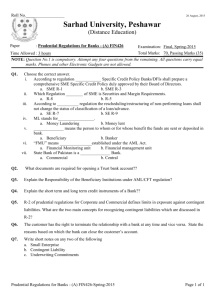

SBP's Initiatives for SMEs Financing

advertisement

SBP’s Initiatives for SMEs Financing Initiatives • Issuance of a separate Prudential Regulation (PRs) for SME financing. • Help in capacity building in human resource development of banks/DFIs in the field of SME lending. • Creation of a separate SME Department in State Bank. • Enlarging the scope of Credit Information Bureau (CIB). • Granting commercial banking license to SME Bank. • Focus on SME lending in SBP Lending Schemes for banks. Defining SMEs In Pakistan, definition of SME varies from institution to institution. PRs define SME as an entity which fulfills all the following characteristics. Trading Manufacturing Services 50 250 250 Total Assets at cost up to Rs.50 M Rs.100 M Rs. 50 M Total Sales Turnover up to Rs.300 M Rs.300 M Rs. 300 M No. of Employees up to Encouraging Cash Flow Based Lending • Banks/DFIs are encouraged to lend to SMEs on the basis of asset conversion cycle/cash flow basis. – Banks / DFIs are allowed to take clean exposure i.e., facilities secured solely against personal guarantees on an SME up to Rs. 3 million provided that funded exposure should not exceed Rs. 2 million. Exposure Limits • Per SME limit Per Bank: Rs. 75 M • Per SME limit From All Banks: Rs.150 M • SUBJECT TO: – For other than leased assets: Up to Rs. 100.0 M – For Clean exposure: Up to Rs. 3.0 M • It is expected that SMEs approaching this limit should have achieved certain sophistication as they migrate into larger firms and should be able to meet the requirements of Prudential Regulations for Corporate / Commercial Banking Capacity Building of Banks for SME Lending: Hiring of a Consulting Firm • SBP has hired a foreign consulting firm, which will provide capacity building support to a few commercial banks, including SME Bank, on cost sharing basis. • The above will cover full spectrum of establishing an SME business line ranging from preparation of participating banks’ business plans to training of loan officers. • The IBP and NIBAF will also collaborate with the firm in providing training on SME credit to bankers. Establishment of SME Department at SBP • Objectives: – To help create conducive macro-prudential environment for banks/DFIs thereby increasing the flow of credit to SMEs; – To promote strategic focus on SMEs on the part of the banks/DFIs; – To facilitate banks/DFIs in adopting best practices for the development of their SME business lines through provision of capacity building and training services; – To induce banks/DFIs for up-front investment in people and technology. – To coordinate with other SME stakeholders for matters relating to SME financing. Enlarging the Scope of Credit Information Bureau (CIB) • SBP is in the process of further lowering the CIB limit from Rs 500,000 to cover all loans by the end of June 2005. This will help in improving the financial institutions’ ability to provide loans especially to individuals and SMEs. Issuance of Commercial Banking License to SME Bank • The SME Bank, which was established through a merger of Small Business Finance Cooperation and Regional Development Finance Cooperation, has been issued a commercial banking license by SBP enabling the bank to undertake the whole range of banking business. • SME bank will also receive capacity building services through the international consulting firm hired by SBP. SBP Credit Schemes • The State Bank in its different credit schemes namely: 1) Long Term Financing of Export Oriented Projects (LTF-EOP); 2) Locally Manufactured Machinery (LMM); and 3) Export Finance Scheme (EFS) has been paying special attention to the financing needs of SME Sector. • The banks/DFIs are advised to focus SME sector while allowing credit under these schemes. Flow of Credit to SMEs • Share of SMEs in total bank credit: (Rs. in billion) Dec-02 Dec-03 Dec-04 170 215 284 • 67% increase since 2002. Thank You