b) Crossed cheque. c) Bearer cheque d) Order cheque e) Stale Cheque:f) Mutilated Cheque:g) Post-dated Cheque:- Handouts Handouts iv. Pay Orders v. Demand Drafts vi. Demand draft, payment order, postal order, money order, traveler cheques etc. Features of Negotiable Instruments Differences between bill of exchange, promissory notes and cheques 5 Quiz 2 Clearing House, Payment & Clearing System Clearing function with bank Clearing House (NIFT) RTGS and its working PRISM in Pakistan SWIFT Course Outline Handouts Page 5 6 7 8 9 ECIB as per State Bank of Pakistan SBP’s NIFT Guidlines Prudential Regulations For Consumer Financing SBP regulations SBP’s Latest Minimum requirements for consumer financing Operations Prudential Limits on exposure against total consumer financing Regulations Total financing to be commensurate with the Income General reserves against consumer financing. PERSONAL LOANS & LIFESTYLE/ CONSUMER DURABLE LOANS Eligibility criteria Amount of loan / Tenure Credit Analysis Pricing Documentation / Security Mode of repayment Verification Charges Customer Services Prudential Regulations For Personal Loans Collections & Recovery of NPLs Litigation process for Write-Off loans. AUTO FINANCE Eligibility Criteria Equity Requirement / Tenure Documentation / Security Mode of repayment Pricing & Interest Calculation Insurances Verification / Data Check / CIB Report Customer Services / Charges Prudential Regulations For Auto Finance Classification and Provisioning Collection Recovery of NPLs & Repossession Process Litigation process for Write-Off loans. Assignment / Case Study. Course Outline SBP’s Latest Prudential Regulations SBP’s Latest Prudential Regulations Page 6 10 11 Quiz 3 HOME FINANCE Eligibility Criteria Purpose ( Improvement / Renovation/ Self construction ) Property Analysis / Evaluation Legal Consultation before disbursement of Loan Repayment Process / Insurance Prudential Regulations For Home Finance Classification and Provisioning Collection Recovery of NPLs & Repossession Process Litigation process for Write-Off loans. SBP’s Latest CREDIT CARDS Eligibility Criteria / Application Analysis Documentation Verification / Sanction Mode of repayment Financial Activity / Mark-up Charging Customer Services / Charges Balance Transfer Facility (BTF) SBP’s Latest 12 13 Installment Plans (Step By Step Payment Plan) Utility Bill Payment Facility Transaction Process Flow Acquiring Business Inter Bank Transaction Charges Prudential Regulations For Credit Cards Collection & Recovery of NPLs Litigation process for Write-Off loans. Quiz 4 VISA / Master Card Concept (Associations) Internet Transactions through Credit Cards International Spending Security & Safety Virtual Cards Pre-Paid Cards Pay-Roll Cards Charge Cards Course Outline Prudential Regulations Prudential Regulations Handouts Handouts Page 7 14 General Concepts Bank Statement Analysis for Allocation of Loan Credit Card Mark-Up Charging Policy Deviation / Exceptions Hypothecation Handouts Consumer Finance for Prime Customers (Platinum Cards) Involvement of Fraud & Risk Management Unit (FRMU) Plastic Money Security Features. Case Study on Card Usage In International Market 15 Course Outline Project & Presentation. Page 8