Managerial Economics

advertisement

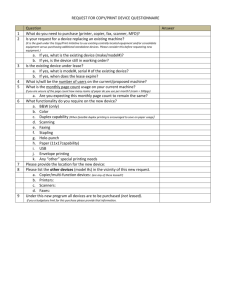

Welcome ECON 6313 Managerial Economics Fall semester, 2010 Professor Chris Brown Outline What is managerial economics and why should you study it? Examples of managerial decisions Six steps to decision making ? What is managerial economics? Managerial economics is the application of economic theory to management decision making Examples How to use economic theory to set prices that maximize profits. How to use economic theory to choose the costminimizing production technique for a given scale of output. How to use economic theory to select the “optimal” location for a new restaurant, grocery store, etc. How to use economic theory to forecast near-term demand for goods and services. How to use economic theory to make decisions subject to calculable risk. Examples of Management Decisions 1. What rates should Sprint charge for its 3G internet service? 2. How many iPads should Apple manufacture in the current quarter? 3. Should Red Lobster locate a restaurant in Jonesboro? 4. Should Time-Warner leave the cable TV business? 5. Should Minneapolis build a new baseball facility for the Twins? 6. Should Ohio Edison scrap its coal-fired power plants in favor of oil fired plants to comply with regulatory controls on sulfur emissions? Or should it install expensive “scrubbing” equipment to its existing plants? 7. Should ASU charge differential tuition for business, nursing, and engineering courses? 8. Should the City of Jonesboro offer bus service? 9. Should H & R Block outsource tax preparation to India? Six Steps to Decision Making 1. Defining the Problem 2. Determining the Objective 3. Exploring the Alternatives 4. Predicting the consequences 5. Making a choice 6. Performing sensitivity analysis Defining the problem “The copier has broken down again.” Defining the objective We need a copier that works! Exploring the alternatives Repair the existing copier Lease a new copier Purchase a new copier Predicting the consequences Repairing the copier involve the least expense in the short run. But we will have to replace the existing copier soon. The lease option includes a service agreement. The purchase option involves a large outlay up front, but may be the most economical in the long run. Making a choice We have decided to lease a new copier. Sensitivity Analysis: Why is it Useful? •Sensitivity analysis provides an insight into the key features of a problem that affect a decision—e.g., the decision to continue a product line depends of profit forecasts, which in turn are based on assumptions about future sales, prices, or costs. What happens to our forecast when we modify the assumptions? •It allows us to trace the effects of changes about which the manager may be uncertain. •It can give solutions to decisions which are recurring, but must be made under slightly different conditions. Estimates of the profits derived from the purchase of a new fleet of tractortrailer rigs are sensitive to assumptions made about a number of factors, including the price of diesel fuel. Present value (V) maximization The naïve version of model assumes that managers maximize profits—but over what time horizon? We get around this problem by assuming that managers seek to maximize the present value of the firm Ri Ci R1 C1 R 2 C 2 Rn Cn V ... n 2 n ( 1 r ) ( 1 r ) ( 1 r ) ( 1 r ) i 1 n Where: Ri is sales revenues of the firm in period i (quarter i, year i); Ci is cost of the firm in period i (quarter i, year i);and r is the discount rate Theory of the firm •Managerial economics is based on the “model of the firm.” •The model of the firm is based on the assumption that firms, or managers of firms, are “optimizers.” •What is it that managers optimize—i.e., what is the nature of the managerial “objective function”? Berle and Means view1 V MAX •The gigantic, publicly-owned, vertically integrated corporation has displaced the small, owner managed business as the dominant form of economic organization. •Given the separation of ownership and control indicative of modern corporatism, a large share of economic resources are under the control of the professional management class—i.e., owners, or shareholders, are “passive.” •There is no guarantee that the interests of shareholders and managers will coalesce—i.e., managers may be interested in objectives other than value maximization(e.g., growth of the firm, power, job security or perquisites). 1 Adolph Berle and Gardiner Means. The Modern Corporation and Private Property Topics we will cover in ECON 6313 (Managerial Economics) Demand Analysis and Forecasting Chapters 3, 4, and 5 Competitive Analysis and Market Structure (Game Theory) Chapters 10, 11, and 12 The Firm (Profit Analysis) Chapters 2, 3 Decision Making Under Uncertainty Chapters 8 and 9 Cost Analysis Chapters 7