Main TALC - Irish Tax Institute

advertisement

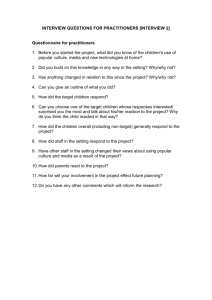

Main TALC Summary Note of Meeting held 14 September The Main TALC committee met on Wednesday 14 September. The matters discussed at this meeting were as follows: Matters Arising – Form 46G Revenue will confirm if taxpayers (as well as agents) will have access via ROS to the Form 46G. Update on Attachment Orders Revenue guidance is expected to be finalised and published on the Revenue website in the coming weeks. Stamp Duty Self-Assessment System A number of issues were raised by practitioners and it was agreed that the main issues will be discussed at the next meeting of the TALC Capital Taxes sub-committee. PRSI Issues Practitioners expressed concern about recent policy changes in the area of PRSI, particularly concerning the PRSI status of propriety directors and PRSI charge on share awards. R&D Claims Revenue will provide details on the number of claims for R&D relief selected for verification/audit at the next meeting of the TALC Audit sub-committee. E-issues ROS offline forms Practitioners noted that recently DWT and stamp duty forms do not include a space for a client signature. Revenue will look into this matter. CAT and stamp duty payment options The arrangements previously notified to practitioner bodies as to how payment for CAT and Stamp Duty should be dealt with where an agent does not operate a client bank account were confirmed by Revenue. These arrangements are an interim solution until such time that agents can make the relevant payment by RDI. Requirement for Irish bank account Revenue confirmed that a number of foreign institutions have access to Irish bank sort codes and ROS is capable of handling payments with Irish bank sort codes. Details of such institutions are available from the Irish Payment Services Organisation (IPSO). Workplan Update Revenue Internal Review Procedures A draft Statement of Practice (SOP) was circulated to practitioners for their comments. Further consultation will take place over the coming weeks. RCT A copy of the draft regulations will be provided to the RCT sub-group shortly. The new system is expected to go live, as planned, on 1 January 2012. RTS Review Revenue will provide an update at the next meeting. Domicile Levy Revenue confirmed that the levy is not an income tax for Irish tax purposes and that foreign tax cannot be offset against the levy. Mandatory Disclosure Regime To date, seven disclosures have been made to Revenue. Budget 2012 The date is yet to be confirmed. Cumulative USC Currently, employer and pension providers must operate the USC on a week-one basis. Draft Regulations are being prepared which will provide that the USC will operate on a cumulative basis with effect from 1 January 2012. Revenue is communicating this development to stakeholders. AOB Revenue will look into the issue raised by practitioners concerning ROS incorrectly calculating preliminary tax where the amount is based on 100% of the prior year and the taxpayer is claiming a tax relief. The tax treatment of receivers is under review by the TALC Direct Taxes Technical subcommittee. Appropriate engagement will be undertaken with practitioner bodies if there is any proposal to change the current income tax pay and file deadline. Concerns about the introduction of EII scheme and the impact for undertakings given to investors under the current BES were raised by practitioners. Revenue is finalising procedures which will allow PAYE refunds to be mandated directly to an agent account. Draft copies of the procedures will be provided to the committee. The next meeting of the Main TALC is provisionally scheduled for Friday 9 December.