Management Accounting

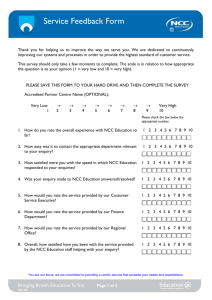

advertisement

Finance and Accounting Unit 1: Introduction to the Module and to Organisations Instructor: Johnson Hsu V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.2 Module Aim To provide an introduction to finance and accounting in a trading or organisational environment, giving students: • an understanding of main concepts and terminology, in order to • facilitate calculations, analysis and group discussion. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.3 Module Coverage V1.0 • Getting an organisation started – funding, premises and equipment • The nature of costs – fixed/variable, direct/indirect, break-even analysis • Costing activities – full-cost, marginal cost • Controlling the organisation – management accounting, cash-flow, stock, budgets, accruals and profit • Decision making – pricing, special contracts, unprofitable activities • Reporting the results – income & expenditure, profit & loss, assets & liabilities • Companies – share issues, stock exchanges, accounting standards • Financial evaluation – ratio analysis © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.4 Terminology • The module has no essential textbook, all terminology will be explained in lectures. • Students should raise any questions as they arise at lectures and seminars • Students are encouraged to work together as a team to provide mutual support and assistance. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.5 Underpinning Themes This module is underpinned by 5 themes: 1. 2. 3. 4. 5. V1.0 Achievement of objectives Limited resources Competing demands Management Accountability © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.6 Achievement of Objectives V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.7 Limited Resources V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.8 Scarcity Is the fundamental fact of economic life: there is a limited amount of resources that can be used to produce a limited amount of goods and services to meet unlimited human want. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.9 Wants Are the need or desire for goods and/or services. Goods are visible and touchable, such as bread, audio tapes, and clothes, while services are invisible and untouchable, such as airplane trips, rock concerts, or a lesson in mathematics. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.10 Physical wants Are those wants or needs that are necessary to sustain human life. Such wants include the need for air, water, food, cloths, and shelter. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.11 Psychological wants Are wants for those things that are not essential to sustain life. They include wants for exotic food, fashionable clothing, and an air-conditioned home. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.12 Competing Demands V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.13 Demand Is the quantities of a good or service that buyers are willing and able to buy at various prices in a particular period of time. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.14 Elasticity of demand Means the responsiveness of the quantity demanded to a change in price. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.15 Factors determining elascity of demand 1. Lots of substitutes. 2. Small items in a budget. 3. Essential items. 4. Over time. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.16 Supply Is the quantities of a good or service that sellers are willing and able to sell at a various prices in a particular period of time. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.17 Management V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.18 Partial Organization Chart. Manufacturing Company President Line Function Staff Function Production Vice -President Financial Vice -President Controller Production Supervisor Machining Foreman V1.0 Assembly Foreman Internal Audit Treasurer Cost Financial Systems Tax © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.19 Accountability V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.20 Unit 1 Coverage V1.0 • This unit has provided a broad introduction to the module. • We shall now consider general issues of finance, accounting and organisations to set the context for later units. © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.21 What is Finance? In organisational terms: ‘finance is the money/funding necessary to start-up and run the organisation’ V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.22 What is Accounting? Accounting is simply ‘the keeping of records’, and may be subdivided into: • Financial Accounting – ‘records of financial transactions and balances’ • Management Accounting – ‘records of financial and other factors; for internal management and control purposes’. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.23 Elements of a Traditional Responsibility Accounting System Individual in Charge Center Budgets Static Standards Responsibility Defined Standards Are Set for Performance Measurement Organizational Unit Financial Responsibility Standard Costing Currently Attainable Controllable Costs Performance Measurement Comparing Actual Costs with Budgeted or Standard Costs Promotions Reward Individuals Based on Budgetary Performance Bonuses Salary Increases V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.24 Financial and Management Accounts - Examples Financial Accounts • Purchases V1.0 Management Accounts • Sales • Production records • Value of stocks • Staff work records • etc • Machine operating hours and vehicle mileages, etc © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.25 MANAGEMENT ACCOUNTING HANSEN/MOWEN Economic Events Collecting Measuring Storing Analyzing Special Reports Product Costs Customer Costs Budgets Performance Reports Personal Communication Reporting Managing Inputs Processes Outputs Users V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.26 A Question for Students In an organisation, who needs to understand finance and accounting? V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.27 The Answer? To some degree, everyone! Even staff at the lowest levels should understand the effect of their actions and individual performance on the performance of the organisation. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.28 What is an Organisation? There have been many attempts at definition. Usefully, Anthony (1965, p.8) suggested: “groups of people brought together for a common purpose”. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.29 A Question for Students Organisations may perform many different activities (goods or services, buying and selling, manufacturing voluntary work etc) but how might they be structured and organised? What forms might the organisation take? V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.30 Forms of Organisation • Sole proprietor or sole trader • Partnership • Private company (Corporation) • Public company • Charity or voluntary organisation • Local government body • National government body V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.31 Sole Proprietorship is a form of business organization in which one person owns and operates the business. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.32 Advantage of Sole proprietorships Easy to establish can makes all the decisions V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.33 Disadvantage of Sole Proprietorship Liable for the losses of their business difficult to sell their business Liability is unlimited The proprietorship is ended if the proprietor dies, goes to prison, or become insane. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.34 Partnerships is a business organization in which two or more individuals enter a business as owners, and share the profit and losses. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.35 Advantage of Partnerships can raise more capital Responsibilities can be divided and therefore handled more efficiently the business can continue to run under the control of one or more of the other partners if one member of the partnership is absent V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.36 Disadvantage of Partnerships Liability is unlimited A partner cannot simply withdraw from the business. A new agreement must be drawn up each time when a partner resigns, or dies. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.37 Corporation is a form of business organization that has an existence of its own separate form those who created it or own ot. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.38 Advantage of Corporation Limited liability Legal personality V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.39 How Corporation to raise capital? to retain the earnings of the corporation rather than distributing them in the form of dividends to the owners. by issuing securities. (1) Common shares (2) Preferred shares (3) Bonds V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.40 Ownership Ownership of organisations depends on their form, for example: • Sole traders – single owner • Partnership – two or more owners • Company – shareholders • Government and local government bodies – electors • Voluntary organisations – arguably none, assets and funds are held in trust. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.41 Stakeholders ‘Stakeholders are those people or other bodies that have legitimate interest in the position, status or welfare of an organisation’. Who or what might this include? V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.42 Stakeholders • Owners • Suppliers • Managers • Customers • Employees • Lenders • Dependents of above • Investors • Local community • Government V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.43 References Anthony, Robert N. (1965). Planning and Control Systems: A Framework for Analysis. Boston: Harvard University. V1.0 © NCC Education Limited Introduction to the Module and to Organisations Unit 1 - 1.44 Unit 1 Any questions? V1.0 © NCC Education Limited